Table of contents

Intro to ORCA

ORCA is the first product from Kujira, a team dedicated to making dApps which make DeFi accessible to everyone.

ORCA’s intuitive design makes the liquidation process simple to navigate.

We’ve made a silky smooth UI and everything from placing your bids to withdrawing your earnings is little more than a few clicks.

This article is a companion piece as you venture into your first liquidation bids.

We’re confident you’ll get the hang of it quickly, but if you run into any trouble, our enthusiastic Telegram Community is always eager to help.

It’s liquidation time

Don’t worry, you don’t do the liquidations. ORCA takes care of that. You have two decisions:

- How much to bid.

- Which premium to bid at.

Bidding

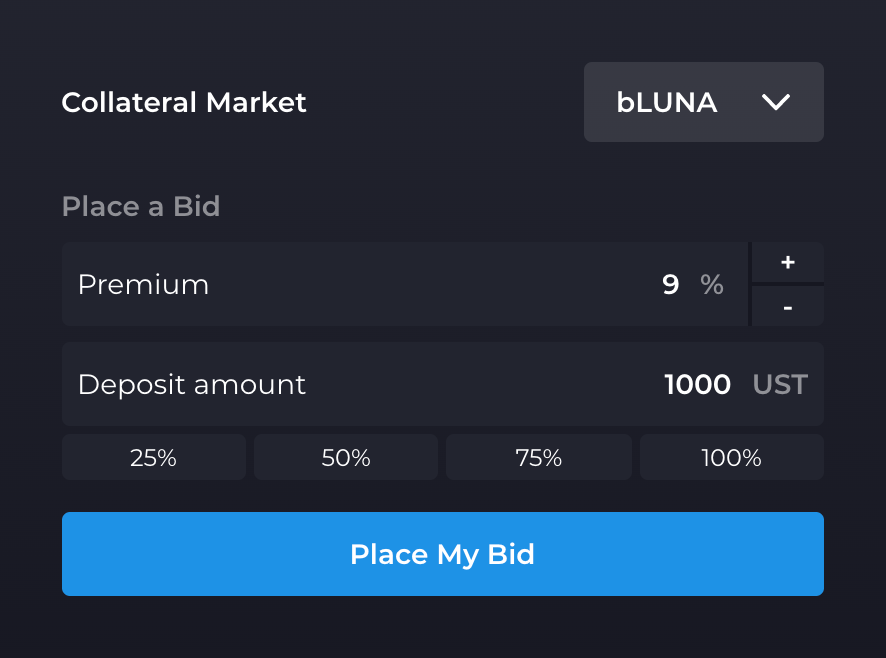

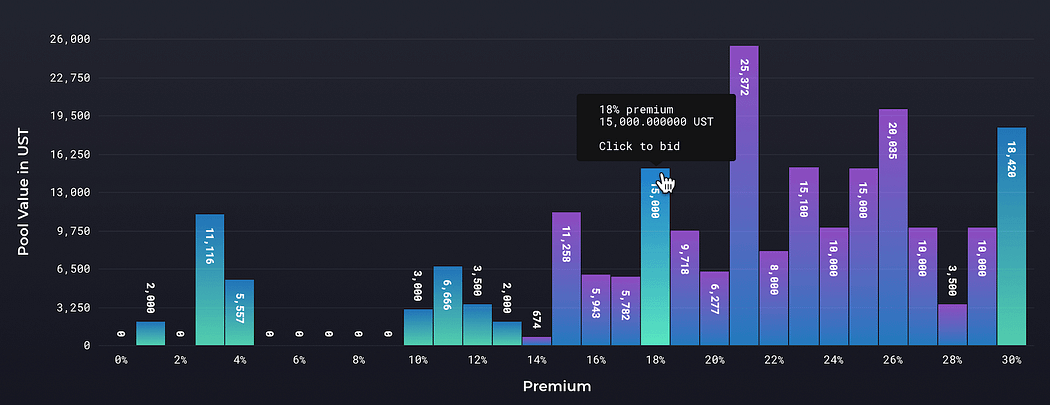

The size of your bid is completely up to you. There are no minimum or maximum amounts. Choose the amount you wish to bid and hit the blue button marked, “Place My Bid”. ORCA’s dashboard shows the total value of bids at each premium, and the premiums at which you have placed bids.

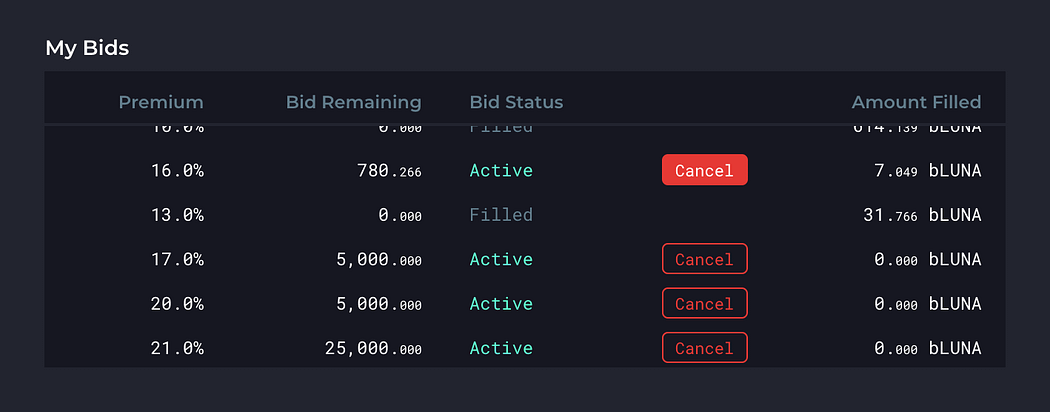

Yup, you can place bids at as many premiums as you like.

Premiums

The premium is the discount received by the bidder. It starts at 0%, goes up to 30% and the smallest premiums are satisfied first. Assuming there are enough loans to liquidate, all the bids at the lowest premium are utilized before the next highest are activated, moving steadily upward until there is no more collateral to liquidate or no more bids.

Withdrawing bASSETS

When you’re ready to call it a day, it’s time to withdraw your bASSETS. Simply click on the green Withdraw button, confirm the transaction on your wallet, and the bASSET will be removed from ORCA and placed in your wallet.

Cancelling bids

The same goes for your bids. If you decide to cancel your bid to re-deploy at a different premium (or move from bLUNA to bETH) scroll down to the table marked “My Bids” and click the red Cancel button next to the bids you’d like to, you know, cancel.

General info

There’s some background knowledge you need to better understand this process. Here’s the steps to placing your first successful liquidation bids. We’ve added every step we can think of, so skip the ones you already know about.

You’re gonna need a wallet

If you haven’t already downloaded the app, or the Chrome extension, you’re gonna need to start there. Remember to take all necessary precautions with your passwords and seed phrase. Load it up with some UST and you’re good to go.

What’s a loan?

When an individual wants to borrow UST, they deposit collateral with Anchor in the form of a bonded asset. This is currently either bLUNA or bETH. We go into more detail in this intro to liquidations.

The loan in this instance is the UST that Anchor loans to the borrower.

This loan has terms attached to it; if the borrower is unable to meet these terms, the loan is liquidated, and the borrower forfeits the collateral they had bonded.

When this happens, a liquidation occurs.

What’s a liquidation?

Anchor loans out UST equal to a maximum of 60% of the collateral bonded. When that ratio tips past 60%, the loan is deemed to be at risk and in danger of liquidation. This happens because the loan is in stable UST, but the collateral (bLUNA, for example) fluctuates in value.

Bottom line, when the value of the borrower’s collateral goes down, their loan could be deemed at-risk.

A third party then steps in to pay up the difference. In Anchor’s case, that third party is ORCA users (i.e. you).

What happens when a liquidation occurs?

When a loan is liquidated, the lender seeks to recoup the UST they loaned out.

This is the liquidator’s role: they pay up the difference and make the lender whole.

The lender rewards the liquidator for this service by selling them the collateral at a discounted price compared to the going market value. The size of the discount is known as the premium, and on ORCA, you choose a premium from one to thirty percent.

An example

Bob has some LUNA. He mints $100 of bLUNA in Anchor and then deposits it. He’s eligible to borrow $60 of UST, which he may use however he likes.

Meanwhile, his buddy Ross has $100 UST, which he bids at 30% on ORCA.

Crypto is a volatile market and some FUD makes LUNA’s value slide. Bob’s $100 of bLUNA is now worth $95, and his loan is at risk.

ORCA leaps into action, and Ross’ bid comes into play. Bob’s loan is liquidated, and Ross receives the bLUNA at the premium he bid on.

The end result stands like this:

- Anchor (the Lender) gets the $60 back they had loaned out by “selling” the bLUNA Bob bonded.

- Bob has the $60 he borrowed, but the bLUNA is no longer his*.

- Ross has $95 worth of bLUNA, which he paid $66.5 for. Ross still has $33.5 left in the ORCA contract should any other at risk liquidations pop up.

*Fortunately for Bob, the token he bought with the UST he borrowed does pretty good. At Kujira, we like it when everyone has a happy outcome.