Welcome to GHOST, Kujira’s premier money market.

In today’s article, I discuss GHOST’s core aspects and functionalities, providing a comprehensive guide to lending and borrowing on GHOST before highlighting how investors can use this platform to start generating passive income today.

Table of Contents

- What is GHOST?

- Borrowing on GHOST: Under The Hood

- Borrowing on GHOST: A Step-by-Step Guide

- Lending on GHOST: Under The Hood

- Lending on GHOST: A Step-by-Step Guide

- Closing Thoughts

- Useful Links

What is GHOST?

GHOST is a decentralized money market built on the Kujira ecosystem that provides a gateway for users to access DeFi services such as lending, borrowing, and yield farming, offering attractive returns for market participants and an innovative solution to the failures of traditional finance.

So, how does it achieve this?

GHOST: An Overcollateralized Answer

Prospective lenders and borrowers interact through GHOST’s supply-demand framework, mobilizing their assets through lending and borrowing to earn interest or secure working liquidity.

Lenders supply assets to GHOST to earn variable interest on those provided assets based on their overall utilization by borrowers, whilst borrowers borrow assets supplied on GHOST (by others) in order to secure working liquidity and participate in financial speculation/take out loans without selling underlying assets.

As all loans on GHOST are overcollateralized, lenders are covered even if borrowers fail to repay their loans, making the process of opening or closing a loan, and supplying or redeeming assets, nearly instantaneous. This significantly enhances user experience (UX) and accessibility and also offers competitive returns for participants, making it an attractive option for both lenders and borrowers.

Additionally, the absence of artificial incentives ensures that the returns are sustainable and not subject to abrupt changes due to external market manipulations creating a reliable financial ecosystem available to all.

GHOST: Financial Inclusion & Economic Empowerment

Typically, stringent banking requirements in developing nations prevent individuals from accessing much-needed financial services, leaving much of the population isolated and unable to escape poverty. Through the elimination of the need for credit checks/loan applications, made possible by its decentralized design, GHOST removes the barriers imposed by traditional banking in these nations.

By democratizing access to financial services and addressing the inherent shortcomings of traditional finance, GHOST has the potential to bring millions of previously excluded individuals into the economic system and pave the way for a more inclusive and equitable financial ecosystem.

Ok, now that you are familiar with the concept behind GHOST and the potential solutions it offers, let’s take a look under the hood of Kujira’s money market.

Borrowing on GHOST: Under The Hood

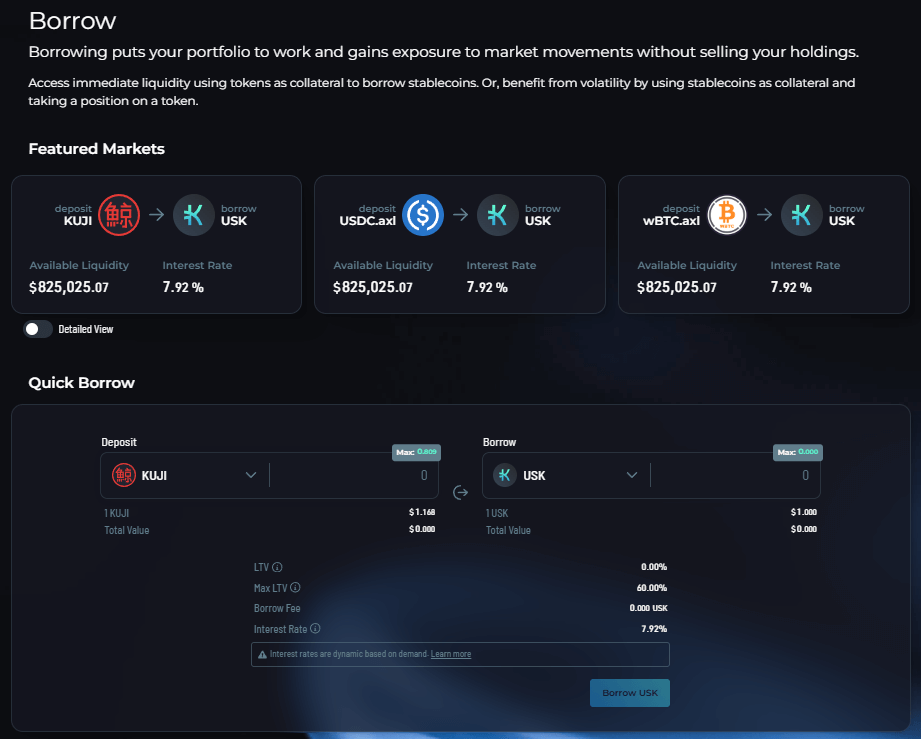

Dashboard

Upon navigating to the borrow dashboard on GHOST you will see a list of the featured markets, the available liquidity, and the interest rate that corresponds to the chosen market. You will also see the ‘Quick Borrow’ feature, which provides an option to open a position between two assets immediately.

The available liquidity reflects the amount of the asset available to be borrowed, and the interest rate reflects the amount (%) an investor must pay to borrow the asset.

For example, if an investor wanted to borrow $USK using $KUJI as collateral, they would be required to pay 7.92% interest on the total amount borrowed. So, if they borrowed $1000 of $USK, they would be required to pay $79.2 in interest payments when closing their position.

Borrowing on GHOST: The Basics

To borrow on GHOST, an investor must put up collateral (in asset ‘C’) in order to take out a loan (in a different asset ‘L’). This collateral determines the maximum loan amount available. As mentioned above, the overcollateralized nature of the loans ensures that the borrowed amount is always less than the value of the collateral, protecting the system from defaults.

If a borrower fails to pay back the loan in time due to decreases in collateral value, increases in funds borrowed, or accrued interest, the deposited collateral will be liquidated via ORCA. In this case, the borrower will keep the borrowed funds, but lose their collateral.

Now, how is the liquidation price (the price the collateral is liquidated at) determined?

LTV Ratios

For those of you who are unfamiliar with this term, the LTV, or loan-to-value ratio, is a financial metric used by lenders to assess the risk, or ‘health’ of a loan, defined as the perceived risk relationship between the supplied collateral asset (asset C) and borrowed loan asset (asset L).

It is this which determines the maximum allowable loan-to-value (LTV) ratio belonging to that loan.

If the price of the collateral increases relative to the borrowed asset, the LTV ratio will decrease, and if the price of the collateral decreases relative to the borrowed asset, the LTV ratio will increase.

However, if the price of the collateral relative to the borrowed asset decreases too much, the LTV threshold will be exceeded, and the asset will be liquidated. For those interested in a more technical explanation or the math behind this, check out the Kujira docs.

Let’s now look to understand this through a working example.

Borrowing on GHOST: A Step-by-Step Guide

To begin borrowing on GHOST, users are required to:

- Create a SONAR wallet.

- Navigate to the GHOST Dashboard.

- Select the asset you wish to borrow ($ASSET).

- Specify the amount of the asset ($ASSET) you would like to deposit.

- Specify the amount of the asset ($ASSET) you would like to borrow.

- View the LTV ratio and the liquidation price set for the position.

- Click ‘Open Position’ to initiate the borrowing transaction.

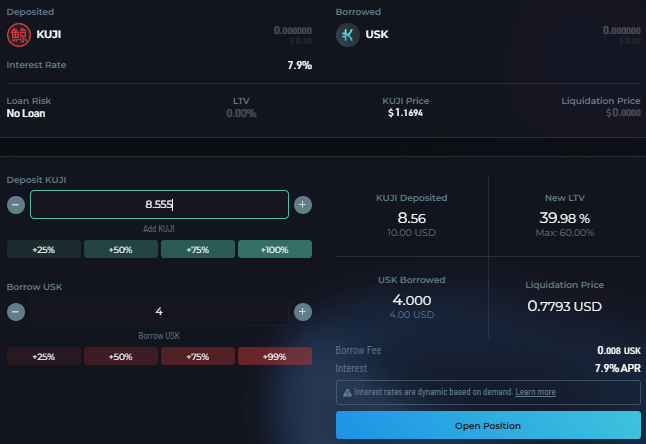

Example: $KUJI/$USK

An investor is depositing 8.6 KUJI ($10) and borrowing $4 USK, with an LTV ratio of 39.99% and the liquidation price set at $0.7793. The maximum LTV ratio is set at 60%.

Once a position has been opened, there are several scenarios an investor may face.

Scenario 1: LTV Increase

An increasing LTV ratio (45%) indicates that the value of the collateral ($KUJI) has fallen against the value of the loan ($USK), making it a riskier loan for the lender.

In this scenario, an investor can either decrease their borrowing position by repaying part of the loan or increase the value of the collateral ($KUJI) to restore the LTV ratio to its previous level.

Scenario 2: LTV Decrease

A decreasing LTV ratio (35%) indicates that the value of the collateral ($KUJI) has risen relative to the value of the loan ($USK), and suggests a less risky loan.

In this scenario, an investor can either increase their borrowing position ($USK) or decrease the amount deposited ($KUJI) to restore the LTV ratio to its previous level.

Scenario 3: Liquidation

In some cases, liquidation may be necessary to prevent an investor from defaulting on their debts.

In this scenario, the LTV of an investor’s loan has exceeded the liquidation price ($0.7793), meaning the value of their asset ($KUJI) has significantly declined against the value of their loan ($USK). This would result in the investor’s collateral ($KUJI) being sold, or ‘liquidated’, to meet their debt obligations, which is a serious event that can have lasting implications on an investor’s portfolio.

So, what is the key takeaway from all this?

The Key Takeaway

Manage Your Position

A high LTV ratio not only increases the risk of default but also reduces an investor’s flexibility, who has to keep assets liquid to service their loan, missing out on new investment opportunities in the process.

That being said, whilst a high LTV ratio can be risky, it may also be necessary to achieve certain financial goals. Investors should add to, or draw down from, their positions, based on the LTV ratio they wish to maintain.

- To decrease the LTV ratio or risk of their position, investors can repay some of the borrowed amount ($USK), or increase the amount deposited ($KUJI).

- To increase the LTV ratio or risk of the position, investors can increase the borrowed amount ($USK), or decrease the amount deposited ($KUJI).

By managing their position, an investor can keep the LTV ratio at a level acceptable for their risk tolerance, mitigating the risk of liquidations and maximizing the returns on their investment.

Okay. Now that we’ve covered borrowing on GHOST, let me explain how investors can put their capital to work and earn passive income through lending on GHOST.

Lending on GHOST: Under The Hood

Dashboard

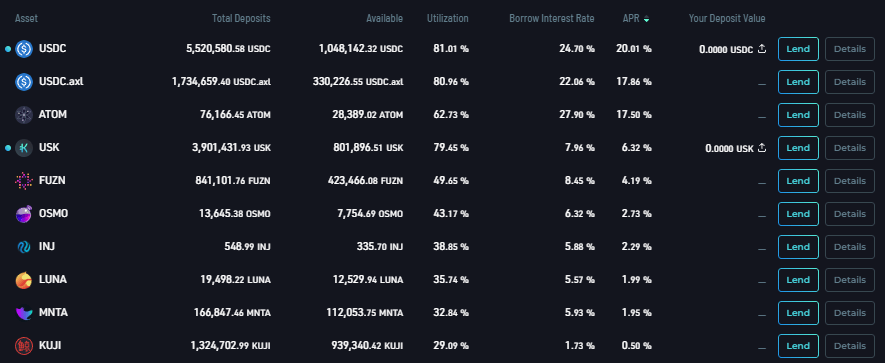

Upon navigating to the lending dashboard on GHOST, you will see several key metrics.

Asset Name

- This displays the asset ticker. For example, Kujira has KUJI as its asset name.

Total Deposits

- The total amount of an asset lent to GHOST collectively across all lenders.

Available

- The total amount deposited minus the total amount already borrowed by other users.

Utilization

- The ratio of the amount already borrowed to the total amount deposited. The maximum possible utilization rate is 100%. Interest rates correlate with utilization.

Borrow Interest Rate

- The yearly interest that borrowers owe on any open positions where they have borrowed on a specific asset. This varies over time with the asset utilization.

Lend APR

- The current yearly interest rate that lenders earn on any provided liquidity to GHOST for that asset. Again, this varies over time with the asset utilization.

An Important Note

The maximum possible utilization rate is 100%, and interest rates (borrow interest rate and lend APR) vary over time with the asset utilization.

Your Deposit Value

- The amount of an asset that an investor has deposited into GHOST.

Details

- A graph that depicts the relationship between the utilization, borrow interest rate and lend APR over time for a particular asset.

Lending on GHOST: The Basics

All lenders on GHOST provide liquidity by lending assets to the platform and get paid a variable interest rate as compensation.

When users deposit N units of an asset called “TOKEN” into the platform, they will receive N liquid units of an asset called “xTOKEN” in their wallet. xTOKEN is similar to a receipt token that represents a claim to lent TOKEN on GHOST., and can be traded on FIN, sent to other wallets, or used with ORCA to bid on liquidations, offering a wide range of investment opportunities for lenders.

This is especially attractive as units of xTOKEN automatically accrue interest that is collected from TOKEN borrowers’ open loan positions on GHOST. When the lender eventually redeems their xTOKEN, they will receive back all their TOKEN and some extra TOKEN corresponding to that accrued interest.

For example, if an investor lends 10 KUJI on GHOST, they will receive 10 xKUJI in their wallet. Let’s say they leave this KUJI in GHOST and redeem it after 3 months.

Depending on utilization levels and how much interest was accrued during that period of time from KUJI borrowers, they would receive your initial 10 KUJI back in addition to the interest earned on that KUJI.

Let’s look to understand this through a working example.

Lending on GHOST: A Step-by-Step Guide

To begin lending on GHOST, users are required to:

- Create a SONAR Wallet.

- Connect your wallet to GHOST by Kujira.

- Navigate to Lend.

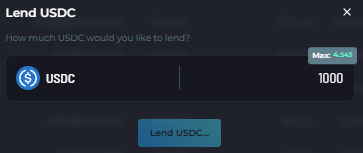

- Choose the asset you wish to lend (USDC).

- Indicate the amount you want to lend.

- Approve the transaction to start lending on GHOST.

Lending on GHOST: A Working Example ($USDC)

In this example an investor supplies $1000 to the $USDC lending pool. After connecting their SONAR/KEPLR wallet to GHOST, they navigate to the lending dashboard, selecting ‘Lend’ $USDC and typing in the amount ($1000) they wish to lend.

Once this transaction has been confirmed, the investor can view the ‘Lend APR’ for this asset, which describes the annualized percentage yield (%) earned for lending $USDC.

The current Annual Percentage Rate (APR) for $USDC stands at 20% as of 01/07/2024. Based on this APR, an investment of $1,000 would yield the following returns over different periods:

- $1,000 at 20% APR for 1 year: $200

- $1,000 at 20% APR for 6 months: $100

- $1,000 at 20% APR for 3 months: $50

It is important to note that the APR is subject to change depending on the asset utilization rate, which means the actual yield earned may vary slightly from these estimates.

The Key Takeaway

Lending on GHOST is a slightly more intuitive and lower-risk process than borrowing on GHOST, and provides a fantastic opportunity to earn passive income whilst waiting for other investment opportunities.

By supplying assets to GHOST’s lending platform, lenders can earn variable interest on deposited assets which automatically accrues interest and can be traded or used for bidding on liquidations. That being said, given that the ‘Lend APR’ fluctuates based on asset utilization rates within the lending pool, it’s crucial for these lenders to carefully monitor the interest rates applied to the lending pool in order to maximize their returns.

Thus, while lending on GHOST provides a potentially profitable platform for earning interest, active management and awareness of changing APR rates are essential for optimizing investments.

Closing Thoughts

GHOST, a decentralized money market within the Kujira ecosystem, offers innovative solutions for lending and borrowing, providing a secure and efficient platform for investors to leverage their crypto assets and start putting their money to work.

By eliminating the need for credit checks and enabling instant loan processing, GHOST removes barriers typically present in traditional finance, promoting financial inclusion and economic empowerment throughout the world, and especially in developing countries.

As DeFi continues to evolve, platforms like GHOST will lead the way in democratizing financial services, providing accessible lending and borrowing options that enable users to take control of their financial future. So, whether you’re looking to borrow against your crypto assets or earn passive income through lending on GHOST, my advice to you is this.

The money market of Kujira is evolving fast.

Get on board. Quickly. This boat is about to set sail, and you don’t want to end up washed ashore.

Disclaimer

This article is intended to provide insight and educational resources, and should not direct your investment decisions. It is always encouraged to DYOR and come to your own conclusions.

Useful Links

- A GHOST Technical Deep Dive

- GHOST Basics – Kujira Docs

- Borrow on GHOST – Kujira Docs

- Lend on GHOST – Kujira Docs

- GHOST: Lending Dashboard

- GHOST: Borrowing Dashboard

Kujira Academy is a platform that aims to bridge the gap between young entrepreneurs and Web3, providing them with tangible education and career acceleration opportunities. Built by students, for students. Learn more about the academy and our vision here.

To register your interest and become a student of Kujira Academy, click here.

Written by KidKuji