Whether you’re a crypto veteran, a whale, or a shrimp, one thing we all have in common is wanting fast, easy, and inexpensive transactions.

In today’s article, we discuss the rapidly changing world of cross-chain asset exchange before exploring the role CacaoSwap will play in Web3’s hottest new trend, the cross-chain revolution.

So strap in, get your reading glasses on, and come and explore the future of Web3 with us!

Table of Contents

- CacaoSwap: Embracing the Future

- Interoperability: Cross-Chain Challenges

- Interoperability: Existing Solutions and Limitations

- Providing a Solution: The Role of CacaoSwap

- Thorchain and Maya: Behind the Scenes

- CacaoSwap: Under the Hood

- CacaoSwap: Key Features

- CacaoSwap: What’s Next

- Useful Links

CacaoSwap: Embracing the Future

Traditional banking infrastructure is broken beyond repair. Plagued by centralization, inefficiency, and susceptibility to corruption and inflation, these shortcomings have exposed the need for a new financial infrastructure that is sustainable, scalable, and fair for all participants.

This is where Web3 comes in.

By eliminating intermediaries and enabling peer-to-peer (P2P) transactions, cryptocurrencies and decentralized technologies are able to provide secure, transparent, and inclusive financial services to all, highlighting the potential Web3 has to revolutionize multiple industries and solve for the many failures of traditional finance.

However, like any groundbreaking technology, Web3 faces obstacles that must be overcome to achieve widespread success and mass adoption. Let’s take a look at one of the most prominent challenges, interoperability.

Interoperability: Cross-Chain Challenges

In the world of blockchain technology, interoperability stands out as a key requirement for enhancing the functionality and efficiency of decentralized networks. It describes the capability of different blockchain networks to communicate and interact with each other in a seamless manner, and is a central aim for any protocol looking to expand their current reach.

However, early blockchain designs, despite their innovations, were developed without industry standards and in isolation from one another. This lack of coordination led to the fragmented and diverse blockchain ecosystems, causing a number of significant issues across the Web3 space.

Some notable issues include:

- Slower innovation

- Difficulty fostering cross-chain partnerships or DeFi strategies

- Delayed adoption due to higher technical expertise requirements

- Confinement of users to fewer ecosystems, or ‘siloed bubbles’

- Fragmented liquidity pools, higher volatility, and less efficient market

Evidently, interoperability within Web3 is in need of a comprehensive solution, and fast.

Interoperability: Existing Solutions and Limitations

Some existing solutions to the issue of interoperability are:

Layer 0 Protocols facilitate direct communication between blockchain networks, enabling them to interact with each other’s data and assets. However, they confine builders to specific frameworks and standards.

Examples include Cosmos and Polkadot.

Blockchain Bridges secure an asset on one chain while issuing a corresponding (wrapped) asset on another. These require trust assumptions and have potential vulnerabilities with the bridge interface, utilizing synthetic (wrapped) assets.

An example is Wrapped Bitcoin (wBTC) on Ethereum.

Rollups process multiple transactions off-chain and bundle them into a single transaction that is recorded on the main blockchain, increasing throughput and reducing fees. They come with added complexity, more infrastructure layers, and centralization risks.

Examples include Arbitrum, Optimism, and ZK Rollups.

While each of these offer somewhat of an answer to the issue of interoperability, they are not without their limitations. Whether it be reliance on third parties/centralized intermediaries, the use of synthetic (wrapped) assets, or the requirement to build under specific frameworks, they all fail to provide a final, complete solution.

However, there is a path forward.

One in which native assets are easily and efficiently exchanged across blockchains, all on one interface. One where technology bypasses the need to take on intermediary risk, require complex bridging methods, or have deep knowledge of blockchain function.

The answer, cross-chain exchanges. A new generation of DEXs that will unify the liquidity and compatibility of the crypto world and open up a world of opportunities, paving the way for a seamless user experience.

Allow me to introduce CacaoSwap, a protocol setting out to achieve exactly this.

Providing a Solution: CacaoSwap

Until now, DEXs have operated independently on their specific blockchain without the capability to execute cross-chain transactions. Consider the following example.

Swapping ATOM –> ETH

If you wanted to swap ATOM to ETH, this was not possible through a direct method.

Let’s say a user wanted to swap ATOM to ETH. They would have to swap ATOM to wETH (wrapped Ethereum), before subsequently using a bridge to convert wETH to native ETH.

This swap would require the user to navigate the complexities of several blockchains, requiring many steps, multiple wallets, and the onboarding of funds for gas fees on several chains in order to avoid having to use centralized exchanges.

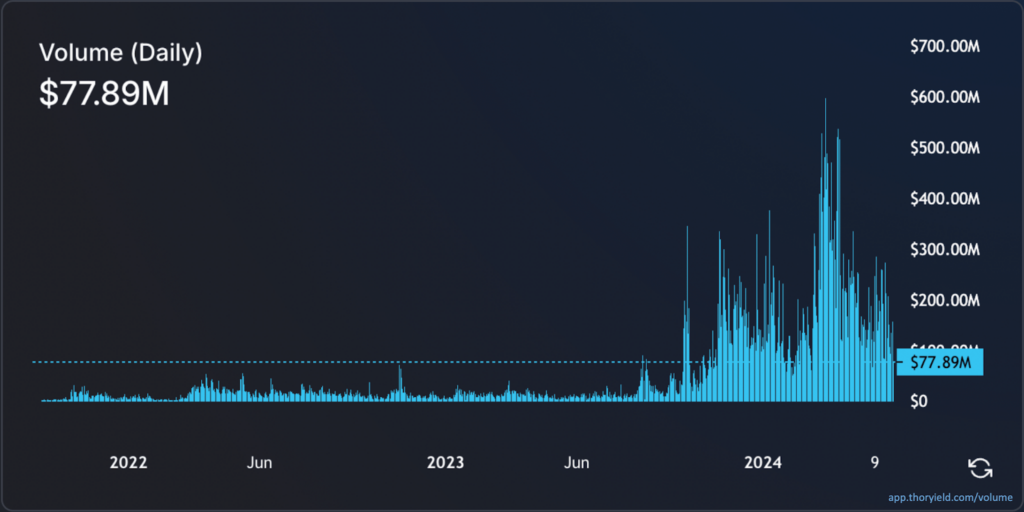

Cross-chain DEXs, such as those accessed through CacaoSwap, solve this by utilizing infrastructure that facilitates asset exchange without chain confinement. Below, you will see a volume graph of the pioneering cross-chain DEX infrastructure, Thorchain ($RUNE).

Thorchain volume from 2022-present

The considerable traction seen in recent months is driven by the increasing functionality, integrations, and awareness of the utility of cross-chain infrastructure. However, these are not the only driving forces behind this increased demand.

Another major factor is the role of Thorchain’s native token, $RUNE.

Thorchain and Maya: Behind the Scenes

$RUNE serves as the sole liquidity pair for every native asset traded on the protocol. This ensures that $RUNE, and by extension, any asset bonded to $RUNE, is fundamentally backed by the diverse basket of native assets traded within the ecosystem.

This bolsters the assets’ health in a way that has never before been accomplished in crypto on a large scale, making Thorchain one of the most robust, secure, and efficient models in the entire space. Maya Protocol, a synergistic fork of Thorchain with distinct adjustments, is also experiencing growth trends on its native token ($CACAO).

As cross-chain DEXs continue to integrate with each other, the power of these protocols will also improve, driving more liquidity through the orderbooks. Additionally, by covering a diverse variety of ecosystems, Thorchain and Maya will enable access to the large majority of blockchains in Web3.

Thorchain and Maya Protocol, amongst a few others, are building novel liquidity solutions for crypto and are growing at a rapid rate. So, how does this concern you?

As mentioned, these projects serve as crucial building blocks, and CacaoSwap will be the final piece of the puzzle. Let me tell you why.

CacaoSwap: Under the Hood

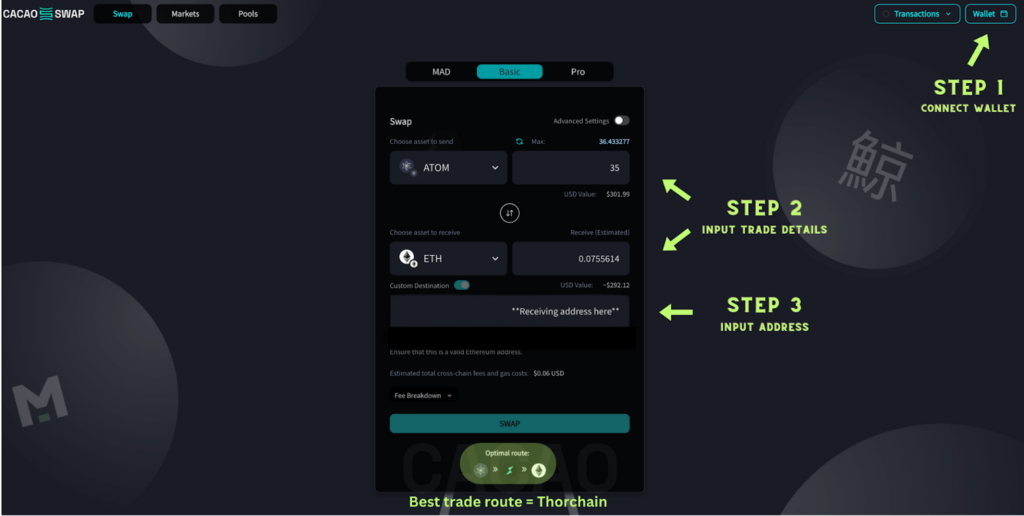

CacaoSwap is aiming to become the go-to community gateway to utilizing these many protocols, enabling users to leverage the unprecedented power and convenience of cross-chain DEXs, accessible via a seamless User Experience (UI), displayed below:

When using this platform, all trades are scanned and aggregated to find the best trading routes. So, unlike traditional exchanges, where putting your assets to work requires 3rd party risk, CacaoSwap enables users to directly utilize the underlying cross-chain DEX infrastructure (Thorchain/Maya).

This means that CacaoSwap is never in custody of user assets, which reduces risk for investors and enhances protocol stability, and with upcoming integrations, they look set to continue expanding their reach. Additionally, on top of integrating some of the most promising new technology, CacaoSwap also provides access to a multitude of DeFi opportunities and tools.

Let’s now take a look at some of the key features CacaoSwap offers.

CacaoSwap: Key Features

- Multi-Protocol Aggregator: Harnesses cross-chain infrastructure to find the best swap routes.

- Portfolio Tackers and Graphs : Users can easily check the live status of markets and wallets.

- Streaming Swaps: Users can gradually exchange one cryptocurrency for another over a set period of time in one transaction, greatly minimizing slippage.

- Liquidity Pools : Users can provide liquidity directly to the underlying integrations using both assets of a trading pair to earn interest from protocol revenue.

- UI Customization: Access multiple layouts to tailor to preferences (basic, pro, and meme).

- Savers (coming soon): Users can provide one-sided liquidity and earn interest on a single asset.

- Analytics (coming soon): Advanced analytics for users to make more informed decisions.

Now, I know this was a lot of information, so let me summarize the contents of this article in a clear, concise manner.

CacaoSwap: What’s Next?

There’s no doubt about it, achieving blockchain interoperability is a crucial and inevitable milestone in the evolution of crypto.

The high liquidity of CEXs, in addition to pioneering platforms like Thorchain, Maya Network, and other cross-chain DEXs demonstrates the immense amount of opportunity for seamless, on-chain, non-KYC crypto transactions.

CacaoSwap, which provides unparalleled access to efficient trades, diverse DeFi opportunities, and useful tools, is positioning itself as a key player within the cross-chain asset exchange narrative, and as the Web3 space continues to expand, community members who hold CacaoSwap’s native token $YUM look set to reap the benefits from this innovative and groundbreaking technology.

So, if this article has piqued your interest, keep your eyes peeled for more content discussing everything you need to know about $YUM’s upcoming token launch on PILOT, beginning June 17th.

Next up: The Implications of $YUM Tokenomics.

Disclaimer

This article is intended to provide insight and educational resources, and should not direct your investment decisions. It is always encouraged to DYOR and come to your own conclusions.

Important Note: Bookmark www.cacaoswap.app for quick access and give it a test run. All trades made prior to the token launch will be eligible for a $YUM airdrop.

Useful Links

The Importance of Interoperability: Cross-Chain Bridges Explained

Kujira Academy is a platform that aims to bridge the gap between young entrepreneurs and Web3, providing them with tangible education and career acceleration opportunities. Built by students, for students. Learn more about the academy and our vision here.

To register your interest and become a student of Kujira Academy, click here.

Written by Kucci