(Any views expressed in the below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

If you have ever tried trading and especially if you have ever used margin to trade, you understand what a liquidation is. However, have you ever tried to be on the other side and become the liquidator? Kujira protocol is innovating in the DeFi space by democratizing the liquidation activity on other protocols. Not only this, but they are developing a suite of dApps that can solve problems in the space. Kujira looks to make complicated DeFi actions (like liquidations) more accessible to the average user. They look to provide tools that can benefit everyone regardless of their skills and knowledge in the space. In this article I will look into what they are doing and if this truly solves a problem that exists in the crypto space.

Table of Contents

Borrowing and Liquidations

In DeFi there exist many protocols where you can borrow other crypto assets as long as you can provide collateral that covers a percentage of the value that you wish to borrow. These tend to be overcollateralized loans. These protocols are known as Money Markets or Borrowing/Lending platforms. The most popular of these protocols are Aave and Anchor. These two are also the biggest by TVL in the money market space according to DefiLlama.

On these platforms users can borrow assets by providing a collateral. If the value of their collateral falls below a certain threshold, then their collateral will be liquidated to cover their loaned amount. Depending on the asset you choose to use as collateral, as well as the asset you are borrowing, these LTVs can vary ( LTV= Loan to Value ratios). For the purpose of this example, we will use an LTV of 80% . If I choose to borrow say, UST on Anchor, I would need to supply a collateral like bLuna. I am allowed to borrow up to 80% of the value of my collateral, but to stay safe, I borrow only 40%. This gives me an LTV of 40%. If my collateral lowers in value and I go over the threshold of 80%, I would be put in a line to have my collateral liquidated in order to pay off my loan that has now become undercollateralized. Back in the days before Kujira, users would get liquidated of all of their collateral needed in order to pay off the total loaned amount. This can cause problems like what we saw in the May 2021 crash where users were getting liquidated in a cascade that in turn was driving the price of Luna lower, thus liquidating more people.

What are liquidations? “The term liquidation may also be used to refer to the selling of poor-performing goods at a price lower than the cost to the business, or at a price lower than the business desires.” In other words: the forced selling of assets for a lower price than desired because of obligations to pay something else. Because DeFi works with overcollateralized loans, it is important to keep this system healthy for protocols to function correctly. In order to regulate the market and keep DeFi lending safe, loans need to be liquidated when they become undercollateralized.

Typically in DeFi, protocols manage their own liquidations. Some users or “whales” also participate in these liquidation strategies as a means to buy assets that are going for lower than the market price as they are forced to sell to cover the value of the loans. A smart contract will automatically queue an account that is undercollateralized so that it can get liquidated in order to pay off the loan.

Now that we understand Borrowing as well as Liquidations, let’s look at Kujira Protocol and how it is solving problems in this space.

What is Kujira Protocol

Kujira Protocol is developing a set of dApps that will allow common users to participate in what otherwise used to be inaccessible activities in the DeFi space. At the moment they have three dApps that you can interact with: Orca, Beluga and Blue. I will break these down below.

Orca

This is the main dApp in the Kujira family, Orca is where you can become the Liquidatoooor.

On Orca you can set bids to buy “at-risk” collateral. With an easy-to-use layout, you can pick the discount price you would like, the amount you wish to deposit and then sign a transaction to participate. When the price of the asset you look to liquidate drops and someone is undercollateralized, your funds will be activated to liquidate that person’s collateral. This is the simplest way there is to participate in a liquidation.

Traditionally this was all done by bots that had big amounts of liquidity. Thanks to Kujira, now ordinary users can partake in this liquidation activity. This not only benefits the users who get discounted tokens, but also benefits the users that are being liquidated. Their full loan is not being liquidated, rather, only enough of their loan to put them back into a safe LTV zone is being liquidated.

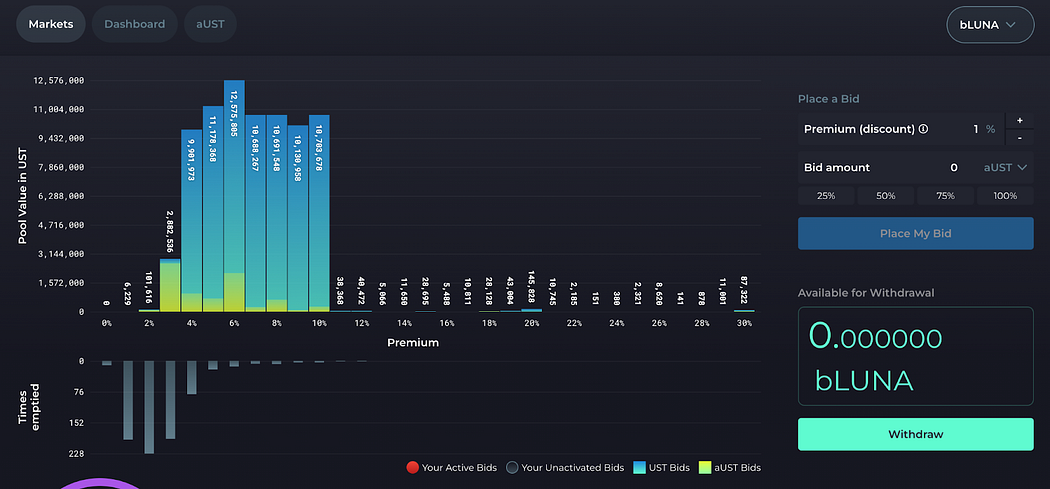

In the Orca Markets tab you can pick the desired discount you wish to buy at. If the price drops and collateral is at risk, then your funds are deployed to pay off that loan and liberate that collateral for yourself at a discount. In this tab we also get a straightforward visualization of the amount of UST set to be deployed in that range in case the price drops and liquidations are set to take effect.

Currently users can only bid on undercollateralized assets on Anchor protocol. These assets include bLuna and bETH. There are more assets set to be deployed on Anchor soon and you will be able to bid on those too. Not only that, but with the success of the Orca dApp, Kujira has plans to expand to other chains and other apps to help them manage their liquidations and undercollateralized assets.

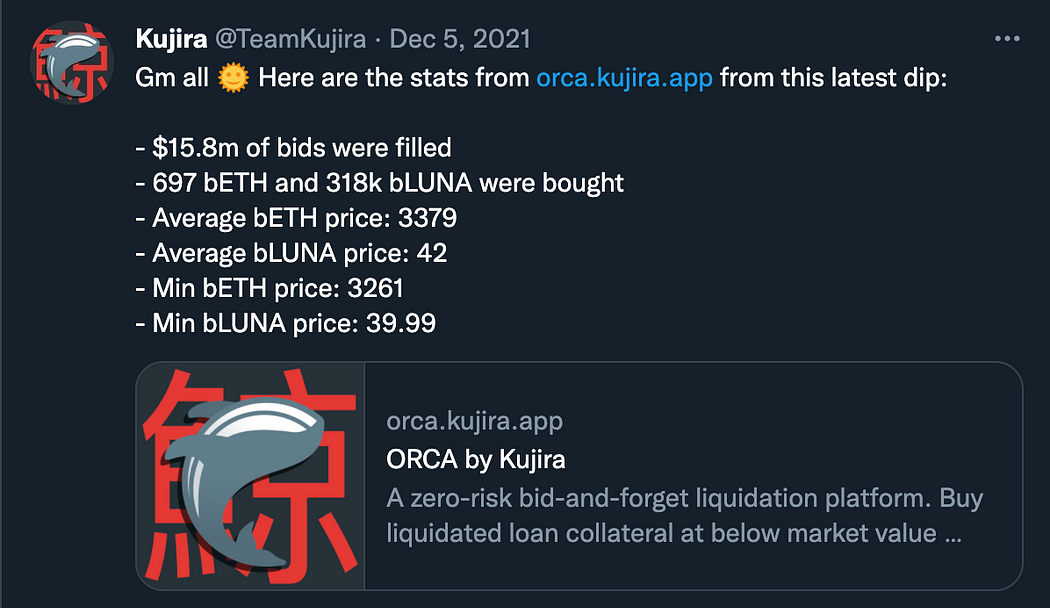

Some of the amazing discounts participants can get were well described in this tweet from Kujira.

If we look at the lowest market price for Luna and ETH on December 4th 2021, we can see Luna reached a low of $49 in the market, but Kujira users were able to buy some for $42 and even $39.99. Looking at ETH, we can see it reached a low of $3500 but again Kujira users were able to buy for $3379 and even as low as $3261. You can’t really beat these discounts anywhere.

Beluga

This is a dApp that allows users to send any CW20 token on Terra to multiple addresses simultaneously in a single transaction. Simple, sweet, useful.

Blue

This is your home for all dApps that Kujira develops. It is a dashboard where you can find a list of Kujira related sections. First, the governance section where you can vote on new proposals. Next, a swap section where you can buy the KUJI token and a section to stake it. Not only that, but with the new update of sKUJI, the dashboard is where you can track the protocol’s revenue pool and your share of the pool if you chose to bond your KUJI there. sKuji is a great innovation in protocol fee sharing, arguably the next step on the xSushi model. I have written more about that in this article.

Ecosystem Health

Kujira’s innovation with the Orca dApp brings new health to an ecosystem as it mitigates liquidation cascades and allows for a slower bleed in times of drawdowns in the markets. It behaves as a form of release valve that allows liquidations to slowly take place and be bought up by other market participants. Not only that, but since it does not fully liquidate one’s loan, rather just brings it back to a healthy LTV, users don’t exit the system completely. This is all in Anchor Protocols Docs on how the borrower is liquidated until they are brought back to a safe LTV. With all the bids that there are in place on Orca, liquidations can occur at a faster, less aggressive rate, keeping the ecosystem healthy.

Kuji Token

The $Kuji token is used throughout the Kujira protocol’s dApps for a variety of reasons. You can stake a certain amount of the token to gain access to advanced data about liquidations. You can get discounts on fees on Orca or Beluga, and now you can also bond it. The $Kuji token is available to buy directly on the Blue dApp from Kujira as well as most DEXs on the Terra network. Currently it is also available on the MEXC Global exchange, but the best place to buy is directly on Blue.

Some of the specific utilities for staking the Kuji token are:

- Stakers of 5000 $KUJI or more gain access to Orca’s premium dashboard.

- Stakers of 300 $KUJI get access to a basic analytics dashboard.

- All fees and commissions earned by Kujira products are paid to $KUJI stakers.

- Stakers also receive a 20% cut of interest earned by bids made using aUST while they wait for liquidations to occur.

Conclusions

Participating in liquidations appears to be the best way to get discounted tokens. Not only that, but it also helps the ecosystem avoid liquidation cascades that could be potentially harmful for the longevity of the participants in the space. I look forward to seeing more innovations and evolution with the Kujira dApps as their protocol grows.

Take care,

Xulian