The Kujira ecosystem has been growing rapidly in 2023 due to a variety of launched applications. Beyond apps built by the core team (FIN, GHOST, ORCA and many more), theoretically anyone can deploy applications (after going through a governance process) on Kujira. Hence there has been an uptick in projects launching recently, some with a token, some without. The Kujira Ecosystem flywheel effect has kicked off and could be in full swing sooner rather than later.

KUJI as main token of the ecosystem captures fees from almost all products built on the chain. It has risen to almost $500m market cap, up over 10x from its 2023 bottom. While there might still be upside available, the launch of several small caps certainly provide alternative investment opportunities.

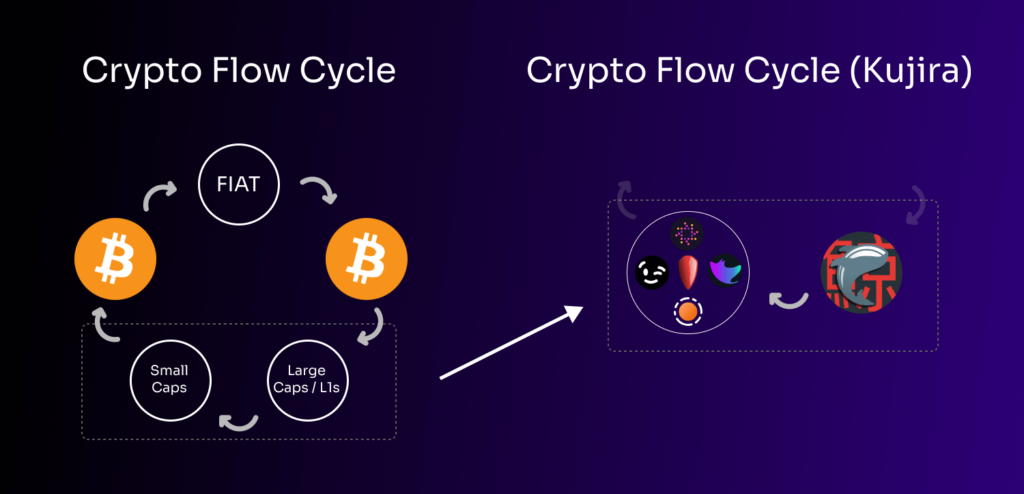

Money moves in cycles

In every market cycle, money typically flows from fiat to BTC to large caps and L1 tokens, to small caps, back to BTC and then either repeat or back to fiat.

While crypto is likely not in a full blown cycle yet, KUJI, as the main asset of the ecosystem will likely continue to capture most of the attention. But there will be times where money flows from KUJI —> Kujira Alts in hope of bigger upsides.

In order to keep exposure to the entire ecosystem, one would have to acquire multiple altcoins, paying attention to all of them in hope to catch the right ones in the next leg up. And all this still does not guarantee that one will actually chase and catch the winner.

Introducing the Kujira Index

As the name suggests, the Kujira Index is going to be an asset index tracking the broader Kujira ecosystem. It simplifies exposure to Kujira as a whole without having to individually pick and choose which assets to invest in.

The Kujira Index is going to consist of a basket of the Kujira assets, weighted by different metrics, including market capitalization, liquidity, past performance and more.

It aims to stand out as an asset in the ecosystem due to:

- Diversification: As a diversified basket of Kujira assets, investors are not exposed to just a single asset while capturing the upside of many assets.

- Convenience: Beyond our UI we strive to integrate the product in multiple places. This will make it easy for investors to buy and sell the index.

- Transparency: The Kujira Index is going to be fully transparent, and investors can see exactly which assets are included in the index and how they are weighted at all times.

Why “The” Kujira Index? Will there be more?

More indices are certainly possible in the future, and a mid-to-long-term goal for us. Whether it’s strategies tailored to different risk profiles or community created indices. We are open to anything at this stage and are eager to listen to what the community wants.

However, we want to find product-market-fit with one product first before expanding into any direction and we strongly believe the Kujira Index will enable us to do that. Hence the full focus is on the first product: The Kujira Index.

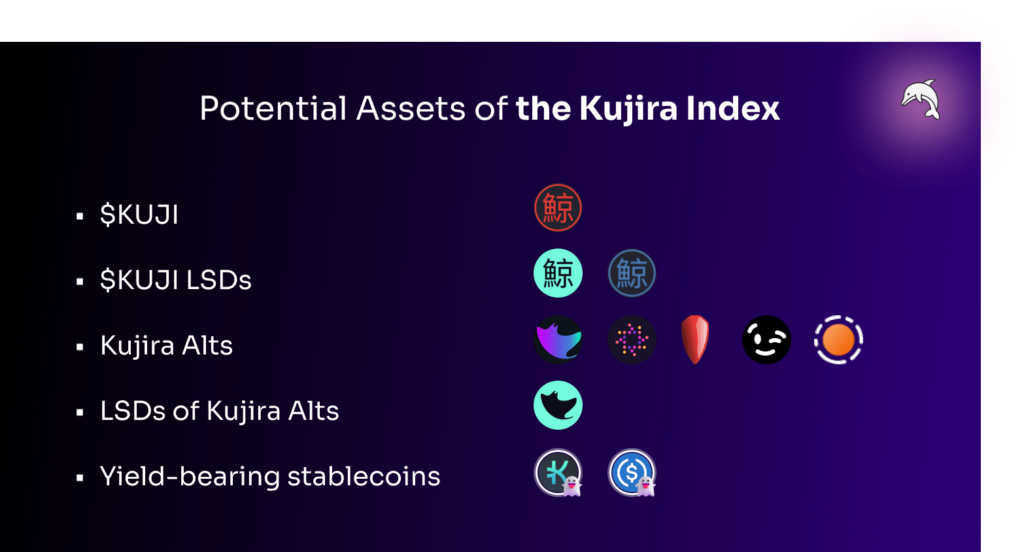

What assets will be part of the Kujira Index?

While the exact assets and asset weights are not yet set in stone (and we also want to involve the community in the discussion), we gauged some sentiment on Twitter in the past week and the results were aligned with the assets we had in mind. These asset types are:

- $KUJI, the ecosystem’s native token

- $KUJI LSDs, representing liquid staked $KUJI

- Kujira Alts, such as $MNTA, $FUZN, $NSTK, $WINK, and $LOCAL

- LSDs of Kujira Alts

- Yield-bearing stablecoins, such as xUSK and xUSDC

All assets will have to fulfill stringent prerequisites such as minimum available liquidity, team and project vetting prior to be added to the index to ensure quality user experience.

What’s next?

Look out for another blog post deep diving into the product and tech as well as the mid-term roadmap.

Further, we are going to decide the ticker of the Kujira Index soon. We want to do this together with the community. Keep an eye on our Twitter for more info on that.