The passing of governance proposals 39 and 40 will mark the beginning of an exciting new era for Kujira — the launch of USK. Given the nature of stablecoins and their significance within crypto, it is important that you understand how USK maintains a “soft-peg” and thus what to expect upon launch. A stablecoin that is soft pegged to the dollar allows for volatility in supply and demand with the price fluctuating around $1.00 ± a few cents.

The purpose of this article is to ensure you understand how USK will maintain its peg, how you can profit from this model and price fluctuations you can expect to begin with.

Table of Contents

- Quick Recap — How to Mint USK

- What Detwrmines the Price of USK?

- How Can You Profit From This Arbitrage

- Over-Collateralization

- What to Expect When USK Launches

Quick Recap — How to Mint USK

To mint USK, users need to deposit ATOM as collateral. This means that ATOM is locked in a contract (so cannot be spent after) and in return, USK is minted. This loan must have an LTV (loan-to-value) of 60%, meaning if $100,000 worth of ATOM was deposited, up to $60,000 of USK could be minted. This is the only way in which USK can be minted, with other assets as collateral in the future.

What Determines the Price of USK?

In short, supply and demand. In the same way that USK is minted by depositing ATOM, USK is burnt when the loan is paid off and the ATOM is returned. If this mechanism was the only way in which USK can be obtained, the peg would always remain at $1.00 (since it could always be redeemed for at least $1 worth of collateral).

However, assets always end up on secondary markets. For example, Dale can buy or sell USK on an exchange at market price rather than redeeming or purchasing them from the issuer. Using basic supply and demand laws, if there is increased demand for USK trading pairs on FIN, USK will increase in price as more is bought from the axlUSDC-USK pair.

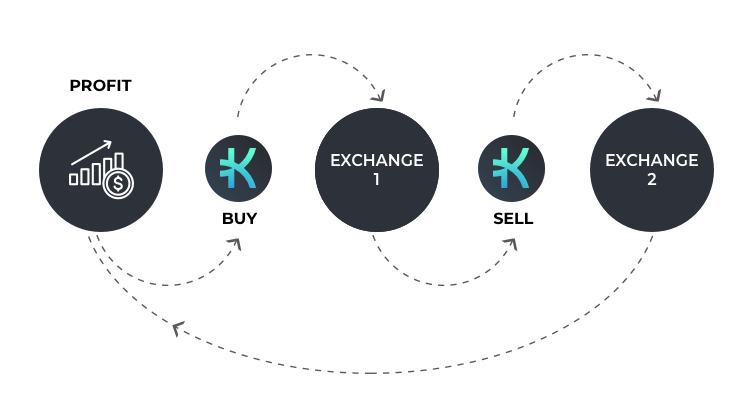

How Can You Profit From This Arbitrage

You may have heard of arbitrage before — the process of simultaneously purchasing and selling an identical asset in two separate markets. This method is used by profit-taking market participants that take advantage of the deviations in price around $1.00 for stablecoins. But how does it work?

IF THE PRICE OF USK > $1.00

Let’s say the demand for USK rises, causing the price of USK to increase to $1.03. If you were to buy $100 worth of ATOM and deposit it as collateral, you could mint up to 60 USK. However since USK is now $1.03, you borrow $1.03 worth of USK for every $1.00 of ATOM you deposit. You may now swap USK for axlUSDC for 3% profit

IF THE PRICE OF $USK < $1.00

Let’s say USK drops in price to 97c. In the axlUSDC-USK pair, the price of USK will be 3% lower than the price of axlUSDC, even though both are pegged to $1.00. An arbitrager can take advantage of this by buying USK on this pair, yielding them 3% more USK for every axlUSDC. Remember, in theory both these assets should be the same price — $1.00.

With 3% more USK now in the wallet, the arbitrager can do two things:

- Wait for USK to return back to $1.00 and sell for 3% profit.

- Pay back the loan on Kujira, receiving ATOM at a rate of 1 USK = $1.00 ATOM. Remember USK is still worth 97c at this point. The user can then sell ATOM on the open market to lock in the 3% profit.

These two profit-making methods contribute significantly to the stablecoins peg, providing opportunities for yield each time the price deviates from $1.00. If you have faith in the underlying mechanism that USK uses (one that is nearly identical to DAI’s), deviations from the peg should be seen as profit-making opportunities and not reasons to be fearful

Over-Collateralization

As we have mentioned, loans need to be over-collateralized by 67% in order to mint USK. This is a deliberate safety mechanism that ensures USK is backed by real value in the form of cryptocurrencies. To begin with, only ATOM will be used as collateral — a token that has demonstrated its resilience time after time. Ensuring that loans are over-collateralized by 67% means that an extreme drop in price is required for USK to no longer be backed 1:1 in dollar value.

Collateralization ratio = collateral value (ATOM) / debt (minted USK)

Min collateral ratio = Collateral / maximum debt = 1 / maximum LTV

“The greater the amount of collateral, the more these cryptos would have to fall in value before a stablecoin loses parity.”

We prevent the value of the reserves from ever coming close to a 1:1 ratio to the issuance of USK using liquidations on ORCA. Once loans have an LTV of higher than 60%, the loan is liquidated using USK community deposits in ORCA. The USK is then burnt and the ATOM locked as collateral is sent to community bidders on ORCA at a discount/premium to market price. This means that as the price of ATOM falls, liquidators provide USK to pay off bad loans, ensuring that the value of USK supply never exceeds the value of deposited collateral. As a result, USK can always be redeemed for $1 worth of collateral.

ORCA is a tried and tested model, liquidating approximately $250m in capital on Terra Classic. Users are incentivised to deposit USK in ORCA to purchase ATOM at a premium to market price, ensuring the money market remains solvent at all times.

What to Expect When USK Launches

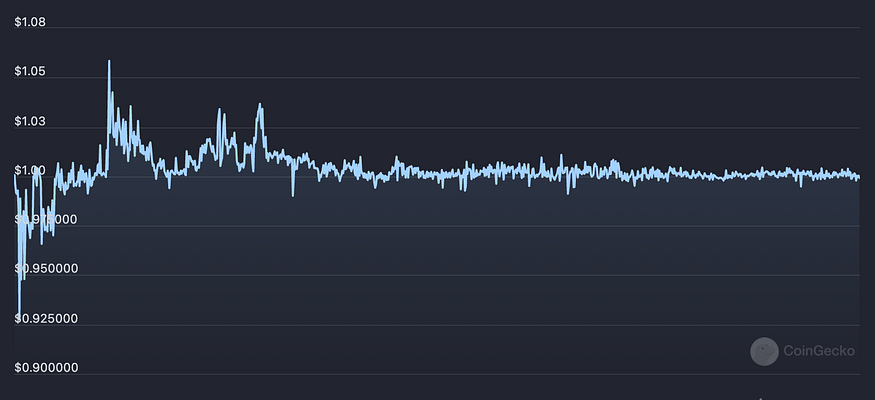

Since $USK is modelled off the DAI mechanism, it is safe to assume that the launch of USK may follow a similar trajectory. DAI was released in November of 2019, so it is worth pointing out the difference in market conditions. However, as it takes time for arbitragers to write bots and profit-makers to deploy capital, the price may well be more volatile to begin with until these conditions are established. Take a look at DAI’s price chart upon launch:

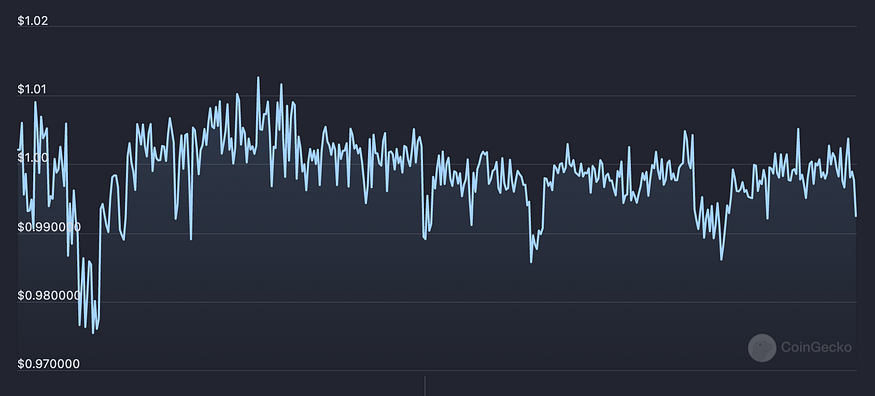

As you can see, the price fluctuates between $1.01 and 93c until users took advantage of the arb opportunities available to them. To use another example, here is the launch of MIM:

The point of this explanation is simple — the mechanism that underpins the USK peg is designed to create incentives for users to restore the peg. Do not be alarmed if USK is volatile during the first few weeks of being live — this is temporary until the arb bots have been put in place and demand stabilizes.

Written by Kuji Peruggi