With the official launch of WinkHUB, it’s time to resume the Kujira Roundup with a special piece. Peruggi’s been busy with Kujira Academy and the Plucky Penguins mint, so I’ll be filling in for now. I wanted to use this opportunity to do something different. A comprehensive ecosystem encyclopedia.

This article details the important milestones for every single part of the wider Kujira ecosystem since the last roundup on July 10th. Furthermore, it provides a high-level overview of every protocol & tool, leaks juicy alpha about next steps, and puts things into perspective from then to now. This all on a backdrop of an exciting time where Kujira TVL has gone absolutely bananas, the founders’ KUJI has completely finished vesting, and KUJI has reached the top 100 coins by market cap!

To give every protocol and development time to shine in the spotlight, I’ll split up the recap into different parts each focusing on specific aspects of our ecosystem’s efforts. I’ve broken down most sections into 1. an overview of what I’m describing, 2. an update of recent/cumulative efforts, and 3. next steps & leaky alpha to look forward to.

Table of Contents

- Kuji Kast

- Fuzion

- Kujirans NFT

- Blend Protocol

- Quark Protocol

- LocalDAO

- Ghosts in the Chain

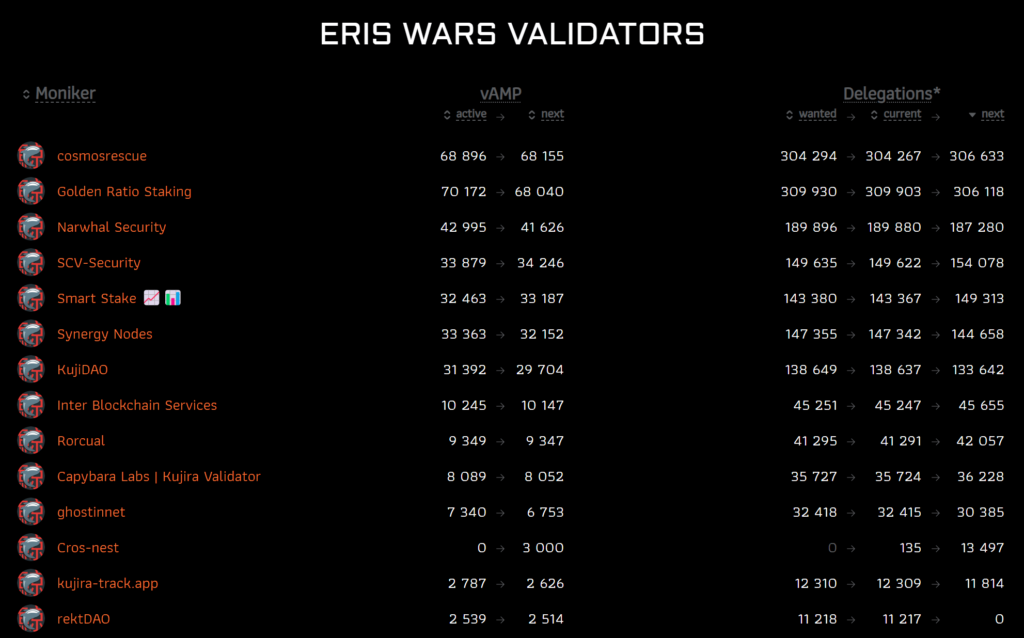

- Eris Protocol

- Nami Protocol

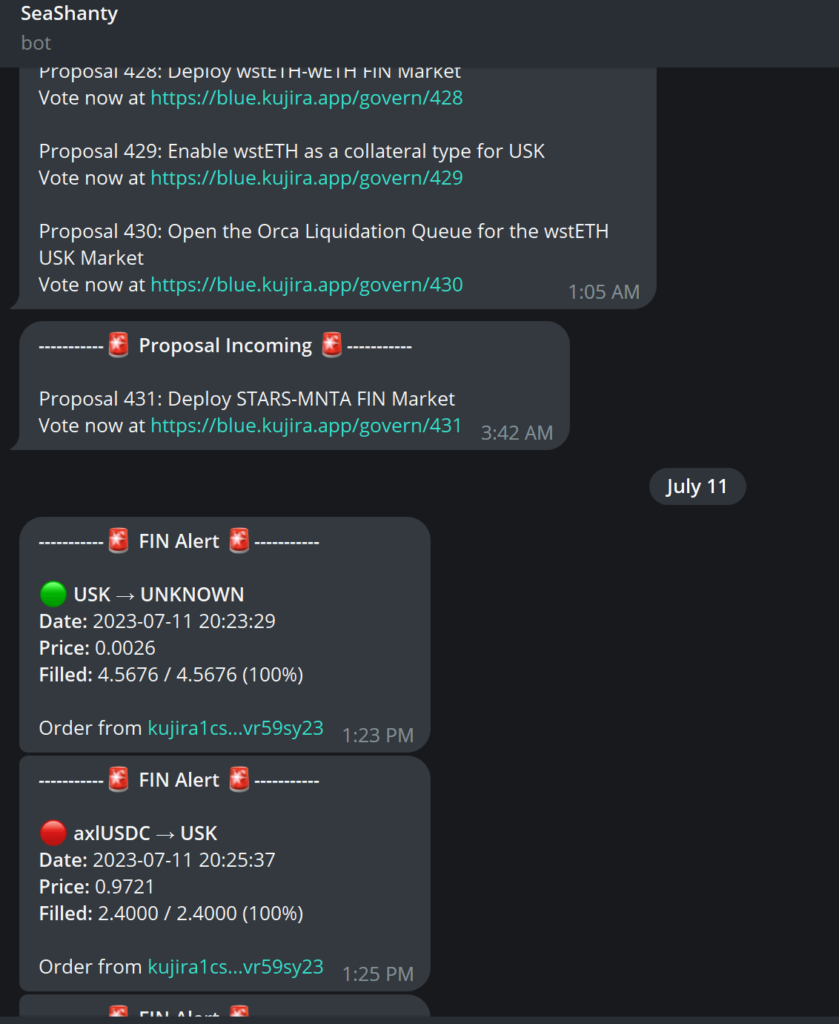

- Sea Shanty

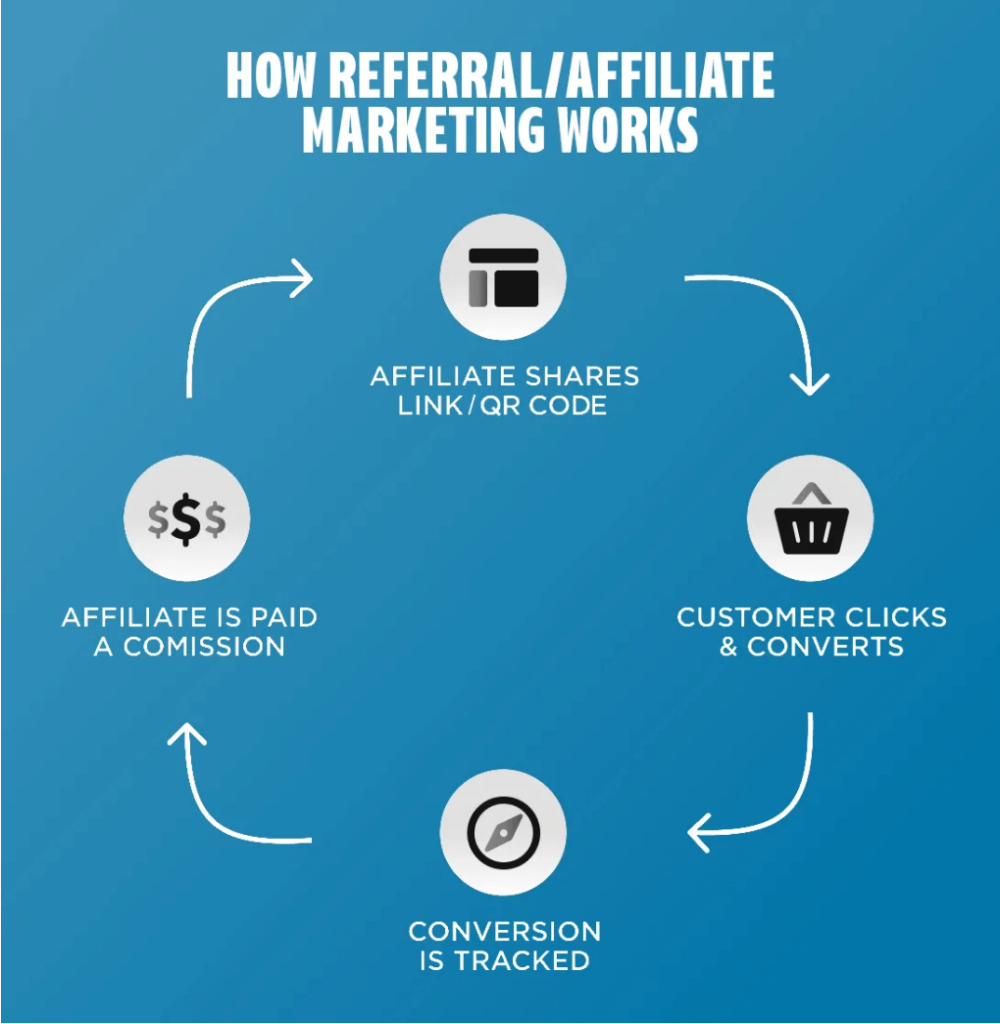

- DLOYAL

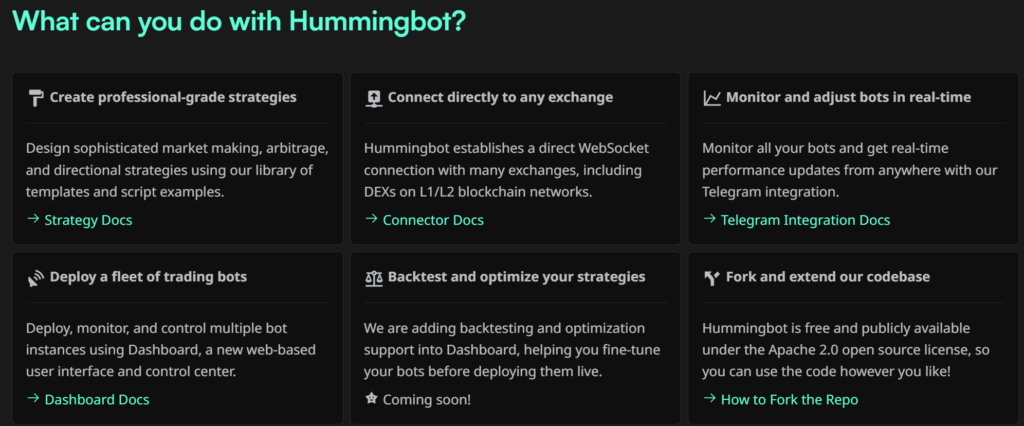

- Hummingbot Adapter

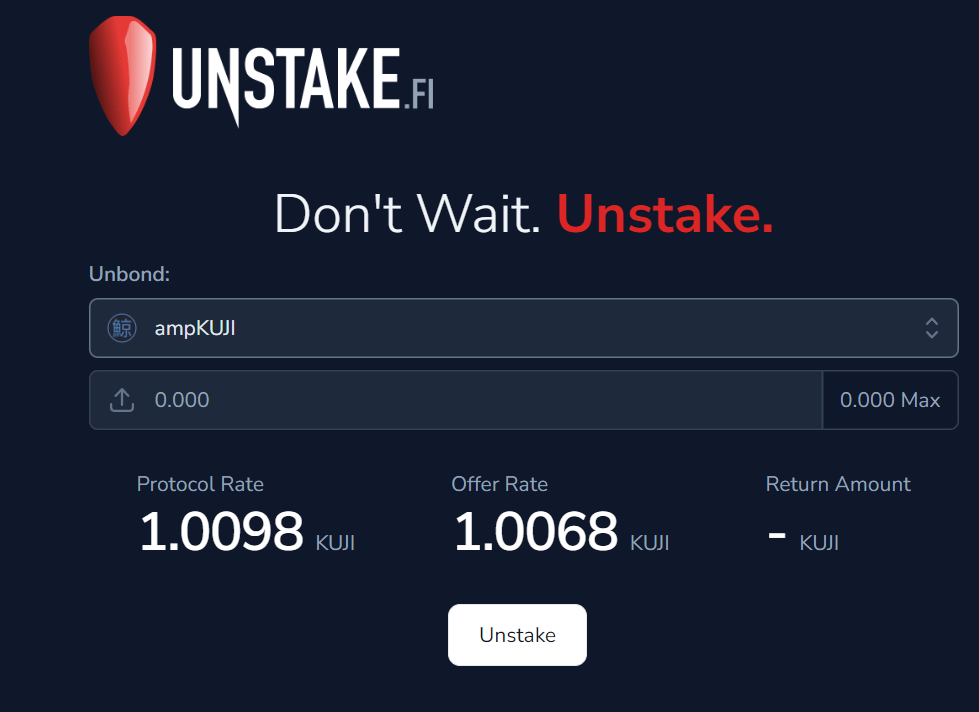

- Unstake Finance

- Community Projects

- International Communities

- Kujira is for Everyone Community Spotlight Series

- Maya and El Dorado

- Nomic

- Galactic Mining Club

- Miscellaneous

- Wrap-Up

Section I

Part 1: Kujira Product Suite

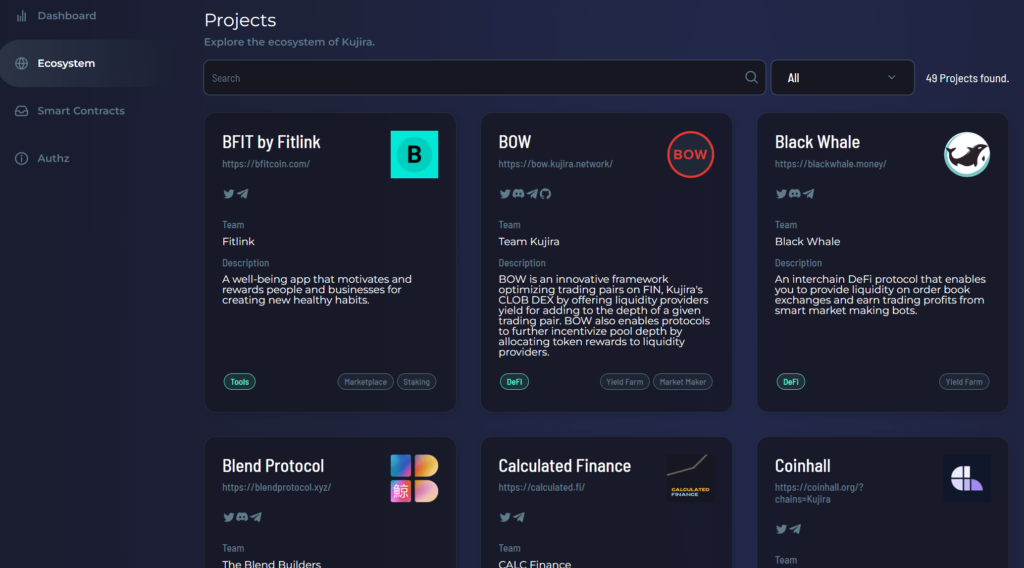

BLUE

Overview

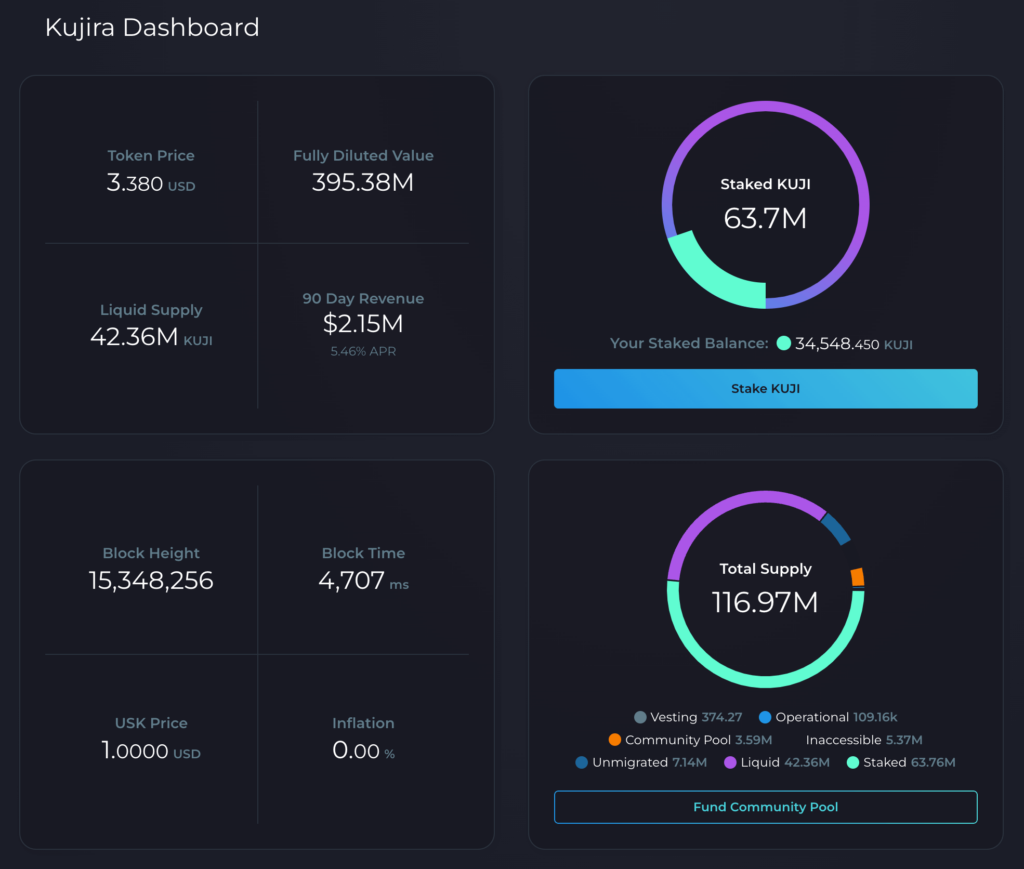

BLUE is your all-in-one dashboard for the Kujira ecosystem. Here, you can bond KUJI, vote on governance, swap KUJI, bridge to the Kujira network, and claim rewards. This is the hub of the Kujira blockchain, where you can shape its future through governance and earn a portion of Kujira’s revenue by staking KUJI.

Blue is composed of a few main tabs including the following:

- Dashboard (Ecosystem analytics)

- Wallet (View token balances, send tokens, automatically convert small balances to KUJI)

- Swap (Simple token swap user interface)

- IBC / Bridge (Transfer tokens from other blockchains to and from the Kujira blockchain)

- Mint (Mint USK, Kujira’s native stablecoin, using acceptable collateral)

- Stake (Bond KUJI with validators to earn rewards and vote on governance proposals)

- Govern (Vote on governance proposals, review past proposals, track Kujira Senate activity)

- Developer (Store, instantiate, migrate, query, and execute contracts)

Update

One major change to BLUE on SONAR is that Kujira now uses MantaSwap on the backend to route all market swaps for increased efficiency and improved liquidity.

Another important change to BLUE is the addition of Nomic to the IBC/Bridge tab–as now that nBTC is live–it is possible to easily transfer native Bitcoin to Kujira via Nomic.

A developer tab has also been added as part of an overall effort with POND and other ecosystem efforts to make building on Kujira easier than ever before with developers being able to easily work with contracts on testnet (which is easier than ever before thanks to POD).

Finally, thanks to the recent Unstake.fi airdrop and high trading volumes on FIN, Kujira’s 90 day revenue has soared to over $2.15 million on BLUE.

ORCA

Overview

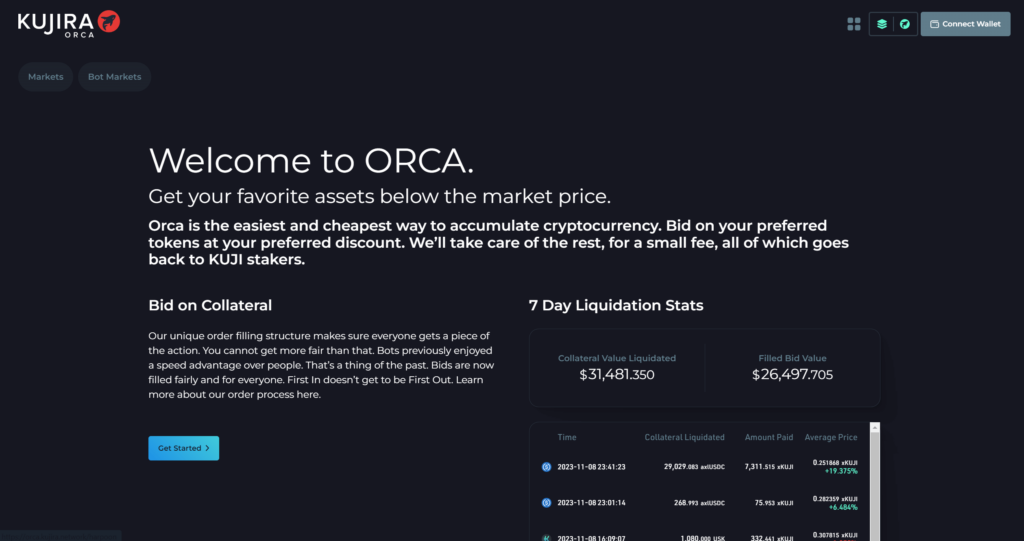

“Liquidate multiple assets across the whole of Cosmos at the click of a button. No bots, no code, no problems.”

Built on Kujira, ORCA was team Kujira’s very first decentralized application and is currently the world’s first public marketplace for bidding on liquidated collateral. By effectively participating in a Dutch auction, users are able to obtain liquidated collateral at up to a 30% discount. To bid on liquidated collateral on ORCA, users can select the desired market and premium, input the amount they want to bid, and hit the “Place My Bid” button. SeaShanty conveniently allows autoactivation of bids.

Now that GHOST is live, users can also use ORCA to sell yield bearing assets at local tops up to 43% above the market price. Read more here.

ORCA operates using a queue-based and anti-bot approach, filling bids from the smallest discount to the biggest. This helps to find an optimal discount rate and prevents immediate selling and damage to the market by bot operators. Instead, liquidated assets are purchased by community members who often have a stake in the longer-term success of partner platforms and may increase their ownership rather than immediately selling.

In this way, ORCA offers several benefits for partner money markets and users, including a user-friendly interface, transparent bidding process, near instant settlement of liquidations, robust yet capital efficient approach, ability to earn yield while waiting for liquidations, and strong community.

Kujira also offers ORCA liquidation analytics to all users on all ORCA markets.

FIN, ORCA, GHOST, and USK all have co-integrations. USK relies on ORCA as a liquidation settlement layer. You can read more here.

Update

In recent months, the Kujira team has introduced ORCA liquidation alerts on all 1st party Kujira applications which allow users to see collateral at risk with associated collateral position health indicators in a simple UI. This allows users to quickly move funds to ORCA to both backstop and profit from ecosystem-wide liquidations–making the ecosystem safer than ever before.

The team have also leaked an upcoming ORCA subinterface Harpoon, which will compete with bots for liquidations.

At the same time, with all the new GHOST markets and additional USK collateral–many new associated liquidation queues have been opened accordingly. With the launch of GHOST, ORCA saw a massive overhaul to ensure that it had associated markets for each GHOST lend/borrow pair.

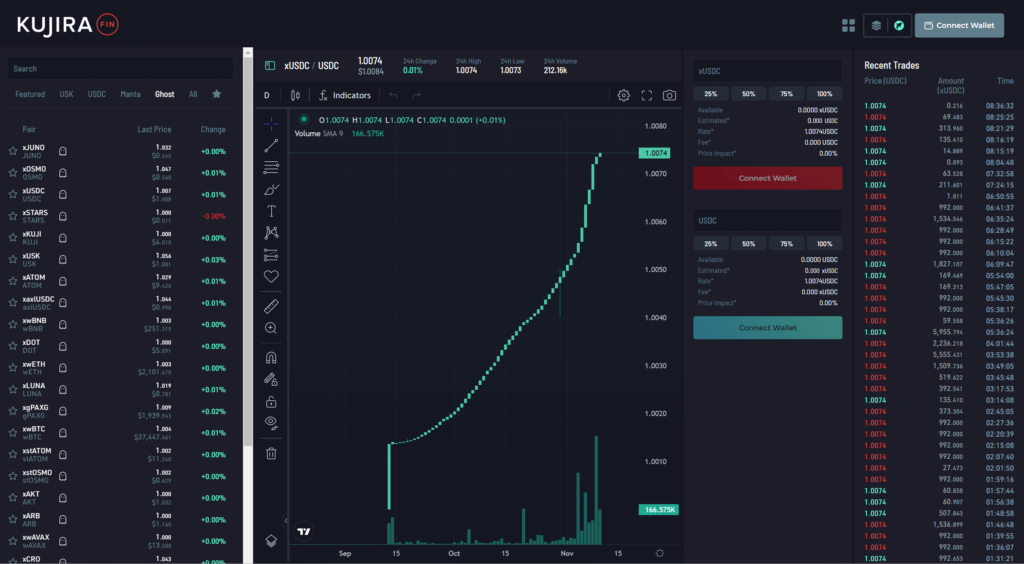

FIN

Overview

As a key product in the Kujira ecosystem, FIN is an orderbook-style decentralized exchange (DEX) that allows for the trading of assets on different blockchains. It has seen over $171 million in volume since its initial launch in July 2022.

But FIN’s potential goes far beyond its initial success. As an orderbook-style exchange, it has several key advantages that make it a more sustainable and long-lasting option compared to other DEX models:

- Improved trade execution: Orderbook-style exchanges offer better trade execution, resulting in increased capital efficiency.

- No reliance on inflationary incentives: Unlike AMMs (Automated Market Makers), which use inflationary rewards to encourage liquidity provision, FIN does not rely on this unsustainable model. Instead, FIN leverages BOW as a next generation market maker for liquidity, providing a more sustainable and efficient solution.

- Scalability: FIN is designed to be scalable, allowing it to handle increasing demand and volume. Its fair matching algorithm has O(1) algorithmic complexity, meaning it can process orders in constant time regardless of the number of orders in the system. This is a significant advantage in terms of scalability and efficiency, as it allows FIN to handle a large volume of orders without sacrificing performance.

- Low fees: With low gas fees and maker/taker fees, FIN offers a cost-effective trading experience.

- Future on/off-ramps: FIN has plans for future integrations with on and off-ramps, improving the bridging experience for users.

But why is FIN a better option than AMMs? While AMMs have been successful in solving the liquidity issue faced by many DEXs, they have their own set of problems:

- Inflationary rewards are unsustainable: AMMs use inflationary rewards to encourage liquidity provision, but this model is not sustainable in the long run.

- High APR not always due to swap fees: While it may be advertised as such, the APR for swap fees alone is often much lower than advertised, with the remainder made up of inflationary rewards.

- Volatility exposure: LPs (liquidity providers) are exposed to the volatility of the underlying token, and must be provided with a higher APR to compensate for this risk.

- Lack of alternative revenue streams: Without a plan to move from inflationary rewards to other forms of value creation, AMMs risk losing value as the token supply inflates and rewards decrease in value.

Orderbook-style exchanges like FIN do not rely on inflationary incentives and offer superior trade execution compared to AMMs. They also have a more intuitive user interface and the potential for future integrations.

In summary, FIN is a scalable DEX with lower fees and improved trade execution, making it a strong contender in the decentralized exchange market. With its focus on sustainability and long-term success, FIN is well-positioned to stand the test of time.

Read here to know how to use FIN and here how to list tokens on FIN.

Update

A lot of new pairs have been added to FIN including multiple USDC pairs, wBTC pairs, nBTC pairs, and wETH pairs as well as many other token pairs including WINK-MNTA pair and NSTK-USK pairs.

FIN was upgraded to v2.0.1 as well.

In recent days, FIN has seen multiple all time high volume days reaching over $4 million in daily volume just yesterday.

USK

Overview

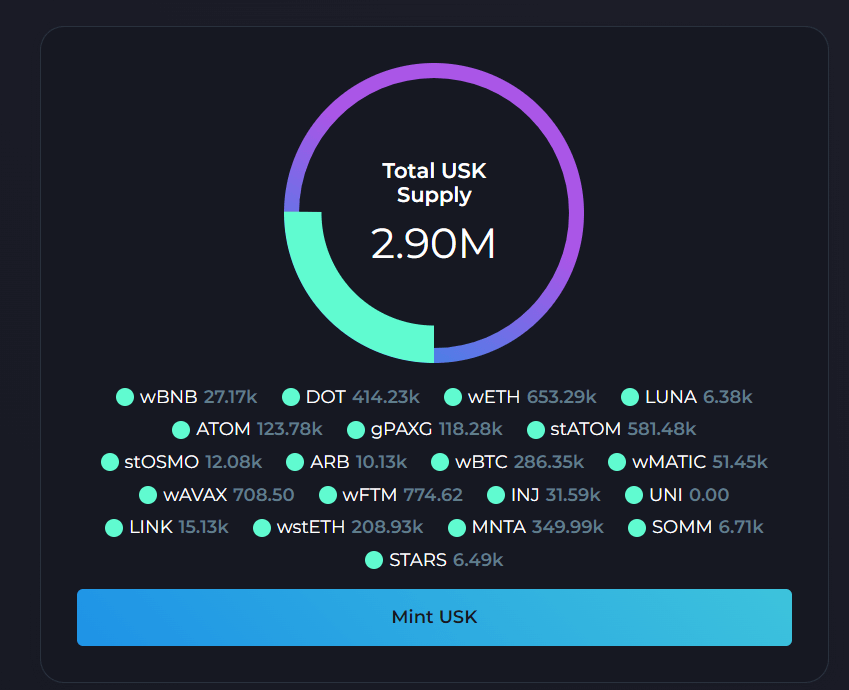

Kujira’s USK stablecoin is a decentralized stablecoin soft-pegged to the US dollar that is (more than fully) backed by a variety of collateral including ATOM, wBTC, wETH, wBNB, LUNA, MNTA, DOT, and gPAXG (a full list can be found here). It is an overcollateralized stablecoin, meaning that it is backed at a minimum collateralization of 166%. This helps ensure the stablecoin’s stability and reduces risk of liquidation.

- Mint USK by depositing collateral on the Kujira platform

- Manage USK through the platform’s dashboard

- Maintain a low loan-to-value (LTV) ratio to avoid the risk of liquidation

- In the event of a liquidation, collateral is put up for auction on ORCA

- Users can bid on collateral to help protect the stablecoin and obtain the collateral at a discount

USK leverages Kujira’s original flagship product ORCA to handle the liquidation layer and make all USK market activity, minting, burning, liquidating, transacting, accessible to everyone. As USK is soft-pegged, it is normal and expected to see some volatility in USK price over time based on changing market supply and demand dynamics for Kujira financial services and payments infrastructure. USK is omnipresent across Kujira’s 1st party products and is a central fixture of the Kujira ecosystem. Minting or acquiring USK will be a gateway to unlocking financial opportunities and services only available on the Kujira network. USK will also leverage Sonar and other Kujira applications to serve as a base layer for a new wave of real-world payment opportunities and infrastructure.

USK is designed to be sustainable, robust, and usable for payments and commerce. Its codebase is written in Rust, which is a more robust and expressive language than Solidity or JavaScript. Rust is also inherently built to be safer (bug-resistant) and is increasingly used for financial applications due to its level of safety guarantees. As a native Cosmos stablecoin, USK has the potential to drive value accrual for ATOM and can be used for other purposes in the future. It is integrated into the ORCA platform to allow for seamless and publicly accessible liquidations.

The USK mechanism is intended to be sovereign, uncensorable, and revenue-generating, and it is intended to provide a secure and reliable foundation for decentralized finance.

Part of Kujira’s vision with USK include a greater focus on payments and real-world applications for decentralized commerce (which can already be demonstrated integration with WooCommerce, one of the largest online merchant providers); synergy with Kujira’s native wallet, SONAR, and all of their other products; and set mint caps per collateral type to ensure proper diversification of its backing composition.

You can find a technical overview of USK here, an explanation of how to mint here, a guide to track mint/burn events as well as USK health and collateral makeup here, and use cases here.

Update

After the introduction of new experimental BOW strategies, USK has reached a new degree of stability. At times, due to the overwhelming demand for USK in the Kujira ecosystem, we have seen USK be valued higher than $1 at times; however, based on various technical controls and mint cap increases, we are seeing USK becoming more stable than ever.

In the past few months, USK use has seen immense growth. Not only have we recently enabled SOMM, STARS, and MNTA as collateral, but we’re also in the process of adding SOL in the near future now with Wormhole enabled. The stATOM mint cap was increased from 400k to 600K, but we’re considering increasing a few mint caps including MNTA and various other pairs to ensure MNTA backing stays below a certain percentage threshold of the overall backing (in both the short and long term) to ensure decentralization and diversification of backing.

Aside from that, USK is now a featured market on Umee and USK can be used to mint NFTs on Stargaze.

FINDER

Overview

FINDER is the official blockchain explorer for the Kujira Network. It is an essential piece of infrastructure that allows users to track addresses, transactions, validators, and more on the Kujira Network.

Some key points about FINDER include:

- Can be used on both mainnet and testnet

- Mainnet is intended for the majority of users, while testnet is useful for developers to verify transactions and track other information

- Allows users to bookmark and name multiple addresses by searching for them and clicking the bookmark icon in the upper right corner

- Saved addresses correspond to cookies, so they may need to be recreated if cookies are deleted

- Users can view saved addresses by clicking the bookmark button next to the search bar

FINDER is a valuable tool for anyone using the Kujira Network, whether for mainnet, testnet, or Pond (local network) purposes. It allows users to easily track and manage their addresses and transactions, making it an important part of the Kujira ecosystem.

BOW

Overview

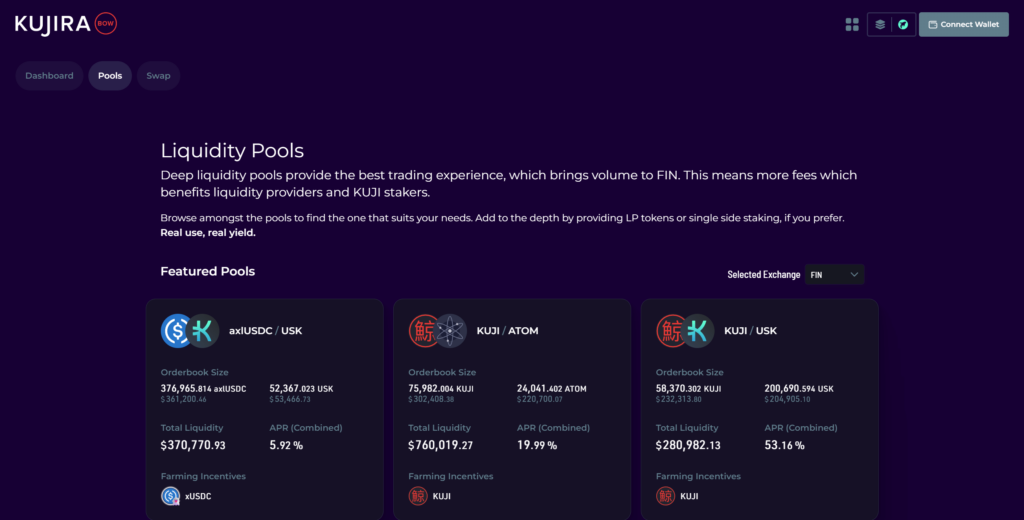

BOW is a framework ensuring optimal trading conditions for pairs on FIN, Kujira’s on-chain orderbook DEX. It aims to attract liquidity providers by offering yield for adding to the depth of a given trading pair, which narrows the price spread and ensures deep order books for traders. BOW also enables protocols to further incentivize pool depth by allocating token rewards to liquidity providers.

BOW uses an internal algorithm to automatically place orders on FIN pairs based on its own internal token balances, similar to the XYK algorithm used by Automated Market Makers like Uniswap. As market buys and sells come in, these orders are filled, causing the contract’s internal price calculation to move and re-submit orders at the new mid-market rate. BOW is a self-sufficient and 100% on-chain market maker for the FIN order book.

To use BOW, connect your wallet to the Pools tab and top up on the Swap tab if necessary. Choose the pool you’d like to participate in, deposit the desired amount of tokens, and create liquidity provider (LP) tokens. Holding LP tokens earns you a share of the fees from transactions using that pair, which can be further increased by staking the LP tokens on the Stake tab.

BOW offers several benefits to the ecosystem, including an on-chain solution for market making that doesn’t rely on a third party and the ability to incentivize pool depth through fees and rewards. It also provides a stable and deep order book for traders, leading to higher volume and stability.

Learn more about BOW’s Dashboard, Pools, and Swap.

Update

High-powered by GHOST, Kujira’s money market, leveraged LPs and single-sided BOW positions are coming soon which will make it more attractive to contribute liquidity than ever in Kujira.

Furthermore, in the past few months, special BOW strategies have been launched tailored to specific types of token pairs. For example, BOW strategies for LSDs and stablecoins have both launched, yielding high APRs for liquidity providers, with a BOW selector on certain pairs allowing users to try their market making strategies of choice.

Aside from a few recent liquidity campaigns in which the team has added USK incentives to many LPs, other incentives such as xUSDC have been added to various pools such as the USDC/USK pool. BOW has been working wonders for liquidity in tandem with MantaSwap which has helped drive Kujira ecosystem TVL to a new all time high of $70 million in TVL.

POD

Overview

POD is a custom staking user interface (UI) designed to support decentralization on the Cosmos network, a proof-of-stake (PoS) blockchain.

Decentralization on a PoS blockchain can be evaluated using the Nakamoto coefficient, which measures the minimum number of validators that could potentially collude to take control of the network. The more evenly distributed validator delegations are, the higher the Nakamoto coefficient of the network.

It is common for people to assume that validators with larger delegations are inherently superior to delegate to, but this can lead to security issues and undermine decentralization. In POD, Kujira has designed a system to highlight validators with voting power that is disproportionate to the equal power threshold (which represents perfect decentralization with uniformly distributed delegations across the validator set). Validators with voting power above the equal power threshold are shown in red with a bar indicating their percentage of overall voting power. Validators with medium voting power above the threshold are highlighted in yellow, while those with voting power below the threshold are colored blue.

In reality, validators have different levels of technical expertise, values, and levels of community engagement and value, which attracts different numbers of people. As a result, it is challenging to achieve perfect decentralization. Decentralization is just one factor to consider, balanced against others such as network value, supporting community projects and tools, voting to protect the network, and various other tasks.

That’s why Kujira created POD, a staking UI advancing decentralization. We will continue to improve POD over time by listening to user feedback and innovating.

SENATE

Overview

The Kujira Senate was a new governance structure for the Kujira blockchain aiming to facilitate validators on the platform, represent the values of the community, and support the stability and growth of the ecosystem. It was composed of up to 9 experts elected by the staking community and was accountable, transparent, and democratic.

Update

After coming to a mutual accord with the core team, the Kujira Senate decided that it would be for the best to halt at this stage of ecosystem development. The Senate was always meant to use a light touch approach; however, as the core team never clearly laid out a clear scope and purpose for the Senate–-it grew too big and developed too many objectives and structural institutions to be reconciled with the team’s original vision. Senators spent so much time on their work that it was impossible for the role to be feasible anymore in a volunteer capacity. As it didn’t make sense for the team to fund the Senate at that point in time, a mutual decision was reached to wind down.

Throughout the Senate’s existence, it was difficult to navigate keeping communications private for the sake of builders applying for grants while maintaining basic public accountability to keep the community informed to the basic weekly goings on. Still, the Senate did its best to be accountable to the community and made sure to provide summaries of every single one of its weekly meetings directly in Kujira’s docs.

Finally, the Senate published a meticulous cumulative financial report that dissected every aspect of their inner workings with respect to funding projects and moving funds around. You can read that report here.

While active, over the last few months, the Senate performed activities including an involved multi-week grant application process, responsibly converting KUJI to stablecoins using tools like CALC and Plasma (to minimize sell pressure) to have them ready to fund projects, managing Treasury funds in Kujira dApps without siphoning yield (i.e. creating BOW LPs but not staking them, not staking large amounts of KUJI, providing liquidity to GHOST in moderation, etc.), and helped facilitate funding discussions around a number of projects including MantaDAO & Blend among others.

As part of the wrap-up process, the Senate sent all treasury assets to the core team’s operational wallet as it is difficult for a CW4 multisig like the Senate to try to execute token swaps or price deals. Finally, the team returned remaining Treasury funds back to the community pool to complete the process.

You can read through all the past weekly Senate meeting summaries here.

Next Steps

The core team would handle all related business development and grant funding in the short-term and instead focus on empowering community members to be able to have a stronger voice in a DAO-like system for protocol governance in the longer term once the ecosystem’s development would see further maturation.

PILOT

Overview

PILOT is a launchpad built in partnership with Kujira and Fuzion. It uses a unique method based on ORCA’s revolutionary bidding process that leads to fair token valuations for both founders and raise participants. PILOT’s innovations make participation equal for everyone by removing chance and speed from the process. This experience provides a fair opportunity for all.

For all PILOT token sales, 5% of the money spent to buy the launch tokens are distributed proportionally to all KUJI stakers and 0.5% of the launch tokens sold in the sale are also distributed proportionally to all KUJI stakers. This allows all KUJI stakers to get some exposure to every new project launching on PILOT.

The first project that launched on PILOT was WinkHUB, Kujira’s content platform–this platform you’re reading this article on.

The second project launching on PILOT is Aquelibra, a real world assets voluntary market carbon credits enterprise that plans to launch their AQLA token on PILOT at the end of November. You can find out more about Aquelibra by referring to my recently published transcript of the Kujira Founders’ third transcript which is also on WinkHUB.

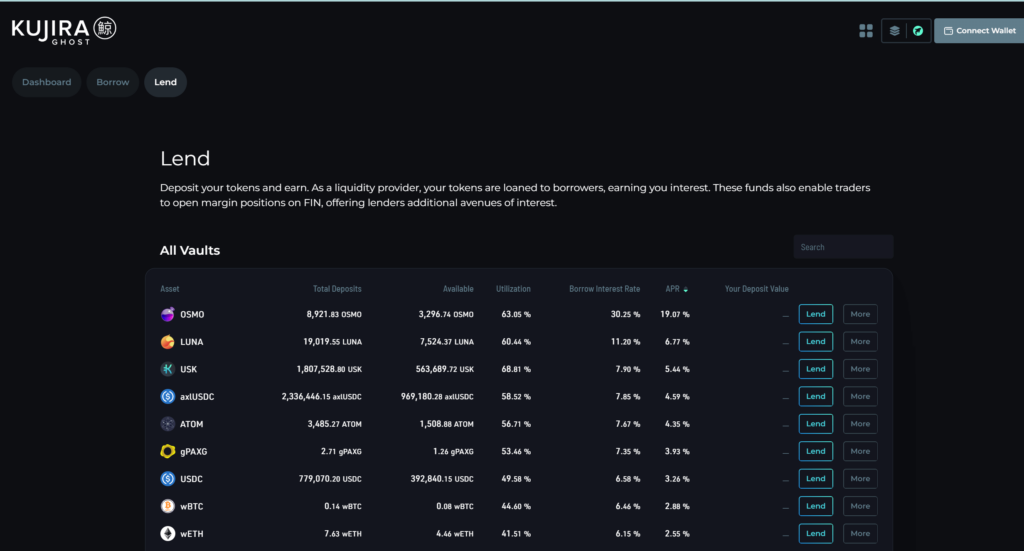

GHOST

Overview

GHOST is Kujira’s premier Money Market. As a decentralized money market, GHOST allows would-be lenders and borrowers to cooperate by providing a convenient supply-demand framework. Furthermore, it generates attractive returns for market participants without relying on artificial incentives.

Since GHOST is a decentralized money market, lenders are covered even if borrowers fail to repay their loans. Furthermore, since all loans on GHOST are overcollateralized, borrowers don’t have to apply for loans or go through credit checks. Opening or closing a loan and supplying or redeeming supplied assets is a near instant process that can be done at nearly any time. The only exception is when the utilization of an asset reaches 100%. In this case, supplied assets of that type cannot be redeemed until some are returned (or more are supplied) to the platform.

Lenders lend assets to GHOST to earn variable interest on those provided assets based on their overall utilization by borrowers. Borrowers borrow assets supplied on GHOST (by others) in order to participate in financial speculation or take out loans without selling underlying assets. Borrowers are charged variable interest over time dependent on the borrowed assets’ overall utilization by borrowers. This interest rate cycles between high and low over time based on inherent market demand and GHOST’s framework. Here‘s more about how the interest rate works.

When borrowers fail to pay back their loans in time due to decreases in collateral value, increases in funds borrowed, or accrued interest–provided collateral is liquidated via ORCA. Here‘s more about how liquidations work on GHOST.

Here‘s more about how borrowing works on GHOST and here’s more about how lending works on GHOST.

Learn more about GHOST’s Dashboard, Borrowing, and Lending.

Update

In recent months, GHOST has seen higher volumes and APRs than ever due to increasing composability and integrations within the Kujira ecosystem. In the past few months, GHOST has seen an upgrade to V1.1.0 and xTOKENS are now tradeable on FIN (and by extension BLUE) rather needing to be unlent on GHOST.

xTOKEN pairs demonstrate very clearly, the increasing valuation of lent tokens due to received interest from GHOST. Recently, STARS have been added to GHOST to be both borrowed and lent–MNTA has become possible collateral on GHOST, and USDC APR temporarily spiked to over 150% due to crazy borrow demand for it.

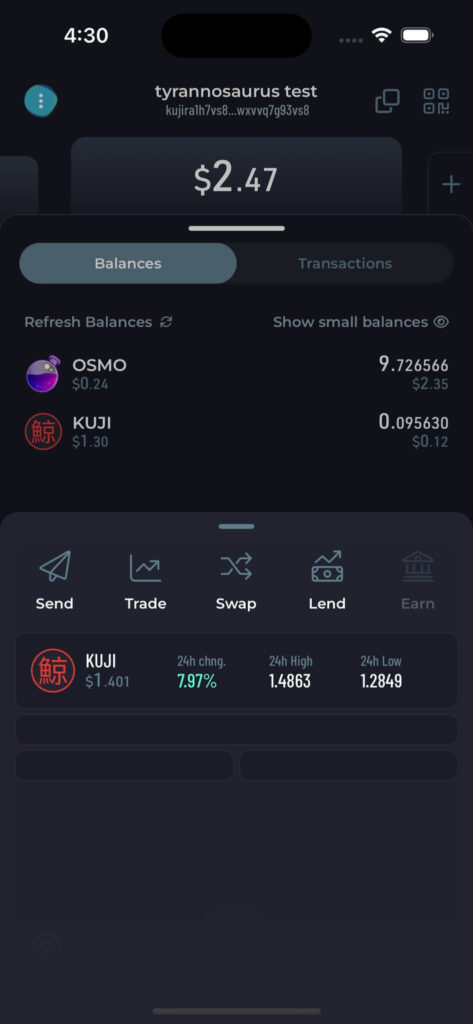

SONAR

Overview

SONAR is a native mobile wallet app that aims to provide users with a seamless and intuitive experience for interacting with blockchain technology. More than just a wallet for sending and receiving tokens, SONAR is a framework for a real payments platform for on-the-ground vendors, e-commerce merchants, and everyday users. It is integrated into key Kujira protocols that focus on payments and commerce, and has a goal of providing a transparent asset experience, allowing users to move their assets between different chains without having to worry about the underlying network.

SONAR provides the ultimate native Kujira experience as it is custom built for our blockchain and is available both on mobile and desktop. There is currently a beta accessible through TestFlight available on iPhones and Google Play on Androids.

Please check out the SONAR Beta at sonar.kujira.network if you’d like to experience a wallet purposely designed to provide the highest quality native Kujira ecosystem experience for both mobile and desktop users.

Update

A few major updates have been added to SONAR. SONAR has made it easier than ever to bring assets into the Kujira ecosystem with its simple to use interface.

SONAR’s native swap mechanism has integrated MantaSwap which routes all trades through aggregated asset pairs to ensure optimal execution in terms of price impact and slippage.

Brett and Hans have been hard at work to introduce a dynamic new token-centric design for SONAR that makes the mobile wallet experience cleaner than ever. The goal is to make the experience as accessible as possible to individuals who are less familiar with DeFi.

SONAR has also been upgraded with a sleek new launcher UI.

Brett recently revealed in the Founders’ third Kujira chinwag that he is working on introducing a (non-mandatory) way for users to create new SONAR wallets without ever needing to see or use seed-phrases, rather simply relying on sophisticated passkey technology. This is intended to make the experience and leap to DeFi far more accessible to retail–where it feels much more like a comfy web 2 product while actually being a web 3 product on the backend–web 2.5 as some may call it. Brett goes into far more detail in the Chinwag. I’ve included another article with the full Chinwag transcript if you’d like to learn more about his work and overall development direction with SONAR.

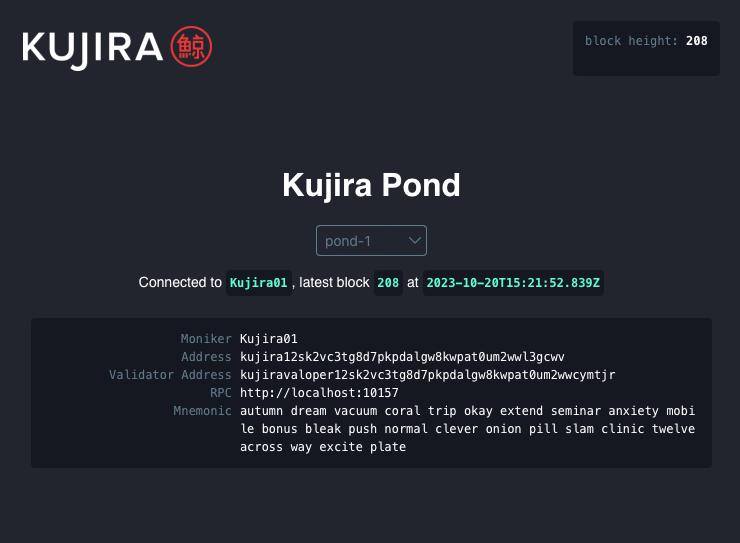

Pond

Overview

Pond ushers in a new unified Kujira dApp development framework for builders on Kujira. It makes creating applications on the network easier than ever before.

Available since October 20th, Pond creates an entire local Kujira Network complete with price feeders and scaffolds out a dApp template that you can start building on straight away.

It takes just 3 commands to get the network running & pond-UI will configure itself automatically & connect to your local Pond network. The process is extremely simple. Just follow the steps here.

Pond will come with pre-installed contracts for all key applications including USK, FIN, GHOST, BOW, ORCA, and PILOT. Protocol teams can PR to have theirs included as well.

The Pond UI will have a sample wallet connection for SONAR and have a demo for how to construct, sign, & broadcast a transaction.

OTHER

Overview

We have made a few other updates such as adding price oracles for various tokens including NTRN, ampKUJI, STARS, SOMM, ampMNTA, SOL, RLB, HNT, etc.

Furthermore, Kujira also saw Chain upgrade v0.9.0 which instantiated newer versions of Cosmos SDK, Wasmd, IBC-go, Tendermint, and Alliance, while removing Ignite. Furthermore, the update also included the ibc-go factory token mapping in refundPacketToken oracle vote rating.

Currently folks are discussing possibly lowering the threshold for making governance proposals on Kujira.

Part 2: Kujira Founder Chinwag 3

Overview

The Kujira Founders came together for their third team Twitter Space that lasted just over an hour. They discussed a variety of topics including Kujira Futures (Perps), POND (a unified dApp UX on desktop for Kujira builders), future SONAR direction and updates, a real-world asset carbon credit trading platform Aquelibra launching on PILOT, an expanding developer team, and the evolution of Kujira’s brand over time.

The Chinwag has provided a lot of insights about general themes of central importance moving forward and what’s in store for the current phase of Kujira. What’s for sure is that the devs are full of passion and want to do chinwags more often to keep the community up to date about what they’re working on as well as their general thoughts and goals–as they’re often too busy to talk about these things in detail as they’re furiously building.

Update

I’ve published a complete transcript of the Founder’s twitter space with timestamps organized into relevant sections on WinkHUB for everyone to read in depth at their own leisure. I removed filler words, paraphrased, and changed some language for brevity.

Next Steps

I will share and analyze some of the key takeaways I mentioned in the overview in a separate WinkHUB article. I think it’s important for folks to understand our current direction and the thought process behind it. These will shape the future of Kujira.

There’s a lot going on at Kujira and our team considers it a priority to support all of our builders. We’ve been hard at work for months, especially ever since UST crashed almost a year and a half ago now. Everything is starting to come together in a recognizable way. But this is still only the beginning of a longer journey.

In the span of just two years during a brutal bear market, we have built an interface to make liquidations accessible to the general public (ORCA); software that allows users to cheaply multi-send balances (BELUGA); Kujira’s DeFi hub complete with dashboards, wallet, bridging, staking, governance, etc. (BLUE); a central limit orderbook decentralized exchange (FIN); a blockchain network (Kujira L1); a blockchain explorer (FINDER), an overcollateralized stablecoin (USK); a highly efficient decentralized market making platform; a platform that enables and decentralizes cross-chain staking (POD); a money market (GHOST); an experimental governance body (SENATE); a gamified launchpad platform opening up early stage investing to everyone (PILOT); a native wallet (SONAR); and a wider project ecosystem. Furthermore, we are also currently developing a perps platform (Kujira FUTURES) and a unified desktop dApp UX framework for Kujira builders (POND).

We aim to keep building and delivering excellence relentlessly for the sake of our goals and vision to empower everyone and create a blockchain where everyone can be a whale.

Section II

Part 3: WinkHUB

Overview

WinkHUB is the content epicenter of Kujira. Home to influencers, writers, filmmakers, and content creators who promote Kujira or do their thing with the Kujira brand integrated into it. A place where creators showcase their films, documentaries, educational content, blogs, podcasts, live streams, and art; whatever amazing dreams they have made into reality!

As the platform matures, the WinkHUB will double as a talent pool for protocols to browse and source creative partners who can satisfy their marketing, advertising, and brand needs. A space where they can create contracts, review portfolios, and put up Requests for Pitches (RFPs) for the creative they need.

WINK is the grease that keeps its wheels turning. It can be used to tip, donate, & follow your favorite creators (not unlike a Patreon). An economy of content with WINK as the currency. Revenues generated by the platform will be distributed to KUJI stakers, WINK stakers & the treasury to invest in further growth (things like fees or creator income, profit share of projects that are funded, sponsorships, protocol partnerships, etc.).

Update

Maximus and Danny (Togwos) have been super hard at work over the last few months ever since the PILOT sale. After carefully working to secure valuable partnerships, build out a solid content platform, develop a wider WinkHUB strategy, source high-quality creators and content pieces, the duo have finally launched their media hub to much fanfare. The WINK token has rallied over the past few weeks as a result. And the addition of a MNTA/WINK pair has also brought extra liquidity.

Next steps

Based on the current roadmap, WinkHUB’s V1 platform will be much like Medium–however, our main platform focus gives creators far better SEO (search engine optimization) and overall control over their work and its associated stylization to help them achieve organic growth via increased page views. Users will be able to stake WINK and participate in platform governance as well.

Later on, the next focuses will be videos, a gallery, and & other types of content. Eventually, the platform will incorporate elements such as Patreon, Kickstarter, Fiverr, etc. There are certain Kujira ecosystem protocols that greatly help enable this vision. WinkHUB will be a key piece of the ecosystem moving forward and is already looking to partner with various protocols such as Local, Fuzion, and many others.

Keep your eyes peeled on unannounced WinkHUB alpha. The roadmap is only part of the vision. I’ll also publish regular WinkHUB content and other research. And I further plan to make a Wiki to complement Kujira’s official docs. Please look forward to it.

(From the future March 2024) WinkHUB will also be home to Gojira, Kujira’s revolutionary new NFT marketplace. You can read more in-depth here.

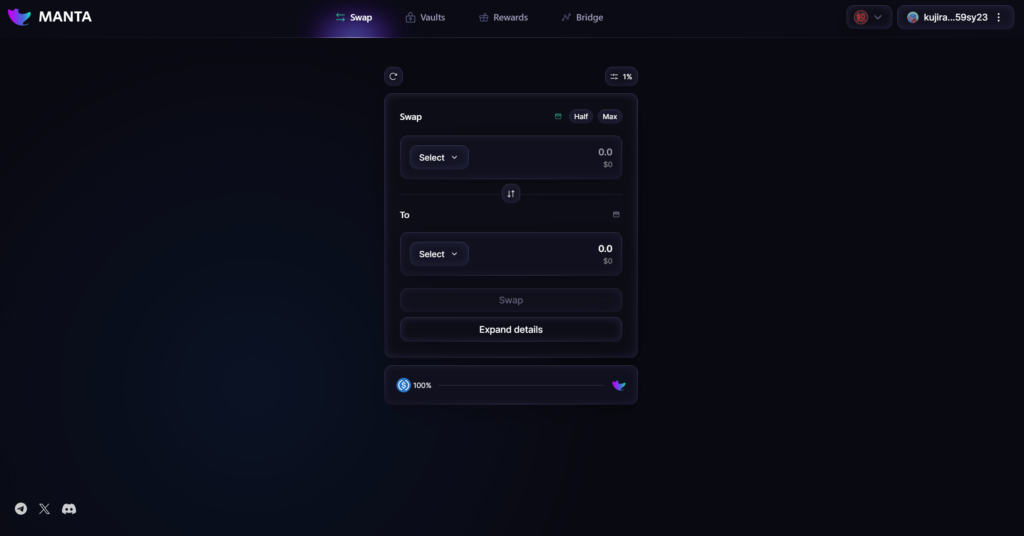

Part 4: MantaDAO

Overview

MantaDAO is a community owned DAO deployed on the Kujira blockchain that went live in April 2023. Its mission is to support the entire Kujira ecosystem towards delivering a best-in-class experience to both traders and protocols looking to list their token on FIN (Kujira’s orderbook DEX), while being profitable for MNTA stakers.

MantaDAO operates 1. a development arm building applications and tooling to improve user experience and opportunity across the Kujira ecosystem & 2. a market making arm focusing on deepening liquidity on FIN’s orderbook via long-term Protocol-Owned Liquidity (POL) and sustainable market-making programs.

5.0% of the total supply of 100m MNTA was airdropped to KUJI stakers at inception. The remaining 95m supply is DAO-governed and largely being carefully utilized to build POL and fund development of revenue generating products.

Update

MantaDAO has really taken off over the past few months accomplishing a number of important strategic objectives which have substantially increased both protocol and chain owned liquidity and led to rapidly skyrocketing TVL. With Mike at the helm developing as well as many other dedicated contributors including Vlad and Pragmatic Monkey, Manta has really come into its own.

Manta has managed to close a number of successful protocol token swaps with other protocols to increase its own protocol owned liquidity through the use of effective business development efforts. Partner protocols have included Stargaze, Sommelier, Shade, Osmosis, and Kujira. The following amounts of each asset were received for an equivalent value of exchanged MNTA in each case: $101,526.20 of STARS, $94,640.80 of SOMM, $88,908.80 of SHD, $96,749.80 of OSMO, and $100,000 of KUJI.

Furthermore, various operational efforts were carried out such as using protocol Treasury MNTA as loans on GHOST to borrow various stables and purchase corresponding amounts of wBTC ($192,718), stATOM ($99,884) wstETH ($77,800.90), and yieldETH ($100,000) to further increase protocol owned liquidity for desirable assets.

MNTA has been added as the first endogenous Kujira ecosystem USK collateral with a mint cap of $350K. The USK mint interest rate is 1% and by exercising an extremely low mint LTV of 1-2%, MantaDAO is employing careful debt financing for protocol growth.

As a result of Manta’s activities both indirectly and directly, Kujira’s Total Value Locked has increased by significantly. This has helped start a flood of incoming ecosystem liquidity that has helped power the machine and create a foundation for perpetuals, leveraged LPs, and other goodies. Thanks to the high level of trust in their work and close alignment of our teams, we have used governance to grant MantaDAO the ability to create FIN & BOW markets. This has allowed Manta to operate more efficiently and independently with its liquidity initiatives.

MantaDAO has made professional monthly transparency reports that have displayed useful key data for associated growth metrics. These transparency reports have cataloged everything from loan debt levels, to risk of external 51% attacks, and to protocol revenue and staking yield month over month. As a result of the protocol’s diligence, staking yield has reached 8% with over 50% of that yield being real yield derived solely from protocol fees charged on Mantaswap use. This is a yield of $28.42 per 1000 MNTA staked. The proposal has accumulated a diverse treasury of assets and has seen strong price action over the past few months.

On the Governance side, MantaDAO has seen extraordinary levels of participation. In the few months since launch, the DAO has already passed 108 proposals. DAO members are eager to ramp up participation even further, however, and have introduced rewards for active participants such as random airdrops. Manta has seen an incredible amount of engagement not only on-chain, but also on Telegram and Discord. Manta recently completely overhauled its Telegram to help make the DAO more transparent and accessible to the average community member so anyone can get involved and contribute in a meaningful way.

Next Steps

MantaDAO is well on its way as a symbol of high quality development in the Kujira ecosystem. Furthermore, it has announced sweeping changes that will be arriving soon on top of its recently revamped UI. ampMNTA, a liquid staking derivative created by Eris, and qcMNTA, a liquid staking derivative created by Quark have both just been instantiated with qsMNTA also on the way from Quark. Manta is also working on bringing Squad to life. Squad will be much like Enterprise or DaoDao and will provide custom DAO tooling and infrastructure to users on Kujira. These will enable a whole new layer of decentralized governance. Aside from the above, Pragmatic Monkey is working on bringing custom vaults to Manta and Mike has announced future Terra integration functionality.

Another area that Manta is working towards differentiating itself in is with its community Manta NFTs. Worked on in collaboration with Shrimp Gang, Manta Squad NFTs which launched today (and ultimately minted out within one hour), feature all sorts of adorable Mantas and a few… interesting ones. The community got a bit restless and a few resorted to other tactics such as making their own Mantas.

Exhibit A-> Exhibit B->

Note: ^ A: Not a real Manta NFT (Tieg’s) B: Example of a real Manta NFT (Mike’s)

Manta Squad NFTs are a collection of 3000 PFP Manta NFTs that have already been designed and that have launched on Stargaze. The collection mint whitelisted the following types of participants: stakers with over 10.1 MNTA, users that have MantaSwap trade volume, Shrimp Gang OG holders, and Shrimp Avatar holders. Each whitelisted address was able to mint one Manta. Anyone can participate in the continuing public mint to finish minting the rest of the collection afterwards. Mantas cost approximately $20 (exactly 20 USK which can be moved over to Stargaze via the IBC/bridge tab on BLUE). Revenue accrued from the mint will be repurposed accordingly: 60% will go back to MantaDAO and 40% to ShrimpGang. Finally, the DAO has full control over any royalty decisions and would receive all potential income if any are set. All in all, together with the functionality to display a user’s rarest Manta as their wallet avatar while using the platform, the Manta collection is a fun way to get the Manta community more involved in the social aspects of MantaSwap. A lot of people have been adorning their Manta PFPs. MantaDAO is also giving away 500 KUJI to a lucky Manta Squad Minter for anyone who retweets this tweet, follows the MantaDAO account on Twitter, and makes (any of) their minted Manta their Twitter PFP.

Part 5: ShrimpNFT

Overview

Shrimp Club (originally Shrimp Gang – named after the first NFT collection) is a project and a group of people who primarily operate within the Kujira ecosystem. The NFT collections themselves have their home on Stargaze. The group is most active on Telegram and Twitter.

The fundamental philosophy of the Shrimp Club is the redistribution of profits from sold collections and staking among the club members and the general public. The goal is to “feed the shrimps,” meaning to provide benefits to small investors and spread awareness about Kujira.

The Kujira community holds the ethos that everyone can become a whale. From the very beginning, community members used the term “shrimp” to refer to small investors who couldn’t match the so-called “whales” littered throughout crypto. Kujira brought these shrimps the opportunity to use tools that were previously only available to whales. And so, the term quickly caught on and began to evolve into a community meme.

On August 3rd, 2022, this mention stuck with one of the two founders of Shrimp Club, performing under the pseudonym LL, and shortly after, he decided to create a modest package of Telegram stickers. Shrimps quickly gained popularity within the community, and soon, ideas for creating an NFT collection began to emerge. DD joined LL, and together they started turning these ideas into reality. This led to the creation of an unconventional, humorous, and slightly irreverent collection that formed a strong community around it.

Update

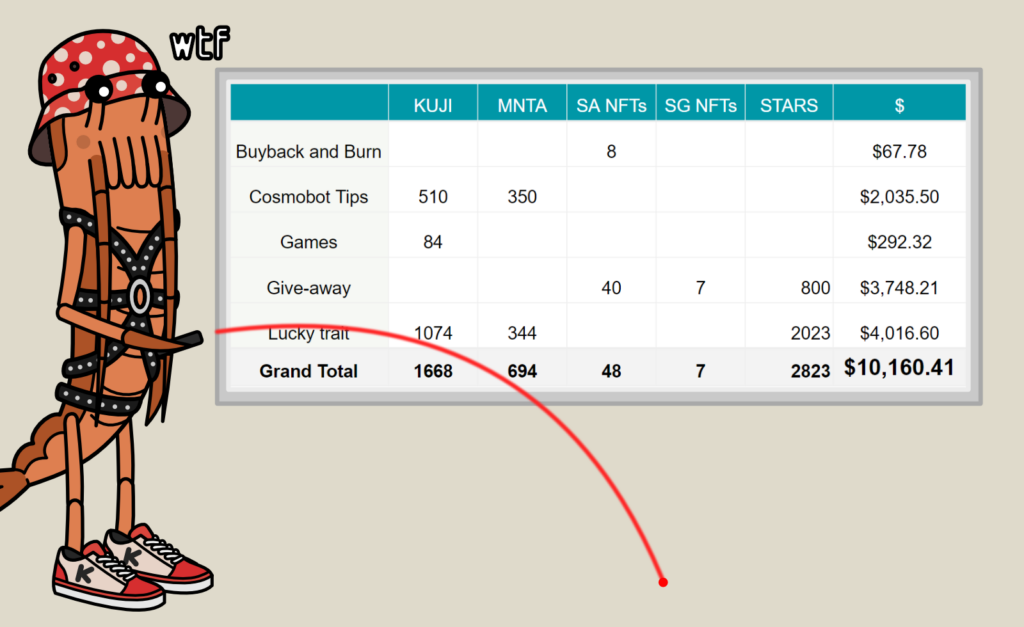

For those that know the Shrimp founders well, since the very beginning they have joked about creating a collection that would make holders poorer. However, despite that fact, the Shrimp Community are some of the worst attempted rugoors I’ve ever seen considering that they’ve given back to their community more money than they got from the mint at current STARS prices via various methods and the fact that their NFTs which minted for approximately $20 and now have a floor price near $600.

They’ve done just about everything from buying back shrimps, to sending tips to community members via Cosmobot, rewarding community members (specifically Shrimp NFT holders) for getting weekly high scores on games in their Telegram chat, handing out funds for various special give-aways with unique conditions, and performing monthly distributions to lucky trait holders who happen to own Shrimp NFTs with a particular sub trait of the month.

Aside from STARS’s price decline, Shrimps have consistently seen higher and higher floor prices, currently reaching nearly $600 to buy the cheapest Shrimp Gang NFT as they continue to be in very high demand and relatively low supply. Through months of perseverance and endearment, Shrimp Gang have established themselves as core parts of the Kujira community who bring joy (and chaos) to every chat they participate in. Aside from participating in the odd Twitter space and partaking in Twitter banter, Shrimp Gang actually have a methodical game plan for their future projects.

Next steps

Aside from the planned Manta collection, Shrimp Gang is considering a third collection (worked on by both Duarte and Lower Lows and a wider team) featuring Beavers that is separate from the main shrimp brand and possibly situated outside of Cosmos. This NFT collection is meant as an initial test to see if they have the potential to succeed outside of Stargaze. They’re also hard at work on a community shrimp collection. Duarte and Lower Lows are also considering exploring a launch on Solana or Polygon for a fourth shrimp collection to see if they can bring new community members into the Kujira fold. Finally, another collection is being planned on Maya that could directly benefit shrimp gang/avatar holders in an entirely unexpected way.

Aside from that, there’s some more juicy pieces of alpha. For one, KUCCI will be a governance token airdropped to Shrimp NFT holders. I’m not allowed to reveal more details yet (just that SG’s hold more value than SA’s towards the airdrop), but they’re hard at work towards making it into a successful launch and they’re going for a long-term approach in their execution. Second, they’ve announced NFTAAS–NFT as a Service. This should recontextualize what I said above. Shrimp NFT will offer their services and social reach to other projects in exchange for a share of the profits from their collections. This will allow them to continue funding operations, pay out juicy lucky traits, and further development. MantaDAO is their first partner via Manta Squad. Third, C3drik and Shrimp NFT are partnering for a Narwhal x Shrimp validator (C3drik will run the technical side and Shrimps will promote and try to get delegations). Duarte feels that as Shrimp NFT is a big collection, he wants to be present in Stargaze governance and give a voice to the shrimps. C3drik will vote in line with what the community wants. A long-time supporter and ally of Shrimp NFT who even funded its Discord, C3drik has been running his validator at a loss all this time. He is also validating on Nomic which has finally launched nBTC–so please consider delegating to him there too! Finally, https://t.me/shrimpleaking is a few week old official Shrimp alpha channel; there’s around only 10 members in there at the moment!

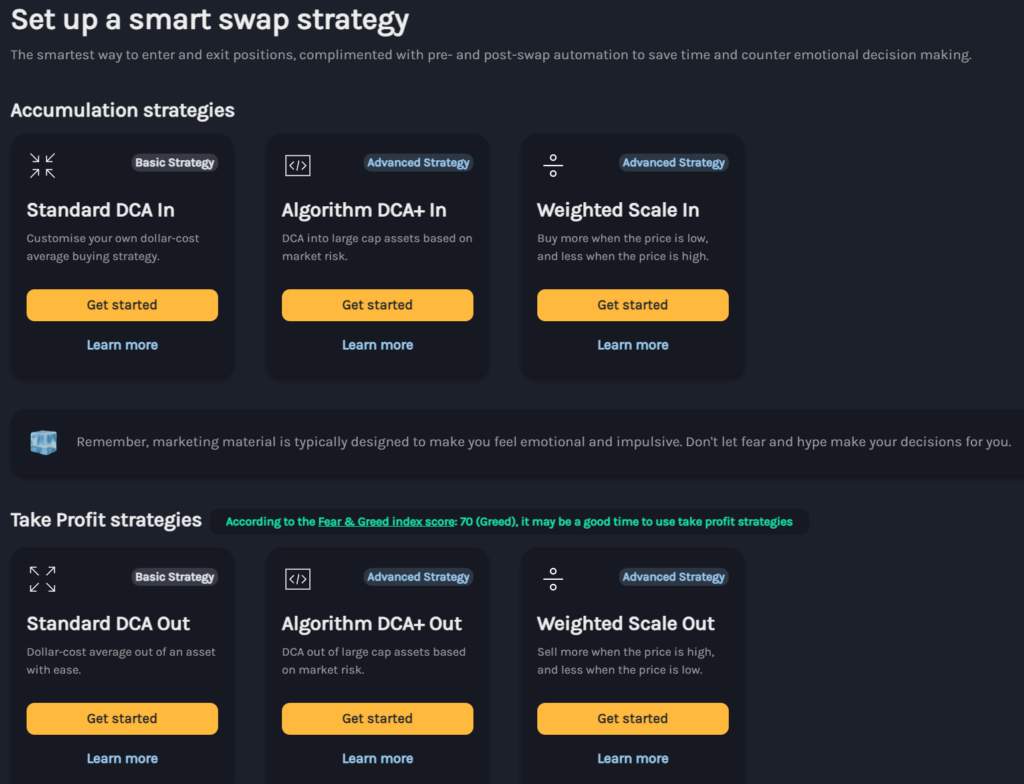

Part 6: Calculated Finance

Overview

Calculated Finance is a platform that provides users with a variety of sophisticated automated trading strategies. These strategies enable users to expose themselves to the market in ways that let them capture upside while avoiding downside. In short, it helps users acquire tokens at good value and take profits on them when appropriate.

Calculated Finance initially marketed itself as a dollar-cost averaging protocol providing advanced algorithms for long-term investing. Dollar-cost averaging is the practice of making recurring purchases of assets over time rather than buying all at once. The protocol has not only developed advanced DCA algorithms that leverage machine learning to outperform regular DCA strategies, but also swaps assets directly on decentralized exchanges & has a seamless user interface with top quality UX.

Over time, however, Calculated Finance has added so many effective ways to create ‘calculated’ trading strategies with sophisticated controls that this characterization has changed. Although Dollar-cost averaging is a risk-offsetting strategy, CALC’s main value proposition at the moment is moreso a set of more strategic value-acquiring (and value-exiting) strategies.

CALC Protocol users now use the platform well–employing weighted scale strategies with price floors & ceilings and looping. They aggressively accumulate (sell) assets when prices are low (high) by carefully selecting strategy sensitivity to price changes.

Update

Having solidified its base on Kujira. Calculated finance primarily focused in the short-term on expanding over to Osmosis to help image build for Kujira and help establish a soft partnership. CALC quickly became the second most clicked dApp in the Osmosis dApp store after its launch and reached over 350K swaps in just 50 days. At this point, CALC has achieved over 4.5 million swaps when counting both chains. It’s also hit over 5078 strategies over Kujira and Osmosis and over $5.081 million swapped in total.

Furthermore, the CALC dApp continues to innovate. Aside from adding various assets for DCA purposes such as IST and MNTA, it was one of the first non-Kujira dApps to enable support for native USDC, wstETH, WINK, yieldETH, LOCAL, which is rapidly becoming a Cosmos game changer.

Most excitingly, CALC has integrated Squid directly to its UI to make it easier for users to bridge their funds over in just one click before starting new strategies. The further launch of MetaMask Snaps by Leap Wallet has brought many new potential users to the forefront of heavy DCA machinery.

Meanwhile, the DCA+ challenge recently finished. As expected, despite the market being largely down only for most assets over the last few months, the DCA+ strategy performed admirably well and showed the prowess of the sharp minds at the protocol.

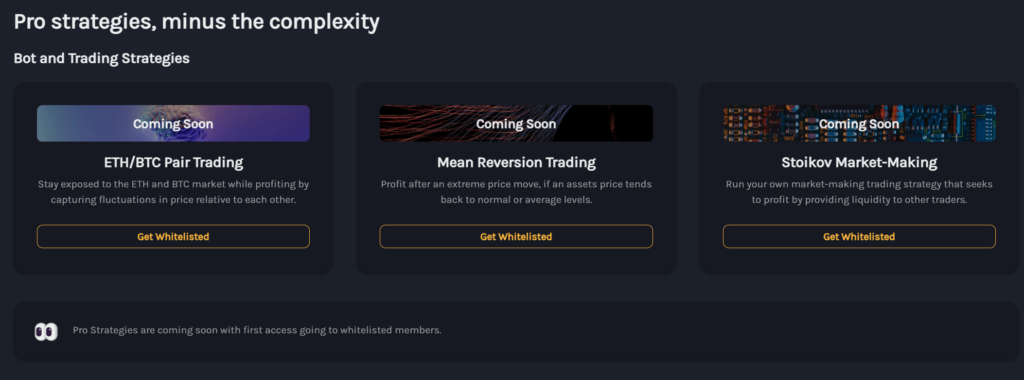

Next Steps

CALC’s main product has a few upcoming pro strategies.

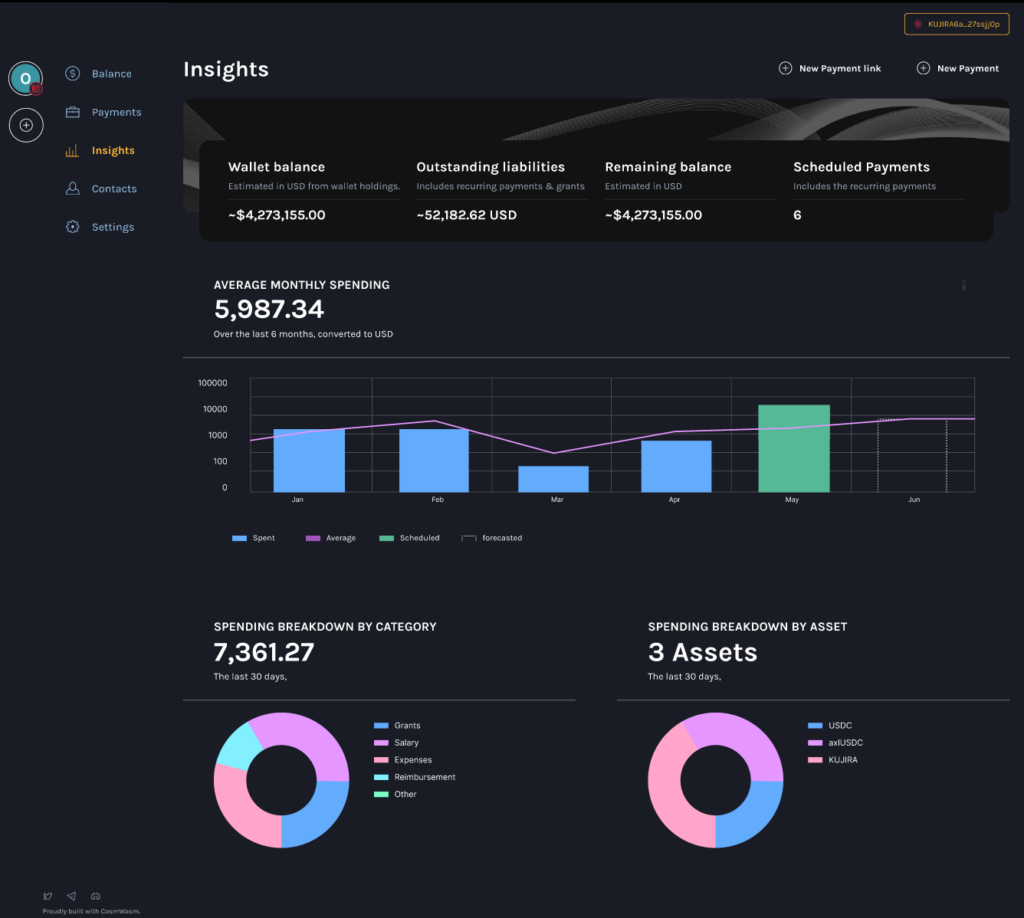

Aside from that, CALC is in the early stages of creating a new product prototype. For now they are still evaluating general feasibility, TAM, and other metrics before committing to development.

Their main idea is to create technology for organizations & builders to manage on-chain (and eventually off-chain) payments & track core accounting such as tax reporting, budgeting, etc. There is a big opportunity in this space to reduce startup burden by eliminating inefficiencies such as the need to manually send transaction IDs, employ google sheets, etc. So much startup work, such as legal compliance, relates to efforts outside of the value teams bring and have proficiency with. This can overwhelm and make it difficult for smaller organizations to launch and deliver the value they would like.

In essence, the most important features would allow users to manage current and future outgoings, view existing and future financial health data, and make better operational decisions accordingly.

Planned core conceptual features include 1. Authz powered payment links to avoid needing to obtain payee wallet addresses; 2. Private key based JWT authentication for storing and managing private contact and categorization data off chain; and 3. Chain agnostic user experience powered by Comoskit and IBC.

This three-tier combination would allow the product to initially be attractive to teams on various Cosmos chains–and eventually on different EVM networks or L2’s.

Part 7: Kujira Name System

Overview

Spearheaded by MintTheMoon, the Kujira Name System (KNS) is a full-featured on-chain domain name system providing much more functionality than a map from domains to wallet addresses. Decentralized finance needs decentralized infrastructure, and reliance on traditional DNS is an underappreciated problem without simple answers. The long-term goal of KNS is to provide some of these answers, and in the short-term wants to improve on many existing services.

Kujira Name System will use an auction system for Kujira Domain Names. Auctions will allow users to place bids with a base price determined by domain name length; and only a limited number of auctions with the highest bid totals can be opened. Once opened, existing bids are locked and cannot be withdrawn, only increased, until the end of the open period when the auction is closed and a winner is chosen. Limits and durations are configurable by governance so they can be adjusted as capacity and demand evolve over time.

An initial base price structure is 20 USK for names with 5+ characters, 100 USK for names with 4+, and 500 USK for names with 3 characters. The platform commits to 80% revenue share with stakers. 80% of all auction proceeds (all in USK) will go to KUJI stakers which has huge potential for revenue generation.

Planned features include KNS gateway which means that one’s KNS record can point at content hosted with IFPS or link to the traditional internet with an IP or DNS name. All related records are supported on-chain and will be queryable on Kujira and accessible at yourdomain.kujira.link. Another planned feature is ICS721 support which will allow cross-chain NFT transfers (for moving KNS domain NFTs wherever you want). Finally, MintTheMoon wants to introduce owner auctions which can function as price discovery mechanisms for new tokens–something that he wants to be available to holders as well.

Update

MintTheMoon and his team have been hard at work on KNS this year. His team has been taking their time to make sure their solution is the best it can be–a solution the community will get their hands on soon. At the current pace, public testing for KNS will be open by the end of the year.

I have also gotten some new alpha. Mint’s team is also building Ursula–a smart contract auction house with the ability to trade just about anything that can be represented on a chain. You might have seen that Kujira News already made an announcement about this a few days ago–as Romano misses nothing. However, I have some extra details for people who want more.

Next Steps

The unique auction system in KNS is built to discover a fair market price with a minimum of transaction spam. Ursula will be the engine powering these auctions, and that functionality will be open for any and all apps to integrate in, themselves.

There’s an incredible amount of potential and many exciting possibilities using this technology. For one, on top of this framework, it wouldn’t be too difficult to create a Kujira-native NFT market with minimum transaction spam.

The wider Kujira community has more than enough brilliant devs and diversified protocols to come up with multiple interesting use-cases built on top of this massive innovation. MintTheMoon encourages individuals and teams to reach out to him if they have a good idea in mind.

Part 8: Kujira Academy

Overview

Kujira Academy–an initiative led by Peruggi and Kid Kuji–is a program with four main components: content creation (multi-lingual, high quality newsletters, interviews, protocol deep dives, and group projects), a student ambassador program (getting students involved, opportunities for employment and compensation), a Kujira Academy Twitter (featuring student content), and NFT Hackathons (pitching projects in a detailed group format to inspire collaboration and community networking).

Update

The duo have had an exciting last few months. In that span of time, they have launched a litepaper detailing some of the program’s specifics and gave Kujira’s community a first look at what’s soon to come.

Peruggi has been doing rounds presenting about Kujira at universities while also building out the program. As a result, he and Kid Kuji have already gathered their first cohort of student ambassadors from educational institutions including University of Noottingham, University of Glasgow, and Coventry University among others.

Next Steps

The first few pieces of Kujira Academy ambassador content have now launched on the WinkHUB platform, on their Twitter, and on their Medium. And the team continues to present to more universities as we speak as the program continues to expand and gain more legitimacy as it organizes various initiatives to incubate high quality talent for the ecosystem .

Make sure to check out the Kujira Academy twitter to get real-time updates.

Part 9: Plucky Penguins

Overview

NOOT NOOT folks. Plucky Penguins (PP) is a new rising NFT project on Kujira, masterminded by Kuji Peruggi. The 1000 NFT Penguin collection will come in two rarities: normal (900) and gold (100) priced at $50 each to mint.

Plucky Penguins distinguishes itself in a few ways from other NFT projects. For one, Peruggi plans to use the mint proceeds to raise over $90K of BTC and ETH liquidity that’ll be deposited on BOW in Kujira. In the weekly Cornucopia, 5 Plucky Penguin NFTs will be randomly selected and their owners will receive a week’s worth of all derived BOW yield. As a result, the mint will almost immediately pay itself off for any weekly winner. For the drawing, gold penguins are worth 4x voting power.

But that’s not the only major innovation. Plucky Penguins has a unique background storyline based around other Kujira NFT projects and their communities including the Mantas (Manta Squad), the Whales (Kujirans), and the Shrimps (Shrimp Gang). The four factions are fighting (or allying) for survival in a dystopian world following an unexpected overwhelming ice age. Each week, the outcome of polls and competitions on social media between the four collections will dictate the story’s progression–with the story being published weekly on Twitter and Medium. Your choices and activity within the Kujira Ecosystem will have direct consequences within the fictional world.

Update

Over the last few months, Plucky Penguins has launched a bustling Telegram and Discord in recent weeks. Contributors have gotten incredibly excited and created all sorts of NOOTurally amazing memes.

Next Steps

The project goes hand in hand with Kujira Academy in terms of increasing Kujira’s mindshare and overall presence in both the wider public eye and DeFi landscape. It’ll also help unique the Kujira community and get more people involved in all the related crazy antics of the fight for survival. At the same time, Plucky Penguins is expanding into the Injective, Cardano, and Solana communities–uniting penguins together and bringing enhanced general awareness of Kujira’s sustainable real-yield approach.

So far, the project has already been going on a veritable bonanza using all sorts of clever games and events for whitelist seekers to get involved and participate. They’ve also been appearing on Twitter spaces including one with the WinkHUB founders.

Dig more into Plucky Penguins by reading their introductory Medium article.

Section III

Part 10: Kuji Kast

Overview

WinkHUB’s founders, Maximus and Danny, are the passionate brains behind Kuji Kast, Kujira’s beloved community media duo. Kuji Kast is a weekly (sometimes bi-weekly) Kujira community podcast that often interviews protocols or other high-profile members of the community with exciting, colorful twitter space segments that give deep-dives and unique up and personal glimpses into protocols and teams. The two have conducted a multitude of interviews and other sorts of community event spaces across various platforms including YouTube and Twitter.

Update

Kuji Kast have created a bunch of stellar content including funny informative videos about Kujira, builder & founder interviews, gamified contests, and community spaces. Their goal is to share the Kujira vision in a creative and fun way.

In just the past three months, they’ve managed to interview LOCAL, Plucky Penguins, Kujira Academy, Maya, Nami, Gelotto, and Fuzion, as well as host multiple spaces on WinkHUB and Kujira in general. I still haven’t gotten them to interview me yet. #rugged

They are intelligent, insightful entertainers who know more about this ecosystem than anyone else bar the team. You can get a better sense of their values and vision in the first ‘Kujira is for everyone’ spotlight series article. Having worked with them in the Senate, I can firmly say they’re good, hard-working people who take their responsibilities seriously. They were the only two Senators who attended every single Senate meeting–yeah, even I missed one.

As Kujira content creators who have been with Kujira since even before it first launched on Terra, the team constantly makes new friendships and partnerships with different teams and players all across the ecosystem. And they fully intend to bring all inculcated value there-in back to WinkHUB as they make it grow.

Next Steps

Kuji Kast plan to improve their platform and make more content that delivers value to the Kujira community. They have demonstrated continued community commitment. They put effort into the Senate daily for months; constantly perform deep-dives and investigations into ecosystem protocols; and are building a Kujira content hub (at zero cost to Kujira) solely focused on spreading its brand, ecosystem, message, and content. I look forward to what they do next.

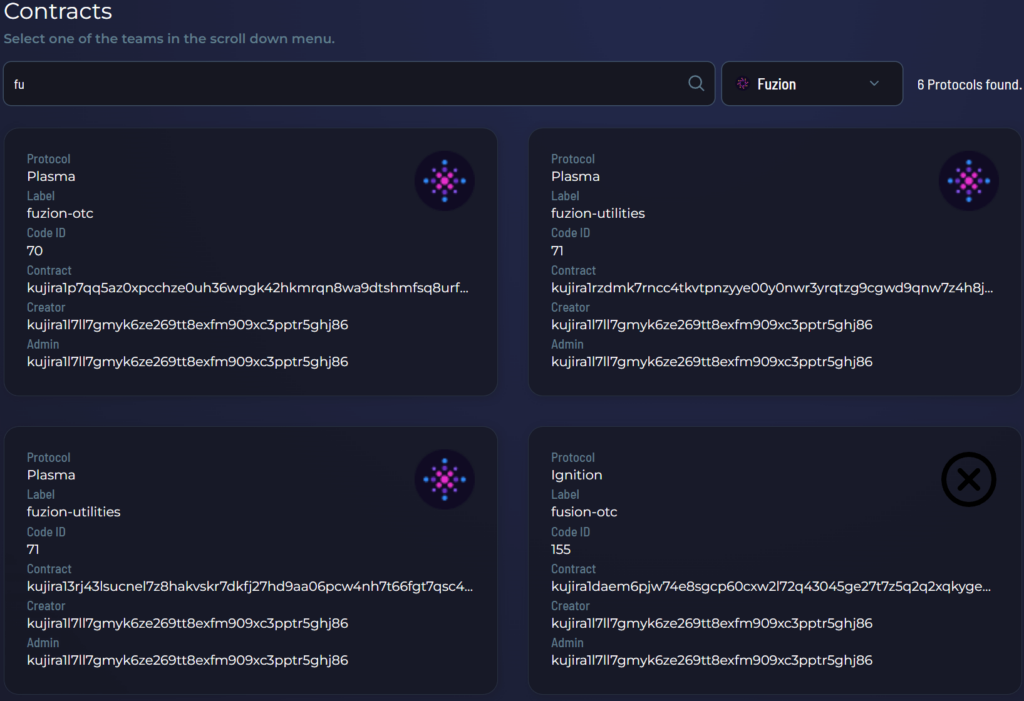

Part 11: Fuzion

Overview

Fuzion is a Kujira project (formerly known as Atlo) responsible for shipping both Pilot, a one-of-a-kind fair gamified launch mechanism leveraging ORCA’s UI, and Plasma, an Over the Counter (OTC) portal enabling users to set up and find deals using a variety of tokens.

Fuzion, much like Kujira at its inception, seeks to offer a variety of related products that all tie back to a shared overall vision. It wants to provide a high quality experience that empowers users with new funding opportunities. Fuzion specifically focuses on access, convenience, collaboration, and technology. Their products are aimed at a range of folks including founders, builders, whales, and shrimps.

Update

Fuzion have been hard at work on their product line over the last few months. They have continued to improve PILOT and upgrade Plasma while courting teams to use their existing (and upcoming) products. Both MantaDAO and LionDAO have used Plasma to distribute their tokens in targeted OTC sales to their community members in order to improve protocol decentralization. In particular, through multiple Plasma OTC MNTA distributions, MantaDAO was able to accumulate a substantial amount of protocol owned liquidity. Fuzion plans to add the ability to make OTC deals with LPs as well, which will open many new possibilities for protocols looking to acquire or trade away specific types of liquidity. In practice, such LP trading will likely be most attractive for users of their two new upcoming products.

At the same time, Plasma’s main smart contracts were upgraded to V1.2.1 and the Flows V1.0.1 contract was also instantiated which enables the Plasma OTC type for Ignition deals and flows. Fuzion uses ‘Flows’ to refer to the vesting and cliff schedule created by deal makers that govern how the deal Taker receives their tokens.

At the same time, Fuzion has worked on the migration infrastructure for the FUZN token in preparation for the right timing. Now that Fuzion will have multiple products creating revenue for their stakers, that’ll be a gamechanger for the relaunch.

Recently, the NSTK token saw heated trading OTC on Plasma before being listed on FIN a few days ago. NSTK accounted for about $80,000 on Plasma with almost 1 million NSTK traded. This demonstrates the power and appeal of Fuzion’s over the counter decentralized solutions such as Plasma.

Furthermore, in other exciting news, Fuzion kicked off their ATLO token migration from Terra to Kujira today. The token supply has been shrunk from 200 million tokens to 175 million tokens total. This means that holders will end up with 12.5% proportionally more tokens as a result.

Next Steps

Most importantly, Fuzion is soon to launch Bonds (very soon) and Ignition, two game changing protocols that will add ‘Flows’ into the mix to allow protocols, DAOs, chains, and other organizations with existing tokens to fundraise either short-term or long-term with minimal price impact by using targeted whitelists as part of turbocharged community marketing campaigns or liquid bonds with distributed vesting schedules. Bonds and Ignition will be particularly exciting products. MantaDAO and LionDAO would have been able to use these two protocols to do similar fundraising for community token distribution and protocol owned liquidity acquisition with negligible price impact while preserving their immediate access to funding. I’ve actually written a piece on Bonds–as I think the product has a lot of potential that will bring Kujira’s DeFi composability to the next level.

Part 12: Kujirans NFT

Overview

Kujirans NFT is a Kujira community NFT project initially launched on Stargaze by two passionate community members–Velcro & D–who wanted to help create a stronger alliance between Kujira and Stargaze and deliver value back to the Kujira community. According to Velcro, “this was in large part designed as a way to thank the team for their actions post the unfortunate events that saw us leave Terra and become a sovereign blockchain, saving an entire community and thousands of portfolios along the way.”

The initial collection of 4444 NFTs, initially priced at 999 stars each with 5% royalties, had a variety of 4 species who represent the inherent diversity of the Kujira community: whales, sharks, krakens, turtles, and a hidden species ORCAs. The large collection was carefully created with a variety of gamified traits to ensure that no particular feature such as rarity or appearance would determine the perceived value of the Kujiran which kept many holders happy even with lower rarity Kujirans.

Kujirans’ journey parallels that of the KUJI token and the community we forged along the way. It was always designed to be an evolving community project. Like Kujira, Kujirans NFT battled the headwinds of a merciless bear. Despite launching on the very week of FTX’s demise, Kujirans persevered and successfully minted out, giving 50% of mint revenue to KUJI stakers, significantly boosting Kujira’s revenue and staking APR.

In total Kujirans NFT contributed over 100k USD back to the Kujira ecosystem without receiving funding other than from their successful mint thanks to the unwavering support of the amazing KUJI community.

Update

The team has continued to work on developing the connected KUJI Island game & work on various community collections such as Kujimon that will accrue value back to the first collection. The team’s networking and partnerships have contributed to the project’s status as rarely being outside of the top collections on Stargaze. The collection has achieved the 11th highest all-time volume on Stargaze, with a current total volume of 5,770,252 STARS.

The Kujirans collection floors have risen in STARS denomination over time for each species based on their perceived rarities from 999 STARS to 6.68K STARS for krakens, 6.69K STARS for whales, 11k STARS for turtles, 22K STARS for sharks, and 100K STARS for ORCAs. Also, approximately 114 Kujirans have been burnt since inception.

Recently, Kujirans have established a partnership with the Necropolis NFT marketplace and Backbone Labs. This has allowed for migration of Kujirans to Necropolis where they can be staked in order to earn bKUJI and receive a SOUL airdrop which will capture value from all the Gravedigger collections.

As Kujirans will be a genesis collection on Necropolis, with the NFT marketplace’s early stage, the Kujirans team are looking forward to receiving extra focused support and DeFi expertise from the Necropolis team to complete development of their game which will live on Migaloo and create even more DeFi infrastructure built around the project.

Next Steps

The Kujirans team hopes that with the inculcation of a DAO and a vibrant, blossoming community of NFTfi degens on Necropolis, they will have all the components for another symbiotic and extremely beneficial partnership for not just Kujirans NFT but for the entire KUJI Community.

Kujirans’ NFT partial migration may also be a first of its kind, but they assure that Kujirans holders who remain on Stargaze will be supported by the project and benefit from a reduced supply along with much more still to come. The team is committed to continue to create new ways to bring KUJI front and center in both emerging and established communities.

From its roots, Kujirans is a passion project designed to benefit the Kujira community and ecosystem, whilst rewarding holders in a continually evolving gamified setting. They envision it as a community led marketing and ecosystem partnership incubator that will always prioritize its holders and the underlying ideals of what it means to be Kujiran.

The recent partnership with Backbone Labs is testament to this. Holders now have the option to migrate to Migaloo and join the Gravedigger collection which brings with it the benefits of a community owned LSD in the form of bKUJI which will generate and add value/composability to the entire ecosystem.

Part 13: Blend Protocol

Overview

Blend Protocol is a platform that gives DeFi users access to advanced yield strategies on different Kujira and Cosmos protocols. The product was inspired by the idea of mixing and blending assets, hence its name. The protocol is built such that it only takes a single click from a user to deposit their funds, and then the Blend strategy will manage the rest, until they elect to withdraw their investment. An example of a Blend strategy is their flagship BOW strategy which will utilize BOW vaults and capture related yields to generate returns for Blend vault depositors. It’ll automate the process and make it simple for the end user so they don’t have to worry about any intermediate steps. Blend is open to facilitate all sorts of creative strategies on Kujira and to synergize with Quark, MantaSwap, GHOST, BOW, and various other Kujira protocols.

Update

Over the last few months Blend Protocol have worked with the Senate to get approved for protocol funding and have had their smart contracts audited by Resonance Security to deploy on Kujira Mainnet. At the same time, the BLEND token and tokenomics were carefully drafted in preparation for an OG pre-sale. Unfortunately, the sale was ultimately delayed to a new future date albeit with the promise of more attractive prices for OGs.

Since then, the team has opened a Blend closed-beta that has given access for select early supporters to test out the protocol and provide feedback to the team. The product is in beta on testnet and contracts are already deployed on the mainnet.

As protocol development began in April, the team was forced to build with limited resources during the bear market. As a result of the team facing unexpected headwinds, they have been searching for new ways for sustainable development in order to confidently ensure a high quality launch of Blend to the Kujira community in the future. Unfortunately this search has not seen the expected results so far.

Next Steps

As per the Blend team–“The Blend team is very sorry that this force majeure happened. Once there is, we hope, a new and clear path, we will share it with the Kujira community. We thank everyone for the support they’ve given us.”

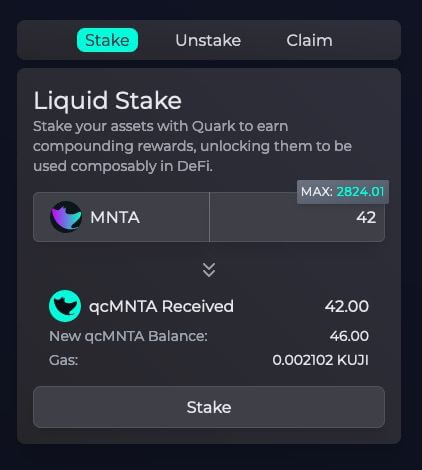

Part 14: Quark Protocol

Overview

Quark Protocol, created by Entropic Labs (and in particular Amit, also a Kujira team member) plans to bring the most advanced and composable Liquid Staking primitives to Kujira. Quark wants to revolutionize Liquid Staking Tokens (LSTs) and will live in Kujira’s complete and integrated DeFi ecosystem. Quark’s potential integrations with the Kujira-native dApps like GHOST, FIN, ORCA, BOW, etc. enable countless strategies. These include easy cash-flow manipulation, innovative DeFi strategies, self-repaying loans, yield tokenization, and more. Quark’s goals align with Kujira’s vision and ethos.

On a big picture level Quark stands out in a few major respects. It is tailor made and built from scratch to be as composable as possible with existing and future Kujira products. It will unlock powerful strategies that increase capital efficiency across markets within Kujira. It boasts a very exciting roadmap. Its grand vision increases Kujira’s sovereignty and cements it as a center of influence across the interchain. And as Amit is a Kujira dev–he has extra insight into the dApps and how to work with them.

Quark will use Mantaswap as its underlying swap mechanism.

Update

In the two months since Quark was announced, Amit has been hard at work building Quark. In the time since launch, Quark’s funding proposal (milestone 1) passed MantaDAO governance–and they received 50,000 MNTA to develop a highly integrated suite of DeFi protocols.

Quark launched on mainnet yesterday supporting both qcKUJI and qcMNTA. qcKUJI and qcMNTA respectively are auto-compounding, liquid-staked derivatives of KUJI and MNTA.

Ledger support was also integrated in yesterday.

The protocol can be accessed at quarkprotocol.com.

Next Steps

Quark’s public roadmap is substantial. After supporting KUJI and MNTA via qcKUJI and qcMNTA, he is now focusing on qsKUJI and qsMNTA, which will also consolidate and compound KUJI and MNTA staking rewards. Next, Quark will support qcKUJI & qsKUJI followed by qc and qs LSTs for other Kujira-native tokens over time. After that are yield tokenization protocols built on top of Quark LSTs. Then the larger vision of external Cosmos-wide LSTs and also self-repaying loan infrastructure. Unstake.fi unlocks a lot of new functionality and possibilities for Quark Protocol that allow Amit to focus on building the core machinery which will unlock even more integrations for the Kujira ecosystem moving forward.

Part 15: LocalDAO

Overview

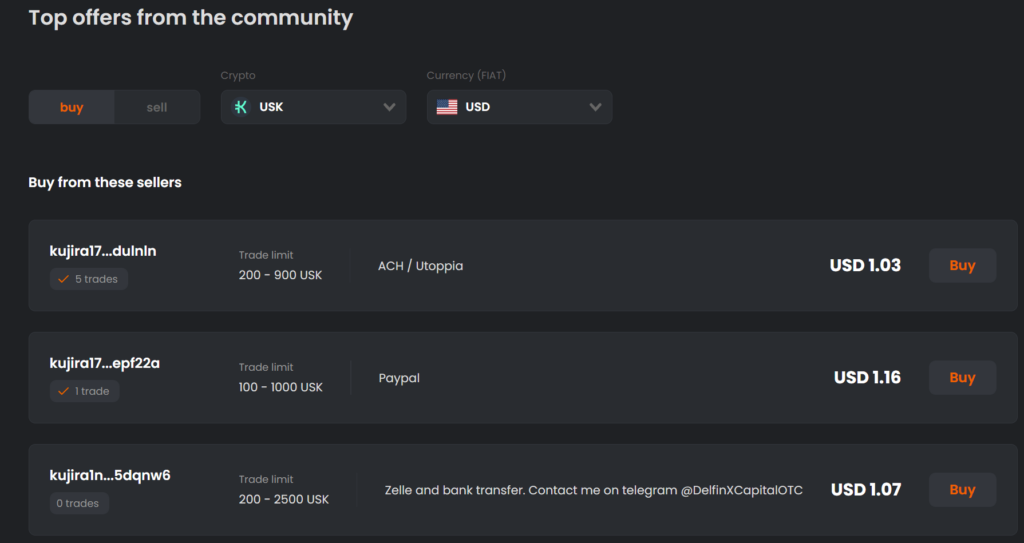

LocalDAO (formerly LocalMoney) is a decentralized peer to peer (P2P) marketplace for the multi-chain world. Local has a few main goals: 1. to decentralize the ramps; 2. pave the way to DeFi adoption; and 3. create a uniquely designed P2P service.

Local aims to build a trustless platform giving customers transparency and accessibility to essential financial services while helping them escape government induced inflation.

Local plans to drive the adoption of stablecoins and DeFi among the masses by connecting people and technology in a decentralized way. The main idea is a smart contract based platform that allows users to exchange any fiat currency for stablecoins and tokens, which helps eliminate the custodial risk of centralized exchanges when converting to and from fiat. Local aims to be the shortest route between your wallet and your bank account.

Local emphasizes decentralization in everything emphasized by the lack of control of a central entity over users’ accounts or funds. The trade between buyers and sellers on the platform are completely decentralized and P2P. By leveraging Smart Contract technology, they have developed a protocol where users (Makers) that provide liquidity between stablecoins, tokens, and fiat currencies can create offers and accept trades from other users (Takers). While doing a trade, the seller deposits the crypto asset into an escrow contract, the buyer makes the offchain fiat payment and notifies the seller, the seller can then verify the payment and release the escrow accordingly.

Update

LocalMoney is relaunching as LocalDAO, a community owned, fully decentralized P2P protocol on the Kujira blockchain. For the past 6 months, Bat Razors and Sam AKA Desamtralized have worked to keep the Local protocol in working shape–and over time have gradually built partnerships with other protocols and chains interested in having access to on/off ramps using Local P2P.

Based on all the upcoming catalysts the LOCAL token saw gains of over 2000% over a few days. A testament to the hard work the two have put into reviving the platform.

Next Steps

On October 30th, the DAO launched at localdao.money, where the community will have the opportunity to stake their local tokens and participate in governance, voting on the many exciting proposals in store.

Speaking of incoming proposals, two of the most significant proposals aim to reduce the reduce the total max supply of LOCAL from 240 million to 24 million tokens and implement rewards for stakers, using a tokenomics mechanism, where 90% of platform revenue will be directly shared back to stakers who help secure and govern LocalDAO.

Local has incoming partnerships with El Dorado and Maya, which will surely drive a healthy amount of volume to Local and Kujira. Furthermore, I’m not allowed to name names quite yet, but there’s been talks with an OG protocol about providing a new arbitrator service for any platform dispute resolutions, which will bring even more peace of mind to every user.

As a final message from Bat Razors who has spear-headed the platform’s transformation into a DAO: “The road ahead looks bright for Local, as it positions itself to be led by its community. Let’s build together!”

Part 16: Ghosts in the Chain

Overview

The origin of Ghosts in the Chain is simple. We’ve all been through the ringer with Terra, FTX, and all the rugs and scams. Life is hard enough, so let’s come together and be Frenz. GITC combines NFTs with DeFi to have something for everyone. If you’re looking to make some Frenz, have a good time, maybe win some cool prizes, and get surprised from time to time, then look no further than the exclusive Ghost Frenz Pixel Club.

Ghost Frenz will consist of multiple collections under a unified brand. For the time being there are two different collections with different underlying mechanics and principles.

The first collection is the ‘genesis collection’ of Ghost In The Chain (GITC) which combines art, passive rewards, and a redeemable backed value to its holders–a first of its kind in Cosmos. To make the project accessible to as many people as possible, it used an affordable mint price of 333 STARS, with a total supply of 3333 of Ghosts. Ghost Frenz holders vote every 4 weeks on reward allocations. Holders decide the % of accumulated rewards to get added to the backed value made of KUJI, the % distributed to holders, and the % compounded to earn more rewards.