A sustainable revenue-generating model, delivering real yield to investors.

Decentralized exchanges (DEXs) are a type of cryptocurrency exchange that allows users to trade assets without the need for a central intermediary.

In this beginner’s article, we discuss FIN, a decentralized exchange (DEX) built on the Cosmos blockchain. We compare the core concepts, uses, and benefits of FIN to centralized exchanges (CEX), before outlining a comprehensive guide to transacting on FIN.

Contents

- DEXs: A Solution to Inefficient Banking

- DEX’s: The Core Concepts

- Start Transacting on FIN

- It’s Time: Spread Your FINs

- Useful Links

DEXs: A Solution To Inefficient Banking

In Traditional finance (TradFi), centralized exchanges (CEXs) are controlled by a single authority and require middlemen, or intermediaries to process transactions.

This results in high fees and lengthy transaction times, with cross-border payments a prime example.

A decentralized exchange (DEX) is a peer-to-peer marketplace where users can trade cryptocurrencies directly with each other, without the need for a 3rd party.

DEXs are powered by smart contracts, which are self-executing agreements that are stored on the blockchain, unlike CEXs, which have a single point of failure that makes them more vulnerable to hacking, fraud, and manipulation.

Best of all, DEXs can be accessed by anyone with an internet connection regardless of their location, delivering faster transactions at a fraction of the cost.

Given this, we can begin to understand the value Kujira, as a DeFi protocol, can offer a faltering payment system, characterized by high fees and transaction times.

DEX’s: The Core Concepts.

FIN: An Orderbook Model

FIN utilizes an orderbook model, which is a trading system that matches buy and sell orders based on price.

This offers a number of benefits over other DEX models such as AMM’s or AMM/Orderbook Hybrid models, such as better trade execution and lower fees, which you can read about in an article from KP here.

The orderbook displays the price at which the order will be executed, the total bid amount, and the estimated return, with the best buy and sell orders at the top.

Investors can track their limit buys/sells via the orderbook, with the green (1.3338) and red (1.4700) bars showing the percentage of the order that has been filled.

Bid-ask Spread

Next is the bid-ask spread, which is the difference between the highest price a buyer is willing to pay (the bid price) and the lowest price a seller is willing to accept (the ask price) for a particular asset.

It represents the cost of executing a trade, as investors typically buy at the ask price and sell at the bid price. Highly liquid assets tend to have smaller spreads, while less liquid assets have larger spreads.

Evidently, a narrower spread is more favorable, as it represents a lower transaction cost to investors.

Slippage

Slippage refers to the difference between the expected price of a trade when it is entered and the actual price at which it is executed.

This occurs when market conditions change rapidly between the time a trade is initiated and when it is filled, and can result in a more or less favorable execution price for the investor.

Slippage is more common in fast-moving or illiquid markets and is influenced by factors like order size, market volatility, and the availability of buyers and sellers.

The wTAO/axlUSDC pair on FIN is such an example, where lower liquidity and lack of available buyers/sellers cause a higher price impact on market orders.

Here, a $100 market buy has a price impact of 8.4%, with this number increasing with larger market orders. Evidently, this is less than ideal for investors, who would incur a loss when going to sell this asset.

Given this, investors should pay attention to the asset’s volatility and the liquidity of the market it is provided in, to avoid incurring losses when they buy/sell assets.

Now, what type of orders can an investor place on a DEX?

Limit Orders and Market Orders

There are two main types of orders that you can place on a DEX, limit orders and market orders.

Limit Order

- A limit order is an order to buy or sell an asset at a specific price or better. Limit orders are placed on the orderbook and are executed when the market price reaches the limit price.

Market Order

- A market order is an order to buy or sell an asset at the best available price. Market orders are executed immediately.

By now, you should have an idea of the benefits DEXs offer when compared to CEXs, as well as the core concepts that underpin this technology.

We now look to apply this knowledge and start transacting on FIN.

Start Transacting on FIN

To use FIN, you will need to create a SONAR wallet and deposit some funds into it. Once you have funded your wallet, you can connect to FIN and start trading.

Onramp Funds

There are a number of ways to onramp funds to FIN. You can purchase Cosmos tokens from a centralized exchange, or you can use a Cosmos bridge to transfer assets from another blockchain.

Read the following article, which provides a step-by-step guide on how to onramp funds to the Kujira ecosystem.

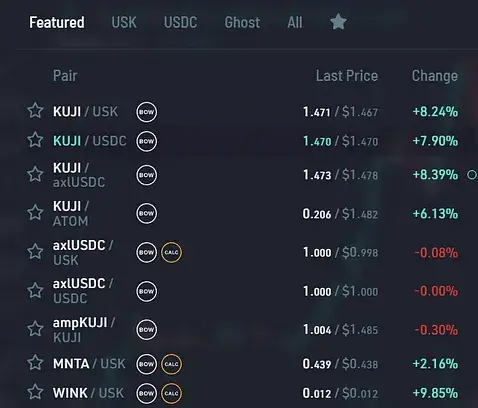

Choose Asset Pair

After onboarding your funds, the next step is to choose the asset pairing you wish to trade. We will use the KUJI/axlUSDC pair for the following examples.

Setting Market Orders

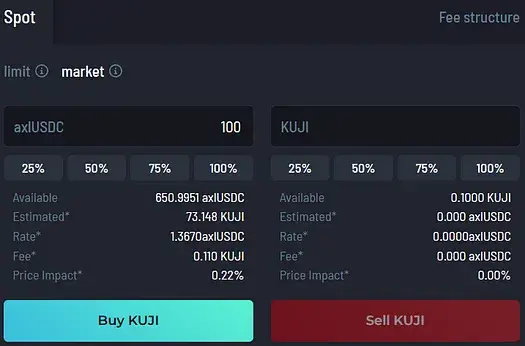

To place a market order, enter the quantity of the asset that you want to trade.

In this example, an investor sets a market buy for KUJI/axlUSDC of $100. They can view the average buy price (1.367 axlUSDC), the transaction fee required to process this transaction (0.11 KUJI), and the estimated return (73.148 KUJI) of this order.

Investors can also view the price impact (0.22%), which reflects both the effect of the order size on the market and the volatility of the asset. A lower price impact suggests a more liquid market and less volatile asset.

Setting Limit Orders

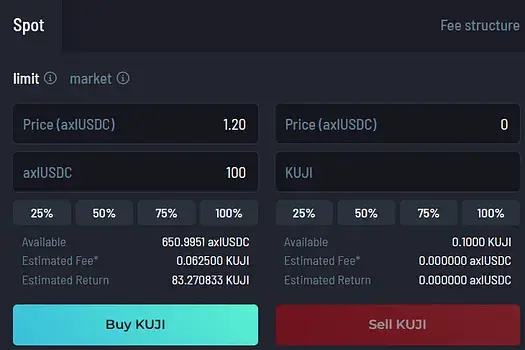

To place a limit order, enter the price, quantity, and asset that you want to trade. In this example, an investor sets a limit buy for $100 when KUJI/axlUSDC hits $1.20.

The investor can view the estimated fee required to process the transaction (0.0625 KUJI), as well as the estimated return (83.27 KUJI), and can track when this order is filled via the ‘Open Orders’ tab.

The investor will be able to see their limit buy in the orderbook and once KUJI/axlUSDC hits $1.20, the order will be filled and the investor will be able to receive their tokens, by clicking the ‘Claim’ button in the ‘Filled Orders’ tab.

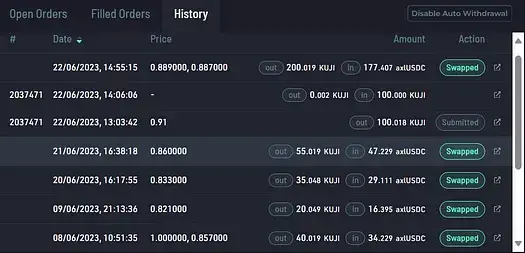

View Trading History

Investors can also view their trading history by clicking on the “Orders” tab. Here, they will see a list of all of their orders, including the status of each order.

This allows investors to track and manage their positions and keep an eye on recent trades, average buy price, and tokens accumulated.

So there you have it, a comprehensive guide to transacting on FIN.

It’s Time: Spread Your FINs

Through reading this article, students should begin to understand the role of FIN within the Kujira ecosystem — a next-generation decentralized exchange offering faster transaction times, lower fees, and greater security than traditional exchanges, that may well provide part of the solution to a faltering banking system, inaccessible to many and affordable to few.

By following these simple instructions, or watching the video tutorial attached, students can familiarize themselves with FIN and get started on their investing journey today.

So, what are you waiting for? Spread your FINs and take flight. The future awaits…

Useful Links

. . .

Kujira Academy is a platform that aims to bridge the gap between young entrepreneurs and Web3, providing them with tangible education and career acceleration opportunities. Built by students, for students. Learn more about the academy and our vision here.

To register your interest and become a student of Kujira Academy, click here.

. . .