Executive Summary

Today we are thrilled to announce a partnership between Kujira and THORChain, making THORChain the platform for Kujira’s DeFi suite with tight integration of THORChain’s native apex assets and deep liquidity, accelerating Kujira into the future.

THORChain enables native cross-chain swaps, without any wrapped or bridged assets. With their upcoming CosmWasm and IBC upgrades, THORChain will now become the new home of Kujira’s suite of leading DeFi products. With hundreds of millions in TVL and billions of dollars of volume in the last month, THORChain will help provide the liquidity and volume that will turbocharge the Kujira flywheel, tapping directly into native BTC and native ETH deposits amongst many others. Our apps will also help unlock the next phase of THORChain’s roadmap and growth, with the Kujira team supporting THORChain in building out their smart contracting layer, and making it the industry leading DeFi platform for both retail and institutional users.

The past week has been challenging for the team and the community. We recognize that, despite the best of intentions, our lack of risk management has resulted in a deficit on the balance sheet that should never have been allowed to manifest. Our partnership with THORChain also brings an underwritten token raise, open to the community, clearing the debt and providing economic alignment between our two communities, discussed later, as well as key operational changes to ensure any similar situations are made impossible.

This move also means a shake-up of the team, as well as our practices going forward. Kujira would not be what it is today without Dove’s leadership, and thus, it’s with great sadness that we part ways with Dove for our next chapter. Please take care Dove, we love you and wish you the best, and thank you for the years of dedication.

Today we also welcome two trusted community members, Amit and PM, to the core team. We’ve worked closely with both for years, and couldn’t be happier to start this next phase together. PM will also be leading initiatives to overhaul treasury management and dApp configuration operations. We are committed to making these processes transparent, calculated, and accountable. Supported by JPTHOR and the wider THORChain operations, we will be able to return to our roots and focus on what we excel at – building world class best DeFi products, delivering value for users and driving revenue from the ecosystem.

Our next step is the PILOT raise, clearing out all debts. With our partnership, JPTHOR, founder of THORChain, has committed to backstop the raise with $3m, which will be the minimum raised via PILOT. Thanks to this, depositors of affected vaults will be guaranteed to be able to withdraw their funds after the conclusion of the sale.This is an incredibly strong start to our next chapter, and one that we’re incredibly grateful for.

The sale will go live shortly after a successful community vote, ratifying the details outlined below. It will run for 3 days, with two concurrent auctions – one to repay the USDC debt, and one to repay the USK debt. You will be able to bid with both USDC and USK, as well as xUSDC and xUSK, allowing everyone, including current depositors, to participate.

We believe that this partnership is truly the best next step on Kujira’s journey. The incredible amount of alignment, both in vision and in vibes, across both ecosystems is something truly special, and we can’t wait to see what the future holds.

Event Post-Mortem

The Kujira team was using a share of the KUJI in the Ops wallet as collateral to borrow USDC and USK on its native money-market Ghost. The USDC and USK borrowed were used to provide liquidity in the ecosystem.

In the last week, KUJI price corrected alongside the rest of the market, and early in the night of August 1st, price dropped to a level that made the team’s leveraged positions fall below their safe LTV levels. People were able to buy the KUJI collateral at risk at a discount to market value using Orca, the liquidation engine of Kujira. Given the volume of bids on Orca vs. size of collateral to be liquidated, there was very little competition and bidders were able to buy KUJI at 30% discount to market price, then sell on the market for immediate arbitrage profits, further dropping price and triggering more liquidations, leading to more KUJI they could buy at 30% discount in a liquidation cascade.

The liquidation cascade proceeded up to the point where there weren’t enough bids anymore on Orca to be able to process liquidations. Liquidations can only go through if it puts back the entire loan in a state where the position is left above the configured max LTV, and at some point, the amount of KUJI to be liquidated to comply with that condition became too large relative to the capital bidding on Orca, resulting in bad debt.

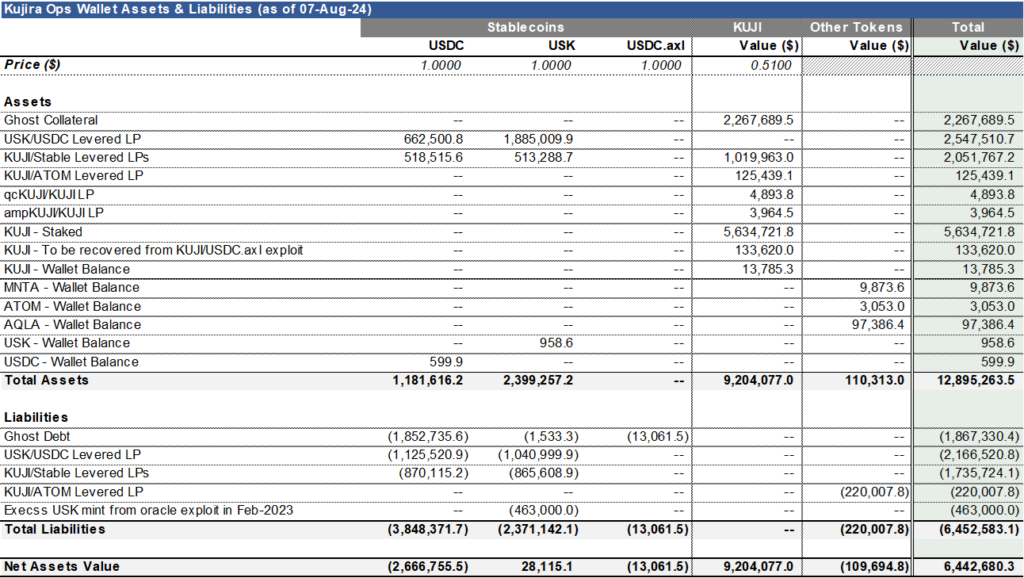

As 07-Aug-2024, the debt situation is the following:

- USDC: 3.85m total debt vs. 1.18m in asset = (2.67m) net debt

- USK: 2.37m total debt vs. 2.40m in asset = +0.03m net cash

- Total stablecoins net debt = ($2.65m) net debt

- ATOM (at current price): $220k total debt vs. ~$3.0k in asset = ($217k) net debt

- Total Net Debt (excl. KUJI and other assets) = ($2.76m) net debt

USK itself is not at risk and is currently at peg, it is still fully over-collateralized and not backed by any KUJI.

So, the minimum shortfall that needs to be covered by KUJI sold OTC is roughly $2.8m. This would bring the protocol in a healthy position with a net stablecoin debt equal to 0.

Raising $4.2m would allow the protocol to repay the entire debt and have a net cash positive position without reducing existing KUJI liquidity.

Any excess would capitalize the reserve, which will mostly be deployed to build protocol-owned liquidity that will be put at work on BOW in the next iteration of Kujira. That will generate additional volumes on FIN and fees for KUJI stakers, particularly once the oracle-based AMM will go live as part of BOW v2 launch.

The Kujira team still has ~18m KUJI in the Ops wallet, of which ~4.5m are used as collateral on Ghost and ~2.25m are in leveraged KUJI LPs as of 07-Aug-2024.

Lessons learnt from the current situation and path forward

The team fully acknowledges the current situation is the result of poor risk management and could have been avoided with better planning. Bad debt was incurred because the protocol was configured to allow too much USDC and USK borrowing against KUJI vs. KUJI/stable liquidity available to perform orderly liquidations. It also happened because there were not clear rules and deleveraging plans in place. The technology worked exactly as designed, however the configuration of the borrow parameters has caused a small amount of third-party debt to remain in the system. The treasury will hold the value of this debt in xUSDC until such time as it can be liquidated or is repaid.

Once the bad debt is cleared, everything else will be back to normal with no operational debt at the protocol level. Some measures will be taken to make sure such situations never happen again in the next iteration of Kujira:

- Max borrowing against KUJI will be significantly reduced. The cap will be set by taking into account KUJI liquidity available on-chain.

- Management of the Ops Fund will be transferred to a new Kujira Operational DAO, a multisig composed of experts and trusted community members that will handle the Ops funds for the benefit of the entire ecosystem. The initial mandate will be to safely close out debts, if any debt remains after the Pilot sale. After that, the DAO will mostly focus on building liquidity for FIN and sustainably increase revenue to KUJI stakers. It will also handle the assessment and distribution of KUJI grants. Operations will be handled from a DAODAO multisig with full transparency.

- The DAO will also be responsible for handling configuration of the core Kujira Protocols. Combined with upcoming admin dashboards, this will create transparency over how these protocols run, and allow the community to propose changes that will be voted on by members of the DAO.

- ORCA liquidation logic will be improved to optimize partial liquidation in times of stress.

While the liquidation cascade has put KUJI at a deeply discounted price, the fundamentals haven’t changed with annualized revenue standing at ~$1.5m. There is a clear path to scale revenue magnitudes higher in the next chapter of Kujira’s life with our new partner, THORChain.

Kujira<>THORChain Commitment

We have been having great discussions with JPThor (founder of THORChain) and his team, and are very excited on both sides about the path forwards:

- Kujira will conduct a fundraise using PILOT, selling KUJI from the Ops Wallet to raise the required capital to clear all the debt and allow GHOST lenders to withdraw their funds.

- JPThor commits to underwrite up to $3m by participating alongside the community and other professional investors in the PILOT launch.

- Kujira will become the first consumer app DeFi ecosystem on THORChain with the Kujira team leading the development and relaunching most of Kujira core apps (FIN, BOW, GHOST, ORCA, PILOT), with exclusivity in the their verticals.

- All deployments of all apps will be re-audited and open sourced before being available on THORChain mainnet.

- The vision is to become the largest DeFi venue with native liquidity, servicing both crypto natives and large institutional clients.

- The THORChain team has made it clear to us their intention to raise and deploy significant funds to the ecosystem that will support liquidity across all the Kujira apps.

- This should result in a material increase in liquidity and volumes for Kujira and all its existing builders that will migrate to the new ecosystem.

- New protocol launches on the consumer chain will be permissioned, with one DeFi provider per vertical. Kujira will become the flagship orderbook DEX, money market, liquidation engine and launchpad for the THORChain ecosystem.

- USK will be retired as part of the migration to THORChain. USDC will be used as the default quote asset for most pairs on FIN, to cater for institutional demand.

- Kujira apps will be secured by THORChain validators, with Kujira apps implementing a 50/50 revenue share between THORChain and KUJI stakers, ensuring alignment and the security of the L1.

- The Kujira team will make its best effort to complete the full migration of Kujira to THORChain within 6 months following the successful execution of the PILOT sale. After that, the Kujira L1 will be moved to “low-power” mode, allowing it to continue to operate only as the canonical issuer of the KUJI token and the migrated altcoins.

- Full details regarding migration and USK wind down will be provided in due time.

Team restructuring and alignment going forward

As part of the next chapter, some material changes will be made to the Kujira core team:

- Dove has been a tremendous captain, Kujira wouldn’t exist if it wasn’t for him, and it’s with sadness that we announce he won’t be part of the next chapter. Please take care Dove, we love you and wish you the best.

- The historical dev dream-team, Hans and Brett, are super excited to continue building Kujira for its next phase of supercharged growth.

- Fresh blood will be added with both Amit and PM joining the core team.

- JPThor will take the role of Project Lead, he will be part of the Operational DAO multisig and will be pushing Kujira to new highs on social media and with his institutional relationships.

- Hans and Brett will re-vest 1m KUJI of their own tokens over 3 years.

- The new team members, Amit and PM, will receive 1M KUJI vested over 3 years.

- Subject to this Recovery Plan being ratified by governance vote, the core team will perform a chain upgrade that will unlock the 5.3m inaccessible KUJI. This was the team’s marketing allocation from the original tokenomics on Terra, which was mapped from a multisig smart contract on Terra Classic at genesis and therefore not currently accessible on Kujira.

- Of that, 2m KUJI will be used for Amit and PM allocation.

- The remaining 3.3m KUJI will be used to recapitalise the new Operational DAO.

The new team is looking forward to resolving the current liquidity situation and going back in super-shipping mode for this next phase of growth!

What will happen with the current validators?

Unfortunately, once the Kujira L1 will be moved to a “low-power” mode, it will be time to retire the current validator set. We are grateful to our amazing validators for their services over the past two years and would like to offer the opportunity for a few of them to become THORNode operators. To that end, JPThor agreed to facilitate a node operator program, to help up to 9 Kujira validators become an active node on TC.

- The minimum RUNE needed to churn in as a THORNode is currently set at 300k (~$900k at current price).

- JPThor has agreed to redelegate up to 300k RUNE each to up to 9 new validators part of the program.

- Kujira validators will have up to 6 months after the conclusion of the PILOT sale to manifest their interest and setup their THORNodes if they are selected.

- Selection will be based on historical contribution to Kujira and degree of involvement, favoring smaller validators dedicated to Kujira over large ones validating across multiple networks.

- JPThor commits to keep those RUNE delegated to those validators for at least 12 months from the moment the delegation starts, with the validator fee set to up to 20% fees as community node.

If you are interested, please reach out to the team.

What will happen for KUJI stakers?

KUJI stakers won’t have to do anything until Kujira goes live on THORChain. For the next few months, you can continue to stake your KUJI as usual, secure the chain and continue to accrue your pro-rata share of 100% of Kujira’ core apps revenue (revenue share with THORChain will only be implemented post migration).

Once Kujira goes live as a consumer app on THORChain, KUJI will no longer be securing the network and will become an app governance and fee share token, similar to other projects currently living on Kujira.

- A 50/50 revenue split will be implemented, between KUJI and RUNE stakers.

- Staking will be done via the DAODAO platform.

- The new Operational DAO Multisig will be registered as a subDAO of Kujira main DAO, meaning KUJI stakers will have ultimate ownership of the assets stored in the Operational DAO Multisig, and the power to change/remove members or recall funds.

- The Operational DAO Multisig will use most of the funds entrusted to its members to build long-term protocol-owned liquidity overtime, to sustainably increase revenue for KUJI stakers and market depth on FIN.

- As protocol-owned liquidity is created, the BOW LP tokens will be sent to the main Kujira DAO for long-term custody. In the event the Operational DAO wants to rebalance certain positions, it will need to request the relevant LP tokens to be sent back to the Multisig via a Kujira governance proposal.

We will share detailed instructions on how to migrate your KUJI tokens in due time.

What will happen with the current ecosystem builders?

We are not leaving our builders behind! Together with JPThor, we will be supporting the migration of existing Kujira–based protocols that are already active or fairly advanced in their development and are excited to join the next chapter of Kujira.

- Protocols’ migration will be organized in stages, with each protocol required to conduct an audit, covered by THORCHain, before migrating.

- Launch of new protocols on THORChain will be permissioned, targeting one provider per vertical, so protocols that get the slot won’t suffer market share fragmentation.

- Each protocol that does not build on top of fee-sharing apps will be required to share 50% of its revenue with THORChain L1 to pay for security. For example:

- Projects that build on top of existing core Kujira apps, such as AutoKujira that automatically place bids on ORCA and sell assets on FIN, or Nami that optimally distribute stablecoins in GHOST lending vaults and FIN stable pairs, or MantaSwap which routes trades on FIN orderbook, etc. are already paying the FIN/GHOST/ORCA fees which are split 50/50 with the L1 to pay for security. They won’t be charged twice for security and will retain 100% of their revenue.

- Projects that create new verticals, such as Plazma for OTC deal, Gojira for NFT trading, or Aquala for Real World Asset issuance and trading, etc. are not building on top of any existing fee-sharing apps and will be required to implement some fee-sharing to pay for security.

- The 50/50 split is a baseline, but nothing is set in stone and some applications might not need to implement revenue share at all. It will be a negotiation as projects pass through the auditing, quality control and staging process, before being flagged on at mainnet.

- JPThor is in the process of raising a very sizable fund that will be investing across the CosmWasm app layer.

- Protocols should expect much higher volumes and revenue (net of THORChain share) compared to what they would have experienced with the status-quo on Kujira, and may even be able to secure additional funding.

Once this plan will have been ratified and the PILOT sale successfully completed, please reach out to the team to signal your intention to continue in the next chapter.

PILOT sale structure

In typical Kujira fashion, the deal will be offered at the same terms to everyone, professional investors and community members will be bidding alongside on PILOT (guide here), the Kujira launchpad using a Dutch auction mechanism for price discovery.

Please note that the exact terms of the PILOT, notably pricing, will be set by the team depending on market condition at the time of the launch.

Key parameters beside price will likely be as follows:

- Total offering size: TBC

- Sale token: Bid will be placed for rKUJI (recovery KUJI), which will be redeemable for either KUJI (1:1) or qcKUJI (equivalent to 1:1 KUJI based on Quark redemption rate) bonds, once the required balance has been freed from collateral & undelegated (14 days post conclusion of the PILOT sale).

- Pricing: TBC.

- FDV at minimum discount: TBC.

- Cliff and vesting:

- rKUJI redeemed as KUJI will be subject to a 3-month lock-up, and 6-month linear vesting after that.

- rKUJI redeemed as qcKUJI will be sold with a 6-month lock-up, and 6-month linear vesting after that.

- Depositors in Ghost will be able to participate with their xUSDC and their xUSK.

- Bid token:

- 80% of the tokens will be sold for USDC and xUSDC.

- 20% will be sold for USK and xUSK.

- Sale duration: The sale will be running for 3 days.

- Minimum raise size: The sale will be calibrated in a way that at least $3m needs to be raised for the sale to succeed.

Timing and next steps

We will be publishing a governance proposal to ratify the proposed plan shortly, with the aim to launch the PILOT sale shortly after the successful conclusion of the community vote.Once the PILOT sale successfully concludes, we will start plotting on the execution plan and will come back to the community with more details about the migration and what to expect next.

Final words

In every crisis, there is an opportunity. Out of the chaos of the past week, has emerged a sensational partner and extremely bright future for Kujira:

- THORChain is getting an incredible team of shippers that will be building the first consumer app DeFi ecosystem, providing a top-notch suite of DeFi products for THORChain’s native assets, and bringing along a fantastic community.

- Kujira is clearing all its bad debt, will get access to many more potential users, including large institutional players, and gets to solve two of the most cited issues of Kujira’s current iteration: liquidity and marketing/visibility.

It feels like a match made in heaven, and we strongly believe this is what is best for the community and, as the new core team, we are incredibly excited for what is to come!

Thanks a lot everyone for all your support in those difficult times, and for your patience while we were trying to figure out the best path forward. We have done it before, we will come back even stronger, LFG