Welcome aboard PILOT, the most grown-up launchpad in DeFi!

In this article I aim to shed light on Kujira’s premier launchpad, PILOT, exploring its role in democratizing the token launch process and highlighting the benefits this product offers to the Kujira ecosystem before explaining how you can participate in Boon’s upcoming token launch on PILOT.

Table of Contents

- Introducing PILOT: A Solution to the Failures of Traditional Launchpads

- Understanding PILOT: Key Features & Functionalities

- Key Features & Functionalities: Understanding The Implications

- How to Participate in Token Launches on PILOT

- Navigating PILOT: A Strategic Approach

- Approaching Token Launches: Suggested Bid Strategies

- Closing Thoughts

- Useful Links

Introducing PILOT: A Solution to the Failures of Traditional Launchpads

Defining The Problem

Decentralized finance (DeFi) has ushered in a new era of financial services, presenting transparent, borderless, and permissionless alternatives to traditional financial systems.

As the demand for DeFi solutions continues to rise, the need for platforms to facilitate the seamless launch of new projects, and provide them with the necessary infrastructure, resources, and exposure to thrive is becoming increasingly apparent.

However, traditional launchpads are marred by several significant limitations, with limited accessibility, favoritism towards established players/early investors, and high technical barriers creating an uneven playing field that deters newcomers, hinders the potential of emerging projects, and perpetuates existing inequalities within the DeFi ecosystem.

Evidently, a fairer and more inclusive launch mechanism is essential for leveling the playing field and providing equal opportunities for all projects and investors. This is where PILOT comes in.

Outlining The Solution

PILOT, Kujira’s premier launchpad, aims to redefine the introduction of digital assets to the market and is meticulously designed to address the significant limitations plaguing traditional launchpads.

So, what key features and functionalities does PILOT offer that help overcome these limitations?

Understanding PILOT: Key Features and Functionalities

PILOT offers a range of features and functionalities tailored to the needs of project creators and investors alike. These include:

Dynamic Pricing

PILOT offers dynamic pricing, allowing token prices to fluctuate within a predefined range. This feature provides launchers with predictability in outcomes while granting backers the flexibility to optimize their purchase price based on market sentiment. Bid distribution reflects demand and interest, contributing to fair and transparent token sales.

Choice of Risk Level

Backers on PILOT can tailor their participation based on their risk tolerance, offering flexibility for both seasoned investors and newcomers. Whether executing complex strategies to maximize ROI or opting for a straightforward approach, users can customize their bidding behavior according to their comfort levels and preferences.

Low Technical Threshold

PILOT is designed with simplicity in mind, requiring minimal technical knowledge to use. This accessibility lowers barriers to entry, making the platform inclusive and accessible to a broader audience. The straightforward concept of price movement ensures that anyone, regardless of technical expertise, can understand and participate in token launches.

Adaptable and Scalable

PILOT supports a variety of bidding strategies and can be augmented with new features over time. This adaptability provides project creators with flexibility and customization options in their launch strategy, ensuring that the platform remains relevant and responsive to the evolving needs of the DeFi space.

Permissionless Sale Creation

PILOT empowers projects to create sales without permissions, democratizing access to token launches and fostering an inclusive ecosystem. This feature enables a more decentralized and open environment, where anyone can initiate token sales without barriers, promoting innovation and diversity within the DeFi landscape.

Token Minting

PILOT allows creators to mint new tokens directly through the application, simplifying the token creation process. This streamlined approach reduces complexity and removes barriers for project teams, making it easier for them to bring their ideas to fruition and participate in the DeFi ecosystem.

Tokenomics Configuration

PILOT introduces tools for detailed planning of token economics, ensuring fairness and alignment with project goals. Project teams can strategically distribute their tokens, define supply allocations, and set vesting schedules, enhancing transparency and trust among stakeholders.

Automatic FIN Listing

PILOT facilitates the automatic listing of new tokens on decentralized exchanges, ensuring immediate liquidity and trading availability. This feature accelerates the post-sale process, enabling projects to leverage launch momentum and maximize their market impact.

Now, what are the implications of these key features and functionalities?

Key Features & Functionalities: Understanding The Implications

Greater Accessibility

Traditional launchpads often require extensive technical knowledge and expertise and restrict participation to a select group of individuals with privileged access, creating hurdles that deter newcomers from participating in token launches.

PILOT tackles this issue of limited accessibility by democratizing access to token launches, opening up opportunities to a wider audience, and allowing anyone to participate in token sales without the need for special permissions.

Additionally, through its user-friendly interface, intuitive tools, and simplified processes, PILOT opens doors to a wider audience, allowing anyone to participate in token sales regardless of their technical expertise.

Empowers Project Creators

In traditional launchpads, projects backed by influential players or those with large investment pools often receive preferential treatment, leaving smaller projects, that struggle to compete for attention and resources, at a significant disadvantage.

However, by implementing a fair launch mechanism, PILOT ensures that projects are evaluated based on their intrinsic worth rather than the size of the initial investment pool, offering equal opportunity for funding and exposure regardless of their size or background.

This inclusive approach lowers the technical and financial barriers for project creators and provides them with the tools, resources, and support needed to bring their ideas to life.

Improved Access to Funding

By participating in PILOT’s token sales, projects also gain access to a pool of liquidity from backers who are eager to support innovative ideas. This funding mechanism provides projects with the capital they need to develop and grow, ensuring their long-term success within the Kujira ecosystem.

So, by democratizing access to token launches, prioritizing merit over privilege, and simplifying the token launch process through dynamic pricing, token minting, and automatic listing on FIN, PILOT enables projects to reach their full potential and engage with a broader audience, creating a fair and inclusive environment that levels the playing fields for all.

Armed with an understanding of the key features/functionalities of PILOT and the implications of this on the project and investors, we can now look at how to utilize this launchpad to participate in $BOON’s upcoming token launch.

How to Participate in Token Launches on PILOT

To understand how to use PILOT to bid on an upcoming token launch, it is first necessary to understand how placing these bids works.

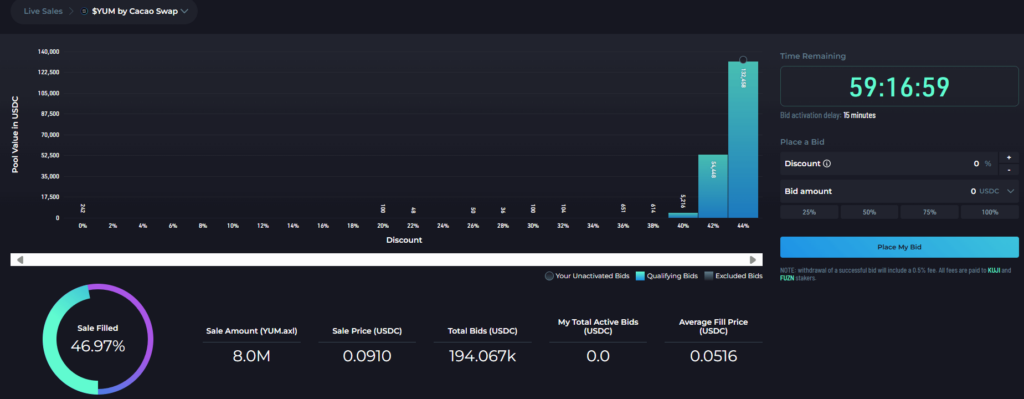

As we do not currently have access to the UI for Boon’s PILOT raise I will now explain this process using CacaoSwap’s token, $YUM, as a working example.

$YUM: A Guided Walkthrough

- Select a Token Launch to Participate In

The first step is to navigate to PILOT, where you will find a list of both previous and upcoming token launches, and it is here that you can select the token launch you wish to participate in.

Note

If a token sale has already finished, it will state completed in the ‘Closes’ column on the far right-hand side (pictured above). You will be able to view the outcome of this launch, but cannot participate in it.

On this page, it will also display the key information for the token launch. These include:

PILOT’s User Interface: The Key Details

- Token Supply (total): The overall quantity of tokens available for sale during the launch.

- Bid Token ($USDC): The currency or token used for placing bids during the sale, typically denominated in USDC stablecoin.

- Sale Base Price: The initial price per token at the beginning of the sale before any discounts or adjustments.

- Max Discount: The maximum reduction (%) in token price available during the sale.

- Total Bids: The cumulative number of bids (%) placed by all participants throughout the duration of the sale.

- Your Bids: The bids placed by the individual participant, detailing the quantity of tokens bid for and the corresponding bid price.

- Closes (date/time of sale completion): The scheduled date and time when the sale concludes, marking the end of the bidding period and execution of the sale.

PILOT’s launchpad mechanism empowers the ‘launcher’, who sets the number of tokens, the “base” price, the discount range, and the % intervals between them. I will come back to this later.

2. Choose Your Token Launch and Bid Parameters

Upon the commencement of the sale, participants can place offers (bids) to buy the tokens, selecting the price (discount from the sale base price) they are bidding at, and the amount they are placing at this price.

In the example below, I have bid $1 at a discount of 44% from the ‘Sale Base Price’ ($0.091). So, if my bid is filled, I will receive $1 worth of $YUM at a discounted price of $0.051, totaling 19.6 $YUM.

Once the sale participant has decided what price (discount range) they are bidding at, and the amount they are bidding at this price, the next step is placing the bid.

3. Place Your Bid

This is incredibly straightforward, simply requiring the participant to select ‘place bid’ and confirm the transaction via their SONAR/KEPLR wallet.

Once confirmed, this will show in ‘My Bids’, and the participant will be able to view the key information pertaining to their bid. This includes:

- Premium: The premium refers to the discount on the sale base price for a participant’s bid, expressed as a percentage.

- Bid Status: The bid status indicates the current state of a bid placed by a participant during the sale and includes information as to whether the bid is pending, or ready to be activated.

- Maximum Sale Amount: The maximum sale amount is the total value of tokens that can be received for a specific bid, and is calculated by dividing the bid amount by the token price at the specified discount ‘premium’

- Predicted Sale Amount: The predicted sale amount is an estimate of the total value of tokens that are expected to be received when the sale executes and is influenced by the number of bids placed at each discount premium.

Following this, the participant will need to ‘activate’ their bid. It is worth noting that there is a manual activation delay, which means that participants must return after a predetermined time (activation delay) to activate their bid.

4. Activate Your Bid

After waiting for the ‘activation time’ to elapse, the participant should navigate to ‘My Bids’, where it will give the option to ‘activate’ their bid.

Let’s look to understand this through an example.

Understanding Bid Activation: $YUM’s Token Launch

For $YUM’s token launch on PILOT, there was an activation delay of 15 minutes, meaning participants had to wait 15 minutes after their bid had been placed to activate it. It’s worth noting that the bid activation delay for Boon will also be 15 minutes and will follow the same process described below.

Participants who activated their bids were eligible to receive tokens at the price they bid at following the completion of the sale window. However, those who bid within 15 minutes of the close of the sale were not able to activate their bid in time and did not receive any tokens once the sale was executed.

Whilst this may seem simple, there have been many individuals who have missed out on the token launches altogether as a result of not considering this information, raising an important point.

If you are looking to participate in a token launch on PILOT, ensure you leave enough time after placing your bid for it to be activated.

Finally, after the conclusion of the sale window, the option to bid will close, and the tokens will then be allocated to the sale participants. So, how are these tokens allocated?

5. Receive Your Tokens

Once the sale ends, token bids will fill from the smallest discount to the largest discount, employing a similar mechanism to the one used for liquidations on ORCA.

Suppose there are not enough tokens available at a particular price point to fulfill all of the bids. In that case, the tokens will then be distributed proportionally based on the size of each bid relative to the total amount bid at that price. The order the bids were placed at is not relevant.

Once all these tokens have been allocated, outstanding bids at higher discounts will remain unfulfilled, with participants able to cancel unsuccessful bids and withdraw the tokens they successfully bid on.

So, by understanding the mechanics of bid placement, activation delay, and token allocation, participants can choose a bidding strategy tailored to their individual risk profile and in doing so, maximize their chances of profiting from token launches on PILOT.

I will explore these strategies now.

Navigating PILOT: A Strategic Approach

Fire and Forget

The fire-and-forget strategy in bidding on token launches through PILOT is straightforward yet effective. It entails placing the entire bid amount in USDC at a 0% discount, ensuring the participant receives the maximum possible number of tokens from their bid and removing the risk that their bid is not filled.

Taking the example of $YUM, this means the participant will secure their full bid amount at the sale base price of $0.2188 per token.

The advantage of this strategy lies in its simplicity and reliability, as it guarantees a substantial allocation of tokens without the need for continuous monitoring or adjustments. However, the main disadvantage is the potential opportunity cost, as bidding at a 0% discount may result in missing out on more favorable discounts available during the sale.

Bid Sniping

Bid sniping, the riskiest strategy in bidding on token launches through PILOT, involves placing a bid in the final minutes of the auction window (taking into account the activation delay) to secure the highest possible discount premium on the token.

The advantage of bid sniping lies in the potential to obtain tokens at a significant discount, maximizing a participant’s return on investment. However, participants must exercise caution in selecting a sensible bid premium to avoid over-subscription, which could result in unsuccessful bids and receiving no tokens.

Split the Difference

The Split The Difference strategy in bidding on token launches through PILOT involves placing a safety bid at 0%, or lower discount ranges (i.e. 30%) to ensure some token allocation and scattering other bids across various discount ranges.

In doing this, the participant aims to strike a balance between securing a guaranteed portion of tokens and potentially obtaining more at lower prices.

The advantage of this approach lies in its versatility, allowing investors to mitigate some risk while still benefiting from potential discounts. However, its drawback lies in the possibility of not maximizing discounts compared to more aggressive strategies like bid sniping.

So, how can we apply these lessons to Boon’s upcoming token launch?

Quite simply, by tailoring your approach.

Tailoring Your Approach

When it comes to choosing the right strategy for navigating token launches successfully through PILOT, adopting a strategic and adaptable mindset is essential. Given that each participant possesses unique risk appetites and the selection of a strategy is highly individualized, understanding the dynamics of bidding and token allocation is key.

Through meticulous research, vigilant monitoring, and timely decision-making, participants can tailor their approach to align with their risk tolerance and investment goals. In doing so, they can effectively deploy strategies that capitalize on opportunities while safeguarding against potential pitfalls.

I will now suggest which type of strategy each type of investor should employ for $YUM’s token launch based on both their risk profile and investment goals.

Approaching Token Launches: Suggested Bid Strategies

Which Type of Investor Are You?

Risk On

If you are a ‘risk-on’ type of investor, you will likely be optimizing for token price and looking to receive $BOON at the highest discount possible. These investors employ a ‘bid sniping’ strategy, targeting the higher discount levels and waiting until as close to the end of the auction window as possible to place their bids and ‘snipe’ others.

Risk Neutral

If you are a ‘risk-neutral’ type of investor, you will likely be optimizing for full token allocation at the lowest possible price. These investors should employ a ‘split the difference’ strategy, placing a safety bid at a lower discount level and scattering bids at the higher discount levels to lower the average price of $BOON they receive once the sale executes.

Risk Off

Finally, if you are a ‘risk-off’ type of investor, you will be optimizing for full token allocation without having to constantly monitor the sale. These investors should place their bids at the lower discount ranges. As mentioned above, bidding at 88% in past token launches would’ve guaranteed a full token allocation, but take this with a grain of salt.

Now, I know this was a lot of information, so allow me to summarize this in a comprehensive manner.

Investors should consider their risk tolerance and investment goals, carefully weighing the certainty of token allocation against the potential for higher returns with more dynamic bidding strategies before deciding on what strategy they wish to employ.

It really is as simple as that.

Closing Thoughts

In this article, we’ve discussed PILOT, Kujira’s premier launchpad, and its pivotal role in revolutionizing token launches within the DeFi ecosystem.

We’ve explored how, by addressing the limitations of traditional launchpads and offering features like dynamic pricing, low technical thresholds, and permissionless sale creation, PILOT empowers both project creators and investors and creates an even playing field for all centered on inclusivity and innovation.

Now, equipped with a comprehensive grasp of PILOT’s key features and functionalities, readers will be able to confidently navigate the BOON’s PILOT raise, and by utilizing strategies like ‘Fire and Forget’, ‘Bid Sniping’, or ‘Split the Difference’, they can tailor their approach to match their risk appetite, maximizing their chances of success whilst minimizing their downside.

Whether you’re a seasoned investor or new to the world of DeFi, PILOT offers a pathway to growth and opportunity.

So, don’t hesitate. Dive in, explore, and let PILOT guide your path to success.

Disclaimer

This article is intended to provide insight and educational resources, and should not direct your investment decisions. It is always encouraged to DYOR and come to your own conclusions.

Useful Links

Investing in a PILOT sale on KUJIRA

The Academy is a platform that aims to bridge the gap between young entrepreneurs and Web3, providing them with tangible education and career acceleration opportunities. Built by students, for students. Learn more about the academy and our vision here.

Written by KidKuji