To bring the understanding of this series full circle, today’s article covers another important topic in CacaoSwap’s mission: to replace Centralized Exchanges (CEX’s).

To drive home the significance of the cross-chain narrative in a clear and practical way, we will discuss where the liquidity and adoption of CacaoSwap will come from, before ending with a recap of the key takeaways from all three articles in this series thus far.

In this series, we have covered the following topics:

By reading these articles, the goal is for you to walk away with an educated understanding of cross-chain swaps, CacaoSwap’s role in facilitating the cross-chain future, and the opportunity presented with the upcoming token launch of $YUM on PILOT, beginning June 17th.

Table of Contents

- The Decentralized Alliance: CacaoSwap, Maya, and Thorchain

- Centralized Exchanges: Faults and Shortcomings

- CacaoSwap and the CEX Exodus

- $YUM’s PILOT Launch: The Key Takeaways

- Closing Thoughts

The Decentralized Alliance: CacaoSwap, Maya, and Thorchain

From a high technical level, the potential that cross-chain swaps offer can be boiled down to a very fundamental concept.

Centralized Exchanges (CEXs) vs. Decentralized Exchanges (DEXs)

Up until the introduction of Thorchain and Maya, which are seamlessly integrated into CacaoSwap, CEX’s have dominated the realm of convenient crypto transactions. With no other viable options to transact freely across chains, much of the liquidity in crypto has remained in CEX’s,

The issue? CEXs are governed by centralized authorities, and as a result are inherently flawed.

Not only does this affect users who had assets on these platforms, but also the entire crypto space by breaking trust and hindering adoption from a broader audience.

Centralized Exchanges: Faults and Shortcomings

There’s no doubt about it, CEX’s are convenient, but at what cost to investors? Let’s take a look.

Some of the most common pitfalls are:

- CEXs require full disclosure of personal information, meaning users forego their right to anonymity or privacy.

- Users do not have custody over their tokens, giving CEXs the ability to freeze/halt funds, which is a common occurrence that causes significant delays for users attempting to withdraw funds or perform other actions.

- Using CEXs means you cannot participate in on-chain activities such as governance or staking, which offer rewards for helping to secure the network.

- Through market making, spreads and controlling user’s assets, CEXs are able to turn a profit, with users the primary vehicle for achieving this.

- As these transactions do not occur on the blockchain, they are not recorded securely or transparently.

- Orderbooks can be subject to manipulation, with shady tactics employed to extract profits from users, such as hiding fees within the spread which obscures the true fees being paid.

- CEXs hold their own liquidity and operate under ‘IOUs’ rather than exchanging actual tokens, which carries the risk of manipulation or even loss of funds, as seen in the FTX and Celsius scandals.

- Mismanagement of funds by CEXs lead to situations where users are unable to withdraw assets, as the exchange no longer holds their ‘credits’.

- CEXs have been known to halt trading during times of high volume, trapping users in high risk positions for extended periods of time.

So, what can we learn from this? We deserve better.

CacaoSwap and the CEX Exodus

For the first time in history, we have access to a decentralized, global, and private solution that eradicates all these issues and makes asset exchange profitable and reliable for everyone, not just the businesses hoping to take custody of your assets.

Considering the numerous flaws mentioned above, it’s more than likely that liquidity and users will flow from CEXs to DEXs, given the same convenience can be offered on-chain in a more secure, efficient and private manner, all while supporting the limitless and innovative features and capabilities of blockchain.

Whilst the CacaoSwap interface may seem simple and familiar, reminiscent of traditional platforms like UniSwap, it couldn’t be more different. Behind the scenes, it seamlessly aggregates the best routes while facilitating a simple and direct DeFi experience in a way CEXs simply cannot match, and by providing this CEX-like experience, with the added benefits of decentralized rails, CacaoSwap may just be final nail in the coffin for Centralized Exchanges.

Now, if you’ve made it this far, you should have a clear understanding of the role CacaoSwap plays as well as its potential to be a key player in the cross-chain narrative, and with the launch date less than a week away, it makes sense to tie this all together by explaining exactly why the launch of $YUM is shaping up to be the best token launch on PILOT yet.

$YUM’s PILOT Launch: The Key Takeaways

Some of the key features that will make the launch of $YUM so special are:

- The first post-product launch on PILOT, providing a fair, equal, and risk-controlled opportunity to get exposure to one of the most promising solutions in crypto for cross-chain interoperability.

- Facilitates the cheapest and most efficient routes by integrating the some of the most innovative underlying tech in crypto.

- Promotes self-custody, removing the need to take on third-party risk or adhere to KYC requirements.

- Grants governance and platform decision-making to $YUM token holders.

- High float, low FDV, meaning the upside has not been front-run by private markets at ridiculously low valuations.

- A great market fit with high potential, a large target audience and industry disrupting technology that directs fees straight to $YUM holders.

- Available from anywhere, any time, on your own terms and without oversight from centralized parties.

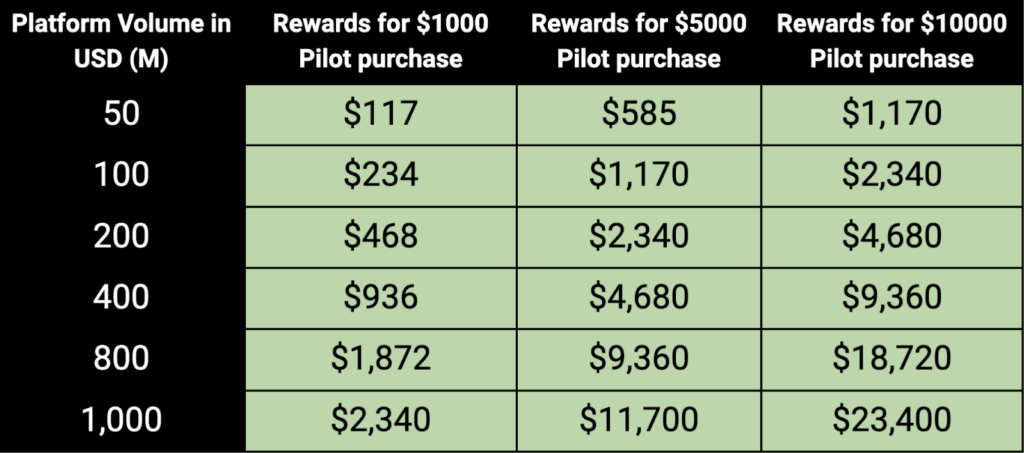

In case you are in need of a refresher, below is a visual of what a $1000, $5000, and $10,000 investment could generate for participants. This chart uses historical data and attempts to use reasonable assumptions based on metrics found in the relevant ecosystems (full details can be found here).

By modeling real market volumes, adequate staking participation, and historical discounts on other PILOT launches, we can see that the return to users for every 50M in CacaoSwap volume is 11.7% of the initial investment. Therefore, a cumulative volume of approximately 500M would pay off the initial investment, just with real-yield revenue.

Given how the underlying tech (Thorchain and Maya) has surpassed monthly volumes of $10 billion, the potential for this investment to grow becomes evermore apparent, and this does not even include the potential appreciation of the $YUM token from speculation!

Closing Thoughts

CacaoSwap signifies a pivotal moment for regular cryptocurrency users and the Web3 landscape as a whole, eliminating the need for CEX’s and its associated flaws.

By providing a reliable, secure, and decentralized platform for cross-chain transactions, CacaoSwap empowers users to take control of their assets in an way not seen before in the space. The upcoming launch of the $YUM token on June 17th symbolizes a commitment to community-centric growth and equitable access to financial opportunities, an avenue that promises exposure to the riches of a new cross-chain world.

So, armed with a comprehensive understanding from our series, you should now be well-prepared to seize the opportunities presented by CacaoSwap and its the launch of $YUM.

Now, for those that are interested in investing in $YUM but don’t know how, fear not! The next article provides a step-by-step guide to participating in $YUM’s token launch on PILOT, outlining the different types of strategy an investor can employ to make the most of this fantastic opportunity.

So, give Kujira Academy a follow, and keep your eyes peeled for the final article of the series!

Disclaimer

This article is intended to provide insight and educational resources, and should not direct your investment decisions. It is always encouraged to DYOR and come to your own conclusions.

Important Note: Bookmark www.cacaoswap.app for quick access and give it a test run. All trades made prior to the token launch will be eligible for a $YUM airdrop.

Useful Links

CacaoSwap and the Cross-Chain Revolution – WinkHUB

Introducing $YUM: The Token Powering CacaoSwap

Kujira Academy is a platform that aims to bridge the gap between young entrepreneurs and Web3, providing them with tangible education and career acceleration opportunities. Built by students, for students. Learn more about the academy and our vision here.

To register your interest and become a student of Kujira Academy, click here.

Written by Kucci