Welcome to the fourth installment of our educational series on Boon!

In our previous articles (Article 1, Article 2, and Article 3), we conducted an in-depth analysis of the various aspects of Boon. Now, as we approach their imminent sale on Ignition, it’s time to delve into one of the most critical components, Boon’s Tokenomics.

Table of Contents

Let’s go!

The Role of Tokenomics

Tokenomics, a fusion of tokens and economics, is crucial for grasping the structure of cryptocurrencies and the models developed to incentivize user engagement.

However, the cryptocurrency landscape can be daunting, often filled with technical jargon and an overwhelming amount of information. Many individuals seek simplicity but struggle to find a suitable platform for meaningful interaction, frequently falling back on outdated systems that depend on paid key opinion leaders (KOLs) who generate hype, potentially leaving them as exit liquidity for yet another project.

To mitigate the risks associated with misleading investments, it is essential to understand the underlying mechanisms that influence a token’s value.

Often overlooked aspects, such as value capture and distribution mechanisms, are critical for comprehending a project’s intent. In many instances, founders, venture capitalists, and insiders take advantage of asymmetric risk/reward dynamics through tactics like irresponsible inflation and undisclosed pre-sales, often at the expense of loyal supporters.

In this context, Boon’s tokenomics framework emerges as a distinctive approach, designed to enhance user engagement through staking rewards, liquidity allocation, and proactive token management.

Let’s explore the opportunities presented by $BOON and examine its design to fully appreciate the potential it offers.

Boon’s Tokenomics Explained

To fully understand Boon’s innovative tokenomics, it is crucial to examine the strategic allocation of tokens within its ecosystem. This distribution is carefully crafted to balance incentives for all stakeholders, fostering sustainability and long-term growth.

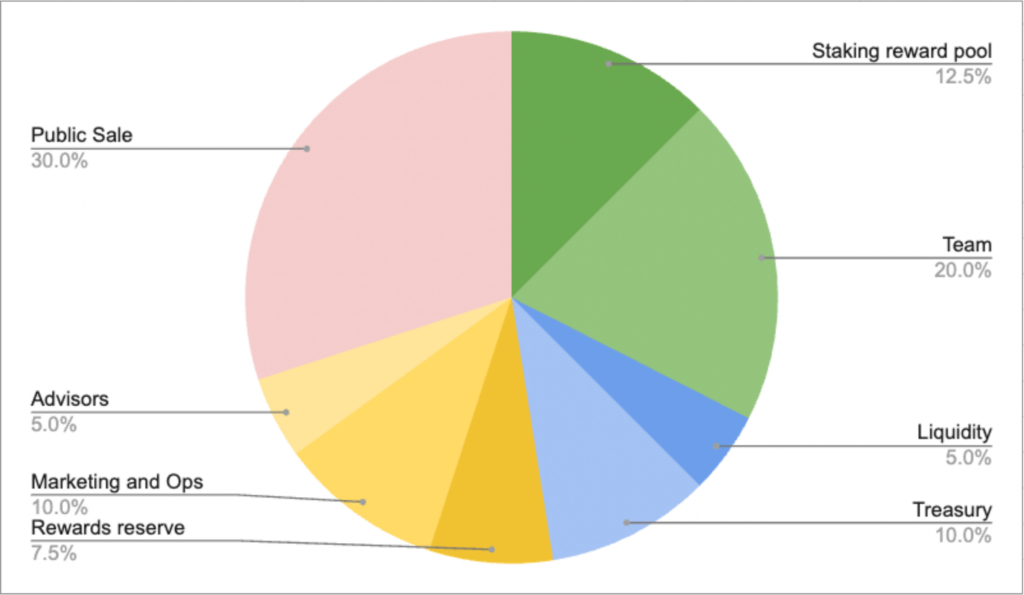

The accompanying pie chart presents a detailed breakdown of $BOON tokens across several categories, including staking, liquidity, team allocation, and community rewards, providing a clear insight into how these resources support Boon’s Social-Fi landscape.

In this article, we will concentrate exclusively on the implications of significant allocations, deliberately leaving out discussions on standard allocations such as team, treasury, marketing, operations, and advisors. These topics have been excluded because they are more straightforward, allowing us to concentrate on the categories that offer greater strategic depth in the role of tokenomics.

Staking Rewards (12.5%)

Boon’s tokenomics are thoughtfully crafted to reward early supporters through its strategic token allocation. By reserving 12.5% of the total token supply for staking rewards, Boon prioritizes giving back to those who contribute to securing the platform during its foundational stage. As the four-year roadmap unfolds and the total token supply is introduced to the market, these incentives will gradually diminish after having achieved their intended purpose, transitioning to real yield generated from multiple sources of protocol revenue streams.

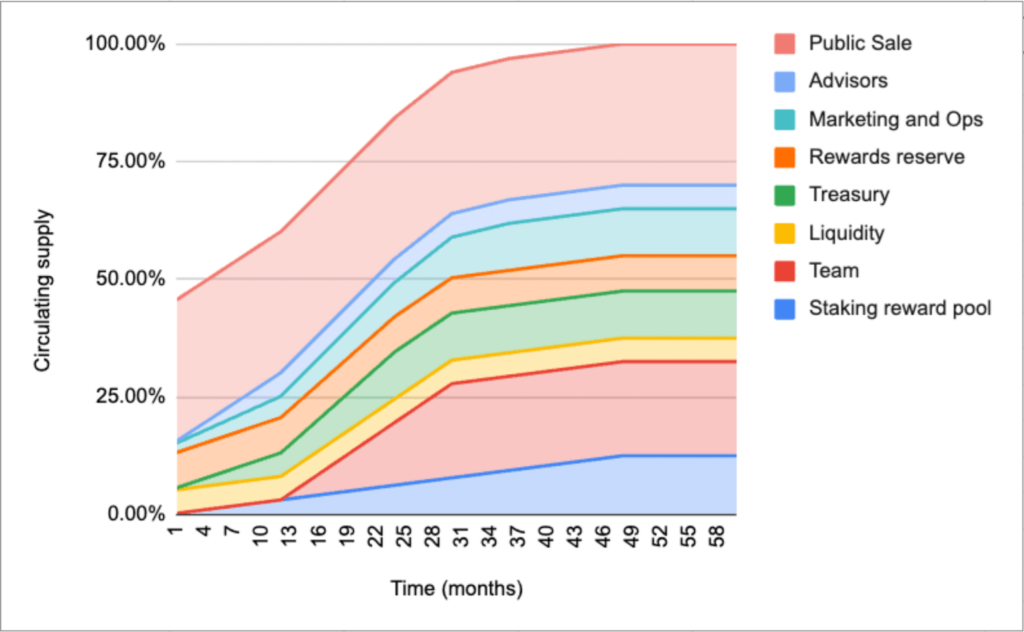

In the first year, projected emissions are expected to vary between 10% and 30% APY, depending on the number of active stakers. This will be followed by an exponential decrease in emissions, as illustrated in the diagram below, which outlines the token release schedule. While the complete token supply won’t be fully available until the end of the four-year vesting period, over 90% will enter circulation by the second year.

Essentially, if you’re reading this, this allocation strategy is crafted to reward YOU!

Public Sale (30%)

The decision to transition from a solely Pilot-based launch strategy to a hybrid model incorporating Ignition as a pre-seed funding mechanism is driven by a desire to strike a balance between expediency and strategic sustainability.

While Pilot’s liquidity provision and credibility offer significant advantages, the recent Rujira events and merger period present technical nuances to launching on Pilot. Following the successful merging of Rujira, Boon aims to be the first Pilot launch on the new Rujira app layer.

By partnering with Ignition as a pre-seed investment platform, Boon seeks to leverage its network effects to accelerate project growth. This initiative introduces a “pre-seed” funding round open to the community, allowing broad participation while ensuring that the tokenomics and liquidity strategies align with user needs.

This dual-pronged strategy allows Boon to harness the strengths of both platforms. By leveraging Pilot’s brand recognition and regulatory compliance and embracing Ignition’s community-driven ethos and fundraising potential, Boon creates a powerful synergy.

Essentially, Ignition ensures a stable foundation for project operations with a lower, preset FDV while the Pilot sale is left to the free market to decide launch price and FDV.

Liquidity (5%) and Rewards Reserve (7.5%)

Liquidity will be strategically deployed to maintain a healthy balance between liquidity and circulating tokens, thereby enhancing market stability and fostering long-term user confidence.

The underlying principle is that a project should avoid significant imbalances between liquidity depth and circulating supply. Such disparities can enable a single large holder to exert considerable influence over the token’s value, as evidenced by the recent decline of Kujira where the price was walked down from $5 to $3 by select holders.

The initial concept behind launching this strategy is that for every 6 tokens in circulation, 1 token will be held in the liquidity pool (LP). As the project evolves, Boon will closely monitor adoption rates and utilize the rewards reserve to maintain a healthy balance until the early phases conclude and liquidity becomes self-sustaining.

To prevent large-scale acquisitions by single entities, a cap of $10,000 per wallet will be implemented during the fundraising phase. Additionally, users will be encouraged to stake their tokens, locking more tokens and further promoting a fluid market ratio of liquidity for buying and selling $Boon.

Nitro Staking

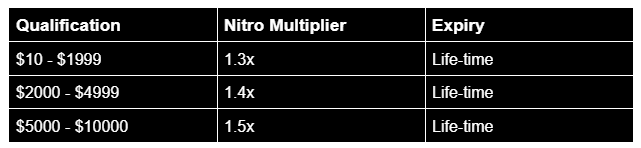

The Nitro feature introduces an XP multiplier, which will be incorporated through the use of NFTs. Following a successful raise, the Nitro NFTs will be airdropped to participants of the ignition sale and subsequent Pilot sale.

The awarded Nitro multiplier will be determined broken into the following levels of participation:

Boon’s tier system is designed to be inclusive, featuring a low barrier to entry. For example, participating in the Ignition sale by purchasing $2,000 worth of Boon tokens grants you a 1.3x multiplier.

Beyond XP points, Boon offers a diverse array of rewards, including NFTs, merchandise, tickets, coupons, tokens, discount vouchers, and certificates, all of which have various applications within the Boon ecosystem. These incentives enhance the staking experience and provide additional value for supporters and superfans.

Owning a Nitro NFT allows users to earn extra XP and climb the rankings, rewarding early adopters for their dedication to Boon. Additionally, thanks to a partnership with WinkHub, these NFTs can be resold or traded, enabling latecomers to access the same benefits as early users in a dynamic free-market environment.

Like other successful projects that have utilized NFT airdrops for whitelist processes, we can expect a dynamic market filled with potential buyers who missed out on initial opportunities. This strategy not only rewards early adopters but also cultivates a flourishing secondary market with royalties being paid back to users.

Closing Thoughts

In conclusion, Boon’s innovative AmpliFi model, supported by strategic tokenomics and robust community engagement initiatives, sets a new standard in the evolving space. By prioritizing user incentives through attractive staking rewards and a carefully crafted token allocation strategy, Boon not only encourages early support from its users but also fosters strong community.

The introduction of Nitro Staking, which allows users to earn additional rewards based on their level of participation, adds further value to the platform. This mechanism not only promotes ecosystem liquidity but also enhances the overall user experience by creating more opportunities to benefit from their engagement.

As Boon continues to implement features that cater to the needs of its community, it offers a strong foundation for long-term loyalty and involvement starting now!

For more details on the launch and how to get involved, have a read of our Litepaper and follow the step-by-step guide of how to participate.

Disclaimer

This article is intended to provide insight and educational resources, and should not direct your investment decisions. It is always encouraged to DYOR and come to your own conclusions.

Useful Links

Core Documentation

Key Content

- Article 1: The Road to Mass Adoption

- Article 2: The Community Hub For Mass Adoption

- Article 3: Boon: Key Features & Applications

Meet The Team

- Meet the Team: Joe Crossley

- Meet the Team: Tengiz Meskhi

- Meet The Team: Andy Raisen

- Meet The Team: Ian Kerr

- Meet The Team: Steve Eatherington

- Meet The Team: George Newton

Socials

Founders

The Academy is a platform that aims to bridge the gap between young entrepreneurs and Web3, providing them with tangible education and career acceleration opportunities. Built by students, for students. Learn more about the academy and our vision here.

Written by Kucci