Table of Contents

- Executive Summary

- Potential Merger Perimeter

- RUJI Tokenomics

- Kujira Ecosystem Projects Allocation

- Why Should Kujira Ecosystem Projects Opt-In?

- Merger Mechanics

- rKUJI Conversion

- Timing and Next Steps

- Final Words

Executive Summary

- We are thrilled to announce the Rujira Alliance (“Rujira”), a merger between Kujira key ecosystem apps and Levana. Unifying the THORChain app layer under one token, $RUJI, that accrues value from all the core applications.

- The Merge will seek to combine $KUJI, $FUZN, $WINK and $NSTK under the single $RUJI token, with the hope that $LVN will also join in due course.

- The unification of the app layer under $RUJI will create a new investible narrative with solid management and hyper-growth focused leadership.

- This allows for a valuation reset, higher fundraising benchmarks and higher potential for listings with top centralized exchanges and market makers.

- To support the growth and development of the app layer, the Rujira treasury will be capitalized with up to $10m.

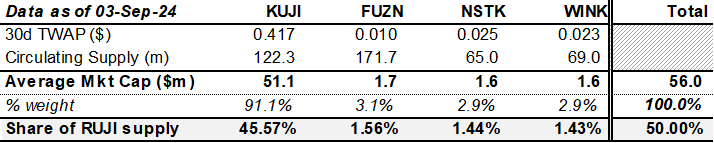

- Kujira and its ecosystem apps will collectively receive 50% of the new $RUJI token supply, with allocations determined by a rule-based system using a 30-day average market cap to mitigate short-term volatility and risk of manipulation.

- Participation in the merger will be subject to a governance vote by each of the Kujira projects ($KUJI, $FUZN, $WINK and $NSTK). Each project will have the option to opt-in or out based on their assessment of the merger’s terms. Governance proposals must be posted within 72 hours of this announcement.

- In case of an opt-out decision, the project(s) will still be able launch as an independent application on the app layer, as per the initial partnership announcement.

- Opting-in will maximize alignment with the app layer while allowing projects to de-risk themselves by becoming part of a much larger ensemble, with access to more resources, and a share of the cashflows from all the core apps, of which the bulk is expected to come from FIN and Perps.

- We believe further deepening our partnership with THORChain via this merger is the best next step on Kujira’s journey. This will enhance alignment and synergies across the app layer while providing valuable funding to fuel growth and provide the much-needed access to institutional partners and listings on top centralized exchanges.

Potential Merger Perimeter

The projects that might be merged into Rujira comprise:

- Kujira ($KUJI) core apps – subject to governance vote:

- FIN, the 100% on-chain orderbook DEX.

- BOW, the AMM adding liquidity on FIN.

- GHOST, the money market.

- ORCA, the liquidation engine.

- PILOT, the launchpad.

- Yield Harbour: Advanced options trading protocol – The Kujira team has already funded most of the development; it will be launched as Kujira Options protocol.

- Levana ($LVN): Perpetual futures trading – to be confirmed in the coming days.

- Fuzion ($FUZN): Capital Raises (incl. PILOT, currently 50% partnership with Kujira, OTC platform, Bonds and other fundraising products) – subject to governance vote.

- Gojira ($WINK): NFT trading platform – subject to governance vote.

- Unstake ($NSTK): High efficiency LST markets and GHOST borrow-side consumer – subject to governance vote.

RUJI Tokenomics

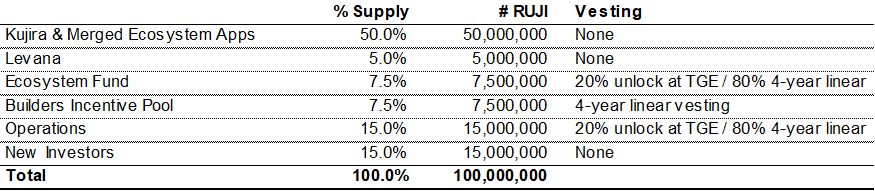

The $RUJI token will be initially distributed as follows (subject to change, there are still several moving pieces):

- Kujira & Merged Ecosystem Apps (50%): Allocated between projects per the methodology described in the next section.

- Acquisitions (5%): To acquire other protocols such as Levana for perpetual futures trading.

- Ecosystem Fund (7.5%): To be used at the discretion of the Ruji team for additional mergers, liquidity mining, airdrops and other activities aimed at attracting users and stimulating economic activity to jumpstart the new Rujira Economy flywheel.

- Builders Incentive Pool (7.5%): To be allocated as performance bonuses to apps, builders, and other contributors across the new Rujira Ecosystem based on revenue contribution over four years, among other factors, to ensure that the verticals that contribute the most value to $RUJI are rewarded for it.

- Operations (15%): To be utilized by the Rujira team to fund operational expenses, facilitate Centralized Exchanges listings, provision Market Maker liquidity, and engage in value-added on-chain activities such as building up long-term protocol-owned liquidity (e.g. to make market on FIN via BOW).

- New investors (15%): Targeting to raise $10-15m at different rounds (targeting a minimum valuation of $100m) to capitalize the Treasury and the Ecosystem Fund. Any unsold tokens will be returned to the Operations treasury.

The total RUJI supply will be 100m tokens. There are no RUJI inflation mechanisms in place at the time of launch and currently no plans to have any inflation in the future.

RUJI will be the fee-switch token of the THORChain App Layer, allowing stakers to capture the revenue generated by the applications that join the Rujira Alliance, net of revenue shared with THORChain L1 to pay for security. As described in the initial partnership announcement, the baseline for revenue share between core apps and the L1 is 50/50 and any economic activity that already accrue value to the L1 (e.g. applications building on top of the Rujira primitives) won’t have to pay twice for security.

Kujira Ecosystem Projects Allocation

The proposed merger comprises several Kujira ecosystem projects/communities, each having a natural bias towards its own investment. To minimize surface for intra-community conflict and subjectivity, we have opted for an objective, two-stage process to determine each project’s respective share of the 50% $RUJI allocation, which is described as follows:

- Use a rule-based approach to determine weights, based on observable market data: 30-day average market cap to limit the impact of short-term volatility and risk of manipulation.

- Based on this objective approach, each project ($KUJI, $FUZN, $WINK and $NSTK) will be granted the option to either opt-in or out of joining the Rujira Alliance via their respective governance process, provided that the governance proposal is posted within 72 hours from the publication of this announcement.

If the stakers of a particular project believe that they would do better on their own and vote to opt-out of the Rujira Alliance, they are free to launch as an independent application on the THORChain App Layer, as per the initial announcement.

If a project opts out, his share will be redistributed to the remaining projects following the exact same rule as per step 1 (i.e. everyone gets a slightly bigger slice of a slightly less valuable pie).

We believe this is the fairest way to conduct an efficient and orderly token distribution for all the parties involved.

Why Should Kujira Ecosystem Projects Opt-in?

Opting-in will maximize alignment with the app layer while allowing projects to de-risk themselves by becoming part of a much larger ensemble, with access to more resources, and earn a share of the cashflows from all the core apps that comprise the Rujira Alliance, the majority of which is expected to come from FIN and Perps. This will also mitigate the impact of the revenue sharing with TC L1.

We can share a few data points to give a sense of the upside that exists for all projects that join the Rujira Alliance and earn a share of FIN’s revenue via their $RUJI allocation:

- There is currently ~$250m of TVL on TC L1, with an average daily utilization rate of 0.48x over the last 12 months; that’s ~$120m of volumes per day at current TVL.

- With the new FIN architecture, FIN will be able to tap into this liquidity from day 1, matching taker orders against the L1 liquidity acting as a maker.

- Assuming an average daily utilization rate of 0.11x (which is the average on FIN over the last 12 months), that would mean ~$27m average daily volumes without taking into account any additional liquidity on the App Layer.

- That would be a 57x increase from current average daily volumes.

- For orders executed against TC L1 liquidity, FIN only collects its 15bps Taker fee; the Maker in that case is the THORChain L1 pool which charges its own fee. Therefore, trades executed against L1 liquidity are systematically accruing value to the L1 and won’t not need to pay for security, so 100% of that revenue will be accruing to RUJI stakers.

- Of course, this is just data-driven speculation, we are not making any promises.

Participating in the merger is an opportunity for FUZN, WINK and NSTK stakers to capture a share of a much larger cashflow stream while still retaining exposure to their respective projects.

Merger Mechanics

Once Kujira is live on the THORChain App Layer, the Alliance contract will be deployed, allowing merger participants to deposit their respective tokens (KUJI, rKUJI, FUZN, WINK, NSTK, LVN) and receive RUJI at a conversion ratio proportional to their share of the RUJI supply.

The Alliance contract will start at a 1:1 conversion rate of TOKEN to RUJI with a 1:1 rate for a minimum of four weeks, which will follow a linear regression towards 1:0 over 12 months. Token holders who do not merge within this period will forfeit their share of the RUJI allocation, which will be streamed back to those who keep their merged RUJI in the Alliance contract, rewarding active and long-term engaged community members.

For an overview of the merger mechanics, please visit: https://kujira.network/merge.

rKUJI Conversion

As part of this merger, the rKUJI terms have to be changed vs. initial plan. There will no longer be a 3 month cliff + 3-6 month vesting, instead rKUJI will remain liquid until the Alliance contract is deployed and will be convertible at the same terms as KUJI at the point of the merge (likely to be around the 3 month mark from the PILOT sale, so roughly in line with the intended 3-month cliff). Like other token holders participating, rKUJI holders will be able to keep their rKUJI in the Alliance contract for up to 12 months after the merger starts to benefit from some bonus RUJI rewards.

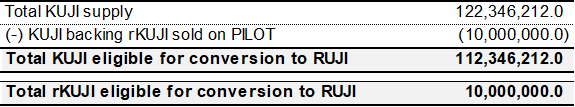

Out of the total KUJI supply of 122,346,212 KUJI, a total of 112,346,212 KUJI will be eligible for the conversion to RUJI, alongside the 10,000,000 rKUJI that were issued and sold during the PILOT sale in August 2024. KUJI and rKUJI will have the exact same conversion terms.

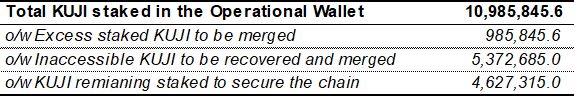

Out of the 10,985,845 KUJI staked in the Operational Wallet, of which 10,000,000 KUJI are backing the 10,000,000 rKUJI, 5,372,685 will be unstaked and merged in place of the inaccessible KUJI (avoiding the need for a chain upgrade to recover the tokens) and another 985,845 excess vs. rKUJI will be unstaked and merged. 4,627,315 KUJI will remain staked to secure the chain and won’t be merged, alongside the 5,372,685 inaccessible KUJI, making a total of 10,000,000 KUJI that won’t be merged, offsetting the 10,000,000 rKUJI merged.

Timing and Next Steps

Within 72 hours following this announcement, each Kujira project involved (KUJI, FUZN, WINK and NSTK) will need to post a governance proposal to their respective governance platforms, allowing their stakers to decide if they want to opt-in or opt-out of the merger. After that, we will be able to confirm the merger perimeter for Kujira apps.

As part of the KUJI governance vote, the stablecoins, ATOM and ETH currently in the Community Pool will be transferred to the Operational wallet. Part might be used to support the repayment of the non-team related bad debt remaining in the system, the rest will be consolidated into the new Rujira Operations wallet post merger.

The RUJI token will be issued on the THORChain App Layer once the technological readiness allows. Detailed instructions on how to proceed with the token conversion will be shared at a later time.

Final Words

We are grateful for the patience and trust the community has demonstrated during these challenging times 🙏

With all the debts in the operational wallet fully repaid, we are now in a significantly stronger position than just a month ago. We now have an opportunity to capitalize on everything we have learned over the last 3 years and take it to a fresh start. This merger deal not only deepens our partnership with THORChain but also opens up unprecedented access to increased liquidity, institutional partnerships, and listings on top centralized exchanges. Truthfully, we believe we are in the strongest position we have ever been and are super excited for this next chapter for Kujira. LFG 🔥