Table of Contents

- Senate Election

- gPAXG as Collateral to Mint

- Gravity Bridge Proposal

- Terra Station Wallet Integration

- New Trading Pairs on FIN

- Validator Voices – Starsquid

- Bfit Updates

- Sorting BOW LPs

- Kujirans Lucky Reels

- Kuji Kast Corner

- Logical Graphs Strategies

- Useful Links

- Closing Thoughts

Gm Kujirans! What a week this has been for fans of governance… A grand total of 40 governance proposals have been posted in the last 7 days, indicating two things:

- We have an incredibly active community that participates in shaping the future of their own blockchain.

- We need a bulk vote button.

Major highlights for the week were the instantiation of our first 9 Senate members, and victory for Arsenal at the Emirates against a smaller club in England. I’ll leave you to decide which was more important.

Without further ado, let’s get into this week’s episode. As always, these articles summarize all Kujira-related news over the last 7 days, keeping you up-to-date and informed.

Written by KPeruggi

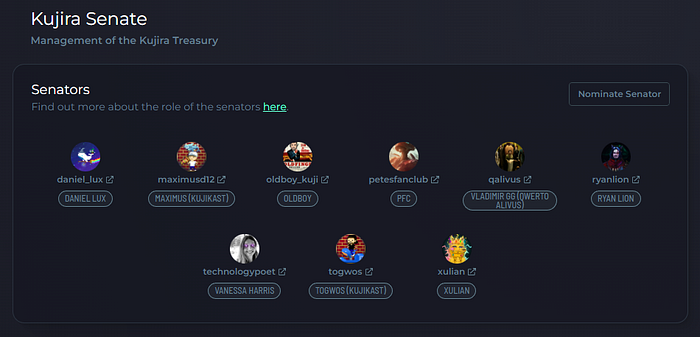

The Senate Election

After weeks of lobbying and scuffed Telegram conversations, the community finally elected the first 9 members of The Senate. The winning applicants are:

- Daniel Lux

- Maximus (KujiKast)

- OldBoy

- PFC Validator

- Vanessa Harris

- Vladimir GG

- RyanLion

- Togwos/Danny (KujiKast)

- Xulian

Congratulations to everyone on this list, and commiserations to those that just missed out. But remember, members can be removed and added at any time in the future, so please don’t give up! We look forward to welcoming The Senate formally during a Twitter Spaces hosted by the core team, and we are excited to see what this talented group produces.

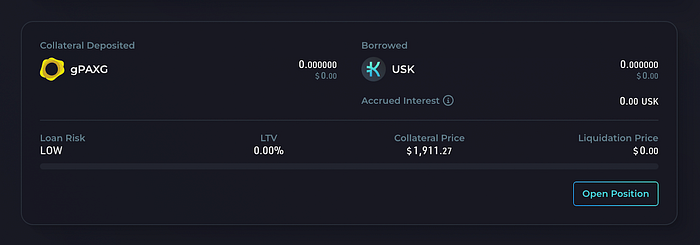

gPAXG AS COLLATERAL FOR USK

gPAXG is the gravity bridge derivative for PAXG, a digital token backed by physical gold. By allowing PAXG as collateral for USK, we can back USK with physical gold instead of more volatile assets, providing a low-risk collateral option. The price of PAXG is also not correlated to the cryptocurrency market, making it incredibly useful capital as a backstop for ORCA.

For example, if the crypto markets begin to crash, users can mint USK using a collateral type that isn’t also crashing in price. This USK can then be placed in the 30% premium pool to profit massively from liquidations. Since the passing of proposal 203, and the listing of gPAXG — axlUSDC / gPAXG — USK trading pairs on FIN, deposits are now open.

Huge thank you to Mike at A10 Capital for spearheading this operation and putting up the proposals himself — another example of a community member shaping the future of Kujira.

Gravity Bridge Proposals

This week, 3 important governance proposals were discussed and accepted on Gravity Bridge. The Gravity Bridge now allows $KUJI and $USK to be bridged and used on Ethereum and any layer 2s such as Arbitrum and Optimism. Layer 2s have seen a large increase in TVL recently, with nearly $2b shared between the two, so getting exposure to this capital is a massive bonus. Not only does this advertise our tokens on other exchanges, it also allows them to be used in applications and protocols on the network, providing further use case for $KUJI.

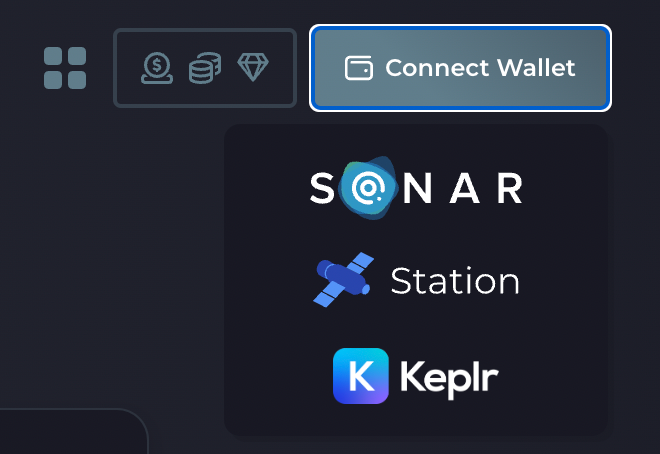

Terra Station Wallet Integration

Following the successful launch of the Terra Station wallet, we have integrated this feature throughout our products. A wallet-agnostic ecosystem helps to onboard liquidity from all communities and allows users to select their preferred wallet for a better UX. Simply click “Connect Wallet”, select the Station logo and approve the connection in the Terra Station popup.

New Trading Pairs on FIN

As there are just so many, I’m going to simply list them with a link to trade them on FIN if possible…

- ampLUNA — LUNA

- wFTM — USK

- DAI — USK

- stATOM — ATOM

- CMST — USK

- wAVAX — USK

- wBTC — USK

- wBTC — axlUSDC

- CMDX — USK

- gPAXG — USK

Pretty insane right? Remember, these governance proposals are put up by community members, so it’s interesting to see what there is demand for. BOW pools have been instantiated for some of these trading pairs too, so there is scope for community initiatives to find external incentives 😉 The team is working on a few ourselves currently, so look out for some major collaborations soon!

Validator Voices: Starsquid

Over the last few weeks, a significant amount of work has gone into fine-tuning and perfecting our price oracle. To understand more about this process, and the valuable work our validators do behind the scenes, I spoke with Starsquid to hear his thoughts:

Currently, I’m working on the internals of the oracle and trying to get the reported prices as accurate and fresh as possible. The current implementation uses a time-weighted average function, which makes the price always lag behind the “real” price reported by the sources (currently centralized exchanges and osmosis as only dex). This average also evens out peaks.

The idea is to use a volume-based average only, like chainlink doing. That and the addition of a bunch of additional exchanges (Bitfinex, Bitforex, Bybit, HitBTC, Kucoin, LBank, Phemex, Poloniex)

On testnet, we are currently stress-testing how many prices the oracle can support in parallel before pushing this to mainnet. We are also looking at how to gather the prices of assets that are trickier to integrate, such as liquid staked derivatives (more on this in next week’s episode of the Roundup!).

Starsquid also cites the fantastic work of other validators and community members that have provided support to this work, which really highlights the cohesiveness and collaboration present between our validators.

Bfit Updates from Fitlink

This week saw the introduction of the “Founders Club” — a community token sale with the aim of getting early adopters on board for beta testing and goodies while allowing Fitlink to raise some funds. Be sure to apply yourself by clicking this link and taking a very short survey.

The beta launch is creeping closer, with smart contracts on testnet and a fully functioning app waiting to be deployed. The long list of beta testers are eagerly awaiting the news, with an estimated launch in the next 2 weeks. Beta testers can expect to earn some rewards such as FitBits, Apple Gift Cards, merch, etc so if you have applied make sure to participate!

Finally, the team are offering an opportunity to become an ambassador for BFIT and earn 500 $BFIT. To earn this title, you must create a short thread about BFIT on Twitter, invite people to the BFIT Founders Club in the tweet, and tag @TeamKujira. Winners will be chosen based on creativity and engagement on the posts, with a deadline set at 6pm GMT on the 27th of January. Good luck friends!

Sorting BOW LPs

As Kujira grows and more trading pairs are added, new pain points and complexities will arise. The community expressed the need for a sorting system for BOW trading pairs, and we have duly delivered! You may now sort BOW LPs by:

- Trading Pair

- TVL

- APR

Navigate to the BOW UI and experiment with this yourself! If there are every Quality of Life (QoL) fixes you would like to see on Kujira, please make your voice heard and we will see what can be done.

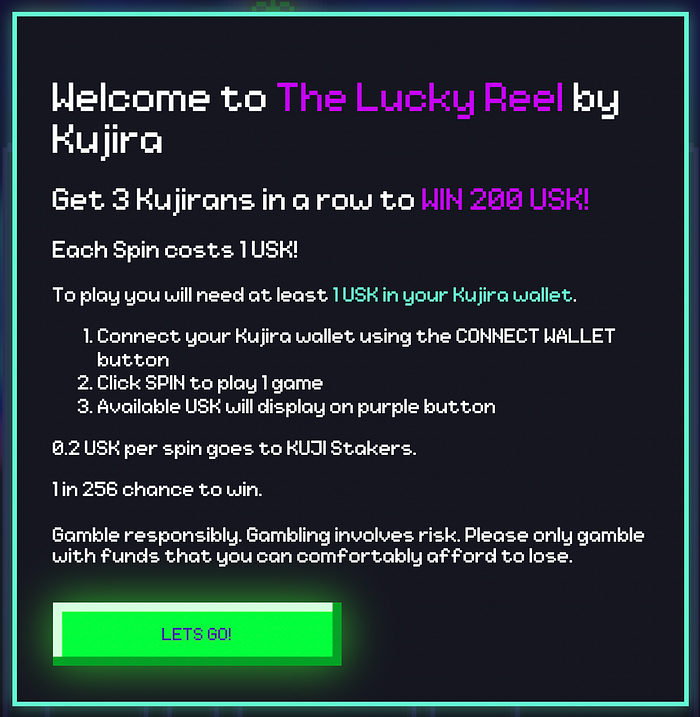

Kujirans Lucky Reel

For all the gamblooors out there, Kujirans have your newest fix — The Lucky Reel. This is a simple slot machine game where each spin costs 1 USK, and you need 3 Kujirans in a row to win 200 USK. The Lucky Reel was deployed using Entropic Lab’s on-chain, verifiable randomness to ensure transparency. There is a 1/256 chance to win, with 0.2 USK from each spin funneled to KUJI stakers. Good luck, and may the odds be ever in your favor.

Recall a few weeks ago when I said 1.8m $STARS are being sent to KUJI stakers? The time is nigh. Check your staking rewards today to see for yourself! Game development is still well underway, and when I convince Velcro to tease something you’ll be the first to see it (after me).

Kuji Kast Corner

You already know how this works — expect drama, expect violence, expect lunacy: Here’s Danny!

Hey gang.

Is love real? Or is it just another trick? Do you think you could ever love me?

I love Kujira. And you. You reading this right now. I care about you.

We just did a live show with Vanessa & had a lot of fun. I think we’re gonna start doing a lot more live stuff. Maybe a consistent live show. Also a lot more sketches & random comedy stuff alongside all the usual.

Sometimes you’ve gotta change things up a bit. You can’t just do the same thing over & over. If you’re hungry & I keep giving you crackers what’s gonna happen? Your mouth’s gonna get dry. And I don’t want that.

The future is looking bright. Super bright. So much has happened & so much is on the way. This community is going to the moon. And if I have to smash into Uranus on the way that’s fine.

Also, Max says hi.

You can listen to their live show with Vanessa by clicking the hyperlink provided.

PS: I’d smash Uranus for Kujira.

Logical Graphs: Strategies to Profit on FIN

The ATOM arbitrage

The orderbooks on FIN provide opportunities for arbitrage 24/7. In this week’s episode, LogicalGraphs goes through a strategy that takes advantage of the difference in ATOM price between USK and axlUSDC trading pairs.

- Monitor the dollar value of ATOM of the two pairs: ATOM — USK and ATOM — axlUSDC.

- Let’s say ATOM — axlUSDC is trading at $13, but ATOM — USK is trading at $12.50. In this scenario, you would set limit buy orders beneath $12.50 on ATOM — USK and wait for them to fill

- Once filled, you then either market sell on the ATOM — axlUSDC pair, or you take the higher risk and set a limit sell order slightly above to increase your profits.

- Setting a limit buy lower on one pair, and a limit sell higher on the other takes advantage of the difference in price *and* increases your profits slightly, while providing liquidity to the orderbook on FIN.

Useful Links and Stats

- DeFi Llama reports a TVL of $7m on Kujira, #64 ranked blockchain by TVL

- $1,000,000 USK minted

- #1 on-ramp integration by volume on KADO

- Cosmos Club spaces with Kujira, Sommelier, and QuasarFi

Closing Thoughts

Another wild, eventful week in the life of a Kujiran. As you can see, the building just doesn’t stop — at some point we’ll need a mid-week Roundup too… I’m glad everybody is still reading and enjoying these articles, and it’s fantastic to see more people contribute each week. A final congratulations to the new Senate members, I’ll be sure to stay in touch with them and convey their thoughts in future Roundups. Thanks again guys, much love for the support. Ciao!