In this post we will explain the process of minting USK, as well as bidding on ORCA in order to both protect the stablecoin, and pick up apex assets at a discount. Let’s dive right in 👇

Table of Contents

- How to open a collateral position & mint USK

- What is liquidated collateral?

- ORCA – Bidding

- ORCA – Premiums

- ORCA – Withdrawing assets

- ORCA – Cancelling bids

- What makes ORCA different?

- How to report bugs & give feedback

- Helpful links

How to open a collateral position & mint USK

Before we get into how to add collateral and Mint $USK, we urge you to read this piece about the $USK mechanism design, as well as the important role that ORCA plays.

At the time of writing, the collateral options to mint USK are ATOM, Wrapped DOT & wETH (brought to Kujira by Axelar & Squid).

Let’s use wETH as the example for this post. The process is identical for each collateral type.

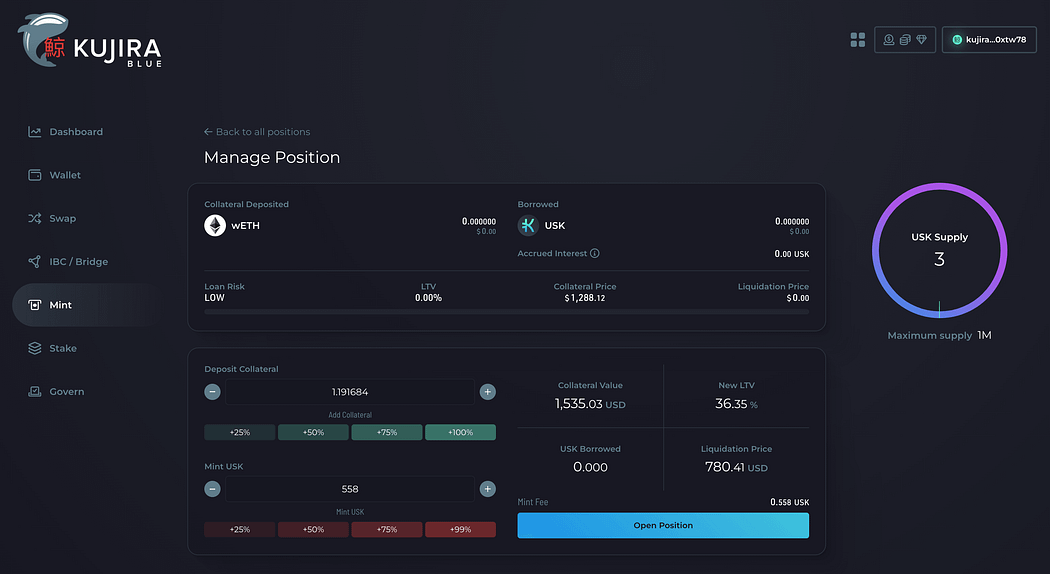

First, head over to the mint tab on BLUE. Then select the collateral that you’d like to use in order to open your position (we’re using wETH for the purposes of this tutorial).

Next, input the amount of wETH you want to deposit, and then select the amount of USK you want to mint. The more USK you mint relative to the amount of wETH collateral, the higher your LTV will be, and hence the higher the risk of liquidation. Another reminder that this is all explained in more detail here.

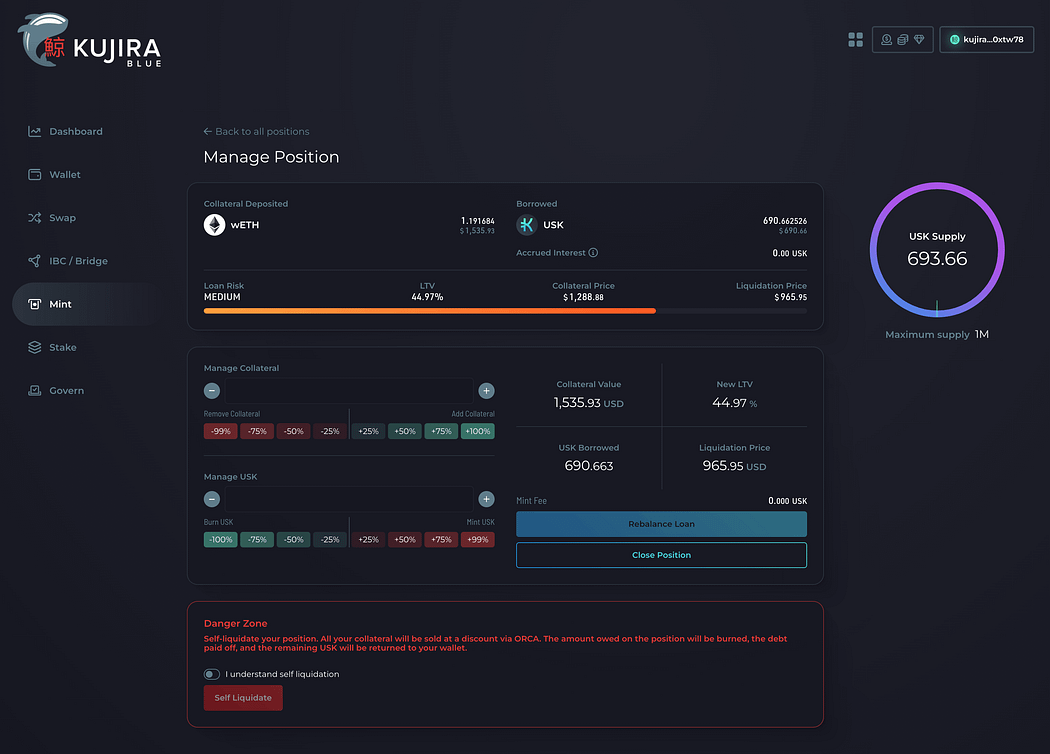

Once your position is open, you are able to manage that position easily from the dashboard. It’s here that you can remove or add more collateral, mint more USK, close the position, or self-liquidate.

Why would you ever want to self-liquidate?

If you can’t repay your loan and you predict the price will fall and cause your loan to be liquidated, you can self-liquidate earlier, getting more back for your collateral than you would if you waited to be liquidated.

What is liquidated collateral?

Before we get into the nuts and bolts of ORCA, it’s important to understand what collateral is, and especially what liquidated collateral means to you as an ORCA user.

In order for someone to mint USK on Kujira, they need to deposit “collateral”. This creates a ‘collateralized debt position’ (a kind of loan). The collateral is deposited in the form of ATOM, Wrapped DOT or wETH at the time of writing.

This collateral is used to provide a backstop for the USK stablecoin, and in order to remain solvent, the value of the collateral must never drop below the value of the minted USK. When this is close to happening, a liquidation occurs.

In the event of a liquidation, it’s this collateral that gets put up for auction, and it’s this same collateral that you are able to bid for on ORCA. By doing so, you are helping to protect the stablecoin and keep it solvent, but you’re also getting this apex asset at a discount. Kujira needs to ensure that there is always sufficient collateral to back the USK stablecoin, and hence are willing to offer this collateral at a premium/discount to willing buyers.

It’s liquidation time

Don’t worry, you don’t do the liquidations. ORCA takes care of that. You have two decisions:

- How much to bid.

- Which premium to bid at.

Bidding

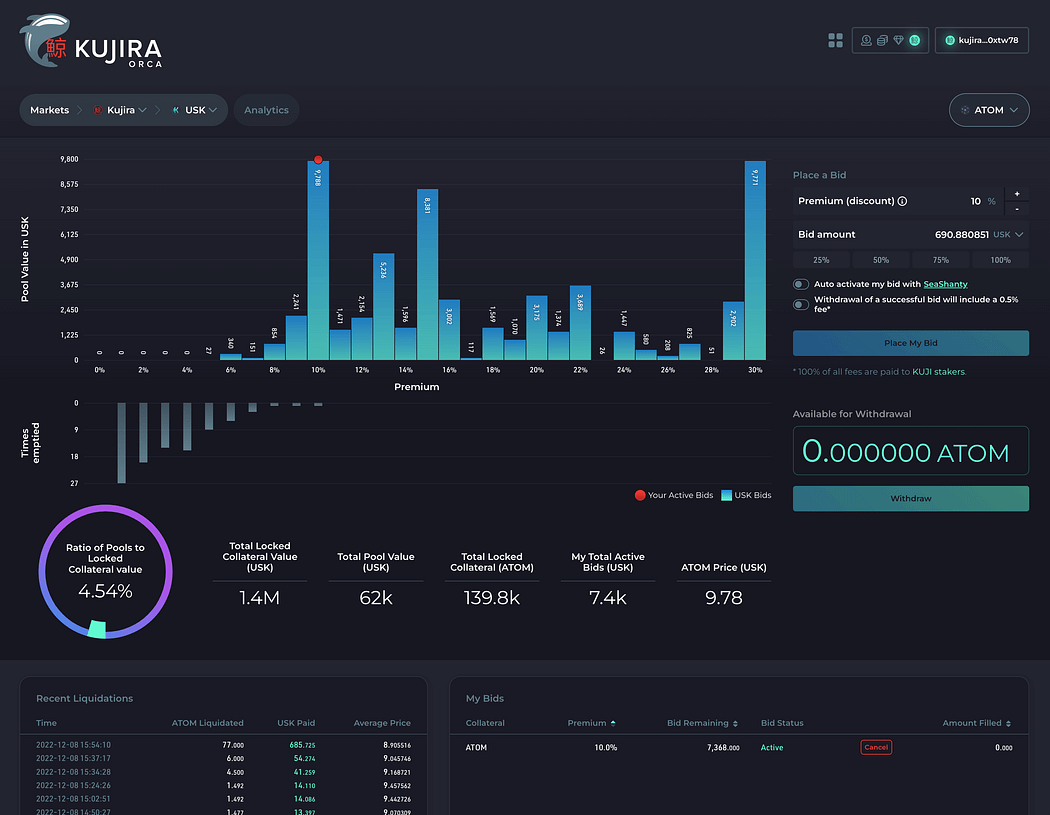

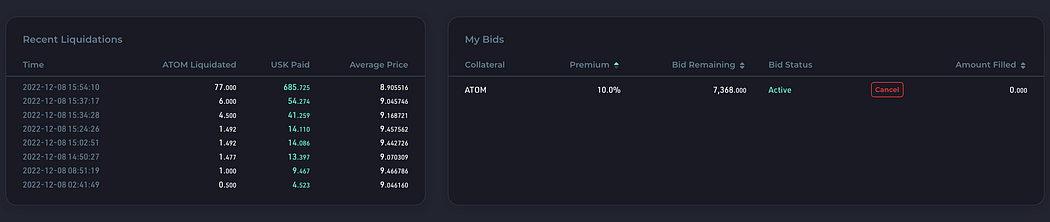

The size of your bid is completely up to you. There are no minimum or maximum amounts. Choose the amount you wish to bid and hit the blue button marked, “Place My Bid”. ORCA’s dashboard shows the total value of bids at each premium, and the premiums at which you have placed bids.

You can place bids at as many premiums as you like.

Premiums

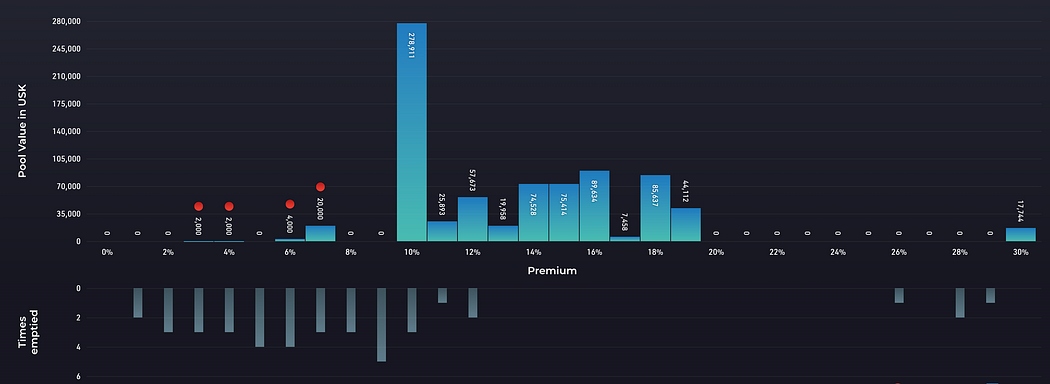

The premium is the discount received by the bidder. It starts at 0%, goes up to 30%, and the smallest premiums are filled first. Assuming there are enough loans to liquidate, all the bids at the lowest premium are filled before the next highest are activated, moving steadily upward until there is no more collateral to liquidate or no more bids.

Withdrawing assets

After you’ve had bids filled, it’s time to withdraw your assets. Simply click on the green Withdraw button, confirm the transaction on your wallet, and the asset(s) will be removed from ORCA and placed in your wallet. *You don’t have to withdraw after each successful bid is filled. These will just pile up until you’re ready to withdraw.

Cancelling bids

The same goes for your bids. If you decide to cancel your bid to re-deploy at a different premium (or move to a new market), scroll down to the table marked “My Bids” and click the red Cancel button next to the bids you’d like to cancel.

What makes ORCA different?

Traditionally, lending markets in crypto have offered liquidated collateral to buyers in a ‘first come, first served’ manner. What this means is that in order to buy this discounted collateral, you need have a lot of money, and be able to build very efficient bots. We firmly believe that having such a huge market being closed off to everyone other than whale techies is neither fair nor in the spirit of decentralization.

ORCA is the first public marketplace for liquidated collateral, and will be expanding onto many lending markets and protocols that want to handle their liquidations in a fair and democratic way.

Everyone deserves to be a whale.

How to report bugs & give feedback

We would really appreciate any help in identifying bugs or other issues you may come across.

The official place to report these is in our #feedback channel in Discord.