Terra’s first decentralized, permissionless, 100% on-chain, order book style token exchange. Compatible with all CosmWasm blockchains. Start trading on FIN here.

Table of Contents

The Basics

Sellers, arbitrage bots, and market makers provide the liquidity for the market, not partisan farmers. With FIN, there is no need for inflationary token incentives. This makes it more capital efficient, and farmers can deploy their capital elsewhere. Think Kucoin, but 100% decentralized and on-chain.

There’s no reliance on bots to execute trades, and no need for additional fees to incentivize them. In short, it’s much cheaper, there’s no risk of a trade being missed, and it leaves no opportunity for bias in which trades bots choose to execute.

So what’s in it for protocols? Well, a whole lot, actually. You now have no need at all for a liquidity pool, which brings about three huge benefits:

- You don’t need to give away millions of printed / inflationary tokens just to keep people in a LP.

- Your community faces no risk of impermanent loss just for trying to support your project.

- You can reallocate your protocol owned liquidity to something more productive.

And last but not least, forget about the first in first out model. All orders on FIN are executed instantly and fairly. Try it here now.

How does it work?

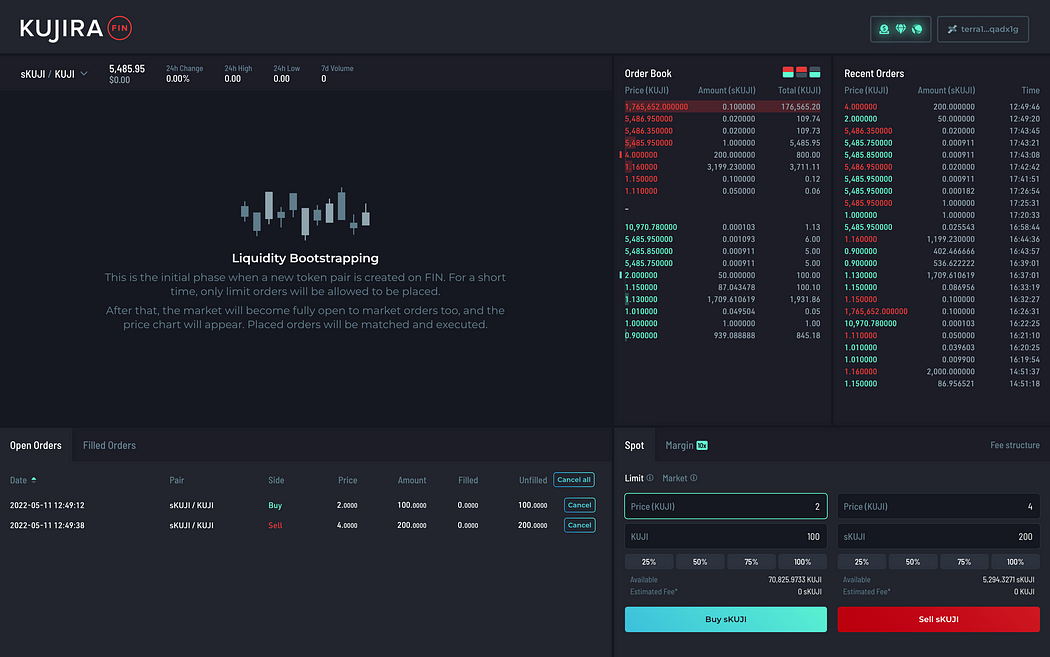

- Bootstrapping phase

This is the initial phase when a new token pair is created on FIN. For a short time, only limit orders will be allowed to be placed. After that, the market will become fully open to market orders too, and the price chart will appear. Placed orders will be matched and executed. - Full trading mode

Once the pair comes out of the bootstrapping phase, you will be free to trade much like on any CEX such as Kucoin for e.g., where you can place market and limit orders at will. - The UI

The UI should feel like a CEX, where you can see all open and filled orders, and place buy and sell orders easily. If you need any help on the dApp, please chat to us on our Telegram group here.

FAQ

- Is this a fork of Miaw or similar?

No, FIN is written from scratch by Kujira, all trading activity is 100% on-chain, and is a completely novel approach to building a DEX. You will be able to note that our contract TX history with no external msgs (ie: nothing calling execute_order) - Who provides the liquidity for FIN trading pairs?

Sellers, arbitrage bots, and market makers provide the liquidity for the market, not partisan farmers. This means there is no need for inflationary token incentives. This makes it more capital efficient, and farmers can deploy their capital elsewhere. Think Kucoin, but 100% decentralised and on-chain. - Is there really no slippage?

Not in the traditional sense, as there is no liquidity being added or removed in a trade on FIN. It works the same as a market buy / sell on a CEX. - Why is the fact that FIN is 100% on-chain & bot free important?

There’s no reliance on bots to execute trades, and no need for additional fees to incentivise them. In short, it’s cheaper and there’s no risk of a trade being missed, and leaves no opportunity for bias in which trades they execute. - Why is the bootstrapping phase necessary?

This is to make sure that there is sufficient liquidity on the pair for market orders. - Is the execution of orders on FIN done first in first out (FIFO)?

No, one of the biggest advantages with FIN is that it’s instant and fair execution. Currently all DEXs on Terra that support limit orders are run purely based on whoever the bots choose to select, and don’t support partial fills (FIN however, does). - Can FIN easily go cross-chain?

Absolutely. FIN already integrates with all CosmWASM blockchains, and development has already begun for chain compatibility outside of Cosmos. - What are the fees and what happens to that revenue?

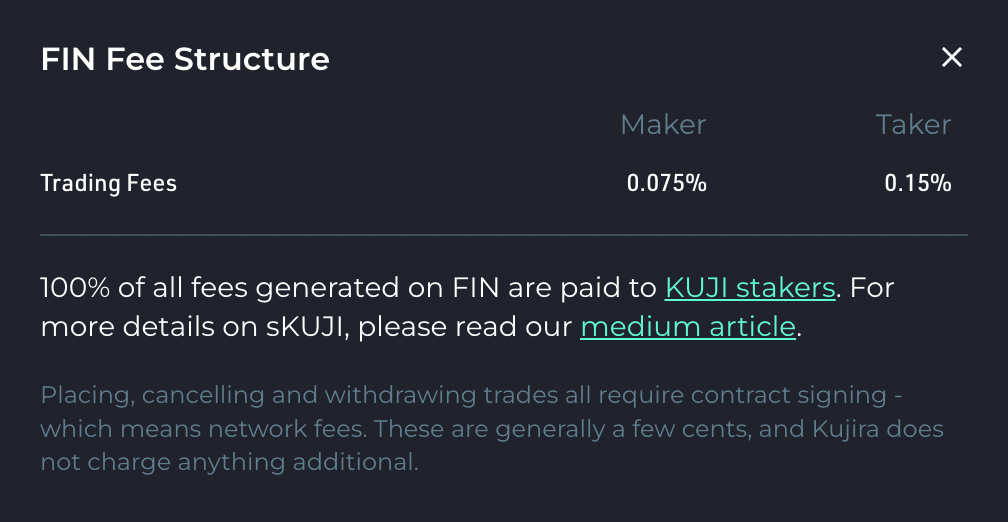

The platform taker fee is 0.15%, a 50% saving vs other Terra DEXs. The maker fee is 0.075%. ALL of this revenue goes back to sKUJI holders.