Welcome back to the second article of our educational series on AutoKujira!

Today, we’ll dive deeper into how AutoKujira can improve your investing potential with actionable analytics and features before breaking down their roadmap, tokenomics, and everything else you need to prepare yourself for their upcoming $AUTO launch.

Before I start though, I’d suggest reading the first article of this educational series on AutoKujira, which provides an introduction to the team, the product and the vision, and can be found here.

Table of Contents

- AutoKujira: An Automated Solution

- AutoKujira: The Underlying Technology

- AutoKujira: The Key Features

- 2024: The Road Ahead

- $AUTO Tokenomics

- Closing Thoughts

- Useful Links

Okay, let’s get into it!

AutoKujira: An Automated Solution

One of the largest obstacles in DeFi adoption is the nuanced and tedious process required to utilize it. New users are thrown into a technical playground full of intricate parameters, lucrative opportunities, and a steep learning curve with new mechanisms to learn in each project and ecosystem.

Given that DeFi is still in its early stages, a large portion of the experience is still “manual” and intensive. Even the minority that do manage to successfully navigate the learning curve are still confronted with a fragmented and inefficient process.

As the wait for the User Experience (UX) in Web3 to improve drags on, degens are left navigating DeFi with inadequate monitoring tools, limited analytics, and strategies which require hunting for links or juggling various interfaces.

This is where AutoKujira comes in, addressing these needs with a seamless, easy-to-use solution that simplifies DeFi into a central resource-hub by providing comprehensive tools and consolidating essential resources into one platform.

So, how is this accomplished?

AutoKujira: The Underlying Technology

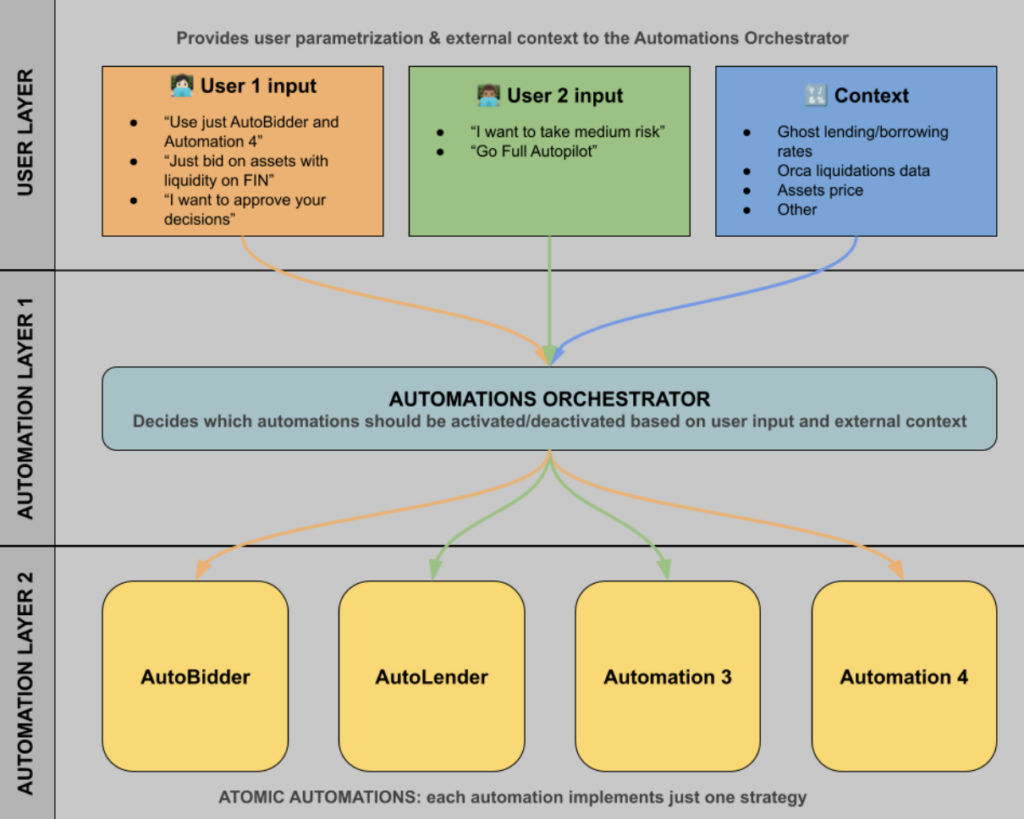

First, the user inputs their preferences and parameters, with this decided by their individual investment goals and risk tolerance. Following this, AutoKujira’s ‘Automations Orchestrator’ will find and execute the most fitting opportunities based on your inputs.

The image below provides a more detailed visual explanation of this process.

So, instead of having to search each individual market in search of opportunities, AutoKujira identifies what an investor is looking for and enables them to execute their positions directly through its simple, easy-to-use interface (UI), providing all the information necessary to make a decision.

Evidently, AutoKujira empowers users to manage positions and efficiently capitalize on (or manage) positions.

AutoKujira: The Key Features

Dashboard

The dashboard provides users with a comprehensive overview of their investment activities including recent liquidations, current bids and orders, lendings, and more.

Now, how can investors make the most of the opportunities presented by AutoKujira?

Opportunities

This tab is an incredibly useful tool that enables investors to find the best opportunities in GHOST and ORCA, meaning there is no longer any reason not to have your money working for you!

To make the most of this feature, scan your wallet (or conduct a manual search), browse the most promising opportunities and then execute on them directly in AutoKujira. It’s as simple as that!

Note: Customizable filters are included within this feature.

‘Let’s Fish’ is another exciting feature developed by the AutoKujira team. So, what does it offer?

Let’s Fish

‘Let’s Fish’ provides a simplified and approachable solution to finding and activating bids on ORCA for discounted assets.

To use this feature, simply indicate ‘what you want to buy’, and ‘what asset you have’. Following this, AutoKujira will then show how close the asset is to liquidation and how much is up for liquidation.

The Market, My Liquidation, My Bids & My Orders

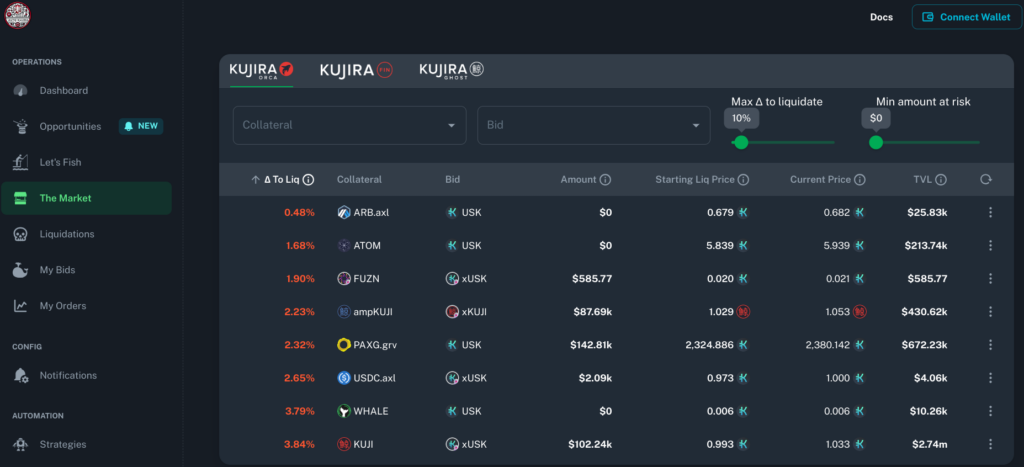

‘The Market’ tab offers a more in-depth and complete overview of the information already discussed.

Here, an individual can view the key analytics pertaining to both the market and their positions, with their recent liquidations, bids and orders shown, as well as market status and overall sentiment, which all help to inform the individual’s next investment decision.

The final feature AutoKujira’s dashboard offers is the ‘Notifications’ tab.

Notifications

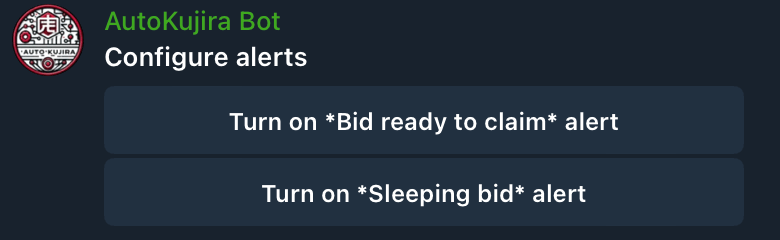

Here, an individual can configure their wallet address to receive timely notifications about their investment opportunities and open positions.

Current notification features include:

- Bid Ready to Claim: Receive alerts for claimable bids, eliminating the need to manually monitor specific positions on ORCA.

- Sleeping Bid: Sleeping Bid: Get notified when bids are “sleeping”, or far from filling for days, and click to find new opportunities to invest the sleeping tokens in.

This should make clear the wide array of powerful tools AutoKujira offers to enhance your investment experience. However, don’t just take our word for it, have a look for yourself!

2024: The Road Ahead

This is still just the beginning for AutoKujira, who have been working hard to deliver their 2024 roadmap. Let’s take a brief look at what this will look like.

Q3 2024: Introduction of Smart Notifications

- PILOT Raise (15th – 17th July)

- DAO Implementation

- New Smart Notifications

Q4 2024: Full Automation Implementation

- AutoBidder Feature: Automatically bid, claim and sell ORCA bids to ensure maximum yield.

- AutoLender Feature: Automate lending with meticulous Loan-to-Value (LTV) monitoring.

- Educational Centre

For a more detailed explanation of their roadmap, visit the following document here.

Now that we’ve covered the range of features AutoKujira offers as well as their roadmap for the next year, let’s take a look at AutoKujira’s tokenomics and how they will generate profits for investors.

AutoKujira’s Tokenomics

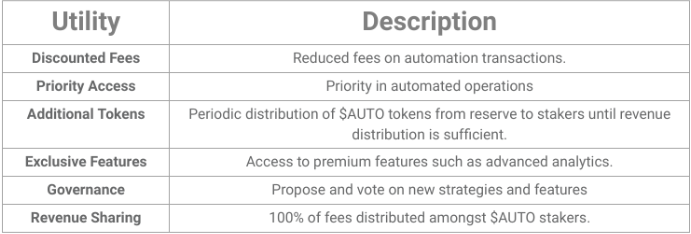

The $AUTO token is designed to offer significant benefits to its holders, providing them with enhanced utility and involvement within the Kujira ecosystem.

The table below list the main utilities and economic advantages of staking $AUTO tokens:

To support these utilities and ensure the sustainable growth of the platform, AutoKujira has implemented a strategic token allocation plan. Let’s take a look at this now.

Token Allocation

The tokenomics are designed with sustainable growth and long-term success in mind by aligning the interests of the team, advisors, and community.

The total supply of 100 million $AUTO tokens is distributed as follows:

Sale (40%)

A significant portion of tokens (40 million) have been allocated via Kujira’s premier launchpad, PILOT.

PILOT’s fair launch mechanism will enable all community members to get in at the ground floor of AutoKujira, encouraging broad-based support and investment from the get-go that will act as a crucial stepping-stone to the long-term success of this protocol.

Community (30%)

30 million tokens have been allocated to the treasury, with these funds used to drive initiatives agreed upon by community members.

With the formation of AutoKujra’s DAO imminent, $AUTO holders will have considerable influence in allocating these funds, empowering them to actively participate in shaping the platform’s future and cultivating a strong, interdependent network of users all working towards a shared goal:

To unlock AutoKujira’s true potential.

Operational Fund (13.5%)

13.5 million have been allocated to the operational fund (which covers ongoing expenses). This is vested over 12 months.

Advisors (1.5%)

1.5 million tokens have been allocated to AutoKujira’s advisors. vested over 12 months with a 3-month cliff.

Core Team (15%)

15 million tokens have been allocated to AutoKujira’s core team. vested over 12 months with a 3-month cliff.

AutoKujira’s decision to structure the team and advisor allocations with a 12-month vesting period and a 3-month cliff reduces the risk of immediate sell-offs, demonstrating the team’s commitment to sustained growth and innovation and ensuring key stakeholders remain dedicated to the platform’s long-term success.

Given all of this, it is evident that AutoKujira has designed its tokenomics to balance the interests of the community with the protocol’s objectives, establishing a solid foundation for users to engage in Grown-Up-Defi both now and in the future.

Closing Thoughts

Whether you’re a seasoned user or newcomer to Kujira, AutoKujira’s innovative approach and dedication to user experience make this protocol well worth watching.

Their wide range of features, ranging from a comprehensive dashboard to automated bidding and smart notifications, provide users with all the tools necessary to optimize their investments and make the most of the opportunities presented by the Kujira ecosystem.

The 2024 roadmap promises even more innovations and by leading the charge towards state-of-the-art tools and insights, AutoKujira will facilitate a future where Kujira operations are fully automated and seamlessly integrated, establishing itself as a leading protocol in the process.

So, check out their live features, participate in their evolving ecosystem, and stay tuned for more articles on how to capitalize on their upcoming PILOT raise, coming soon to WinkHub.

Disclaimer

This article is intended to provide insight and educational resources, and should not direct your investment decisions. It is always encouraged to DYOR and come to your own conclusions.

Useful Links

Kujira Academy is a platform that aims to bridge the gap between young entrepreneurs and Web3, providing them with tangible education and career acceleration opportunities. Built by students, for students. Learn more about the academy and our vision here.

To register your interest and become a student of Kujira Academy, click here.

Written by Kucci