Bitcoin was created in 2009, just months after the Great Recession, with one goal in mind — decentralization. Through the hardship of economic fallout, it became obvious that a central entity controlling the monetary policy and decision-making of an entire population is a flawed system. Enter decentralized networks — one in which anybody can participate indiscriminately with all transactions described on the public ledger permanently. However, with the advent of Proof-Of-Stake consensus mechanisms, the issue of centralization has wriggled its way back into the world of cryptocurrency. By staking assets with validators, users can participate in governance to determine the future of the network by voting on proposals submitted by the community. Yet this comes with a major risk — what happens if a set of validators collude to own the majority of voting power?

Table of Contents

- Nakamoto Coefficient

- What is Kujira’s Nakamoto Coefficient

- Calculating the Nakamoto Coefficient

- Risks of a low Nakamoto Coefficient

- Delegating to validators outside of the largest 5

- Spreading delegations over many validators

- What is slashing?

- What does this mean for you?

- New user interface for staking

- Conclusion

Nakamoto Coefficient

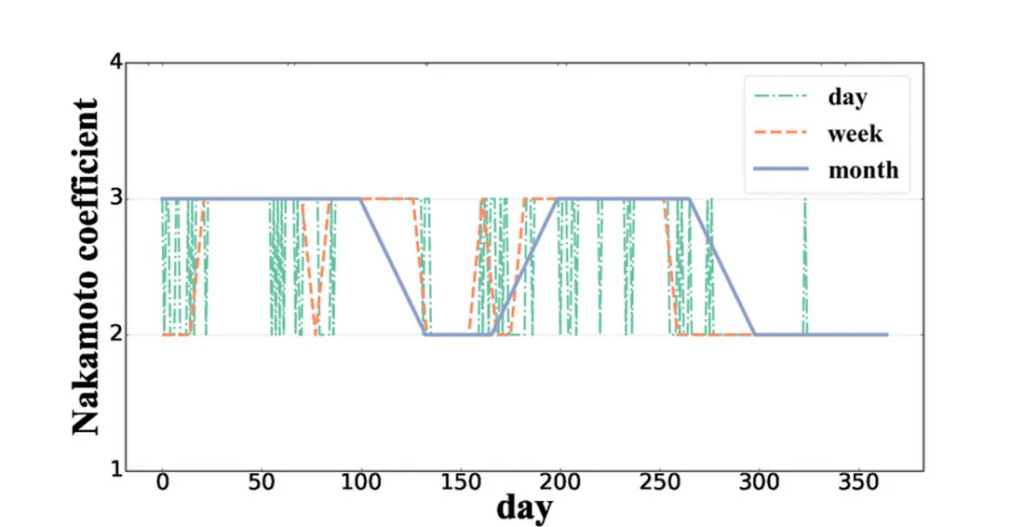

To measure the decentralization of a blockchain network, the Nakamoto Coefficient was created. This coefficient represents the minimum number of nodes (validators) required to disrupt the blockchain’s network, with a higher number representing a more decentralized ecosystem.

What is Kujira’s Nakamoto Coefficient

Kujira has a Nakamoto Coefficient of 5, but what does this mean?

The Kujira network is built on top of the Tendermint consensus mechanism that underpins all of Cosmos. As a Tendermint blockchain, a “super-majority” of the validator set is required to come to a consensus before new blocks are created. Let’s break this down:

Super-majority — a term meaning over ⅔ of the validator set

Consensus — An automated process to ensure only a single valid copy of recorded transactions is shared between all nodes on the network.

Calculating the Nakamoto Coefficient

If ⅔ (67%) of the validator set cannot come to consensus, the network will halt momentarily to allow for a super-majority to form again. Therefore, if over 33% of the active validator set goes down, the Kujira blockchain will be halted. For this reason, the Nakamoto Coefficient is calculated as the minimum number of nodes that contain over 33% of the voting power in the active set, which is currently calculated to be 5.

Comparatively, this ranks low relative to many of the other major blockchains secured through PoS. For example, Avalanche achieved a coefficient of 28 while Cosmos has a more modest 7. The fact that Kujira’s Nakamoto Coefficient is this low comes with a few risks.

Risks of a low Nakamoto Coefficient

Should the top 5 validators collude and switch off their nodes at the same time, the Kujira blockchain will come to a halt. Without a super-majority of the active validator set coming to consensus, no new blocks can be created on the blockchain and all activity will be paused until they come back online again. As interest is timestamp-based on Kujira, in the event of network downtime interest on collateral debt positions will continue to accrue. Thus, halting has clear implications when services such as margin-trading and borrowing/lending are deployed on Kujira. Even USK relies on overcollateralized debt positions! It is in the best interest of every Kujira user to reduce this risk, so what can be done?

Delegating to validators outside of the largest 5

As stated above, the top 5 validators on Kujira collectively have halting power for the network. By delegating or redelegating to smaller validators outside of the top 5, especially those with less voting power, the network becomes more decentralized and the Nakamoto coefficient increases. The goal is to avoid dominance by a minority of actors. If every validator had an equal amount of delegations to them, the Nakamoto coefficient would rise dramatically to 70, meaning every validator in the active set would have to collude to halt the network. Difficult, right?

Spreading delegations over many validators

Whilst this has the same benefits as explained above, spreading your delegations reduces your exposure to the risks of “validator slashing”.

What is slashing?

Slashing is a mechanism used by PoS protocols as an incentive to discourage harmful behaviours and make validators more responsible. It refers to a penalty given to validators that engage in two harmful behaviours:

- Down-time: A validator’s absence from signing operations on a blockchain for a period of time. This can be caused by the node’s infrastructure becoming offline or the node being out of sync with the rest of the chain.

- Double-signing: When a validator submits two signed messages for the same block

The penalty received by the validator for these two actions is different according to their severity. For poor down-time/missing blocks, the penalty is set to 0.01%, whereas double-signing is set to 5%.

What does this mean for you?

If you are delegated to a validator that is slashed, your staked assets will incur the same penalty. For example, if you have 10,000 KUJI staked with a validator that misses too many blocks (i.e. over 95% of blocks in a 18000 block window) you will incur a penalty of 0.01% (and so lose 1 KUJI).

Thus, diversifying your delegations by spreading them over many different validators reduces this risk dramatically, while also promoting a decentralized network that is more resistant to coordinated attacks.

New user interface for staking

As part of our commitment to promote network decentralization, we are introducing a new staking user interface. With this UI, prospective delegators can very clearly see any validators that have been slashed already for these behaviors. Another important piece of information displayed is the “Equal Power Threshold”.

The “Equal Power Threshold” is calculated as total stake divided by the number of active set validators. For example, on testnet there are 20 active validators, so in a uniformly distributed and perfectly decentralized network, each validator would have exactly 5% of total network voting power as displayed above.

At the moment, on MainNet based on the current total amount of staked KUJI and number of active set validators, the equal power threshold would be approximately 1.33%. This number varies with the total amount of staked KUJI and the size of the active validator set.

Our new staking UI clearly displays how individual validator voting power stacks up against the uniformly equal voting power that is often characteristic of an optimally decentralized Proof of Stake network setup.

Conclusion

Decentralized networks are not built in a day. Bitcoin has grown and evolved over the past 13 years on its road to mainstream adoption. Even Ethereum–one of the earliest mainstream DeFi networks–faces new challenges every day ranging from OFAC compliant forks to centralized (validator) network providers to centralized coins to oversized liquid staking providers.

At Kujira, we want to put the power in the hands of the people rather than concentrate it in the hands of a few whales. This is a process that will require persistent community effort–there is no easy road to the finish line. That is why we want to spread awareness of the importance of network decentralization to ensure that we keep moving towards that goal.

We hope that this new staking UI rouses a new round of community discussion around the importance of network decentralization. Let us all do our part to spread out our delegations to better secure the network and build Grown Up DeFi together step by step.