Table of Contents

- Introduction

- History

- Pilot

- Plasma

- Bonds

- Dustbuster & Dust Butler

- Flows

- Options

- Ignition

- Dashboard

- Staking

- Governance

- Fees

- Conclusion

- Useful Links

Introduction

In the cosmic expanse of the blockchain universe, there exists a rather unique constellation known as Fuzion Protocol. This delightful assemblage of decentralized applications orbits within the Kujira ecosystem, each dApp spinning up opportunities as wildly diverse as any planet you might hitch a ride to. With tools like Pilot for equitable token launches, Flows for controlled releases of token and Plasma for tranquil over-the-counter trades, Fuzion invites adventurers and entrepreneurs alike to strap into their cosmic seatbelts and explore the new frontiers of decentralized finance. It’s not just a protocol, it’s an interstellar journey into the future of funding. Join me Fuziliers, on a journey through the Fuzion ecosystem.

Even though we are going to go Full Sned, no towels will be needed for this journey.

History

Fuzion Protocol, originally known as Atlo , had a turbulent past due to the collapse of Terra. In its former incarnation, Atlo, was integrated within the Terra ecosystem launched late 2021. It provided a unique launchpad that brought about equality, and an approach not seen anywhere else. Fuzion Protocol faced challenges following the collapse of Terra in May 2022, but emerged stronger and more resilient.

The team decided to take some time to brainstorm and pivot its focus on rebuilding something more than just a launchpad.

Upon transitioning to Kujira, and rebranded as Fuzion Protocol, the move was not just a change of blockchain but also an evolution in the protocol’s identity and capabilities. Fuzion Protocol expanded its offerings, focusing on providing a comprehensive suite of DeFi tools.They began working with another resilient team, Kujira. A team that also honoured its previous Terra community and upheld the highest standards of professionalism, rarely seen in Web2 or Web 3. This move allowed the Fuzion team to preserve its core functionality and community by transitioning to a more stable and resilient blockchain environment. Kujiras focus on sustainable projects, real yield and Grown-Up DeFi made it the ideal platform for Fuzions chain agnostic vision.

While working on rebuilding and launching on Kujiras ecosystem, both teams quickly realised that by combining their resources they could create a much needed launchpad, and have it go live before needing to relaunch the Fuzion protocol in its entirety. Through the tremendous collaborative efforts of both teams we were first introduced to Pilot.

Fuzion aims to create a suite of dApps that would rival any traditional financial institute. We will take a look at the various DeFi tools already on offer and perhaps some speculation as to what might come.

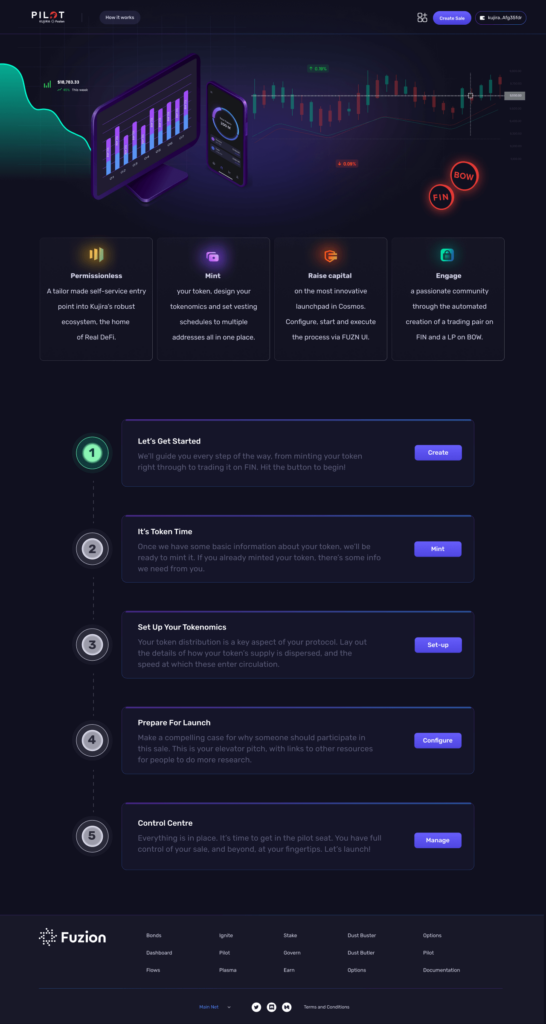

Pilot

Pilot is a launchpad designed to facilitate fair and equal opportunities for participation in token sales by using a unique bidding process pioneered by Kujira’s ORCA. This eliminates the elements of speed and chance from the fundraising process, making it accessible and equitable for all participants.

In this method, participants place bids on tokens during a sale window. Tokens are then allocated starting from the highest bids down to the lowest, until all tokens are distributed. This system aims to provide a more equitable distribution of tokens by allowing all participants a fair chance to purchase at their desired price level rather than being limited to a “first come, first served” basis

After 4236 lines of code,we saw the upgrade of Pilot. Keiko (by one of my favourite devs Bart). This introduces several key features that enhance the product further. Pilot has now become a Self-Service dApp whereby teams can set out all the parameters of the launch themselves with step-by-step guides along the way. Teams can:

Mint a Token – Pilot will mint your token as part of the launch process. If you have already minted, Pilot works seamlessly with existing native and bridged tokens on Kujira.

Create Tokenomics – Set out your tokenomics as part of your launch process. Allocate percentages of supply, set out vesting schedules, and everything unfolds automatically after your sale finishes.

Create LP on BOW – Designate a percentage of the raise to BOW liquidity provision, ensuring instant liquidity to your trading pair. LP tokens are distributed to the launcher via Flows to ensure liquidity for trading cannot be immediately withdrawn.

FIN Listing – Once the sale is complete, a trading pair is created on FIN using the launched token and the purchase denom in the sale.

Participating in a Sale

Please note that these are general steps and the exact process may vary depending on the specific rules of the PILOT platform and the project’s sale such as activation times as they are individually set by each launching team. Always make sure to read and understand the rules of the sale before participating. It’s also a good idea to do your own research on the project to make sure it’s a good fit for your investment strategy.

- Connect Your Wallet: First, you’ll need to connect your wallet to the PILOT platform. This is usually done through a “Connect Wallet” button on the platform’s homepage. You can also use Pilot directly from Kujiras native mobile wallet SONAR, alternatively you can use Leap or Keplr

- Select the Project: Once your wallet is connected, you can browse the available projects. When you find a project you’re interested in, select the view button for more details.

- Enter the Sale: If you decide to participate in the project’s sale, there will typically be a “Join Sale” or “Participate Now” button. Clicking this will take you to the sale page.

- Submit Your Bid: On the sale page, you’ll be able to submit your bid for the project’s tokens. This usually involves specifying the amount of tokens in a stable denom ( ie USK or USDC) you want to buy and the price you’re willing to pay via the corresponding pool with % discount.

- Confirm Your Transaction: After you’ve entered your bid and clicked submit, you’ll need to confirm the transaction in your wallet. Make sure to double-check all the details before you confirm.

- Wait for the Sale to End: Once the sale ends, the tokens will be distributed to the successful bidders. If your bid was successful, the tokens show in the ‘Available for withdrawal’ field, click withdraw and sign transaction and the tokens will be withdrawn to your wallet. For any bids that did not fill or partially filled your stablecoin bid needs to be cancelled below the price information. once cancelled and signed. your unused allocation will be returned to your address.

*If you are bidding in high% discount pools please keep an eye on your bids as if the sale is oversubscribed there is a chance the pool you are in could be partially filled or none at all.

An Example Of A Sale

In our example, there are 10,000 $DEMO in the sale. The price is USK 2.50 per DEMO, with discounts at 5% increments, up to a maximum of 50% off the price, or USK 1.25 per DEMO. The auction window is 48 hours. Let’s have a look at how the sale went for one participant:

This individual had three bids. Two were successful, at 5% and 25%, shown by the red dots. The third bid at 40% would have been partially successful, as that’s where the tokens were allocated up until. Our bidder could have potentially bought a further 280 DEMO at a very appealing 40% discount, if they had activated the bid. They did not, which is why it’s indicated with a black dot. As it stands, they have secured 954.38 DEMO, at a discount of 17.32%.

The sale was oversubscribed by almost 280%. While the DEMO sale sold out at an average price of USK 1.76 they fell short of their raise target, despite $41k worth of bids.

Key Features

Unique Sale Method: PILOT uses a unique sale method based on ORCA’s revolutionary bid process. This process is designed to make participation equal and create a fair opportunity for everyone by removing chance and speed from the process.

Bidding Structure: The unique bidding structure of PILOT allows every buyer to establish a price per token they are comfortable with. This ensures that the price is determined by individual actions rather than group consensus, promoting a fair and personalised investment experience for each participant.

Protocol Growth Hack: PILOT works together with other Fuzion products to provide a powerful growth engine for protocols at any point in their life cycle.

Self-Service Entry Point: PILOT provides a tailor-made self-service entry point into Kujira’s robust ecosystem. You can mint your token, design your tokenomics, and set vesting schedules to multiple addresses all in one place.

Raise Capital: With PILOT, you can raise capital on one of the most innovative launchpads in Cosmos.

Full Control: Once everything is in place, you have full control of your sale, and beyond, at your fingertips.

Plasma

The next dApp in the production line from Fuzion was Plasma, an Over The Counter (OTC) marketplace that allows users to conduct peer-to-peer deals securely. This platform enables trading of any token for another at set prices, without affecting the market price, thus providing a controlled and secure environment for large trades.

Plasma is found in a wide range of places, from flames and lightning on Earth to the solar wind and the Sun’s surface, to interstellar and intergalactic regions in space. It has unique properties and behaviors that distinguish it from other forms of matter and make it useful in a wide range of applications. In our case, this is all very fitting. Fuzions Plasma can be found everywhere and has a wide range of tokens that can be traded, very easily, by anyone.

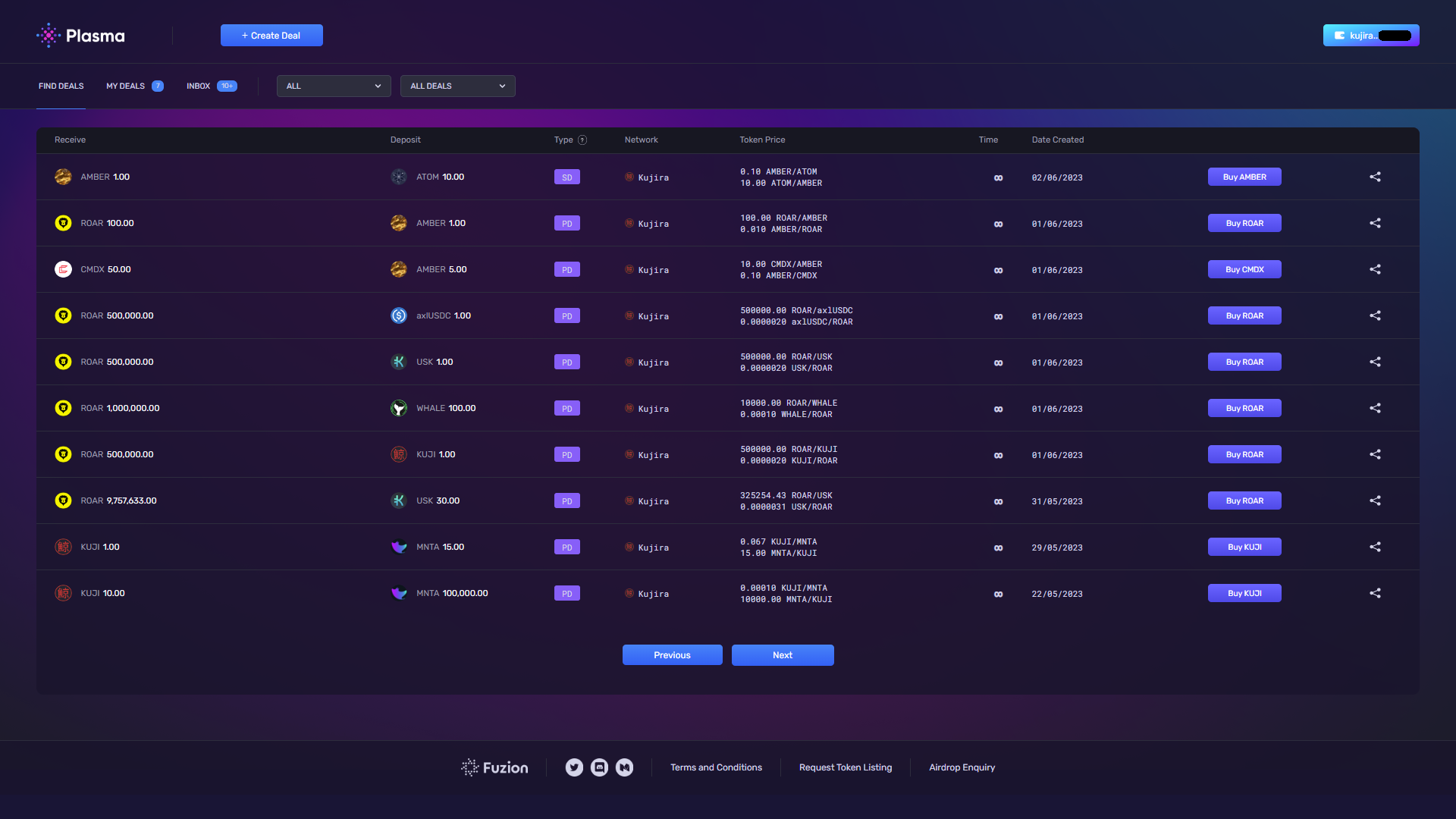

Finding Deals

Anyone can look through available deals. Simply connect your wallet and go to the Find Deals Tab. If you see a deal you like, taking it is as easy as clicking the BUY button and approving the transaction. OTC deal complete!

Plasma takes 1% of the value of the whole deal, paid equally by both Maker and Taker. This is done automatically when the deal is successfully closed. There is no charge for cancelling or refunding.

The drop down filter lets you search for a specific pair if you have something particular in mind. If you don’t see a deal you want, it’s time to create one.

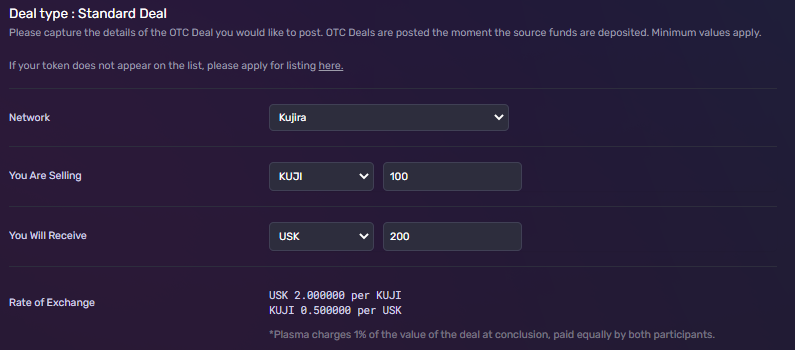

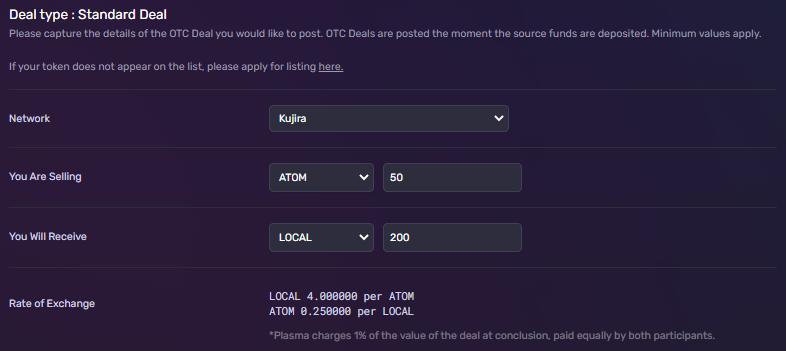

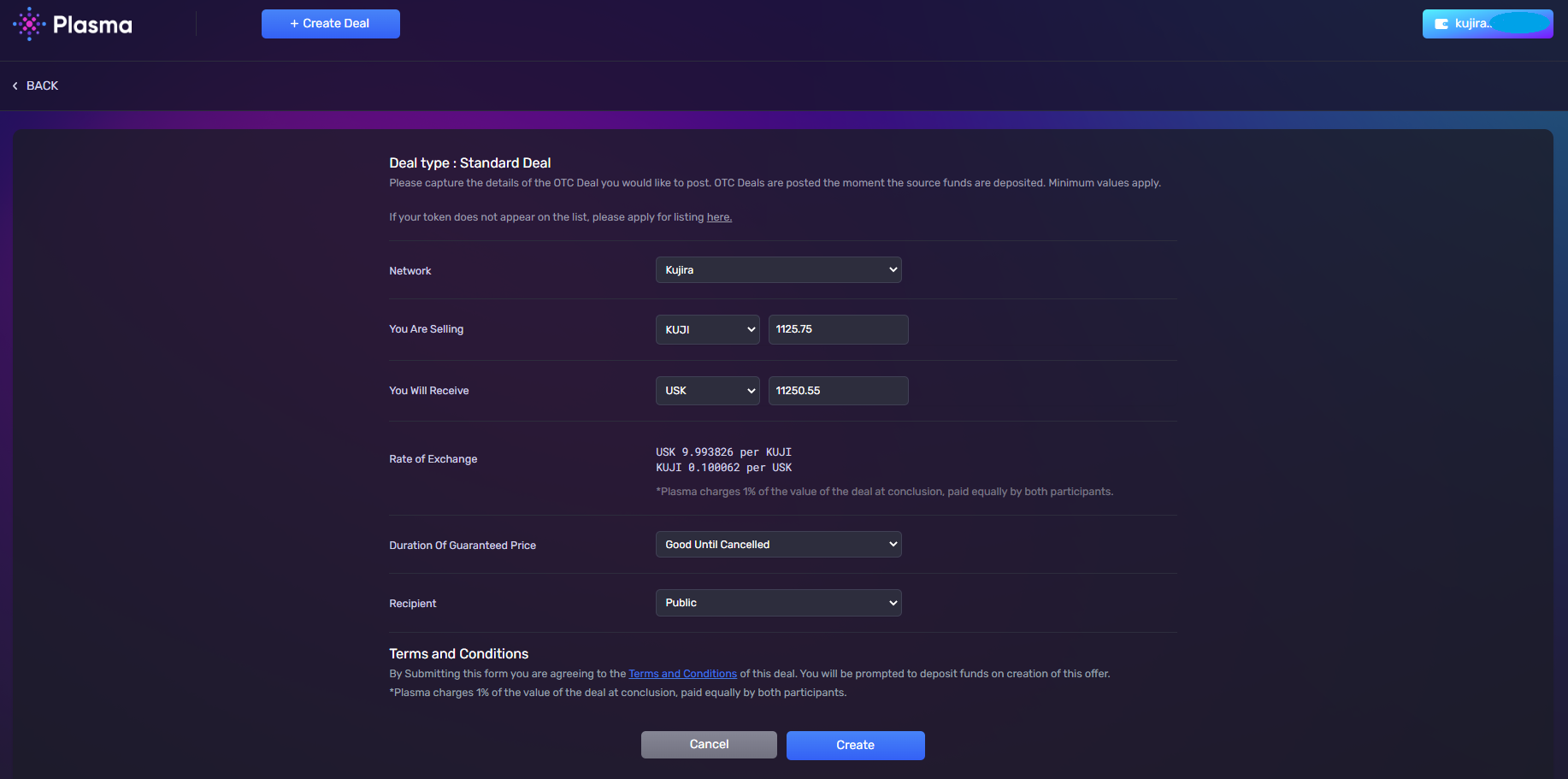

Creating a Deal

Anyone can create deals. Creating a deal requires that your wallet is connected, you have tokens for gas, and of course, the tokens you want to use in the deal.

The steps are as follows

- Connect Your Wallet. This is done in the top right corner of the page, if on desktop. Compatible wallets include Keplr, with Sonar, Kujira’s wallet, coming soon.

- Create A Deal. Click on the + Create Deal button and select “Standard” to create a new deal. This will open a window with fields for all the necessary info.

- Network. This is limited to Kujira, with plans to add more chains.

- You Are Selling. This is the token you would like to trade with. Select your token from the list (it’s alphabetical) and how many you are adding to the deal.

- You Will Receive. This is the token you wish to receive in exchange for your offer, and the quantity of that token you expect.

- Price Per Token. This is the value of the token you’re offering expressed in terms of the token you are accepting.

If you’re offering 100 KUJI for 200 USK, you’re expecting 2 USK for 1 KUJI.

50 ATOM for 200 LOCAL is 4 LOCAL per ATOM.

You get the idea. Pay attention and make sure the Price Per Token is the one you have in mind.

- Duration of Guaranteed Price. This is how long you want your deal to remain open. If you do not wish to include a time limit, select “Good ’Til Cancelled” and your deal will stay open until it’s accepted or you cancel it. If you choose an expiry period, it starts as soon as the deal is created. This can last up to 48 hours.

- Recipient Wallet. If your deal is open to everyone, select “Public”. Once published it will appear in the Find Deals list. If you have a specific recipient intended, select “Wallet”.

- Recipient Wallet Address. If your deal is privately offered to a specific wallet, this is where you enter your intended recipient’s wallet address. Be sure to use the right address for the network; Kujira addresses only for now. Once your deal is published, only the recipient will see the offer in their Inbox after they connect their wallet to the Plasma site.

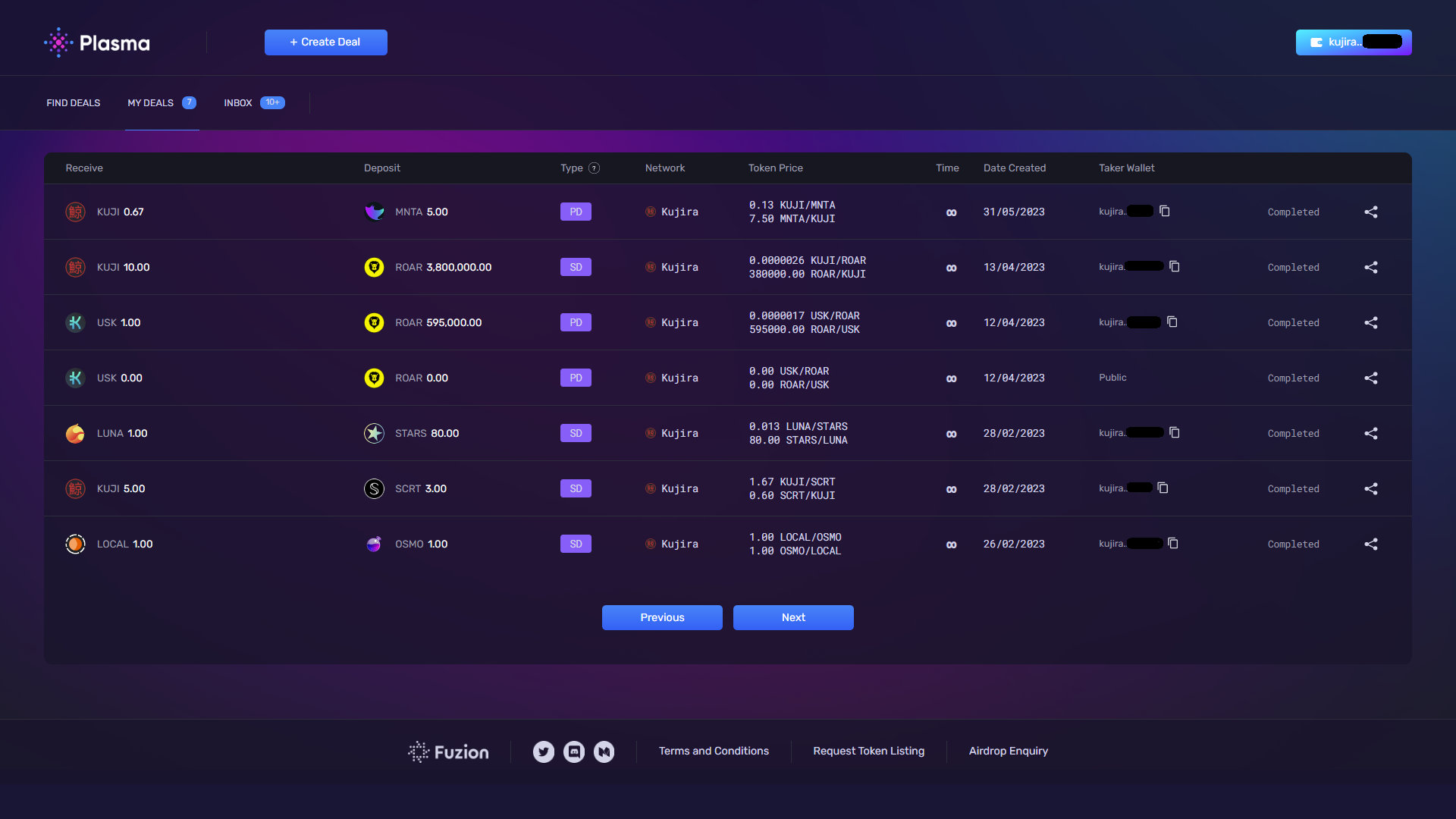

My Deals

These are deals you have created. If a deal has not been accepted by a Taker, you can end it by clicking the Cancel button. You may only cancel a deal that has not been accepted. If your deal has been accepted, the deal is concluded, the cancel button is removed and the wallet of the Taker is displayed.

If a deal has expired without being accepted by a Taker, a Refund button is shown. Clicking this approves a transaction to return the tokens you deposited into the deal to your wallet.

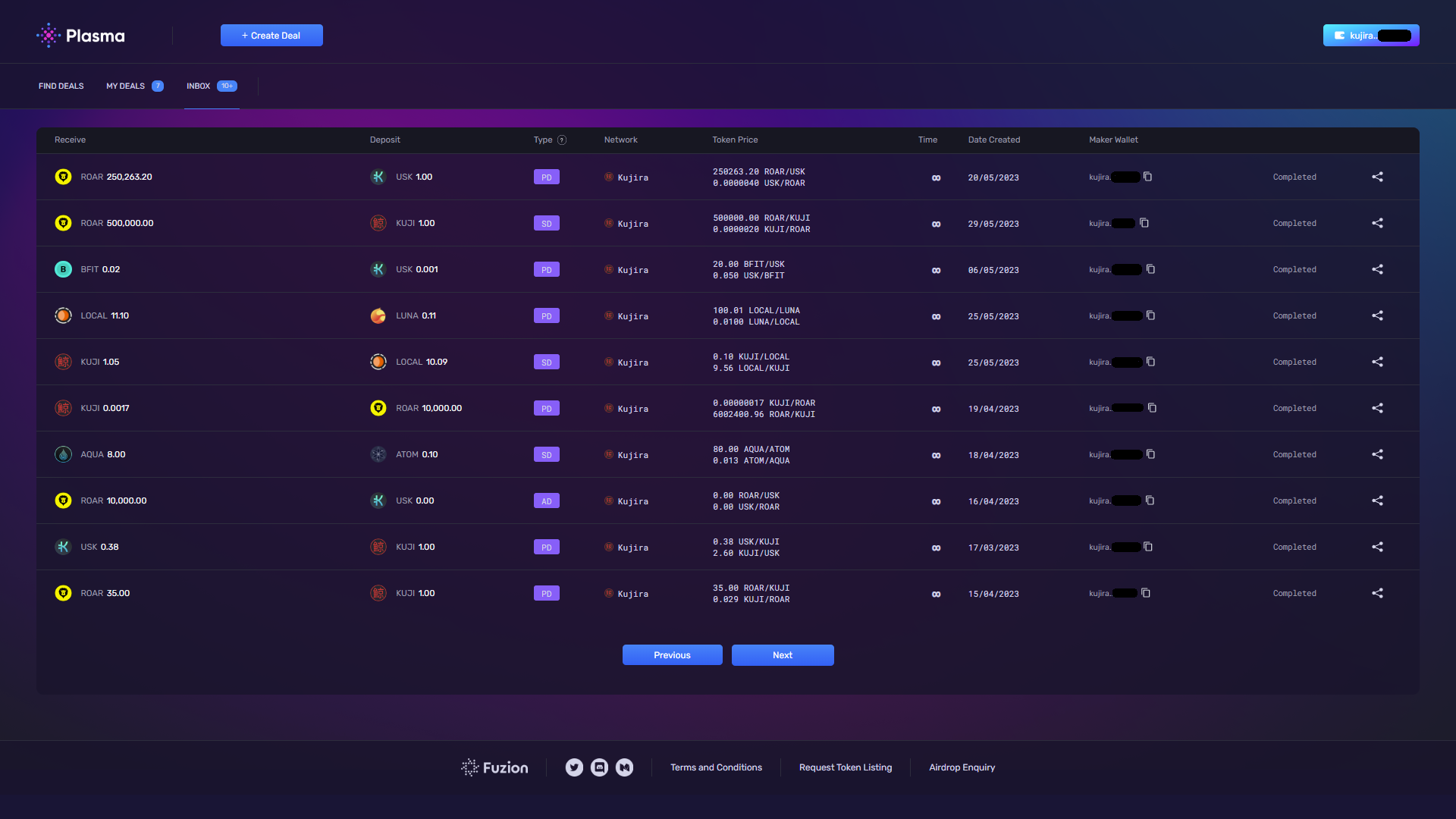

Inbox

This is where you will find any private deals where the Maker of the deal specified your wallet as the Taker. Both completed and open deals are shown. Deals marked “Expired” mean you did not close them in time and they are no longer available to you to Take.

To accept a deal, click the Buy button next to the deal and approve the transaction in the wallet. Once the Tx is approved, your token balances will reflect in your wallet (tokens in, and tokens out)

Deal Types

1. Standard (SD)

A simple deal between two individuals. It may be public or private. The deal can be Good Until Cancelled or have an expiration date of up to 48 hours.

It cannot be partially filled. It can use any token approved by Plasma (over 70 and counting).

The Maker places tokens in the deal when it’s created. After a Taker accepts the deal, their tokens are placed in the wallet of the Maker, and the tokens submitted in the deal by the Maker are placed in the wallet of the Taker.

Both Maker and Taker pay a commission at completion of the deal. Listed as type SD on the Find Deals tab.

2. Partial (PD)

A deal offered by one Maker with multiple Takers. It is available as a public deal only. The deal can be Good Until Cancelled or have an expiration date of up to 48 hours.

Takers can accept as much or as little of the deal as they desire. Makers may cancel the deal at any time. If it has been partially accepted by Takers, Makers are returned what remains of their offered tokens.

Takers pay a commission on completion of their partial fulfilment of the deal. Makers pay a commission on all tokens they receive from Takers.

Listed as type PD on the Find Deals tab.

Bonds

In traditional finance, a bond is a fixed-income instrument that represents a loan made by an investor to a borrower (typically corporate or governmental). Bonds are used by companies, municipalities, states, and sovereign governments to finance projects and operations.

What Are Bonds in DeFi?

In decentralised finance, bonds are financial tools that allow participants (investors) to lock up a certain amount of cryptocurrency or tokens for a set period in exchange for interest or more tokens. This concept is similar to traditional finance bonds, where the bond issuer receives capital (money) and promises to pay back the capital with interest to the bondholder after a certain period. In the case of Fuzion’s Bonds, the buyer is paying a discounted price on a token in exchange for agreeing to take possession after a delay.

Purpose of DeFi Bonds

- Fundraising: Protocols may issue bonds to raise funds for various purposes, such as liquidity, development, or marketing. Investors purchase these bonds with the expectation of future returns.

- Protocol Stability: By issuing bonds, DeFi projects can manage their token supply, control inflation, and stabilise their ecosystems. It encourages long-term holding rather than speculative trading.

- Reward Investors: Bonds can offer higher returns compared to simple staking or liquidity provision, rewarding investors for their longer-term commitment and higher risk.

How Fuzion Bonds Work

- Deal Setup: One Maker and many Takers can participate in a bond deal. The Maker, who is typically the protocol, DAO, or project looking to raise funds, sets the terms of the deal.

- bTOKENs: When Takers participate in a deal, they receive bTOKENs. These bTOKENs can be viewed and claimed in the Taker’s portfolio. They are used to redeem the underlying TOKEN once the Bond deal has matured.

- Raise Capital: Bond Deals allow protocols to use the collateral in their treasury to raise immediate funding without increasing near term circulating supply. The deal maker pre-programs the release schedule of the bTOKEN.

- Maintain Liquidity: bTOKENs allow deal Takers to maintain their liquidity with a token that is transferable and tradable while waiting for the deal to mature and the tokens to become available.

- Endless Possibility: Bonds may be created using a standard denom, LP token or LST, and the deal may be taken using any denom the Maker prefers.

- Multiple Deals On The Go: bTOKENs allow deal Takers to maintain their liquidity with a token that is transferable and tradable while waiting for the deal to mature and the tokens to become available.

Benefits to the Ecosystem

- Predictable Capital: Bonds provide the protocol with predictable access to capital, which can be crucial for budgeting and planning.

- Investor Confidence: Offering bonds with clearly defined terms and rewards can build investor confidence and attract more substantial investment.

Risks Involved

- Market Risks: Like all crypto investments, bonds carry risks related to the volatility of the market. The value of the underlying tokens can fluctuate dramatically.

- Liquidity Risk: For regular bonds, there is also the risk of liquidity, especially if the company is unable to pay out the rewards or return the principal at the end of the bond’s term due to a lack of liquid assets. However, Fuzion bonds use tokens, which are locked into the contract on creation. A token in a bond may have it’s value fluctuate, but it will always be available when the bond matures.

Bond Creation Variables

Bond Start Date and Time (UTC). This is set by the maker. It must be a future date and time. The bond status is “scheduled” until the allotted time and date is reached.

Bond End Date and Time (UTC). This is set by the maker. It must be a future date and time. It must occur after the Bond Start Date and Time. At this point in time a bond is no longer available to be bought. When this time and date is reached the bond’s schedule changes to “Expired”. If all the bond tokens are purchased before the End Date and Time is reached, the bond’s status changes to “Completed”.

Bond Maturity Date (UTC). This is set by the maker. It must be a future date and time. It must occur after the Bond End Date and Time. At this point in time the bonded tokens are available to be redeemed. When this time and date is reached the bond’s schedule changes to “Mature”. The bTOKENs minted when takers bought the Bond token can be redeemed for the tokens in the Bond.

Token Denom. This is chosen by the maker. It is the token locked in the bond deal.

Token Quantity. This is chosen by the Maker. It is the number of tokens in the bond.

Purchasing Denom. This is chosen by the Maker. It is the token used by the Taker to purchase the Bond.

Price. This is the cost per Bond token, expressed in terms of the Purchasing Denom. Eg if 100 FUZN are bonded, the purchase denom is USK, and the price is $0.55 per token, then the Price is 0.55 USK and the entire bond’s value is 55 USK.

Bond Denom Number. This is chosen by the Maker. Each bond has a unique number as part of the bTOKEN denom. This is to discern between multiple bonds using the same bond token. Eg bFUZN01 can only be used to redeem FUZN in one specific bond. Other tokens with bonded FUZN have their own bFUZN.

When a Taker participates in the bond, bTOKENs are minted and distributed to them. These are redeemed for the token in the bond when it reaches the Bond Maturity Date. bTOKENs are distributed to Takers immediately, when the Maker decides not to use a Flow. If the Maker chooses to create a distribution schedule using Flows (another Fuzion product) then bTOKENs are distributed to Takers accordingly.

Schedule Creation Variables

Schedules are instructions created by the Maker defining the distribution of bTOKENs to Takers.

Schedule Start Date. When the distribution of the bTOKENs begins.

First Claim Delay. The number of days after the start of the schedule until the Taker may make their First Claim.

Schedule Length. The number of days it takes for the bTOKENs to be completely distributed.

Bond Maturity and Redemption

When a bond matures, the tokens placed in the deal by the Maker are available to be claimed. Holders of bTOKENs can visit the bond detail page and redeem them for the asset at a 1:1 rate. Every bTOKEN represents a 1:1 access to a token in the bond. The tokens will remain safely in the deal until bTOKENs are redeemed and they are released. There’s no time limit on redemption.

Bond Detail Page

Every bond has a unique Bond Detail Page, with a separate vanity URL. This page shows all the relevant info regarding the bond, and the participation of any connected address. It is where bTOKEN holders go to redeem bond tokens once a bond has matured.

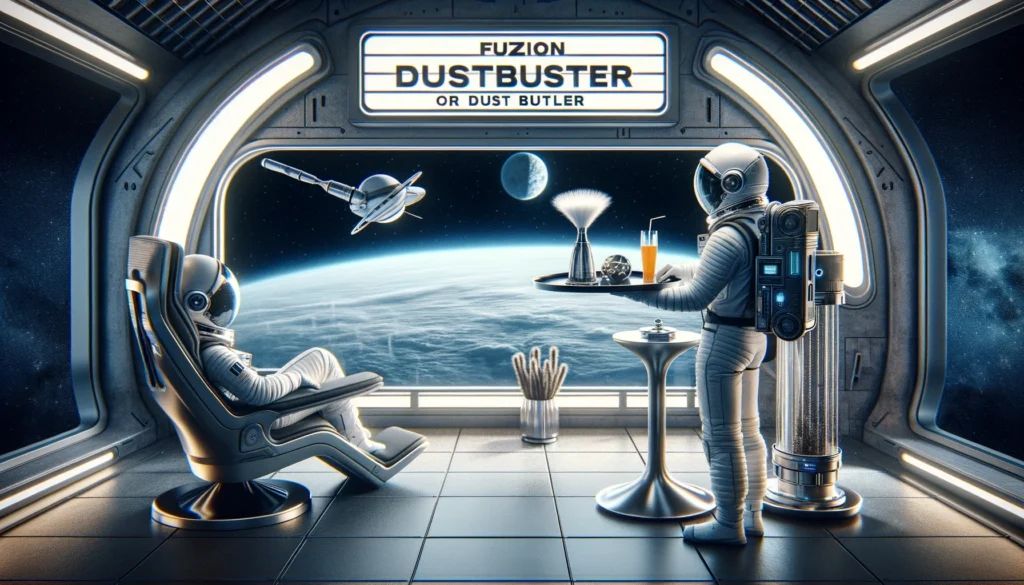

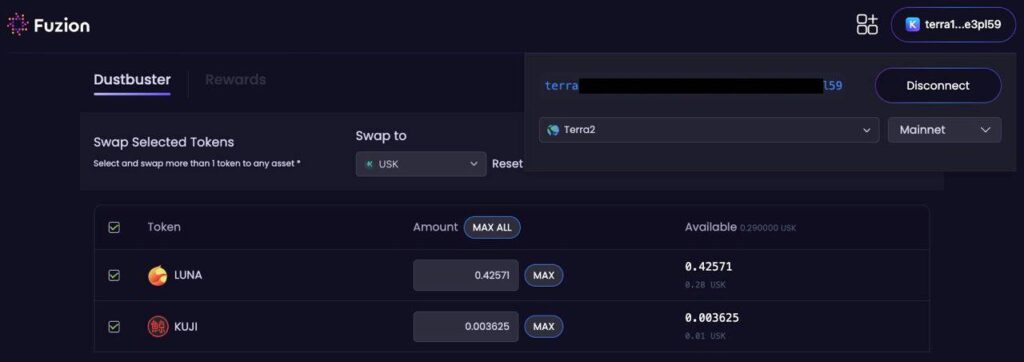

Dust Buster and Dust Butler

Fuzion’s Dust Buster and Dust Butler are innovative tools designed to streamline and automate the process of token swaps and claiming rewards in the DeFi space.

You can view your address balance and complete quick, convenient swaps of tokens already held by your address. using Manta or FIN. Dust Buster is also the only many to one swap. All others are one to one.

Dust Buster provides a user-friendly interface for viewing token balances and claiming rewards, with the added flexibility of choosing between different swap routes using either FIN or Manta. It simplifies the process of managing and optimising your token portfolio.

On the other hand, Dust Butler takes it a step further by automating these processes based on user-set parameters. This means users can “set and forget” their token swaps and claims, saving time and effort.

Lets not forget our favourite whale Sumo has generously given $15,000 USK towards the fees of anyone using Dust Butler to convert their dust ino KUJI. See the thread here and again this week topping up another 5k USK

Dust Buster

This lists all pending rewards by token. It shows the rewards from multiple sources, including staked MNTA, staked KUJI, staked FUZN and incentives earned in BOW. Additional sources will be added as they become available.

The token, the quantity available, and the estimated USK value is shown. When using Claim & Swap, the target quantity of the desired token is shown below the USK value.

Rewards can be used in one of three ways:

A. Claim. This will claim all tokens available from all sources.

B. Claim & Swap. This will claim all tokens and swap any eligible for a token of your choosing.

C. Claim All & Swap Some. This will claim all rewards, and swap the eligible tokens you have selected to a token of your choice. All others will be claimed as is.

A. Claiming Rewards

- Click the claim button.

- Confirm the details are acceptable.

- Approve the Tx.

B. Claim and Swap

- Choose the token you wish to swap to using the drop down list.

- Select a route through FIN or Mantaswap.

- Set your preferred maximum slippage. The default is 1%.

- Check the box at the top of the list in the Menu header. This will swap all eligible rewards to the token of your choice. If a checkbox is disabled, that token cannot be swapped for the denom you wish to receive, and it will be claimed as is.

- Click the Claim & Swap button.

- Confirm the details are acceptable*.

- Approve the Tx.

*Be aware that when claiming and swapping, there may be a discrepancy between the USK value of all the claimed tokens combined, and the value of the token being swapped to. This happens when there is already some of that token present in your rewards. Its value has counted towards the total rewards basket, and as there’s no need to swap a token for itself, its value is not included in the estimated return of the swap.

C. Claim All, Swap Some

- Choose the token you wish to swap to using the drop down list.

- Select a route through FIN or Mantaswap.

- Set your preferred maximum slippage. The default is 1%.

- Check the box next to the rewards you want to swap. If a checkbox is disabled, that token cannot be swapped for the denom you wish to receive, and it will be claimed as is.

- Click the Claim & Swap button.

- Confirm the details are acceptable.

- Approve the Tx.

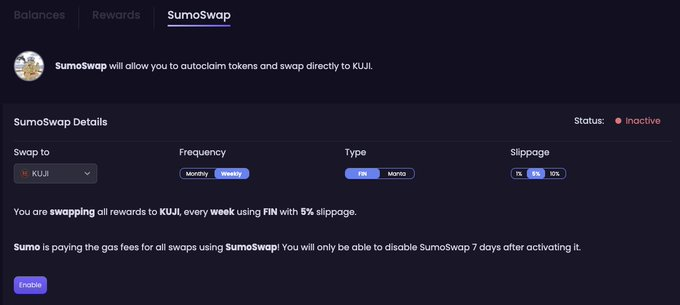

Dust Butler

To enable Dust Butler, choose your preferred settings, click enable and approve the Tx. The indicator will switch from Inactive to Active. To deactivate an Active Dust Buster, click the disable button and approve the Tx.

Dust Butler settings can be updated by clicking the update button, choosing new settings, and enabling.

- Swap To: Choose the Token you want the Butler to convert your claim to.

- Frequency: Choose to execute the process weekly or monthly.

- Type: Choose which service to use; FIN or Mantaswap.

- Choose the slippage you are prepared to accept. There is no default selected.

- Status: This will display as Active when Dust Buster is being used by a wallet, and Inactive when it is not.

Once enabled, Dust Butler will make an initial claim within an hour of being active. It will then follow the schedule selected by the user.

The info below the detail fields will show the Time of the TX, Status as a Success or Failure, and the Sources rewards were collected from (KUJI, MNTA, yFUZN or Bow staking).

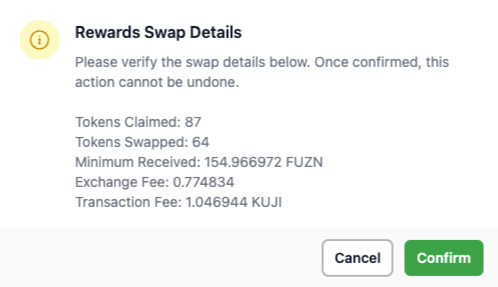

Confirmation Dialogue

After a swap is initiated, but prior to triggering a Tx, a confirmation window gives the user a chance to review the swap. Information displayed includes:

Tokens Claimed: Quantity of tokens being claimed

Tokens Swapped: Quantity of tokens being swapped

Minimum Received: Quantity of the token being swapped to.

Exchange Fee: Expected fee charged by the exchange for the conversion.

Transaction Fee: Estimated fee charged for the Tx.

Once the user clicks confirm, a Tx will be generated for them to approve.

If the details are incorrect, the user may cancel and then edit the details of the swap before continuing.

With the latest chain upgrades, Fuzion Dustbuster 1.4.0 Chain Upgrade Smart Contract Updates, we see it use new Staking Rewards Batch Claim Message and cosmwasm_1_4 Distribution Rewards query added in Kujira 1.0.2 chain upgrade.This allows Claim All Rewards transactions; claim all rewards from all validators in a single, gas-efficient, ledger compatible transaction

Flows

Fuzion Flows, offers a powerful tool designed to manage the flow of tokens between wallets, ideal for handling various kinds of financial transactions over time such as subscription services, payments, salaries, and other long-duration transfers.

The app allows users to set up “Flows” which automate the movement of tokens from one wallet to another on a scheduled basis. This setup provides a consistent, block-by-block transfer that can be used for regular financial commitments, making it an efficient tool for managing recurring transactions. Users can easily track these flows, view transaction details in real time, and access their tokens at any point from their personal portfolio page.

Flow States

A flow exists in any one of three states:

- Pending

- Active

- Complete

A pending flow has not yet reached its active date. No tokens are vesting. The Deal Taker cannot claim any tokens, and the cliff has not started.

An active flow is currently in the process of moving tokens from one wallet to another, according to the first claim and vesting schedule.

A completed flow has concluded the process of moving all of the tokens in the schedule from the dispenser to the recipient, and all tokens are claimable.

Inflows

The Inflows page shows a list of all flows where the connected wallet is the recipient. The Inflows page displays a table with several columns of information and allows the user to, at a glance, see the top line detail of the flows they are receiving.

Clicking on the CLAIM button in a row will open a Tx which will send whatever portion of the flow is claimable to the recipient’s address.

Clicking on the arrow icon will open the flow’s detail page.

Outflows

The Outflows page shows a list of all flows where the connected wallet is the dispenser. The Outflows page displays a table with several columns of information and allows the user to, at a glance, see the top line detail of the flows they have created.

A dispenser is able to see how much of a flow has been claimed to date.

Clicking on the arrow icon will open the flow’s detail page.

Flow Details

The Details page includes all the relevant information of the flow, including the schedule details, allocation, claimed amount and claimable amount. Each flow has a unique ID. Flow Detail pages are viewable by both Dispenser and Recipient.

Creating a Flow

Creating a flow requires a Kujira address, with tokens for gas, and holding the token to be sent to the recipient.

Recipient : the full address the tokens are sent to.

Token Denom: The token you are sending to the recipient.

Quantity : The total number of tokens placed in the flow.

Schedule Start Date : The date on which the flow will start. This must be a date in the future, Flows cannot have a start date in the past.

Days until claims starts : The number of days between the start of the schedule and when the recipient may start claiming. This is sometimes referred to as a “cliff”. Claimable tokens will accumulate during this period as per the flow’s parameters, but will only be claimable once this period is complete.

Length of Flow : The total number of days the flow lasts for. The number of days from the schedule start to the end of the flow. Tokens will release linearly over the duration of this period. Submit : Click submit once you have entered all details.

Review and Proceed : Review the details before proceeding. After the proceed button is clicked and the Tx is approved, there is no way to edit the details of the flow. A flow cannot be cancelled, nor the tokens in the flow recalled or refunded. All confirmations are final.

Once a flow is created, it will appear in the Outflows tab of the dispenser and the Inflows tab of the recipient, with a status that reflects whether it is pending, active or complete.

Options

In traditional finance, option trading involves contracts that give the buyer the right, but not the obligation, to buy or sell an asset at a predetermined price before a specific expiration date. There are two main types of options: calls (which give the right to buy) and puts (which give the right to sell). Options are used for hedging risks, speculating on future price movements, and generating income through premium collection. The value of an option is influenced by factors such as the asset’s price, time to expiration, and volatility.

Fuzion Protocol’s Options app on the Kujira ecosystem allows users to engage in options trading, which involves derivative contracts that grant the buyer the right, but not the obligation, to buy or sell an underlying asset at a set price on or before a specific date. This tool is designed for users who want to hedge or speculate on the price movements of tokens within the Cosmos ecosystem. It provides a robust platform to manage these financial instruments effectively, offering strategies that cater to varying risk appetites and market conditions.

Overview

Options allows deal Makers to Create Call and Put Options. Deal Takers can browse existing options by pair and expiry, and purchase portions or all of an option. Options uses an oracle to track the market price of the tokens in the pairs. It is a European style option, meaning it is executed on the date of expiry only, unlike the American style, which can be done any time before the expiry. Fuzion’s Options platform allows anyone to create a put or call for any of the trading pairs offered.

When the Options deal is created, the tokens (whichever side of the pair) are locked in the contract until the expiry, at which point a buyer of the option has the right, but not the obligation, to activate the option and execute the trade. Options not bought or activated may be cancelled by the creator and the underlying tokens are returned to their address. A buyer of an option pays a premium to the deal maker, which the maker keeps regardless of whether the option is activated or not. A commission of 0.5% of the premium is paid to yFUZN stakers, and 0.5% of any activated option is paid by both maker and taker. Deal takers can purchase all or part of an option. Each purchase must be activated independently.

Pairs

The token pairs available to trade. The numbers next to the pairs indicate the quantity of deals available for each pair.

Tabs

Browse

All shows all options for the pair chosen. Options can also be browsed by expiry date by clicking on the desired date. Options expiring on that date only will be displayed.

Call

Strike Price – The price and denom the buyer pays for the token if the option is activated. It is set by the maker.

Amount – The quantity of the token in the option available. The quantity of tokens in the option is decided by the maker on creation. The amount displayed is the amount available.

Option Price – The premium paid per token to the maker of the option by the taker. This is calculated by the platform using the Black-Scholes model. The premium is dynamic, and changes constantly once the option is created.

Expiry (UTC) – The date when the option is set to expire and can be activated.

Put

Strike Price – The price and denom the option taker sells the token for if the option is activated.

Amount – The quantity of the token in the option available. The quantity of tokens in the option is decided by the maker on creation. The amount displayed is the amount available.

Option Price – The premium paid per token to the maker of the option by the taker. This is calculated by the platform using the Black-Scholes model. The premium is dynamic, and changes constantly once the option is created.

Expiry (UTC) – The date when the option is set to expire and can be activated.

Buy Call

Buying a CALL gives the holder or buyer of this option the right to BUY the underlying asset from the creator on the Expiry date.

Strike Price – The price and denom the buyer will pay for the token if the option is activated.

Amount – The quantity of the token in the option.

Premium – The amount paid by the buyer of the CALL to the seller to hold the right to activate the option on Expiry.

Buy Put

Buying a PUT gives the holder or buyer of this option the right to SELL the underlying asset to the creator on Expiry date.

Strike Price – The price and the denom the buyer of the option will sell the token for if the option is activated.

Amount – The quantity of the token in the option.

Premium – The amount paid by the buyer of the PUT to the seller to hold the right to activate the option on Expiry.

My Options

Options a taker has purchased and is waiting to execute. Users can view calls and puts they have bought for each pair by clicking on the pair they wish to view. Options for that pair only are displayed.

Call

These are calls the user has bought. A green tick box next to a call means it is available to be activated.

Put

These are puts the user has bought. A green tick box next to a put means it is available to be activated.

Strike Price

The price per token paid by the Buyer if they choose to activate the option.

Amount

The number of tokens in the option the Buyer has committed to buying.

Option Price

The premium paid by the option buyer to the seller to hold the option.

Expiry (UTC)

The date the option expires.

Action

Options are active (shown in green) or inactive (shown in grey). Once an option has reached the expiry date, it is active, and the taker has the right, but not the obligation, to take action. The buyer has 24 hours to activate the option. If the buyer fails to exercise their right in that time, they forfeit the right and the Seller can cancel the option and retrieve their tokens. The seller retains the premium regardless of whether the option is activated or cancelled.

My Options History

A list of all Options completed by the user (using the connected address), for the chosen pair.

My Deals

The list is separated into calls and puts:

- Options marked complete have been purchased and actioned by the buyer.

- Options marked scheduled have not been activated.

- Options marked cancel can be cancelled by the user.

Ignition

Fuzion newest dApp called Ignition , is designed as another launch platform within the Kujira ecosystem to give potential projects another choice in the way they can manage their launch. It serves as a hub where capital and ideas can connect, offering a unique space for builders to raise funds for supporting their projects, protocols, dApps, and DAOs. Ignition is primarily targeted at entities looking to leverage their treasury assets to generate funding and garner community support.

This platform allows for the creation and management of “launch deals” designed to facilitate the raising of funds in a decentralised and efficient manner. Here, potential investors or supporters can engage with new projects early on, providing a foundation for future growth and development.

More information on the management of whitelists and creating the deals, with deeper explanations can be found at Fuzion Docs

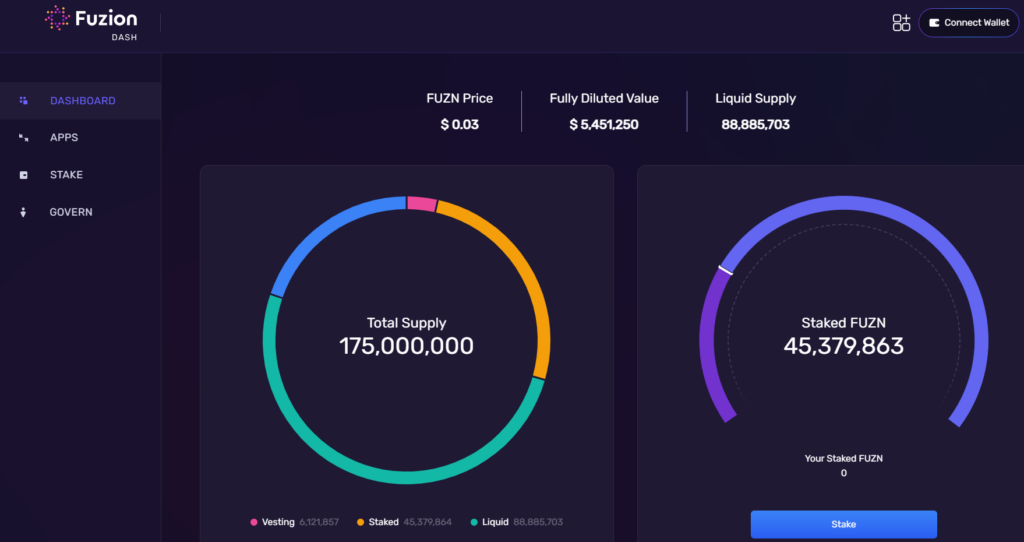

Dashboard

This is Fuzions main landing page, a dashboard where at a glance you can see the current supply and breakdown, the amount of FUZN and yFUZN staked, Stake your own tokens, link through to their other dApps as well as partake in govenrnance voting.

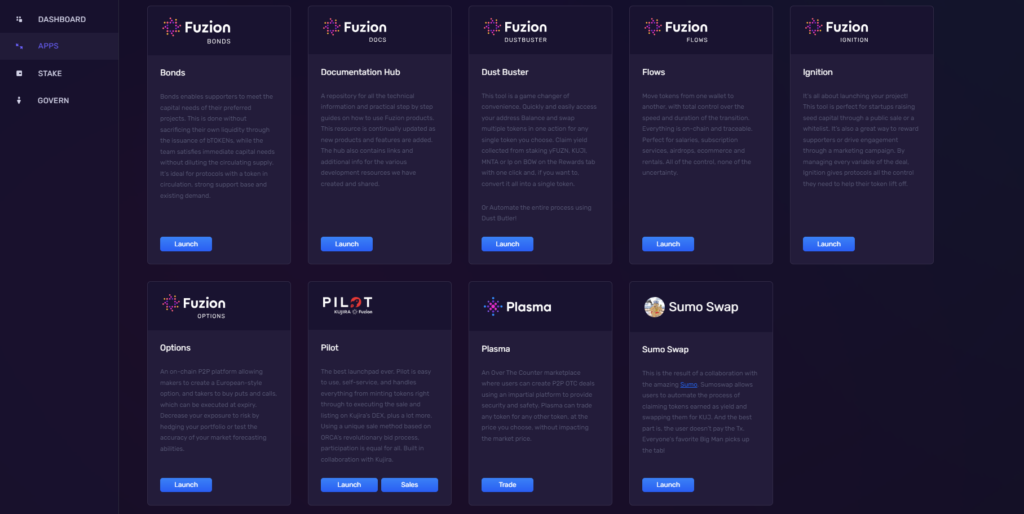

Apps

A handy tab containing quick links to all your favourite Fuzion dAPPs

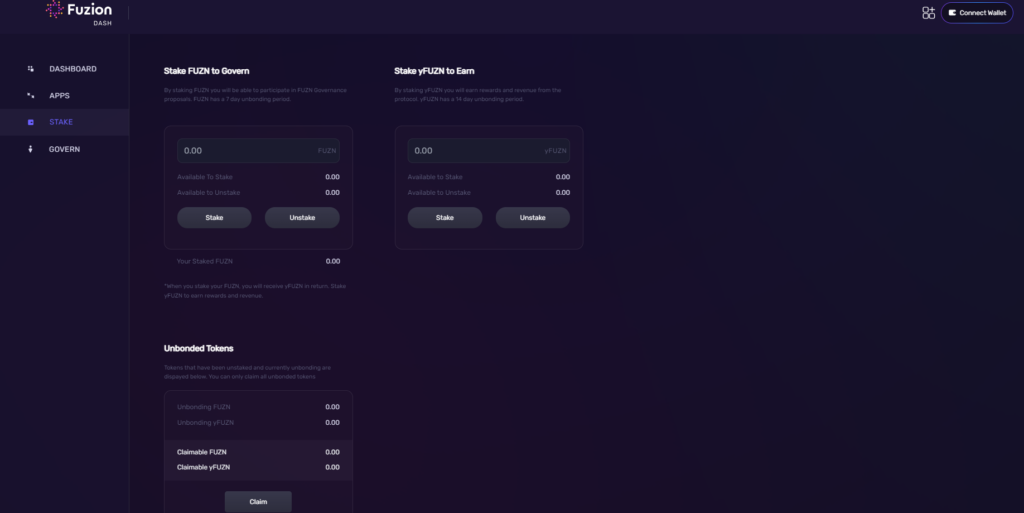

Staking

Staking is a way for a Fuzilier to partake in voting in on-chain proposals ( using staked FUZN) as well as earning all the fees generated by all the Fuzion applications ( by Staking yFUZN)

It’s a two part process:

Stake your $FUZN and you receive $yFUZN as a receipt . You now can vote in governance protocols

Stake your $yFUZN and you now can vote in governance AND receive rewards of fees earned on the Fuzion dApps

Unstaking:

21 days total if you staked your yFUZN too

FUZN 7 days unstake

yFUZN 14 days unstake

You also have the option of autocompounding your stake into even more FUZN!.

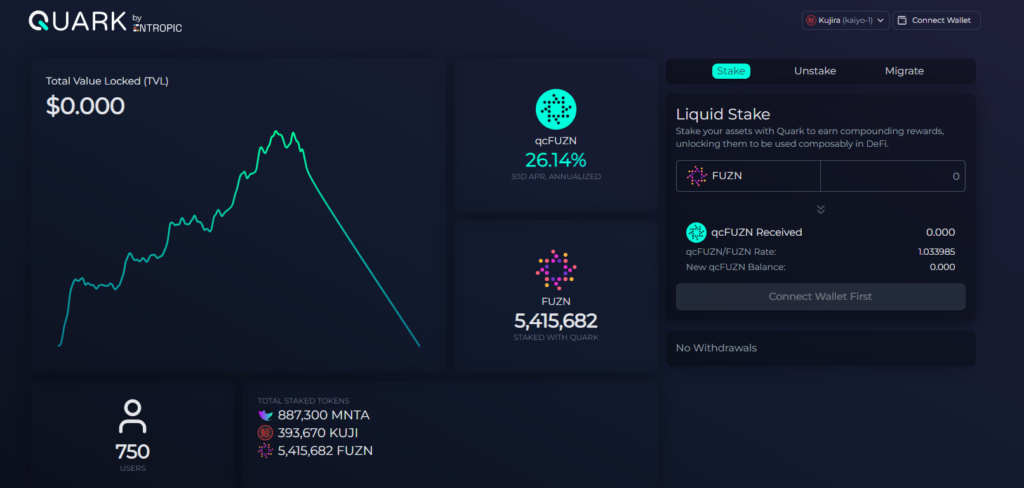

You can do this via the sexy and sleek protocol Quark by Entropic thanks to our awesome Amit.

This will take all rewards and airdpops from yFUZN holders, autosell them back into FUZN and add them to your stake so you can keep on keeping on!

Governance

The team had always envisaged a protocol where the community are at the heart of everything, and this includes decision making. On Fuzions main Dashboard site, you will find the govenrnance tab. There have been 4 public votes to date, with the latest one being the first community driven proposal and executed vote. This was to make a decision on how to proceed with the question of unmigrated tokens, as outlined here.

The Price Chat on TG as well as the Fuzion Discord serve as platforms where community members engage in discussions, propose changes, and make decisions about the protocol’s development and management. These forums are crucial for decentralised decision-making, allowing token holders to decide on proposals related to policy changes and allocation of resources. If you have successfully staked your FUZN before a vote goes live, you will be eligible to cast your vote in that proposal.

All of your staked FUZN in the wallet connected is used to cast a vote, you can’t split one wallet and have multiple votes. Quorum at the moment is set to 20% of the staked FUZN. That target needs to be met,in order for the proposal to progress after the 48 hour voting window.

Fees

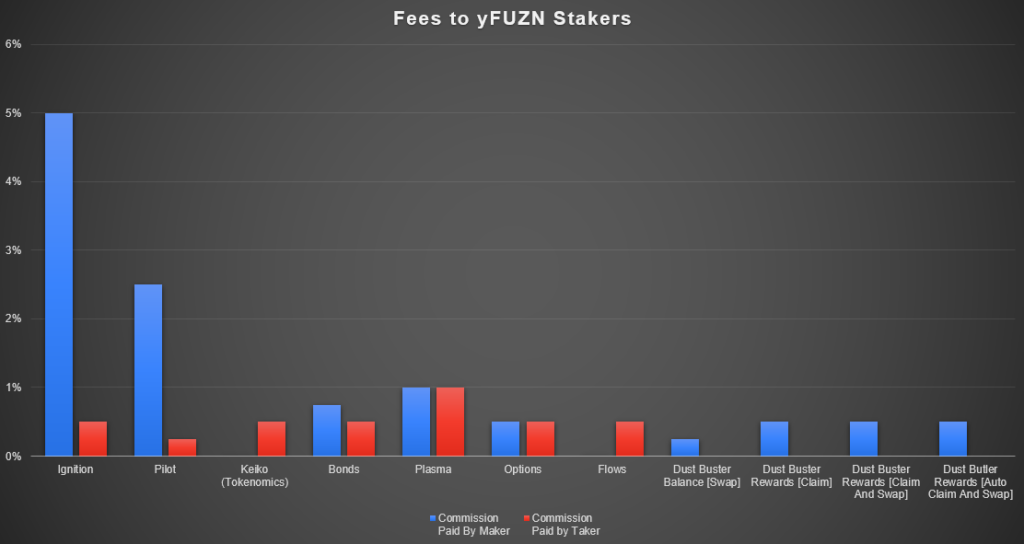

Fuzion’s approach prioritises user benefit and long-term engagement. By maintaining competitive commission rates for both makers and takers, such as those seen in their various offerings in the graph below, like Ignition, Pilot, and Plasma, Fuzion not only enhances the attractiveness of its financial products but also fosters a more equitable and sustainable trading environment. This user-centric fee policy can lead to higher transaction volumes and increased loyalty among users, thereby supporting a healthier ecosystem overall. Users have seen multiple cases of big boosts in staking rewards due to Pilot fees fees paid out on launches like NAMI. I’m sure we will see many more incoming as more projects utilise other products too , such as Ignition, in which 5% of the launch’s raise goes to stakers!

Conclusion

The brilliance of the Fuzion ecosystem can be attributed to its non-stop shipping of innovative decentralised finance features on a robust blockchain platform. By leveraging Kujira’s advanced infrastructure, Fuzion enhances user experience with efficient, secure transactions and democratised access to financial services. It always had and always will have the community at the forefront of everything it does, this makes Fuzion a forward-thinking solution, in not just Cosmos, but the whole blockchain space.

A massive thank you goes out to Dozzin for his assistance in answering all my questions to put this guide together and leveraging some of his documents found in the link below. Also to Bart and Math, for answering all my more technical queries and assisting me with carrying out the first community on-chain vote

Useful Links

- Fuzion Website

- Fuzion Documentation – Highly recommend reading through!

- Kujira Website

- Foundations of Growth