(Any views expressed in the below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

I have written about the Kujira Protocol in the past, however, it has been a long few months and, well… Terra/Luna collapsed, 3AC went under, Celsius, Voyager, CONTAGION. You get it, we’ve grown up, no more ponzis please. Unless… Ok hear me out, we aren’t trying to revenge trade. It’s about finding some green after the fire. What will be the seedlings for the next forest?

I will be covering Kujira, their migration to launch a completely new chain and how they’re striving to build something truly unique.

Table of contents

Some history

Kujira launched in Q4 2021 on the Terra blockchain (now Terra Classic). They started as a liquidation platform. I wrote about this in the past, you can read about that here. The team was not content with simply offering an amazing liquidation experience to their users; they were expanding cross-chain. Kujira also added Beluga — a way to send assets to multiple addresses in one transaction. And of course the amazing sKuji tokenomics, if you want to read about that find it here.

Moving on to the Terra collapse. The team was getting ready to launch their new DEX; FIN. This was going to be the first order-book style DEX on Terra, and was going to have an experience akin to that of a centralised exchange. Think Kucoin, but decentralised. It would not be that easy, the chain was collapsing as UST had died and the infamous “Deploying more capital — steady lads” was merely a joke.

No time to waste (and no capital), Kujira was quick. No time to feel bad about themselves, they announced soon after that they would be building their own chain on Cosmos using Tendermint and would be IBC compatible.

Flash forward 1 month and maybe 15 days, Kujira main-net launched.

I’d like to highlight that many protocols from Terra classic have not yet migrated to Terra V2 (if that was their choice) which requires something of a: ctrl + c then ctrl + v situation (simplified a touch). Kujira has already spun up a completely new chain, and they aren’t slowing down. On to the tokenomics then.

Kuji the birth of “grown up DeFi”

To understand this section it might help to first also read: Evolution of Tokenomics — sKuji & Kujira protocol. But if you don’t have the time we can dive right in.

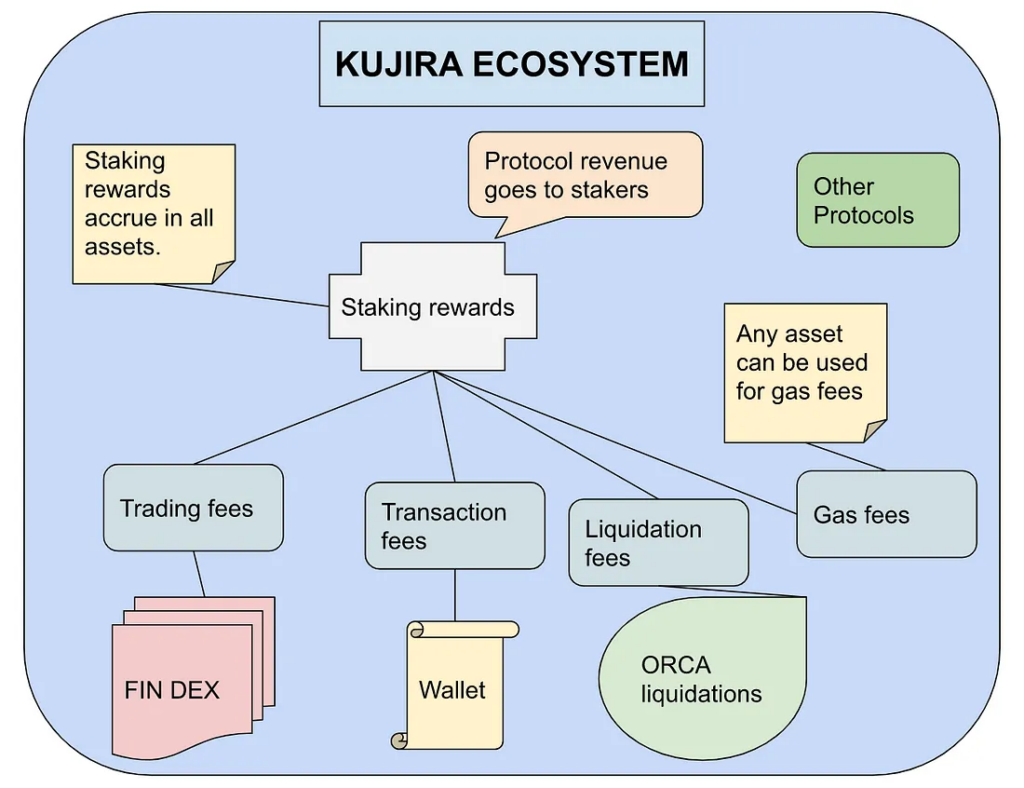

Kujira Protocol has unique tokenomics when compared to any other Layer 1 blockchain. Why? Well there is no need for inflationary tokens for the validators and stakers in order to secure the network. Kujira runs solely on revenue. Yes, all you Arthur Hayes fans obsessed with the P/E (price to earnings) ratios and the protocol sales (fee accrual) can begin to salivate. Kujira operates solely on protocol fees. Not only that but stakers are the ones that benefit the most from it all. Let’s break it down more, this might be better described visually by the flowchart below.

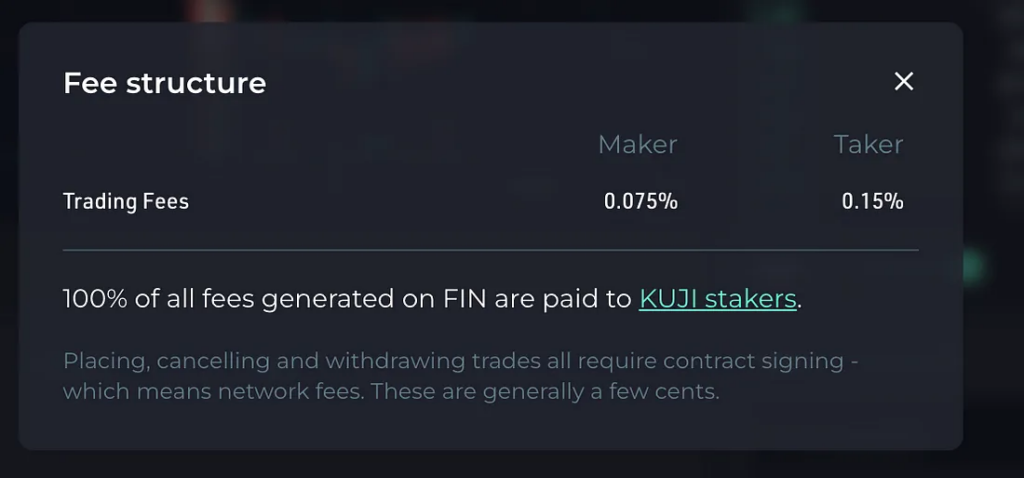

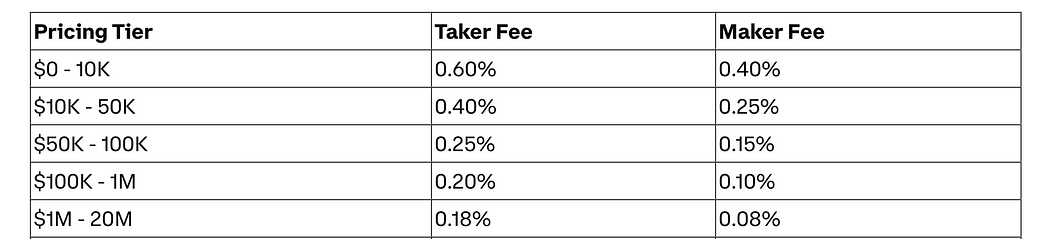

So what is happening? Essentially whenever there is a fee on the blockchain it goes back to the stakers. Don’t be mistaken, this is not a cash grab, as an example the trading fees on FIN are far lower than those on Coinbase.

See below.

KUJIRA FEES

https://fin.kujira.app/trade/kujira14hj2tavq8fpesdwxxcu44rty3hh90vhujrvcmstl4zr3txmfvw9sl4e867

Now what does this mean for the $KUJI token? What’s the value if you can pay gas with any other token and essentially never touch $KUJI when using its products? Well quite simple, staking. The only way you can earn all of these apex assets from the fees is by staking $KUJI.

Why is this unique? Well, until now most DEXs incentivised liquidity through incentive rewards, token inflation, and while they tried to contain sell offs with veTokens or some other way to lock up your tokens that were getting diluted as rewards, they have so far failed. With the current system there is no need to inflate $KUJI.

For new protocols launching, they can simply add their token on FIN and this token will be airdropped to stakers as the trading volume rises. No need for free giveaways, as airdrops are tied directly to volume and usage.

You are just a trader? Well you can hedge your trading fees by staking $KUJI, essentially trading for free.

New protocols will have to find a balance as the values of “Grown up DeFi” require most products to be revenue generating so that they can be a value add to the ecosystem.

Conclusions

There is much more coming from Kujira, as they have only just recently launched their Main-net on July 1st 2022. I will most likely be writing more about the developments given that the speed at which the team has been delivering has been rather incredible.

Some things I am looking forward to:

- Leverage trading activated on FIN. This will be integrated with Orca in a very interesting fashion.

- Orca Liquidations going live and being able to activate liquidations across IBC. Yes, liquidating others is special, more so when done with great UX.

- The new wallet is set to compete with Kepler as the UX/UI on Kepler is currently lacking. This also unlocks much more interoperability for Cosmos IBC integration from Kujira.

- More assets being added to FIN. When I started writing, only KUJI & USDC were active. At the moment there is a proposal for ETH and BTC is being hinted as the next one. More is coming, no time to waste.

As the crypto industry evolves and revenue becomes more important than simple ponzinomics, protocols that generate real sales/revenue will be the ones that get ahead in the fight for survival. Look not only for builders, but self sustaining systems.

Be well,

Xulian