We’ve brought bidding in aUST to ORCA1, and it really is a game changer. Bids in UST waiting to be hit aren’t adding value to your portfolio. We’ve fixed that. We’ve made a few other adjustments too.

For those that prefer video, here is a detailed but concise rundown by the guys at Yield Labs 👇

Table of contents

- aUST bid access is for everyone

- Convert UST bids to aUST bids

- Fixed fee withdrawals

- What we do with the interest

- Placing a bid in aUST

- LTV is now “Risk Ratio”

- The new aUST dashboard

- Still to come

Now let’s cover some essential details.

aUST bid access is for everyone

We’ve made aUST access for everyone in line with our core mission. It will also maximize the rewards for KUJI stakers, which is a big win-win for everyone.

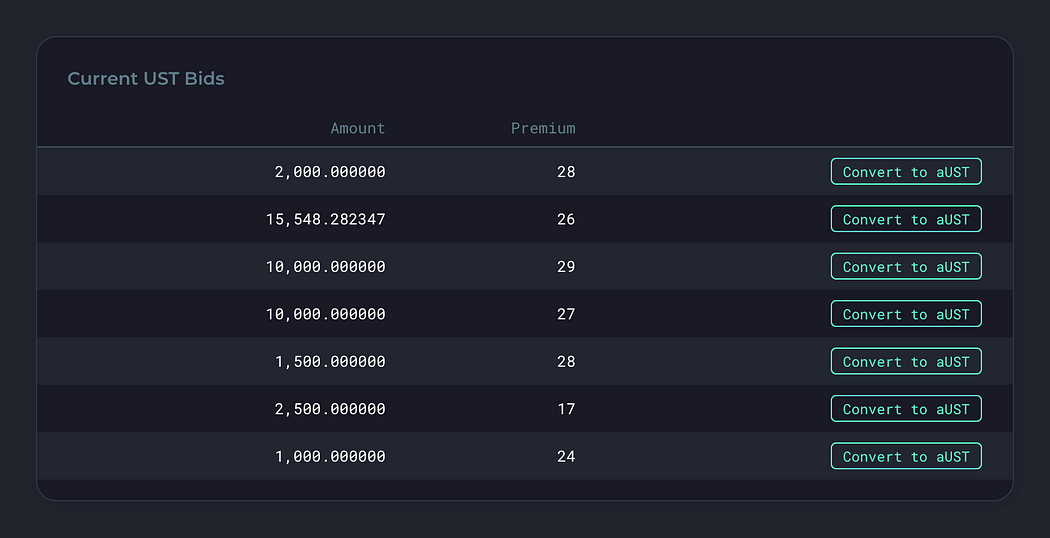

Convert UST bids to aUST bids

If you have existing bids in UST and you’d prefer them to be in aUST, you can convert them literally at the click of a button here.

Fixed fee withdrawals

We now charge a fixed fee of 0.5% across the board for a withdrawal. These are paid in the bAsset earned (bLUNA / bETH etc). As an example, if you’re withdrawing 1000 bLUNA, you’ll get 995 bLUNA in your wallet, and 5 bLUNA will go towards the fees. These fees are then paid in full to $KUJI stakers.

What we do with the interest

We retain 23% of the Anchor Earn yield that comes from aUST bids. This interest is also paid back in full to stakers. Currently paid in $KUJI, but look out for a proposal very soon around how rewards are distributed to stakers.

Placing a bid in aUST

Bidding is done in the same way as UST bids, only now there’s a drop down button next to the bid amount, where you choose from UST or aUST.

Simply select aUST from the bid amount dropdown selector.

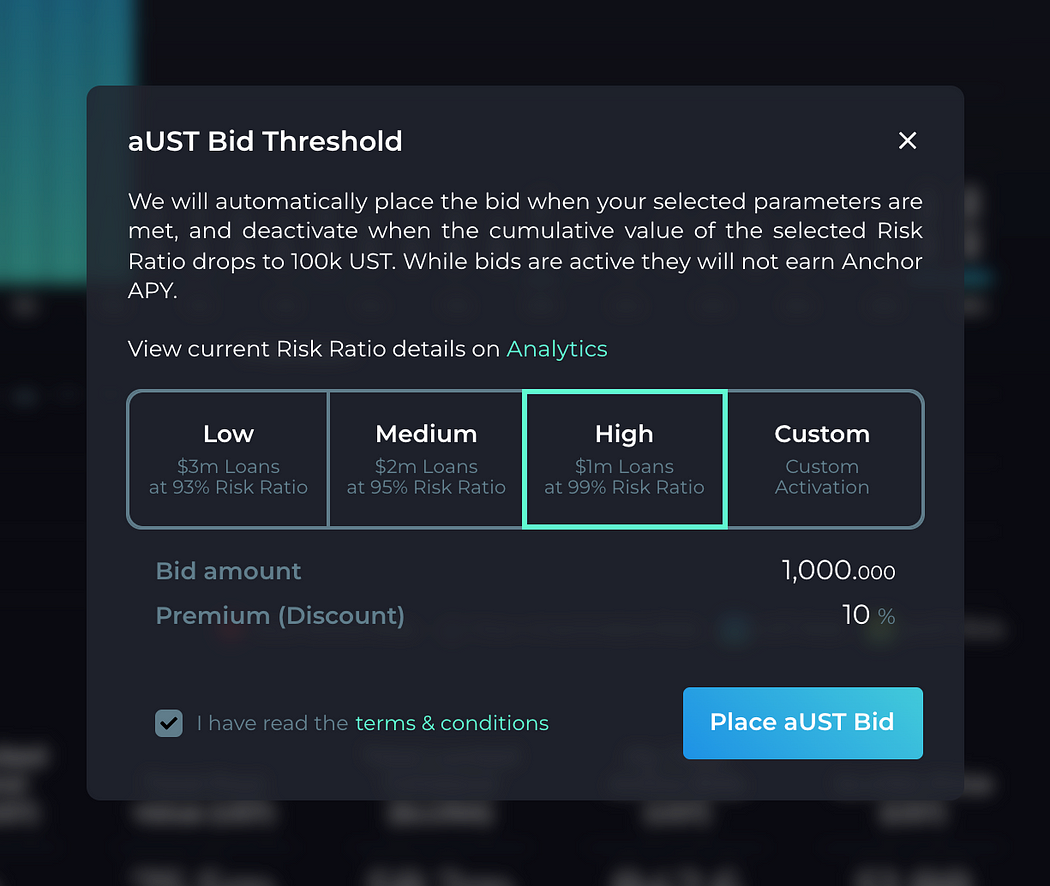

After selecting the premium that you’re targeting, we move to the next screen which is unique to aUST bids.

This is where you choose your bid threshold. When the cumulative Collateral Value (UST) for a given Risk Ratio is hit, the bid is placed. You do not earn interest while the bid is placed.

When the collateral value drops to 100k UST, your bid is retracted and converted back to aUST, and continues to earn interest.

Simply put, “Risk” here refers to the risk of missing your bid.

If you want to lower the chance of that, choose low. If you’re happy to run the risk of missing a bid in favor of leaving your funds in aUST a little longer and earning interest, choose high.

For the power users out there, you can select a custom bid threshold. We expect to see lots of different strategies play out as people play with these settings.

LTV is now “Risk Ratio”

Why has LTV changed to Risk Ratio, and why does it now go to 100%?

With the recently passed proposal to increase the LTV for bLUNA to 80% and other collateral assets on the horizon, we’ve changed the way we report on the state of the loan book.

When bETH and bLUNA have a max LTV value of 60%, it means whatever you deposit into Anchor, you can borrow up to 60% of its current value.

The update changes bLUNA’s to 80%, whilst bETH remains at 60%. This means neither 60% nor 80% is the guaranteed threshold for an under-collateralized loan.

For example:

- When I deposit only bLUNA, my max LTV is 80%

- Instead, by depositing only bETH, my max LTV is 60%

- On the other hand, if I deposit equal $ amounts of both bLUNA & bETH, my max LTV is 70%

Clearly it would be impossible to show a meaningful chart of loan LTVs, as it’s not clear which ones are directly at risk. Instead, we’re moving to reporting on the “Risk Ratio”. This number is independent of any individual asset configuration, and is a percentage of the borrow amount, vs the max borrow amount.

Anything over 100% and the loan is under-collateralized and therefore at-risk.

For example:

If I deposit $1000 of bLUNA at 80% LTV, and $500 of bETH at 60%, my max borrow is $1100 (80% of $1000 added to 60% of $500).

If I have borrowed $880, then my Risk Ratio is 80%. The lower my Risk Ratio%, the safer my collateral is.

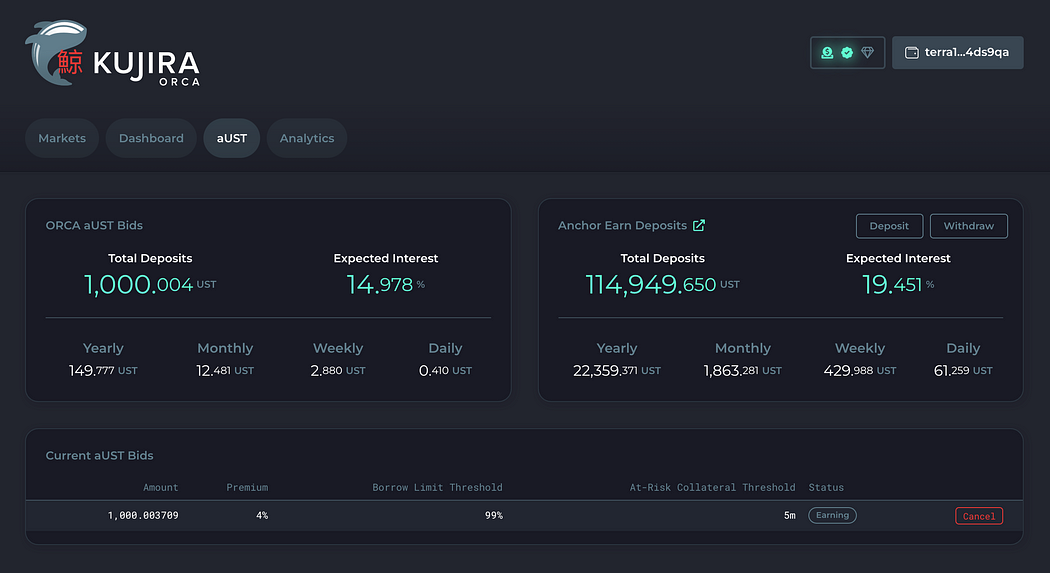

The new aUST dashboard

You now have a single place to view all things aUST on ORCA: https://orca.kujira.app/aUST

From here you can do a number of things:

- Deposit UST directly into Anchor Earn

- View the total of your aUST deposits

- Track the status of all your current aUST bids

Still to come

We know that $bSOL and $bATOM markets are coming, and even $sAVAX.

Anchor borrowing WILL grow.

We are in advanced talks with four cross-chain money markets. It’s clear there’s a taste for this.

As far as we’ve come, there’s still plenty to go!

- From the future: on the Kujira network, ORCA xTOKEN bids emulate aUST bidding. There are two key changes in our new model: A. xTOKEN bidders keep all earned interest; B. APR isn’t fixed and fluctuates with real-time GHOST money market borrow (demand) & lend (supply) activity. ↩︎