Over 1000 Kujirans have decided the ticker of the Kujira Index

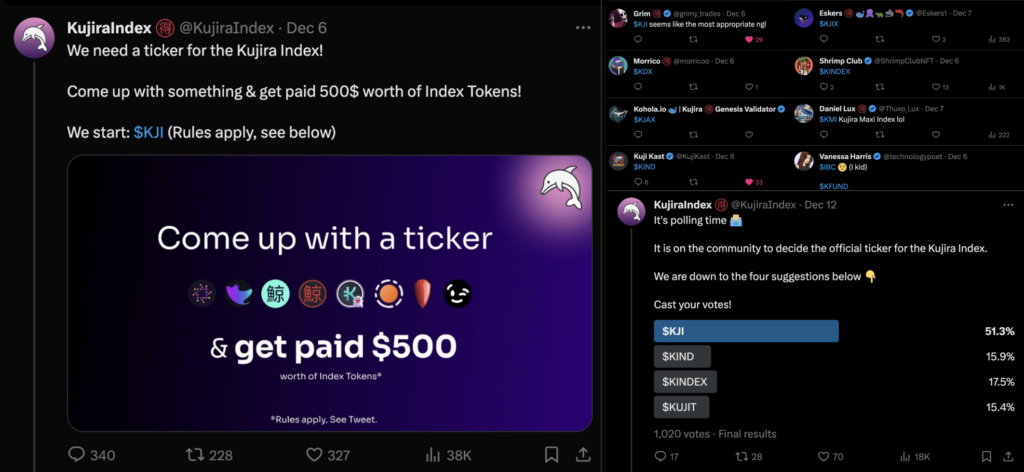

On our Twitter/X, the Kujira community has decided the ticker for the Kujira Index in a two stage naming process. In stage 1, 300 users submitted over 200 unique ticker suggestions. Then, in stage 2, over 1000 Kujirans decided on the ticker via a poll of the 4 finalists. Besides that, there were $500 worth of index tokens on the line, won by no other than ShrimpClubNFT.

The result: the official ticker for the Kujira Index is $KJI.

(Please note that the contest is over and the ticker has been decided)

It’s thrilling to see the turnout of the naming contest. It marks the first of many community involvements in the protocol. We have a community-first mindset and want to be as close to the users as possible. This is especially true as we are building a product that aims to help onboard more folks into the Kujira ecosystem.

Now that the naming is out of the way, we are proudly presenting the logo of KJI. This branding refers to the product “The Kujira Index”, the first index we will launch on the protocol. The dolphin will continue to be the branding of the protocol as a whole.

The Kujira Index – Recap

As outlined in our first announcement, the Kujira Index ($KJI) is going to be an asset index tracking the broader Kujira ecosystem and will mark the first index product of the protocol. It simplifies exposure to Kujira as a whole without having to individually pick and choose which assets to invest in.

The assets to include in the index will be weighted by different metrics, including market capitalization, liquidity, past performance and more. The evaluation includes assets such as LSDs, Kujira altcoins & yield bearing stablecoins.

KJI aims to stand out as an asset in the ecosystem via:

- Diversification: As a diversified basket of Kujira assets, investors do not expose themselves to just a single asset while capturing the upside of many assets.

- Convenience: Beyond our UI we strive to integrate the product in multiple places. This will make it easy for investors to buy and sell the index.

- Transparency: KJI is going to be fully transparent, and investors can see exactly which assets are included in the index and how they are weighted at all times.

Read on for more info in our first announcement here.

What’s next?

Looking ahead, we are working hard on our testnet deployment, which is currently the main focus of the team.

At the same time, we are establishing the risk framework to determine the initial asset weights. In order to minimise slippage & volatility and therefore maximise user experience, we are considering multiple factors such as liquidity, trading history and a vetting process.

Keep an eye on our Twitter/X for more updates in the meantime. Stay tuned!