Welcome aboard PILOT, the most grown-up launchpad in DeFi!

In the third and final article of our educational series about AutoKujira, I aim to provide a step-by-step guide on how to use PILOT to participate in $AUTO’s upcoming token launch, beginning on July 15th.

Before reading this article, I would highly recommend taking a look at the first 2 articles of our series on AutoKujira, which you can find below:

- Article 1: An Introduction to AutoKujira

- Article 2: AutoKujira: Kujira’s Automated Interface

Okay, now that you’re all caught up, let’s get into it.

Table of Contents

- How to Participate in AutoKujira’s PILOT Raise

- Navigating PILOT: A Strategic Approach

- Evaluating Past Token Launches

- Past Token Launches: The Key Takeaways

- Approaching AutoKujira’s PILOT Raise: Suggested Bid Strategies

- Closing Thoughts

- Useful Links

How to Participate in AutoKujira’s PILOT Raise

First, I will explain how to participate in $AUTO’s token launch, taking you through the necessary steps.

$AUTO: A Guided Walkthrough

- Select a Token Launch to Participate In

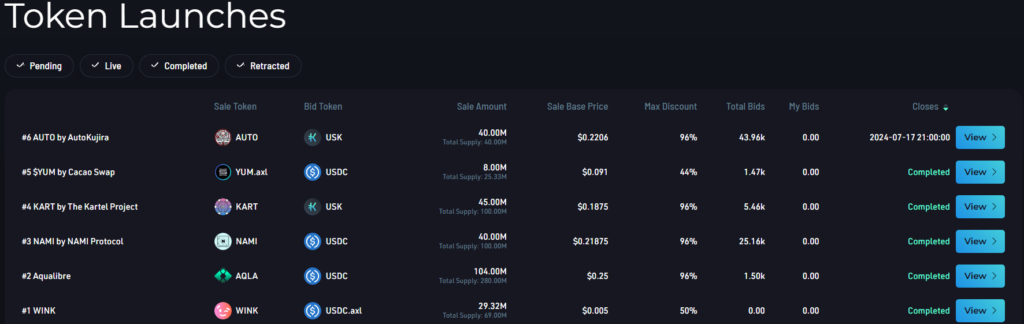

The first step is to navigate to PILOT, where you will find a list of both previous and upcoming token launches, and it is here that you can select the token launch ($AUTO) you wish to participate in.

$AUTO Token Launch: Key Details

This page will also display the key information for the token launch. These include:

- Token Supply (100 million)

The total supply of $AUTO tokens.

Sale Amount (40 million)

- The overall quantity of $AUTO tokens available for sale during the launch.

Bid Token ($USK)

- The currency or token used for placing bids during the sale ($USK).

Sale Base Price ($0.2206)

- The initial price per $AUTO token at the beginning of the sale before any discounts or adjustments.

Max Discount (96%)

- The maximum reduction (%) in token price available during the sale.

Total Bids

- The cumulative number of bids (%) placed by all participants throughout the sale.

Your Bids

- The bids placed by the individual participant detail the number of tokens bid for and the corresponding bid price.

Closes (date/time of sale completion)

- The scheduled date and time when the sale concludes, marking the end of the bidding period and execution of the sale. This sale will end on July 17th at 8 pm UTC.

The next step for participants after selecting the $AUTO token is to set their bid parameters.

2. Choose Your Token Launch/Bid Parameters

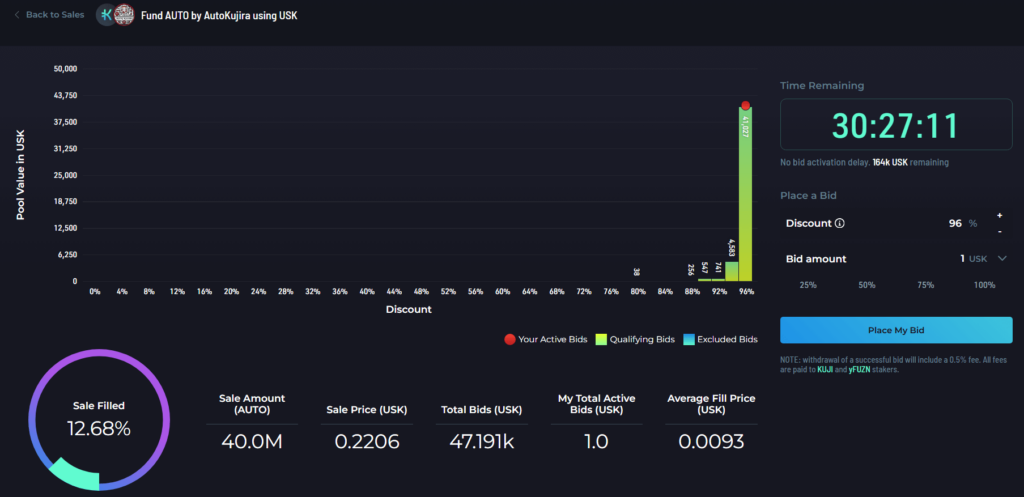

Upon the commencement of the sale, participants will be able to place offers (bids) to buy $AUTO, selecting the price (discount from sale base price) they are bidding at, and the amount they are placing at this price.

In the example below, I have bid $1 at a discount of 96% from the ‘Sale Base Price’ ($0.2206). So, if my bid is filled, I will receive $1 worth of $AUTO at a discounted price of $0.0088, totaling 113.3 $AUTO.

Once the sale participant has decided what price (discount range) they are bidding at and the amount they are bidding at this price, the next step is to place the bid.

3. Place Your Bid

This is incredibly straightforward. The participant simply needs to select ‘place bid’ and confirm the transaction via their SONAR/KEPLR wallet.

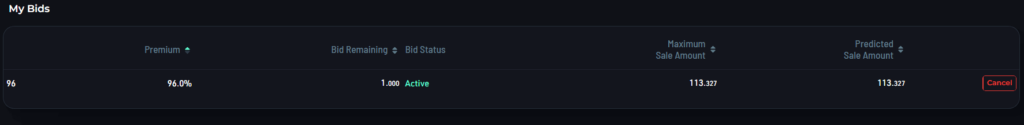

Once confirmed, this will show in ‘My Bids’, and the participant can view the key information about their bid. This includes:

- Premium: The premium is a percentage discount on the sale base price for a participant’s bid.

- Bid Status: The bid status indicates the current state of a bid placed by a participant during the sale and includes information on whether the bid is pending or ready to be activated.

- Maximum Sale Amount: The maximum sale amount is the total value of tokens that can be received for a specific bid and is calculated by dividing the bid amount by the token price at the specified discount ‘premium’

- Predicted Sale Amount: The predicted sale amount estimates the total value of tokens expected to be received when the sale executes and is influenced by the number of bids placed at each discount premium.

Following this, the participant will need to ‘activate’ their bid.

4. Activate Your Bid

After waiting for the activation time to elapse (if necessary), the participant should navigate to ‘My Bids’, which will give the option to ‘activate’ their bid.

Let’s look to understand this through an example.

Understanding Bid Activation: $AUTO’s Token Launch

For $AUTO’s upcoming token launch on PILOT, there will be a 15-minute activation delay, but only after a threshold number of bids has been reached. The purpose of this is to prevent bots from sniping at the last second and give participants a fair chance at the token launch.

So, for participants who place a bid before this threshold is reached, bids will activate automatically. However, if it is placed after, there will be a manual activation delay, meaning the participant will need to return after a predetermined time (15 minutes) to activate their bid,

If a participant’s $AUTO bid has been activated, they will be eligible to receive tokens at the price they bid after the sale window’s completion. However, if the participants’ bid is within 15 minutes of the sale’s closing (assuming the threshold has been reached), they will not be able to activate their bid in time and will not receive any tokens.

While this may seem simple, many individuals have missed out on the token launches altogether because they did not consider this information, raising an important point.

If you want to participate in a token launch on PILOT, ensure you leave enough time after placing your bid for it to be activated.

Finally, after the conclusion of the sale window, the option to bid will close, and the tokens will then be allocated to the sale participants. So, how are these tokens allocated?

5. Receive Your Tokens

Once the sale ends, token bids will fill from the smallest discount to the largest discount, employing a similar mechanism to the one used for liquidations on ORCA.

Suppose there are not enough tokens available at a particular price point to fulfill all the bids. In that case, the tokens will then be distributed proportionally based on the size of each bid relative to the total amount bid at that price. The order the bids were placed at is not relevant.

Once all these tokens have been allocated, outstanding bids at higher discounts will remain unfulfilled, with participants able to cancel unsuccessful bids and withdraw the tokens they successfully bid on.

So, by understanding the mechanics of bid placement, activation delay, and token allocation, participants can choose a bidding strategy tailored to their risk profile and in doing so, maximize their chances of profiting from token launches on PILOT.

I will explore these strategies now.

Navigating PILOT: A Strategic Approach

Fire and Forget

The fire-and-forget strategy in bidding on token launches through PILOT is straightforward yet effective. It entails placing the entire bid amount in USK at a 0% discount, ensuring the participant receives the maximum possible number of tokens from their bid whilst removing the risk that their bid is not filled.

Taking the example of $AUTO, this means the participant will secure their full bid amount at the sale base price of $0.2206 per token.

The advantage of this strategy lies in its simplicity and reliability, as it guarantees an allocation of tokens without the need for continuous monitoring or adjustments. However, the main disadvantage is the potential opportunity cost, as bidding at a 0% discount may result in missing out on more favorable discounts available during the sale.

Bid Sniping

Bid sniping, the riskiest strategy in bidding on token launches through PILOT, involves placing a bid in the final minutes of the auction window (taking into account the activation delay) to secure the highest possible discount premium on the token.

The advantage of bid sniping lies in the potential to obtain tokens at a significant discount, maximizing a participant’s return on investment. However, participants must exercise caution in selecting a sensible bid premium to avoid over-subscription, which could result in unsuccessful bids and receiving no tokens.

Split the Difference

The Split The Difference strategy in bidding on token launches through PILOT involves placing a safety bid at 0%, or lower discount ranges to ensure some token allocation and scattering other bids across higher discount levels.

In doing this, the participant aims to strike a balance between securing a guaranteed allocation of tokens and potentially obtaining more at lower prices.

The advantage of this approach lies in its versatility, allowing investors to mitigate some risk while still benefiting from potential discounts. However, its drawback lies in the possibility of not maximizing discounts compared to more aggressive strategies like bid sniping.

Evaluating Past Token Launches on PILOT

Now that you are familiar with the different strategies an investor can employ when participating in PILOT sales, we will now analyze the token launches of $AQLA, $NAMI, and $KART to understand what strategies were most effective and how this has changed across each sale.

Finally, after carefully considering the key takeaways from these PILOT launches, we will discuss the potential strategies an investor may employ as we approach $AUTO’s upcoming token launch.

An Overview of Previous Launches

Investors’ approach to token launches on Kujira has differed across each sale. $NAMI, $AQLA, and $KART, three of PILOT’s most recent launches, are a perfect example of this.

$AQLA’s Token Launch: An Overview

AQLA, a real-world asset (RWA) protocol focused on providing climate change solutions through carbon offsets, represented the third token launch on PILOT, and it’s safe to say it did not disappoint!

104 million tokens were available for sale during AQLA’s token launch, with the initial price per token, or ‘Sale Base Price’ set at $0.25, and the maximum discount a participant could bid set at 96%.

So, what was the outcome of $AQLA’s token launch?

Participants received $AQLA at an average discount rate of 95% at $0.0136. With the price trading on FIN at $0.027 (as of 15/07/24), the average participant is up a healthy 200%. In fact, anyone who bid at a discount level of 82% or above is in profit.

Due to an oversubscription of bids (>100%) as a result of last-minute ‘bid sniping’, participants who bid at the 96% discount level only received a partial allocation, meaning that whilst they got their tokens at the lowest possible price of $0.01, they did not receive the full amount of tokens relative to their bid amount.

Participants who bid below the 82% discount level, or those who adopted a ‘Fire and Forget’ strategy (placing bids at 0%) are yet to be in profit, suggesting that a higher-risk strategy was the best approach for this token launch.

Now, how does NAMI protocol’s token launch on PILOT measure up, and were the same strategies effective?

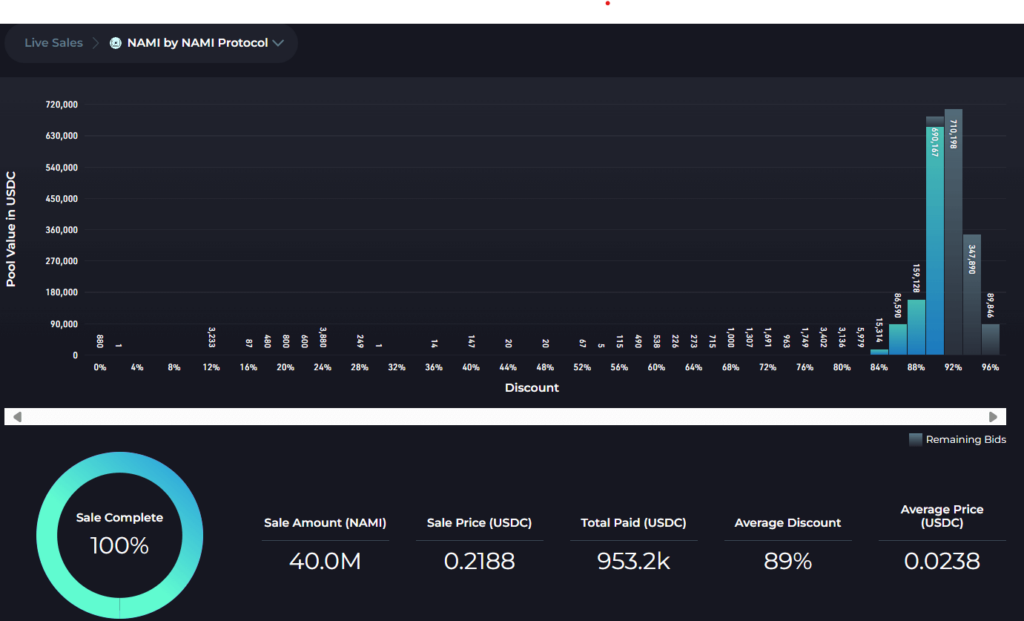

$NAMI’s Token Launch: An Overview

NAMI, a savings protocol focused on providing a straightforward and secure path to better earnings, represented the fourth token launch on PILOT, and this was perhaps the most interesting sale yet!

40 million tokens were available for sale during NAMI’s token launch, with the initial price per token, or ‘Sale Base Price’ set at $0.2188, and the maximum discount a participant could bid at 96%.

So, what was the outcome of $NAMI’s token launch?

Participants received $NAMI at an average discount rate of 89% at $0.0238. With the price trading on FIN at $0.025 (as of 15/07/24), the average participant is currently sitting at roughly break-even.

This token sale saw a significant oversubscription of the total amount ($) of bids placed and an even larger amount of ‘bid sniping’ take place close to sale execution (end of the sale). As a result, all participants who bid at a discount level of 92% or higher were ‘priced out’ of the sale and received no tokens. In fact, even those that bid at 90% only received a partial allocation.

Although many participants (myself included) employed the same bid strategies as seen in the $AQLA launch, there was a considerably different result, with previous ‘high-risk’ strategies failing to yield the same outcome.

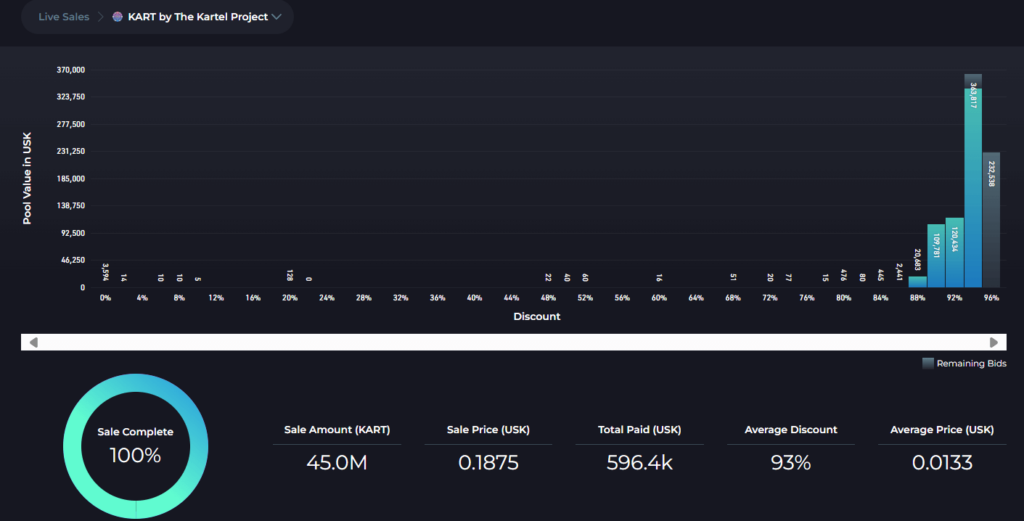

$KART’s Token Launch: An Overview

The Kartel Project, a protocol aiming to bring GameFi to Kujira, was PILOT’s fifth and most recent token launch, and it was anyone’s guess how this would play out.

45 million tokens were available for sale during $KART’s token launch, with the initial price per token, or ‘Sale Base Price’ set at $0.1875 and the maximum discount a participant could bid set at 96%.

However, there was one key difference in $KART’s token launch. The Kartel Project set the activation delay at 15 minutes, representing a marked change from the previous launches of $AQLA and $NAMI token sales, which had an activation delay of 1 hour.

So, what was the outcome of $KART’s token launch?

Participants received $KART at an average discount of 93% at $0.0133. With the price trading on FIN at $0.020 (as of 15/07/24), the average participant is up 50%.

This token also sale saw an oversubscription of the total amount ($) of bids placed, and similar to the $NAMI sale, it saw a significant amount of ‘bid sniping’ take place close to sale execution (end of the sale), with $100,000’s worth of bids activating within the final few minutes. As a result, all participants who bid at a discount level of 96% or higher were ‘priced out’ of the sale and received no tokens, and those who bid at 94% only received a partial allocation.

It also seems participants employed similar bid strategies to that of $AQLA’s token launch, choosing to adopt a high-risk approach to this PILOT raise. These ‘risk-on’ participants fared slightly better than those who approached the $NAMI sale in the same manner, receiving their $KART tokens at a higher discount premium.

So, what can we learn about token launches on PILOT from this, and what are the key takeaways?

Past Token Launches: The Key Takeaways

PILOT’s Launch Mechanism is Still Misunderstood

Following the $AQLA sale, I got a message from a participant who did not understand why they were at a loss following the $AQLA/$USDC trading pair going live on FIN. Despite placing a $1000 bid that was 100% filled, the individual only received $453 of $AQLA, meaning they were immediately at a significant loss.

So, how did this happen? Let’s look to understand this through a working example.

$AQLA’s Token Launch Explained: A Working Example

Before we get into the specifics, it is first necessary to define how the average fill price and discount level are calculated. Each participant’s average fill price is determined by the Sale Base Price multiplied by the inverse of their selected discount level. This is calculated as such:

Average Fill Price = Sale Base Price x (1 – Discount)

The formula for calculating the discount level is derived from the equation above. By rearranging this equation to solve for the discount, we get:

Discount level = 1 – (Average Fill Price/Sale Base Price)

Hence. the fill price for $AQLA at the following discount levels were:

Participant 1: $0.25 @ 96% discount = $0.01 per $AQLA

Participant 2: $0.25 @ 94% discount = $0.015 per $AQLA

Participant 3: $0.25 @ 88% discount = $0.03 per $AQLA

Using the information found on $AQLA’s launch summary, we can also calculate the fill price for the average participant, which was:

Average Participant: $0.25 @ 94.56% discount = $0.0136 per $AQLA

So, the $AQLA received by a participant at each discount level, and the value of the participant’s holdings at launch are as follows:

Average Participant: $1000 @ 0.0136 (94.56% discount) = 73,529 $AQLA

Value of $AQLA holdings at launch: $1000

Participant 1: $1000 @ 0.01 (96% discount) = 100,000 $AQLA

Value of $AQLA holdings at launch: $1360

Participant 2: $1000 @ 0.015 = 66,666 (94% discount) $AQLA

Value of $AQLA holdings at launch: $906.7

Participant 3: $1000 @ 0.03 = 33,333 $AQLA (88% discount)

Value of $AQLA holdings at launch: $453.3

Thus, a participant who receives a full allocation at the 96% discount level will receive two times as many tokens as a participant who receives a full allocation at 92%, and three times as many tokens as a participant who receives a full allocation at 88%.

Given this, it becomes clear why the value of Participant 3’s holdings ($453.3) was considerably lower than the average participants’ holdings ($1000) at launch.

After all, their bid was executed at an 88% discount, which was significantly lower than the average discount level of 94.56%. This meant their fill price ($0.03) was higher than the average fill price ($0.0136), resulting in them receiving fewer tokens (33,333 $AQLA) than the average participant (73,529 $AQLA) and leading to a lower overall valuation of their holdings at launch.

So, what is the takeaway from all this?

Evidently, the discount level chosen by a participant is crucial in determining the financial outcome at launch. Selecting a discount level higher than the average will result in immediate profit for the investor. Conversely, selecting a discount level lower than the average will put the investor an immediate loss.

So, by understanding the key concepts behind PILOT’s launch mechanism, individuals can make informed investment decisions when participating in token launches on Kujira and position themselves to capitalize on market conditions right from the start.

High-Risk Strategies have been Rewarded

As made clear by $AQLA and $KART’s token launch, a risk-on strategy (bidding at high discount levels) can be well-rewarded and lead to favorable outcomes for successful participants.

However, it is possible that as a result of the $NAMI sale, which saw many ‘risk-on’ participants receive no allocation, we will see a marked change in ‘risk-on’ participants’ bid strategies relative to previous launches as they look to prioritize token allocation over token price.

This shift in strategy, which was partially seen in the $KART sale where participants employed a slightly more conservative strategy than they did in the $AQLA sale, is evidence of this.

Bid Sniping is The Most Popular Strategy (so far)

In all of the aforementioned token launches, specifically the $NAMI and $KART sales, bids were coming in right up to the end of the auction window (taking into account the activation delay). Many participants, myself included, thought they had secured $NAMI at a 92% and $KART at a 96% discount to the sale base price, only to be blindsided by a wave of bids in the final minutes that invalidated that discount level.

By closely monitoring bidding activity (with careful consideration of the activation delay), these participants were able to ‘snipe’ others’ bids, securing a full token allocation at the highest possible discount premium.

It’s worth noting that, despite $KART’s smaller activation delay of 15 minutes, we did not see a change in participant’s bid strategies, suggesting that the change in activation delay did not affect the outcome of the sale other than the fact that these bids came in at a later time.

So, whilst this approach has obvious benefits, it is certainly not for the faint-hearted, as if you fail to execute this correctly, the only thing guaranteed is empty pockets and a serious sense of regret.

Participants considering employing this strategy will have to keep their eyes on the ball and their heads on a swivel to ensure timely bid placement and should exercise caution in selecting a sensible bid premium to avoid over-subscription.

Revise Your ‘Fire & Forget’ Strategy

Now, I know some participants value simplicity and reliability over all else, and would rather adopt a ‘risk-off’ strategy to ensure a full token allocation without having to continuously monitor or adjust bids.

However, if this is you, please allow me to make the following point.

Unless you’re in it for the long haul and aren’t concerned by short-term price action, placing bids at the 0% discount level is likely not a financially shrewd decision. Those who have adopted such a strategy in previous launches are severely under water.

So, if you are a more hands-off investor looking to guarantee a token allocation without having to constantly screen-watch, I would offer the following advice – Consider slightly higher discount ranges.

Based on previous launches, bidding at the 88% discount level would guarantee a full allocation. That being said, it doesn’t mean it will this time around, raising an important point.

Past Performance ≠ Future Performance

Whilst past token launches serve as a reference point and useful benchmark, it is worth noting that what works for one launch may not work for another, made clear by the differences in outcome between the $AQLA, $NAMI, and $KART PILOT sales.

Individuals who had employed ‘risk-on’ strategies (placing bids at discount levels 92% or higher) were rewarded in the $AQLA and $KART token sales but would’ve missed out on the $NAMI PILOT sale altogether.

Thus, as more PILOT raises occur and user sophistication grows, the strategies employed for each token launch will continually evolve and participants will have to adapt their approach in line with this.

So, how can we apply these lessons to $AUTO’s upcoming token launch?

Quite simply, by tailoring your approach.

Tailoring Your Approach

When it comes to choosing the right strategy for navigating token launches successfully through PILOT, adopting a strategic and adaptable mindset is essential. Given that each participant possesses unique risk appetites and the selection of a strategy is highly individualized, understanding the dynamics of bidding and token allocation is key.

Through meticulous research, vigilant monitoring, and timely decision-making, participants can tailor their approach to align with their risk tolerance and investment goals. In doing so, they can effectively deploy strategies that capitalize on opportunities while safeguarding against potential pitfalls.

I will now suggest which type of strategy each type of investor should employ for $AUTO’s token launch based on both their risk profile and investment goals.

Approaching AutoKujira’s PILOT Raise: Suggested Bid Strategies

Which Type of Investor Are You?

Risk On

If you are a ‘risk-on’ type of investor, you will likely be optimizing for token price and looking to receive $AUTO at the highest discount possible. These investors should employ a ‘bid sniping’ strategy, targeting the higher discount levels (94%-96%) and waiting until as close to the end of the auction window as possible to place their bids and ‘snipe’ others.

Risk Neutral

If you are a ‘risk-neutral’ type of investor, you will likely be optimizing for full token allocation at the lowest possible price, or highest possible discount premium.

Investors looking to employ a ‘split the difference’ strategy should place a safety bid at a lower discount level (i.e. 88%-92%), and scatter bids at the higher discount levels (i.e. 94%– 96%), so that they can lower the average price of $AUTO they receive once the sale executes.

Risk Off

Finally, if you are a ‘risk-off’ type of investor, you will be optimizing for full token allocation without having to constantly monitor the sale. Such investors should place their bids at the lower discount ranges. As mentioned above, bidding at 88% in past token launches would’ve guaranteed a full token allocation.

Now, I know this was a lot of information, so allow me to summarize this in a comprehensive manner.

Investors should consider their risk tolerance and investment goals, carefully weighing the certainty of token allocation against the potential for higher returns with more dynamic bidding strategies before deciding on what strategy they wish to employ.

Closing Thoughts

In this article, we’ve discussed how to participate in $AUTO’s PILOT raise, evaluated past token launches, and explored the different strategies participants can employ based on their risk tolerance and investment goals.

By now, readers should be able to confidently navigate the $AUTO token launch, and by utilizing strategies like ‘Fire and Forget’, ‘Bid Sniping’, or ‘Split the Difference’, they can tailor their approach to match their risk appetite, maximizing their chances of success whilst minimizing their downside.

As a final reminder, investors looking to participate in the $AUTO token launch should follow these simple steps:

- Select the token launch ($AUTO).

- Choose bid parameters, tailoring your approach to risk tolerance and investment goals.

- Place and activate bids, adjusting your positions if necessary.

- Receive allocated tokens/withdraw unused funds upon sale execution.

Best of luck, and happy bidding!

Disclaimer

This article is intended to provide insight and educational resources, and should not direct your investment decisions. It is always encouraged to DYOR and come to your own conclusions.

Useful Links

AutoKujira: Kujira’s Automated Interface

Kujira Academy is a platform that aims to bridge the gap between young entrepreneurs and Web3, providing them with tangible education and career acceleration opportunities. Built by students, for students. Learn more about the academy and our vision here.

To register your interest and become a student of Kujira Academy, click here.

Written by KidKuji