The Vision: Grown Up DeFi. A circular economy, both accessible & affordable. A sustainable, real revenue-generating model.

The Challenge: How do we get there?

This article provides the answer.

Today, we journey to 2023 with Dove our pilot. Outlining the road ahead, we explore what sets Kujira apart, the key hurdles it must overcome, and how the vision of Grown Up DeFi will become a reality.

Table of Contents

- USK — Decentralized Payment Infrasructure for All

- DeFi is Broken

- FIN — A DEX to Stand the Test of Time

- Liquidity – Make or Break

- BOW — A Grown-Up Solution to Low Liquidity

- Benefits to Kujirans

- 2022 — Preconditions for Takeoff

- 2023 — The Road Ahead

- Useful Links

First, we address the global implications of a faltering payment system, before proposing a solution, USK.

USK — Decentralized Payment Infrastructure for All

Centralized payment infrastructure requires 3rd parties, or intermediaries to process transactions. As a result, there are high fees and lengthy transaction times, with low-income & emerging economies most affected.

Evidently payment infrastructure, both accessible & affordable, is needed. Kujira may have a solution.

How I hear you ask? Through USK, Kujira’s native stablecoin.

KK: What is $USK, and why is it needed?

Dove: ‘As a decentralized payment system, USK removes gateways present in centralized infrastructure. Without the need for 3rd parties or intermediaries, both cost and transaction time are much lower.’

‘The vision for USK is to build proper decentralized payment infrastructure. We want to start from the grassroots up, specifically in South America & Africa where transacting is still quite difficult’

In targeting low-income & emerging economies, USK can provide this key infrastructure to those most in need, delivering faster transactions, at a fraction of the cost. This is a game changer and exactly what a faltering payment system, inaccessible to most and affordable to few, needs.

USK. Proper decentralized payment infrastructure.

Next, we discuss FIN — an orderbook style exchange offering an alternative to inflationary models which characterize the DeFi space.

DeFi is Broken

A key challenge for Decentralized Exchanges (DEX’s) is attracting and maintaining liquidity. Existing models do not suffice, as Dove explains below.

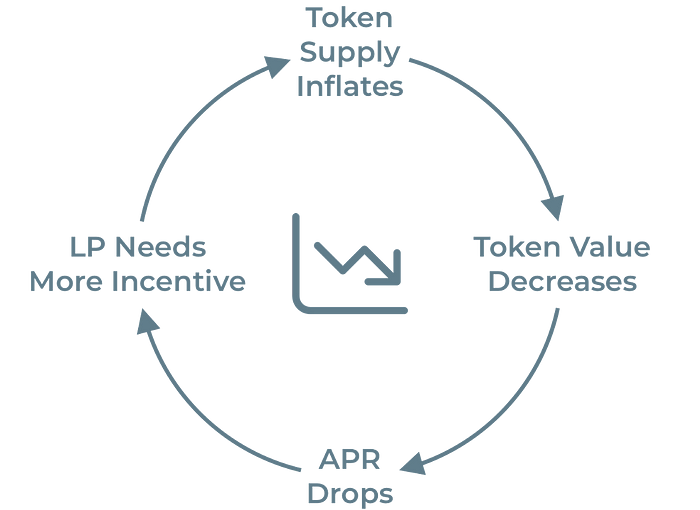

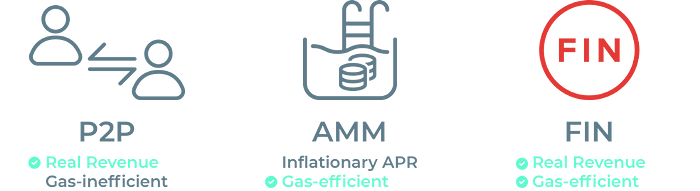

Dove: ‘Currently, DeFi is broken. There are very few real revenue-generating businesses. Many protocols use AMM’s to encourage liquidity, incentivizing LPs with inflationary rewards. Investors believe they are gaining, in the form of tokens, but these inflationary rewards cause a slow bleed in the value of the token over time. These models have a maximum supply. What’s going to happen when the rewards run out?’

If AMM’s cannot create alternative forms of revenue to maintain the APR required to incentivize LPs, liquidity will leave, APRs will plummet, and the system will fall flat, leaving investors exposed to impermanent loss and the reality of DeFi right now…

A sustainable model, which generates real revenue, is vital.

FIN — A DEX to Stand the Test of Time

Enter Kujira’s Decentralized Exchange (DEX), FIN, a model looking to deliver exactly that.

KK: What is FIN, and how does it differentiate itself from existing DEX’s in the space?

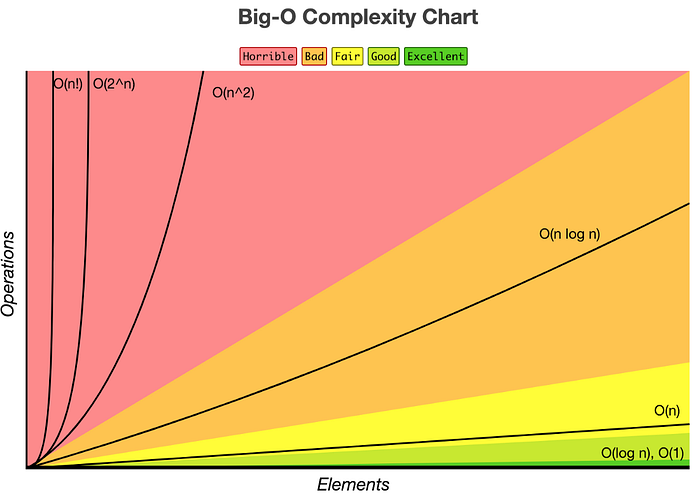

Dove: ‘FIN is an orderbook-style exchange that is both scalable and efficient, achieving a computational complexity of O (1). This allows FIN to operate with constant fees and speed, as its volume continues to grow.

How it does this is very technical. For those interested, read KujiPeruggi’s article, which provides an in-depth analysis of the mechanics behind FIN. I will briefly explain the significance of this model now.

In an orderbook, orders must be matched individually. If a DEX has an inefficient matching algorithm, for example O(n), facilitating high volumes becomes increasingly computationally intensive. Validators must run more expensive hardware, increasing the running cost. To keep these validators exchanges must increase fees. Inevitably, liquidity will leave as these costs are passed on to users of the exchange.

FIN has a computational complexity of O (1), meaning the matching algorithm executes in the same amount of time, regardless of order size/volume. Validators do not have to run more expensive hardware as volume grows, meaning exchanges do not have to increase fees and liquidity will not leave.

Gas efficient & scalable, FIN stands out from the crowd.

In inflationary models, initial liquidity is high but fleeting. Kujira is taking a different approach. Kujira doesn’t offer unrealistic rewards in the form of inflationary tokens, but sustainable, real revenue generated from their dApps.

Grown Up DeFi

Just as an engine needs oil, a DEX needs liquidity. We now discuss the key determinant of Kujira’s success — their ability to attract and maintain liquidity.

Liquidity — Make or Break

Currently, liquidity is thin and spreads are wide. The onboarding of liquidity will be integral to Kujira’s success as it is this which drives APR in the form of fees. A model can be perfect, but without liquidity it simply won’t work.

KK: How does Kujira intend to attract this liquidity?

Dove: ‘It’s important to remember there is only one protocol on Kujira right now aside from our own dApps. ATLO are starting to do raises, with these protocols using FIN as the default way to trade. Platforms like CALC are starting to onboard. Liquidations will happen. All of this will drive liquidity through the orderbooks.’

Independence Day marks another exciting arrival which marks the start of liquidity on FIN, improving trading execution & market depth. Introducing…

BOW — A Grown-Up Solution to Low Liquidity

A premium user experience involves a full orderbook and narrow spreads.

BOW will deliver a better UX, increasing trading volume and earning non-inflationary profits for LPs, or liquidity providers.

This increased trading volume will allow the ecosystem to flourish, with FIN the liquidity hub of Kujira. Their message is definite.

When You Provide Value, You Deserve Profit.

Benefits to Kujirans

Kujira stakers benefit directly from increased liquidity. Transacting on blockchain incurs a fee. Larger volumes result in more fees, with a % of this distributed to Kuji stakers. Further, onboarding protocols bring liquidity with them, providing further incentive to stake as the APR takes off.

2022 — Preconditions for Takeoff

Kujira is certainly making their presence known. WooCommerce represents the start of decentralized payment infrastructure and real-life use cases for USK. FIN, a decentralized orderbook exchange, can scale efficiently and is not dependent on inflationary rewards to attract LPs. BOW provides a Grown-Up solution to low liquidity. These are all keystone developments Kujira are building towards relentlessly.

However, key hurdles must be vaulted. Kujira must onboard protocols and build use cases around USK, in order to drive liquidity through FIN and increase the APR, which will incentivize further liquidity as the staking rewards roll in. If Kujira can do this… Well, I’ll be retiring next year.

Now, we journey to 2023 to understand how Kujira’s vision will become a reality.

2023 — The Road Ahead

KK: Looking to 2023, how will Kujira attract liquidity, build out payment infrastructure and cement its place in the DeFi arena?

Dove: ‘Going into 2023, it will be about onboarding real revenue-generating businesses onto the platform, which is going to bring volume, liquidity, and more use cases to USK. This will be the point when things will really start to take off. With protocols driving liquidity through the orderbooks, APRs will jump up, providing real yield distributed to Kuji stakers.’

‘Towards the 2nd half of the year is the wider goal of tackling payment infrastructure, in a big way. By then, we will have made inroads with various crypto custodians. We have started with WooCommerce, which powers 2/3 of e-commerce online, talking to vendors specifically in South America & Africa. Imagine; you walk into a store and tap your Kuji Kard. A blockchain transaction happens, your USK is sent away, and you receive the product. Without middlemen, there are no gateways, making transactions cheaper, and more efficient.’

USK, A circular economy. True decentralized commerce. Real yield.

2023 is going to be key in actualizing Kujira’s vision of Grown Up DeFi. The foundations are there. In a space littered with fake promises, scammers and rug pulls, Kujira offers a breath of fresh air. A safe environment, with a sustainable APR, where people can educate themselves about the space, free from the dangers which characterize the current DeFi space…

Kujira are still in preconditions for take-off, but the launch date has been set.

A Final Note

A word of advice, keep your eyes open. In an inherently uncertain world, it is nearly impossible to predict what the future holds. One thing is certain though. Kujira is stopping for no one.

This is only the beginning…

Written by The Kid Kuji

Useful Links/Profiles

FIN — A DEX TO STAND THE TEST OF TIME | by Kuji Peruggi | Team Kujira | WinkHUB

KUJIRA $USK STABLECOIN LAUNCH — KICKSTARTING GROWN-UP DEFI | by Daniel Lux | Team Kujira | WinkHUB