Kujira is fast progressing towards its goal of providing a comprehensive DeFi ecosystem under a single blockchain, and dApps like FIN, BOW, and GHOST look set to lead the way.

In today’s article, we introduce the core concepts behind Kujira’s money market, GHOST, highlighting its key features and applications before providing investors with a prescriptive way to start borrowing and lending on GHOST.

Contents

- What Is GHOST?

- GHOST: Borrowing

- GHOST: Lending

- Key Benefits Of GHOST

- Article Summary

- GHOST’S Role In The Future Of Kujira

- Useful Links

What Is GHOST?

GHOST is a decentralized money market that facilitates lending and borrowing on Kujira through a supply-demand framework, generating attractive returns for market participants without relying on artificial incentives.

GHOST: Borrowing

GHOST is an overcollateralized money market, meaning lenders are covered even if borrowers fail to repay their loans.

This means that those looking to borrow need not apply for loans and go through credit checks, making the process much quicker for prospective investors.

Here, investors utilize GHOST to mobilize their capital, either to participate in speculation on an asset’s future price or to leverage their existing capital without having to sell their underlying assets.

Investors who take out a loan are charged a variable interest rate, dependent on the borrowed assets’ overall utilization by borrowers. This rate will fluctuate with the market demand for an asset.

Opening/Closing Loans

Opening/closing a loan or redeeming supplied assets is a near-instant process that can be executed at any time, with the exception being when the utilization of an asset reaches 100%.

At this point, supplied assets of that type cannot be redeemed until some are returned (or more are supplied) to the platform but in the meantime, lenders will earn a healthy 300% APR whilst waiting for new deposits/fewer borrows.

Investors can fail to pay back loans in time for a multitude of reasons; decreases in collateral value, accrued interest, or an increase in funds borrowed.

In these cases, if the investor is unable to pay back, or service the loan, the position will be settled, with the investor’s collateral liquidated via ORCA.

GHOST: Lending

Lending occupies the other side of this money market and is a slightly easier concept to understand than its counterpart. Allow me to explain.

When users deposit N units of an asset called ‘TOKEN’ into the platform, they will receive N liquid units of an asset called ‘xTOKEN’ in their wallet which can be traded on FIN, sent to other wallets, or used with ORCA to bid on liquidations.

This is especially attractive as units of xTOKEN automatically accrue interest, generated from TOKEN borrowers’ open loan positions on GHOST.

So, when the lender eventually redeems xTOKEN, they will receive their principal amount (TOKEN) back, in addition to some extra TOKEN, which reflects the interest accrued on the loan.

See Daniel Lux’s deep dive on GHOST for a more detailed explanation.

To summarize, all lenders on GHOST provide liquidity by lending assets to the platform and are paid a variable interest rate as compensation. This allows investors the opportunity to put their idle capital to work, earning a healthy yield without the need for a lock-up period.

Now that we have a basic understanding of GHOST’s functionality, we can begin to explore the benefits GHOST offers to both prospective investors and the Kujira ecosystem.

Key Benefits Of GHOST

GHOST offers the following benefits to the Kujira ecosystem:

Mobilize Your Assets

- Lend assets to earn interest.

- Deposit assets as collateral to secure working liquidity.

Whether it’s short/long lending or borrowing, GHOST puts your capital to work, leveraging the existing value of your assets.

An Interoperable Network

Kujira’s highly composable product suite leverages the interoperability between products such as FIN, BOW, ORCA and GHOST to create a smooth, hassle-free experience for investors, who can navigate this ecosystem with ease.

It is this interoperability that will set in place the foundations for higher volume in ORCA and perpetuals on FIN, all the while bootstrapping liquidity on BOW and FIN.

Let’s now explore the practical applications of GHOST, starting with borrowing.

Borrowing On GHOST

Before you start using GHOST, it is essential to first define and understand the following two terms.

LTV Ratios & Liquidations

If you don’t already know, the LTV, or loan-to-value ratio, is a financial metric used by lenders to assess the risk of a loan.

The LTV ratio, and liquidation price, are dependent on the price of the deposited asset, or collateral, relative to the borrowed asset.

If the price of the collateral increases relative to the borrowed asset, the LTV will decrease, and if the price of the collateral decreases relative to the borrowed asset, the LTV will increase.

However, if the price of the collateral relative to the borrowed asset decreases too much, the LTV threshold will be exceeded, and the asset will be liquidated. For a more-in depth explanation, head to the Kujira docs.

Now, let’s get started, using KUJI-USK as an example.

A Step-By-Step Guide

To begin borrowing on GHOST:

- Create a SONAR wallet.

- Navigate to the GHOST Dashboard.

- Select the asset you wish to borrow ($USK).

- Specify the amount of the asset ($KUJI) you would like to deposit.

- Specify the amount of the asset ($USK) you would like to borrow.

- View the LTV ratio and the liquidation price set for the position.

- Click ‘Open Position’ to initiate the borrowing transaction.

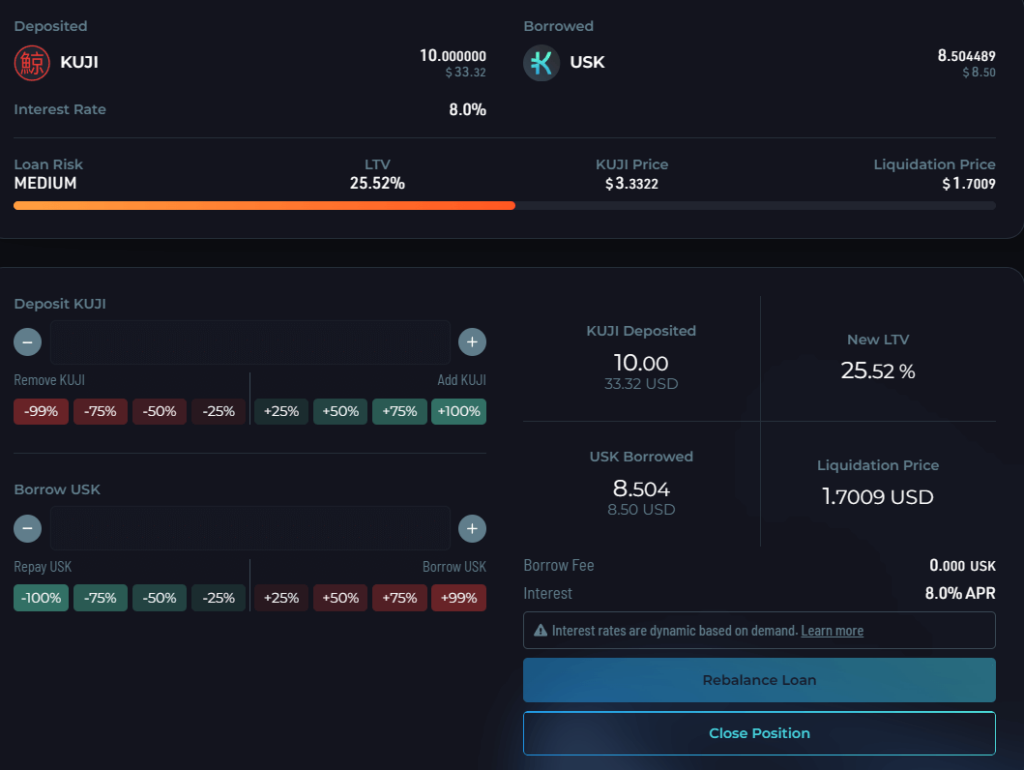

Borrowing On GHOST: KUJI/USK

Now, once a position has been opened, there are several scenarios an investor may face.

Let’s go through these, using the following example:

An investor is depositing $10 KUJI and borrowing $8.5 USK, with an LTV ratio of 25.52% and the liquidation price set at $1.7009.

Scenario 1: LTV Increase

An increasing LTV ratio (30%) indicates that the value of the collateral (KUJI) has fallen against the value of the loan (USK), making it a riskier loan for the lender.

In this scenario, an investor can either decrease their borrowing position (USK) or increase the value of the collateral (KUJI), to restore the LTV ratio to its previous level.

Scenario 2: LTV Decrease

A decreasing LTV ratio (20%) indicates that the value of the collateral (KUJI) has risen relative to the value of the loan (USK), and suggests a less risky loan.

In this scenario, an investor can either increase their borrowing position (USK) or decrease the amount deposited (KUJI), if they wish to restore the LTV ratio to its previous level.

Scenario 3: Liquidation

In some cases, a liquidation may be necessary to prevent an investor from defaulting on their debts.

In this scenario, the LTV of an investor’s loan has exceeded the liquidation price ($1.7009), meaning the value of their asset ($KUJI) has declined against the value of their loan (USK) significantly.

This would result in the investor’s asset ($KUJI) being sold, or ‘liquidated’, to meet their debt obligations, which is a serious event that can have lasting implications on an investor’s portfolio.

So, what are the key takeaways from all this?

Borrowing On GHOST: Key Takeaways

The LTV Ratio Is Crucial

A high LTV ratio not only increases the risk of default but also reduces an investor’s flexibility, who has to keep assets liquid to service their loan missing out on new investment opportunities in the process.

That being said, whilst a high LTV ratio can be risky, it may also be necessary to achieve certain financial goals.

Investors should weigh the risks and benefits carefully before taking on a high LTV ratio, making sure to select an LTV representative of their risk tolerance.

Manage Your Position

Investors should add to, or draw down from, their positions, based on the LTV ratio they wish to maintain.

- To decrease the LTV ratio or risk of their position, investors can repay some of the borrowed amount ($USK), or increase the amount deposited ($KUJI).

- To increase the LTV ratio or risk of the position, investors can increase the borrowed amount ($USK), or decrease the amount deposited ($KUJI).

By managing their position, an investor can keep the LTV ratio at a level acceptable for their risk tolerance, mitigating the risk of liquidations and maximizing the returns on their investment.

One thing we are yet to cover is what to do if you are an investor with spare capital, unsure of where to allocate your funds.

GHOST provides an answer.

Let’s explore this now, using axlUSDC as an example.

GHOST: Lending

For a more descriptive explanation of lending on GHOST, read the Kujira docs.

A Step-By-Step Guide

- Create a SONAR Wallet.

- Connect your wallet to GHOST by Kujira.

- Navigate to Lend.

- Choose the asset you wish to lend (axlUSDC).

5) Indicate the amount you want to lend.

6) Approve the transaction to start lending on GHOST.

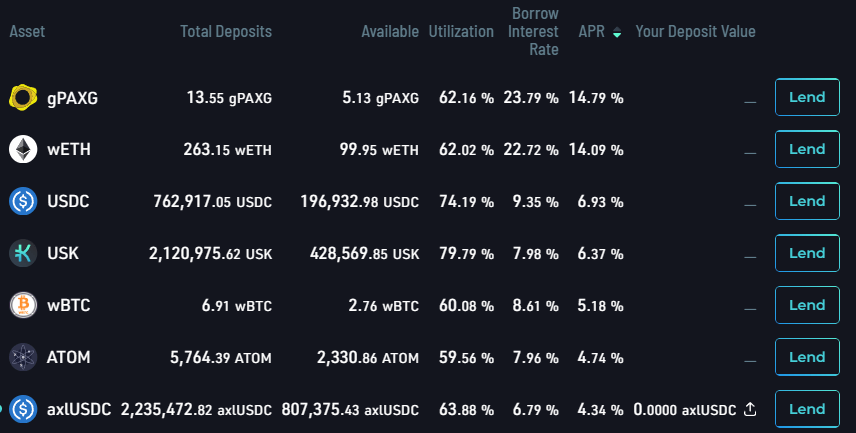

Upon navigating to the lending dashboard on GHOST, you will see several key metrics.

Here’s a brief explanation of these terms for those unfamiliar with them.

Lending On GHOST: Key Terms

Total Deposits

The total amount of an asset lent to GHOST collectively across all lenders.

Available

The total amount deposited minus the total amount already borrowed by other users.

Utilization

The ratio of the amount already borrowed to the total amount deposited.

Borrow Interest Rate

The yearly interest that borrowers owe on any open positions where they have borrowed on a specific asset.

APR

The current yearly interest rate that lenders earn on any provided liquidity to GHOST for that asset.

Total Deposit Value

The amount of an asset that an investor has deposited into GHOST.

Now that we’ve defined these key metrics, let’s outline the main benefits that GHOST offers to the Kujira ecosystem and its users.

Lending On GHOST: Key Takeaways

Lending on GHOST offers the following benefits:

A Diversified Portfolio

Firstly, lending provides a means to diversify investment portfolios, reducing reliance on capital appreciation for returns.

Passive Income

Lenders earn interest on their deposited crypto, often at rates significantly higher than traditional savings accounts, making it an attractive avenue for enhancing returns.

An Improved Ecosystem

Lending contributes to the growth and development of the ecosystem by providing borrowers with access to capital, thereby fostering innovation and adoption within Kujira.

Article Summary

What Is GHOST?

GHOST is a decentralized money market that facilitates lending and borrowing on Kujira through a supply-demand framework, generating attractive returns for market participants without relying on artificial incentives.

Key Benefits Of GHOST

Mobilize Your Assets

- Lend assets to earn interest, or deposit assets as collateral to secure working liquidity.

Whether it’s short/long lending or borrowing, GHOST puts your capital to work, leveraging the existing value of your assets.

An Interoperable Network

Kujira’s highly composable product suite leverages the interoperability between products to create a smooth, hassle-free experience for investors, who can navigate this ecosystem with ease.

Borrowing On GHOST

To start borrowing on GHOST, click here.

Through GHOST, investors can access liquidity without selling their assets, leveraging their funds to amplify returns and diversify their portfolios.

Investors should exercise due diligence when borrowing, ensuring they monitor the LTV ratio and manage it to minimize the risk of liquidation.

Follow the step-by-step guide here.

Lending On GHOST

To start lending on GHOST, click here.

Lending on GHOST provides passive income, with investors earning an attractive interest rate on their deposited asset, often at rates significantly higher than traditional savings accounts.

It also provides a means by which to diversify your investments, reducing reliance on capital appreciation for returns and mitigating overall portfolio risk.

Follow the step-by-step guide here.

By now, you should understand the key mechanisms behind GHOST and the value it offers to the Kujira ecosystem, as well as how to put your assets to work and start borrowing and lending on Kujira.

The Role Of GHOST In Kujira’s Future

I’d thought I’d mix things up, and end things with a specially crafted poem.

Warning: Do not try this at home!

The Invisible Hand

To all investors, big and small,

Portfolio’s short, portfolio’s tall,

there is a chance for extensive wealth,

of happy lives, of endless health..

So raise your glasses, and make a toast,

To the money market, we know as GHOST.

What do you think? Oh, really? Hey, I tried my best, alright…

Seriously though, as much as *certain* protocols may not want to admit, Kujira is disrupting the DeFi landscape, and in a big way.

The money market of Kujira is evolving, and fast.

Hence, my final invitation to investors.

GHOST offers you the chance to put your assets to work, earn passive income, and actively participate in the growth of the Kujira ecosystem.

My advice, get on board. You don’t want to end up washed ashore.

Useful Links

- GHOST by Kujira

- Creating Your First SONAR Wallet

- GHOST (Money Market) — Kujira Docs

- A GHOST Technical Deep-Dive

- Borrow — Kujira Docs

- Lend — Kujira Docs

- Smart Contracts Explained

Kujira Academy is a platform that aims to bridge the gap between young entrepreneurs and Web3, providing them with tangible education and career acceleration opportunities. Built by students, for students. Learn more about the academy and our vision here.

To register your interest and become a student of Kujira Academy, click here.

Written by Kid Kuji