Table of Contents

- Perpetual Swaps Trading Announcement

- Orca live, Seashanty Telegram Alerts

- CALC Funding Milestone 2

- Kujira Now Supported on Coinhall

- Black Whale Audit Returned

- USK Accepted on WooCommerce

- Kado X Kujira Details

- Stats for the Week

“From one Kujiran to another”

Hello, and welcome to our 3rd edition of “Weekly Roundup”. These short updates aim to summarize all Kujira-related events in the last week, keeping you up-to-date and informed. I’d like to emphasize to all our readers and fellow Kujirans: please let us know if you’re working on something awesome. We want to highlight and include it in our weekly roundup. Simply fill out this Google form and I will make sure to review it along with the rest of the team.

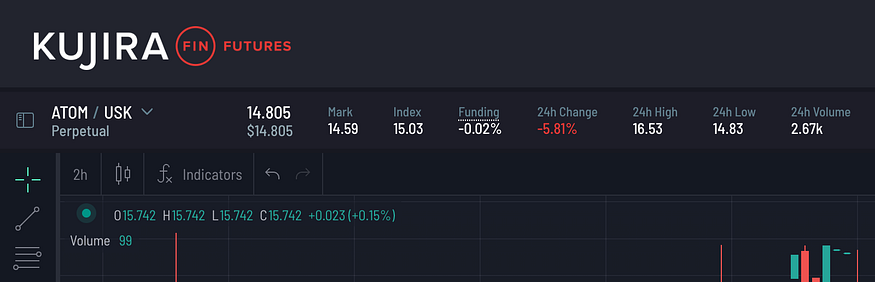

Perpetual Swaps Trading Announcement

In a recent announcement by the team, Perpetual Futures (Perps) will be coming soon to FIN. Perps allow you to place leveraged long/short orders to take advantage of the volatility in crypto, multiplying profits (and losses!). This will include both spot and margin positions, with the ability to set limit orders too.

Since this is integrated with FIN, perps should bring in lots more liquidity to the orderbook, as well as revenue to KUJI stakers through the generation of fees. This also avoids issues that integrating with AMMs gives rise to, such as paying liquidity providers and the recent exploit on GMX.

ORCA Live, Seashanty Telegram Alerts

With the return of ORCA, users can now bid on liquidated ATOM at a discount. This can make for an excellent DCA (Dollar Cost Average) strategy as you can purchase liquidated collateral as the market moves down and loans come under risk.

To make this experience even easier, Capybara Labs (a Kujira validator) have enabled Telegram notifications that track your ATOM-USK liquidation bids and inform you when they have been filled. Thanks guys! To participate, join their Telegram group here.

CALC Funding Milestone 2

The passing of governance proposal 42 sees CALC Finance successfully funding the next phase of its development. Upon completion of milestone 2, the CALC team has successfully deployed v0.1.0 of the DCA smart contracts to the Harpoon-4 testnet.

To learn more about what CALC has achieved so far, and what is to come in the future, read their medium article.

Kujira Now Supported On Coinhall

Coinhall (a DEX aggregator, price charts, and analytics provider) have now integrated with Kujira to provide real-time price charts and analytics. In the future, Coinhall aims to provide market swaps directly from their website by leveraging FIN in the back-end, providing a one-stop experience for all things $KUJI related. You can find this information on their website here.

Black Whale Audit Returned

In last week’s Weekly Roundup, I announced that Black Whale had sent their smart contracts off to SCV Security to have them audited. The audit is now complete and feedback has been sent back to the team to improve the security and efficiency of the smart contracts.

The team scored very well in the 4 sections (Provided documentation, code coverage test, code readability, and code complexity), resulting in very few steps left for mainnet launch — the team have an ETA of the end of this week. We look forward to seeing the first deposits made into the vaults!

USK accepted on WooCommerce

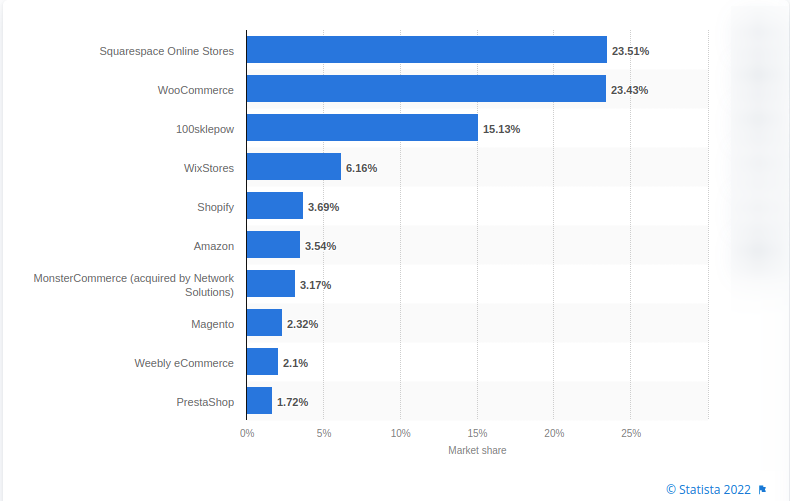

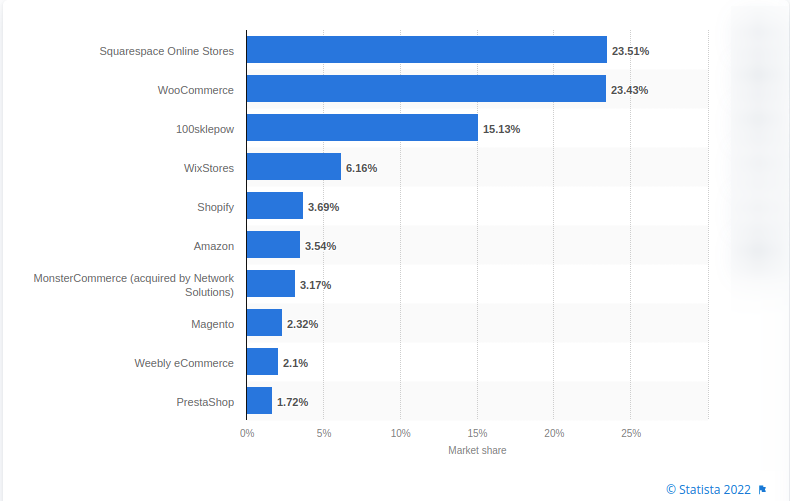

WooCommerce is an extension built on top of WordPress that allows you to turn a website into an e-commerce store. Now that the USK smart contracts have been deployed, our new stablecoin is accepted as a form of payment for products on eCommerce websites.

Kohola, a Kujira validator, has already integrated USK with their eCommerce store, bringing real-life use-case to our stablecoin in its first week of inception. We strongly believe in creating demand for USK before inflating the supply, so keep your eyes peeled for more integrations soon.

As shown in this graphic, WooCommerce owns 30% of the current eCommerce market share worldwide, highlighting how large of a market we are integrating with.

More Kado X Kujira details

This week, Kado have released more information regarding their collaboration with Kujira for a fiat on-ramp. In this tweet, the Kado team teased a direct fiat on-ramp integration with ORCA, allowing you to easily cue up fiat into the liquidation books.

The launch of Kado on Kujira is imminent, allowing for USD <> USK in just a few clicks to easily invest in trading pairs on FIN. This avoids the risks of bridging assets and using exchanges to cash out: win-win!

Some Stats for the Week

Once again, brought to you by valued community member Eskers:

- KUJI entered the top 200 coins on CoinGecko by Market Cap for the first time, just 11 weeks after launch.

- Additional 1m KUJI staked last week, with an additional 700 unique stakers (an increase of 10% this week).

- Kujira POD increases the Nakamoto coefficient for the network to 8, making Kujira the 5th most decentralized IBC protocol.

- Over 65,000 followers on Twitter.

- 200,000 USK has been minted.

- 560 ATOM liquidated at an average price of $14.36, with ATOM soaring to $17 over the weekend (+18%).

That’s it for this week! Again, please let us know if you have something to contribute! A link to the form can be found here, and we want to hear from you.

Written by Kuji Peruggi