Hello and welcome to the second installment of our informative series on CacaoSwap, written to educate the community in preparation for the upcoming $YUM token launch starting June 17th.

In the first article, we covered how CacaoSwap capitalizes on the narrative of cross-chain transactions to produce value for its users. Today, we delve into how this value is captured through the strategic design of $YUM.

Table of Contents

- The Importance of Tokenomics

- CacaoSwap: $YUM’s Tokenomics

- CacaoSwap: $YUM’s Token Dynamics

- CacaoSwap: A Fair Launch Approach

- CacaoSwap: The Utility of $YUM

- CacaoSwap: $YUM’s Potential Earnings

- Closing Thoughts

- Useful Links

The Importance of Tokenomics

When it comes to navigating cryptocurrencies, it’s easy to get lost in the sea of information and technical terms. Out of convenience, many resort to following influencers who are oftentimes paid to shill and generate hype for exit liquidity.

To avoid the risk of misleading or poorly timed entries, it’s important to understand the underlying mechanisms that drive value to a token.

Often overlooked, misunderstood, and obscured, the driving force behind “number go up” can be difficult to pinpoint. However, by examining tokenomics, value capture, and distribution mechanisms, it becomes clear who stands to profit from a project’s success. Frequently, founders, venture capitalists, and insiders enjoy asymmetric risk/reward advantages through hidden mechanisms such as irresponsible inflation, silent pre-sales, and other dubious tactics, all at the expense of loyal supporters.

In rare cases, you may be lucky enough to come across a team such as CacaoSwap, with the vision of building a sustainable community-centric product with equitable and profitable growth for all.

Let’s now break down the opportunity presented by $YUM, and the implications behind its design to understand why you should be paying close attention.

CacaoSwap: $YUM’s Tokenomics

For starters, the design of $YUM goes beyond simple issuance. Each category is strategically allocated to foster growth, security, and sustainability, and ensure alignment with the platform’s goals of user-empowerment. For an in-depth explanation of $YUM’s tokenomics, read the following article.

Here’s a brief description of how each category of $YUM’s tokenomics supports these objectives:

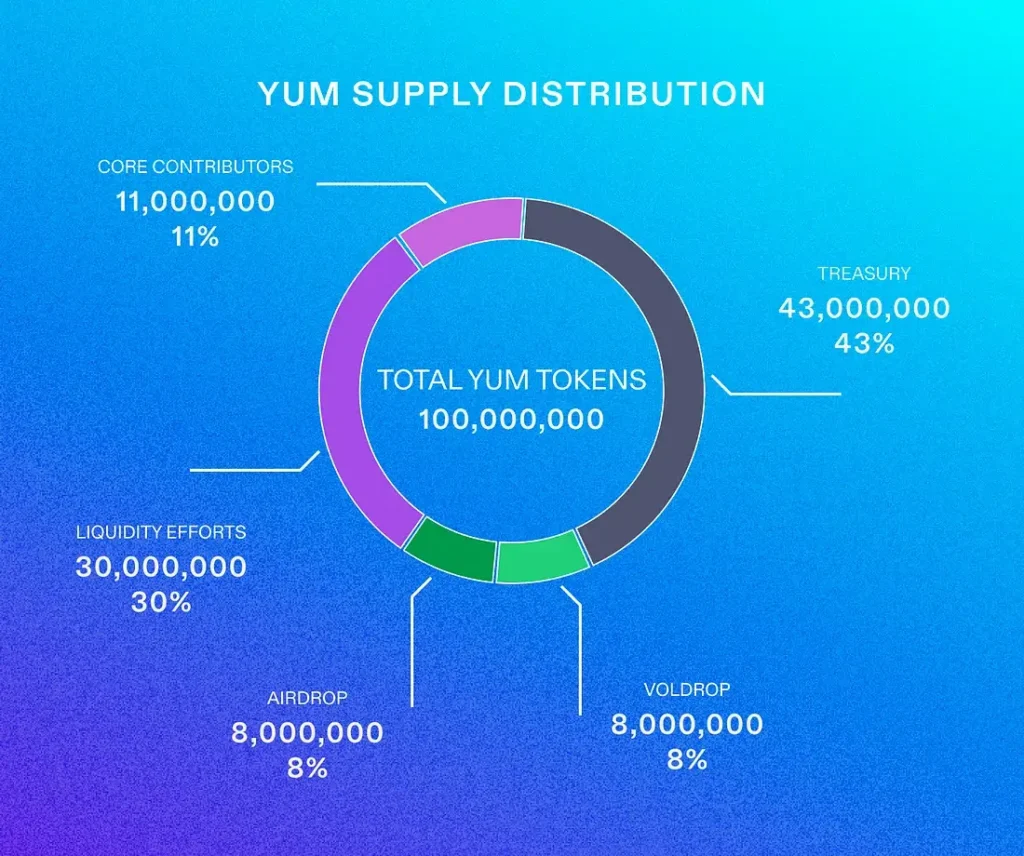

Treasury (43%) – 43,000,000 $YUM

- Funds are controlled by the CacaoSwap DAO through governance to ensure the ongoing support for operations and strategic initiatives including partnerships, future integrations, and operational stability.

Liquidity Efforts (30%) – 30,000,000 $YUM

- While previous Pilot launches have used funding to build, CacaoSwap is breaking the norm by allocating 100% of the Pilot sale to liquidity efforts. In addition to this, funds from the treasury can be used for liquidity efforts as well. Ultimately this will reduce volatility, market manipulation, and slippage fees.

Core Contributors (11%) – 11,000,000 $YUM

- Tokens allocated to contributors help attract and retain high-quality talent, connecting compensation with the project’s growth. The transparent vesting period further fosters long-term commitment and ongoing innovation.

Genesis Airdrop (8%) – 8,000,000 $YUM

- Enhances loyalty and engagement from early adopters, reduces centralization risk by spreading tokens broadly, and establishes early liquidity for healthy price discovery. It ensures that $YUM reaches early supporters and valuable communities, building a foundation from day one.

Voldrop (8%) – $8,000,000 YUM

- The quarterly distribution over the first year supports immediate and long-term ecosystem development. Achieved by encouraging user activity, strengthening loyalty, enhancing distribution, and facilitating a competitive market presence.

Token allocation is not the only relevant factor. Another important consideration is the economic environment the token is trading in.

CacaoSwap: $YUM’s Token Dynamics

To expand on this, let’s discuss a tactic commonly used to discreetly extract value from unknowing retail users… Low float and high FDV environment.

This questionable design creates artificial scarcity that can lead to inflated token prices at launch, allowing early-access investors to sell off significant portions in large profit right at launch. This leaves behind early supporters who are instantly underwater right from the get-go.

This is one of the largest distinctions made with $YUM’s token dynamics, which adopts a high float, low FDV environment.

High Float

- High float means a substantial percentage of the token supply is available for trading right from the start. As a result, holdings value is more accurately represented and not being constantly diluted by the introduction of new tokens to the circulating supply.

- Benefits: Greater accessibility, higher liquidity, reduced price manipulation, and a more stable market.

Low FDV

- Low FDV suggests a lower initial valuation of the token supply, leaving more room for growth and benefitting the overall protocol as opposed to individuals with the most tokens.

- Benefits: Increased growth potential, lower barriers to entry for new investors, and sustainable market expansion.

Unlike most token launches, CacaoSwap’s upside has not been front-run by private markets at ridiculously low valuations. Instead, $YUM maintains equal access for all and distributes its wealth to the community.

CacaoSwap: A Fair Launch Approach

In line with their ethos, CacaoSwap has chosen a fair-launch approach utilizing the PILOT launchpad on Kujira. For those unfamiliar, PILOT is the premier launchpad for the Kujira blockchain, renowned for its ethos of ‘Grown Up DeFI’.

This platform levels the playing field for users by democratizing traditionally exclusive FinTech tools, ensuring all participants have equal access to opportunities. In the case of PILOT, this is achieved through a Dutch auction-style mechanism that allows participants to enter a position at a price that suits their risk/reward preference. More details on this will be covered in our next article.

The benefits of choosing PILOT for launching a token include:

- Mitigation of Bots and High-Frequency Traders: Eliminates automated bots and high-frequency traders that often plague traditional launches.

- Broad Distribution: Promotes a more decentralized and community-driven ecosystem.

- Trust and Transparency: Builds greater trust and transparency within the user base, as the process is clear and defined.

- Discourages Predatory Practices: Limits the potential for insiders to exploit the system.

In essence, a fair launch strategy reinforces the project’s commitment to responsible and inclusive development, setting a new standard for early investment and ethical practices in the DeFi space.

CacaoSwap: The Utility of $YUM

Last but not least is perhaps the most important factor to consider when buying a token, its utility. In a crypto world where so many cryptocurrencies are created as vehicles of speculation with no true purpose, it’s important to ask yourself this one question: What drives value to this token?

Let’s uncover this by looking at how $YUM stands out in this crowded space.

The benefits of holding $YUM include:

Governance: $YUM token holders can participate in governance decisions, influencing the future direction and development of CacaoSwap.

Revenue Sharing: Holders of $YUM benefit from a revenue-sharing model, earning a portion of the protocol’s fees. Unlike many other projects where founders retain all profits, CacaoSwap distributes these earnings to its community. This revenue-sharing extends to include swap fees, DeFi strategies, and other protocol revenue streams.

Access to Premium Features: While not guaranteed, holding $YUM tokens may grant users access to exclusive features such as community airdrops or possible features down the line.

By holding $YUM, the community is able to directly speculate and prosper from the cross-chain traffic, and with the product already being live and functional, initial reactions from the community are overwhelmingly positive, setting a favorable stage for $YUM’s market debut.

Quite simply, the more volume that transacts through CacaoSwap, the more profit it’s holders make.

CacaoSwap: $YUM’s Potential Earnings

Let’s be honest. Every token promises profit, but rarely is this delivered in the proper context. For transparency, we will model this step by step below.

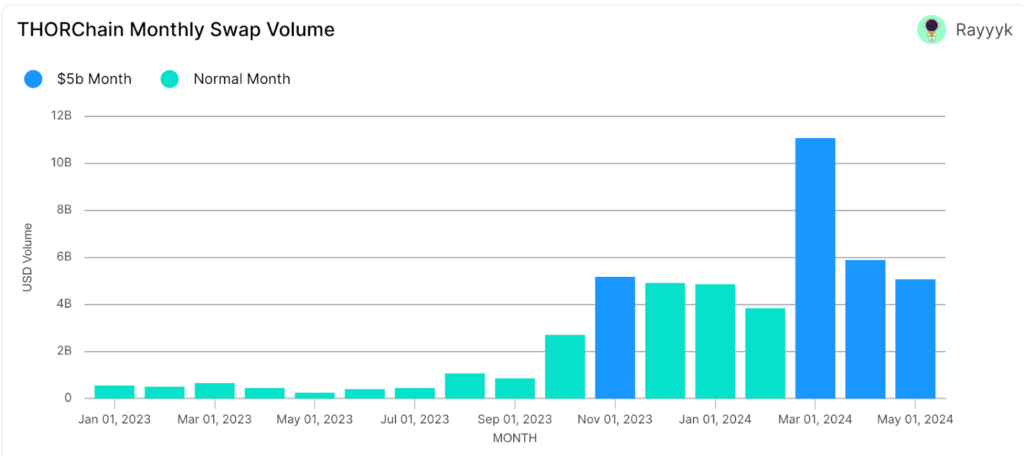

Thorchain Monthly Swap Volume

As depicted in the chart above, Thorchain has demonstrated impressive performance with an average monthly swap volume of around $5 billion.

If CacaoSwap captures even 1% of this volume, it would equate to $50 million in swap transactions, and with its market-leading affiliate fee of 0.44%, this would translate to a substantial $220,000 in revenue.

Revenue (per token)

Considering that 30% of the total $YUM token supply is dedicated to liquidity, 70 million $YUM tokens remain eligible for staking and revenue accrual. If half of these tokens are staked, then $220,000 will be distributed among 35 million tokens per month, equating to $0.006 per token.

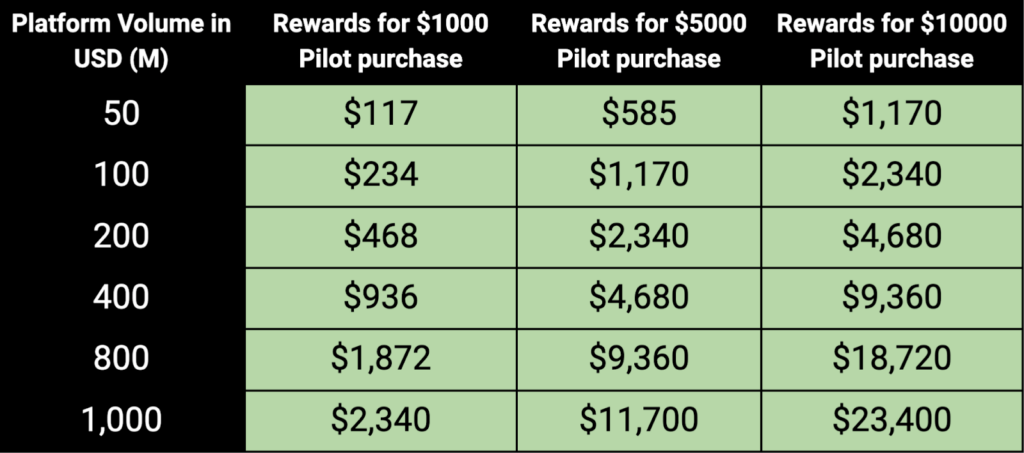

Potential Revenue (per $1000 purchased in PILOT sale)

With $YUM valued at a maximum discount price of $0.051, a $1,000 investment would net investors 19,607 $YUM.

In this scenario, each $1,000 investment could potentially yield $117 for every $50 million in swap volume achieved, a small feat when compared to the ~$5-10b volume that ThorChain and Maya process per month.

This modeling is propagated to various investment amounts and protocol volumes below.

In summary, CacaoSwap has the potential to provide significant returns if it matches even a small fraction of ThorChain’s market volume. The chart reveals that the investment could pay for itself in rewards after reaching just $400 million in swap volume.

An Important Note

- This calculation is only based on Thorchain. It does not include Maya Protocol or future integrations, meaning the opportunity is actually larger than portrayed here.

- This is purely intrinsic value from real yield and does not account for the speculative hype factor on future growth.

- Additionally, an assumption of 50% staked tokens is quite high, meaning rewards could actually turn out significantly higher.

Closing Thoughts

With plans for integrating more blockchains, expanding functionality, and enhancing user experience, CacaoSwap is gearing up for long-term sustainability.

The upcoming launch of $YUM on the PILOT platform extends beyond typical expectations; it’s a strategic move poised to revolutionize the DeFi world. From robust tokenomics to a well-thought-out distribution plan and liquidity strategy, $YUM is well-positioned to capture the growth of the entire crypto market while pushing forward the narrative of decentralized rails.

So, keep an eye out for more updates and detailed guides on how to make the most of this promising opportunity by participating in the $YUM token launch on PILOT, starting on the 17th of June.

Disclaimer

This article is intended to provide insight and educational resources, and should not direct your investment decisions. It is always encouraged to DYOR and come to your own conclusions.

Important Note: Bookmark www.cacaoswap.app for quick access and give it a test run. All trades made prior to the token launch will be eligible for a $YUM airdrop.

Useful Links

Kujira Academy is a platform that aims to bridge the gap between young entrepreneurs and Web3, providing them with tangible education and career acceleration opportunities. Built by students, for students. Learn more about the academy and our vision here.

To register your interest and become a student of Kujira Academy, click here.