Presenting the first strategy of our Kujira investor series.

In today’s episode, I will introduce a strategy that lets you DCA out of your position linearly, earning consistent revenue while continuing to support the Kujira ecosystem.

Contents

Introducing This Strategy

The strategy is straightforward and involves providing liquidity on BOW. However, supplying liquidity in LPs often has negative connotations due to something called Impermanent loss. Let’s break this down.

Providing Liquidity

Imagine you’re running a bakery, and you have a steady stream of customers coming in to buy your pastries.

To meet this demand, you need to have a certain amount of inventory on hand. But if you order too much inventory, you risk having it go stale and wasting money. And if you order too little, you’ll miss out on sales.

The same can happen when you provide liquidity on BOW. FIN is Kujira’s orderbook exchange that is powered by BOW — an algorithm that uses liquidity pools to facilitate trades.

To provide liquidity to BOW, you need to deposit two assets into a pool.

For example, you could deposit KUJI and USK into a pool. This allows other users to trade KUJI for USK, or vice versa. In return for providing liquidity, you earn a portion of the trading fees generated by the pool and any incentives.

However, there is a risk of impermanent loss when you provide liquidity to BOW.

Explaining Impermanent Loss

Impermanent loss occurs when the price of one of the assets in the pool changes significantly relative to the other asset. This can cause the value of your deposited assets to decrease, even if the overall value of the pool increases.

Example — KUJI/DEMO

Let’s say you deposit 1 KUJI and 100 DEMO into a pool. At the time of deposit, KUJI is worth $100 and DEMO is worth $1. So the total value of your deposited assets is $200.

Now, let’s say the price of KUJI increases to $200 and the price of DEMO decreases to $0.50. The total value of your deposited assets is now $150. This is an impermanent loss of $50.

However, impermanent loss can be made less risky and used to your advantage…

The Strategy Explained

BOW: Liquidity Pools

By providing KUJI-BTC, or KUJI-ETH liquidity on BOW, impermanent loss becomes less of a disadvantage.

On one hand, in a KUJI-USK LP, if KUJI increases in price you end up selling some KUJI into USK. On the other hand, in a KUJI-BTC LP, if the price of KUJI increases more than the price of BTC, simply sell KUJI into BTC.

This means that as KUJI price increases, you incrementally DCA out of KUJI into a massive apex asset, BTC.

So instead of selling into a stablecoin and missing digital asset exposure, you DCA into an asset that you are also confident will go up.

Let’s be honest, if BTC were to drop in price then the entire digital asset sector would be expected to as well. So if you are bullish on crypto and the price of KUJI going up, accumulating BTC and ETH is always a good thing too.

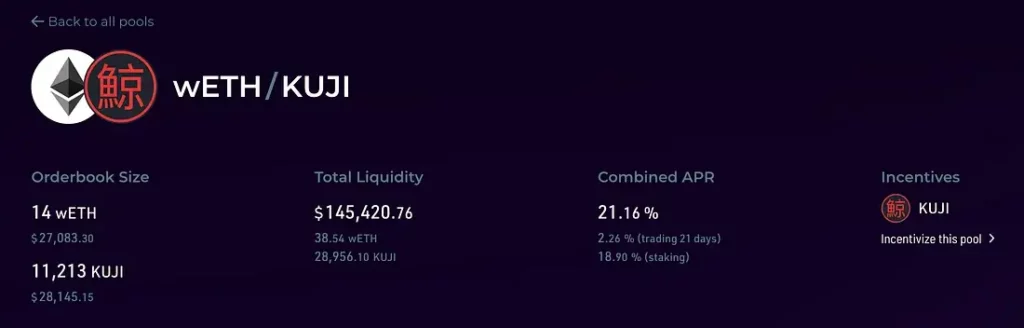

But that’s not all — by providing liquidity, you will be earning a consistent APR from trading activity and KUJI tokens as incentives.

Incentives & Benefits

So while you are consistently selling KUJI into BTC/ETH as it rips up, you are also rewarded with KUJI tokens for assuming this risk.

Perhaps this amount of KUJI won’t make up for the impermanent loss, but it is an attractive APR to receive in KUJI tokens whilst also slowly DCAing into an apex asset that you also expect to go up.

Finally, by providing this liquidity you are also providing a better UX to users within the Kujira ecosystem. The larger the liquidity is for BTC and ETH on Kujira, the bigger the trades FIN can facilitate, attracting traders with larger amounts of capital.

This results in increased usage of the suite of products Kujira has to offer, eventually trickling down into an increase in KUJI price due to the insular nature of the ecosystem.

Strategy Summary

- Supplying KUJI-BTC and KUJI-ETH liquidity allows you to DCA into apex assets when KUJI increases in price

- You will also earn an attractive APR (10%+) for assuming this risk, paid out in KUJI tokens

- Providing liquidity positively impacts a trader’s UX on Kujira, ultimately leading to improved investor confidence and an increase in KUJI price.

Useful Links

. . .

Kujira Academy is a platform that aims to bridge the gap between young entrepreneurs and Web3, providing them with tangible education and career acceleration opportunities. Built by students, for students. Learn more about the academy and our vision here.

To register your interest and become a student of Kujira Academy, click here.

. . .