GM Kujirans! Today we have a mega-article for you, discussing what the Core Kujira team has been building, a look into the future roadmap, and the contributions from external teams to the ecosystem.

Our final destination is a comprehensive suite of DeFi products that are not found elsewhere on a single network, with composability ingrained throughout the ecosystem.

This will be a long one, but probably our most important update yet.

Written by KP

Table of Contents

Internal Updates

Perps

Perps. This is of course the word on everybody’s lips, and our biggest upcoming product launch. Many have asked “wen?”, and indeed we teased this dApp many months ago. So let’s bring you some updates.

Perps is obviously 100% oracle-dependent, with the price oracle integral to the product’s liveness. Currently, our oracle has a liveliness of 30 seconds, and for each update, it requires 150 txs from validators. This is the same for other oracle chains, which is why there is a step change in transaction count for those chains.

With the Cosmos SDK v 0.50.0, there’s a new feature called “Vote Extensions”, allowing validators to submit data on-chain, every block, without this Tx overhead. This means our price oracle has a liveliness of 1-2 blocks max, so on average about 6 seconds.

Why is this important?

Better price availability means better tracking of small movements which allows bigger leverage options – a core component of Perps.

Therefore, it’s time for a huge announcement:

The SDK 50 work with the new price oracle is nearly done, and we’ll be launching Perps initially as a high-leverage forex platform, instead of another cryptocurrency one.

This allows us to do two things:

- Create a differentiated product

- Demonstrate the power of the new oracle.

The oracle will of course be integrated into all existing dApps too. This means you’ll have single-denom deposits for Market Making on BOW that will be routed across *all* perps markets, leveraged limit orders to get an entry at exact price points, and many more.

Leveraged BOW LPs

We are in talks with teams who we currently have listed on the oracle, where we can create leveraged LP contracts for them to provide USK and USDC liquidity using only their own token. With USK lending as it currently is, you could create $1 million of liquidity with $0.5 million of protocol tokens as the max LTV is 75%, and this would open the position at 50%.

The only way you could possibly get to 75% LTV is through interest accrual and impermanent loss, so you’d need a sufficiently large overall change in the underlying position to be liquidated.

Furthermore, we’ll have GHOST vaults which will restore APRs to target utilization faster for further stability.

This will support teams who wish to build Protocol Owned Liquidity on Kujira, but only have a treasury denominated in their own token.

Sonar

We’re working closely with the SDK team and Kado to make Sonar the most seamless Web3 wallet experience in crypto. A major update is that we’ll be adding Passkey support, so wallet setup no longer requires a seed phrase. Just download and go!

Frictionless Onboarding

This means that, thanks to Noble and some very exciting updates to Kado that we can’t announce yet, the Sonar experience will be simplified to as follows:

- Download

- Enter amount to onramp

- Confirm deposit

As the ENTIRE onboarding experience to Kujira. Revolutionary.

Further Product Integrations

Furthermore, we will be integrating Bidali directly into Sonar, and this update will be out in the next Sonar release.

You may have already seen Brett’s Tweet on the ORCA integration and mobile lock-screen notifications too. ORCA will be integrated into Sonar in the next few days, followed up by lock-screen widgets, push notifications, and further 3rd party integrations. There will of course be the full suite of Kujira products on Sonar in time too.

DAOs on Sonar

The last update to mention on Sonar is particularly important for DAOs.

Sonar will be able to connect to a DAO, so you can “act as” the DAO, creating proposals instead of signing transactions. This enables something pretty incredible:

Once you can connect a MantaDAO squad to Sonar, we can roll out the DIY stablecoin platform. This is because the peg price and specific parameters will need to be controlled by a DAO by default.

GUI and UI Updates

To add to this, we will soon be releasing a full GUI to allow the community to create new FIN, GHOST, USK, etc. markets, adjust the parameters, and tailor the experience to the individual.

We’ve also begun the process of componentizing the UIs and the APIs so that they can be:

- More useful for more people

- Open-sourced and run/maintained by anyone.

IBC, ICA, and ICQ

Finally, the next chain upgrade will bring direct IBC connection to Polkadot and Near, Interchain Accounts and Interchain Queries to CosmWasm developers.

Open IBC connections allow the transfer of native assets between these chains and Kujira, offering a new onramp to Kujira and opening up various DeFi strategies between these ecosystems.

The Queries is particularly important as it is the fastest architecture in Cosmos with single-clock execution (most other implementations require 2).

External Developments

This brings us to the external developments on Kujira, as ICA and ICQ enable some incredible things for our builders already here.

LST-Fi

To start things off, ICA/ICQ allow Eris and Quark to create for example ampATOM and qcATOM.

Using Unstake, these protocols can allow instant migration from stATOM to either of their own LST derivatives. Nutsack will also support the migration from any “foreign” LSTs to a native one, fostering more borrowing on GHOST and therefore more lending deposits.

Quark Protocol

Staying on Quark, Quark is built using the same philosophy as the Kujira ecosystem – with composability at the forefront. By integrating with dApps like GHOST, FIN, ORCA, e.t.c, Quark LSTs will enable an immeasurable amount of strategies to be built. These include cash-flow manipulation, self-repaying loans, yield tokenization, and more.

Both Eris and Quark launching interchain LSDs, with Nutsack powering their bootstrapping phase, allows Kujira to become a LST powerhouse.

WinkHub

Then there is the WinkHUB alfa. We’ll allow them to announce this soon, but this will truly melt faces. The underlying technology will be immensely powerful for other builders too, and we can’t wait to see it in action. Sorry, can’t say more than this!

Manta DAO

Moving on to MantaDAO, who have supported Kujira immensely.

Trade splitting will be going live soon on MantaSwap, splitting a trade through multiple FIN orderbooks to ensure that a Token X -> Token Y trade is the most efficient it can be. By splitting your trade through the pairs above, you aggregate the liquidity found in each pair and increase the trade execution massively.

We previously mentioned Squads, the DAO tooling produced by Manta. This is a DAO tooling platform allowing anyone to easily create and manage the treasury of a DAO. Features will be added over time, but eventually, you will be able to easily post all sorts of proposals to execute actions across Kujira apps.

This includes trades on FIN, swaps on MantaSwap, depositing liquidity on BOW, putting an OTC deal on Plasma, launching a DCA strategy will CALC, etc. All from a user-friendly interface that does not require any technical skills.

They are also working on creating a reporting tool that will allow any DAO built with Squad to produce analytics and reporting similar to what MantaDAO publishes in its monthly report. They aim to bring next-level convenience and transparency to DAOs and their communities on Kujira.

With the new release of Leveraged Yield Farming, Manta will be utilizing this to grow its POL exponentially. This allows them to focus on stablecoin pairs as well as / $MNTA pairs without the need for inflationary incentives.

To further assist them with this effort, they have utilized Fuzion Bonds protocol to offer some $MNTA bonds to raise more liquidity on Kujira, improving the trade execution on FIN.

Fuzion

This allows for a good segway to talk about Fuzion. 2024 will be a big year for Fuzion, with the following products in their suite:

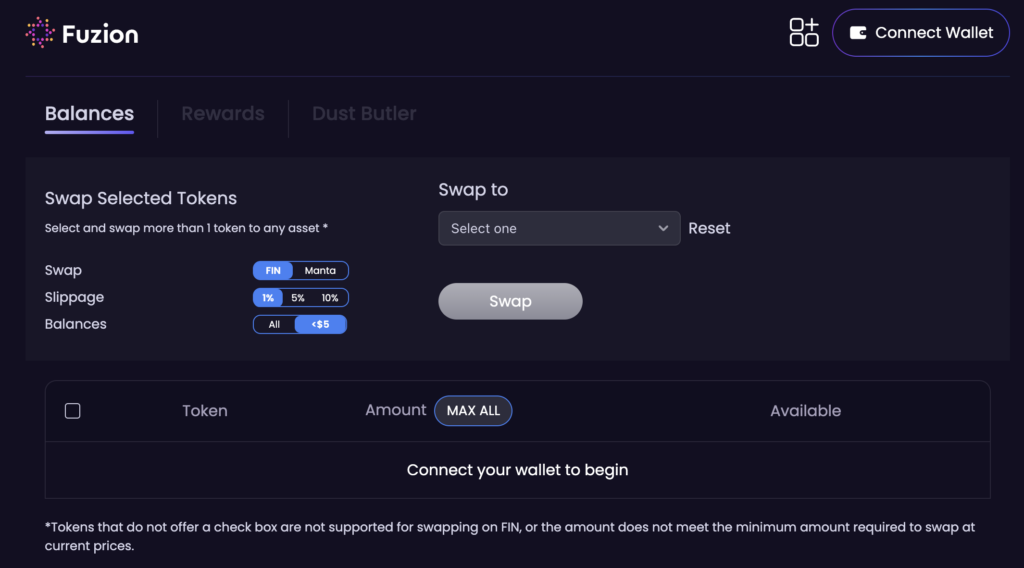

- Dustbuster and Dustbutler released today.

Dustbuster – Only place in Cosmos where you can swap multiple tokens into one token, choosing to do so via FIN or MantaSwap

Dustbutler – Dust butler allows you to auto claim and convert in a weekly or monthly schedule to your token of choice. - Bonds – Allow protocols to raise liquidity efficiently

- OTC Platform – Peer-to-peer trading, allows trading of bond assets. Also working on OTC options too!

- Flows – Manage the movement of tokens from one wallet to another

- Launchpad – Launch new tokens on Kujira

Aqualibre

One such token launching on PILOT is $AQLA from Aqualibre.

This heavyweight in the Carbon Credit RWA industry will bring an injection of large amounts of external capital to the Kujira ecosystem, and high-value investors. They came to us with a proposal to lend a portion of their raise, and a portion of their revenue from OTC deals, on GHOST.

This facilitates more stablecoin borrowing in Kujira and allows them to reward $AQLA stakers with yield-bearing xUSK and xUSDC. They have remained dedicated to supporting the Kujira ecosystem through each step of our conversations, and we will continue to support their navigation into Web3.

Many other protocols are launching very soon on Kujira too.

NAMI

Firstly, we have NAMI Protocol launching a savings protocol tailored to onboarding new users to Kujira and offering them the best stablecoin yields in Kujira.

Yield Harbour

Then there is Yield Harbour, creating an onchain, Kujira-centric decentralized options platform. This will allow for more advanced DeFi strategy offerings on Kujira, hedging for risk management, and enhanced capital efficiency via integration of existing Kujira dApps.

Plankton

We also have Plankton, offering ticketed raffles and GameFi/GambleFi components such as Casino games and slots.

Kujira Index

To top it off, Kujira Index is building a platform for asset indexes, starting with $KJI, a basket of these Kujira assets. UI development is almost done and contract development is in full swing with testnet soon. The asset framework for $KJI is set and weights will be calculated right before launch.

Making Kujira Dev-Friendly

Confio Partnership

We think it’s important to support the people who build the tools that all of our apps and protocols rely on. By subscribing to Confio, we will do just that, and also provide every protocol developer on Kujira with access to their bespoke “Tracing” tool. This will make building protocols on Kujira 100x easier, especially given the composable nature of all our products.

POND

POND creates a Local Kujira Network complete with price feeders and scaffolds out a dApp template that you can start building on straight away. It takes just 3 commands to get the network running and the POND UI will configure itself automatically & connect to your local POND network. It comes with pre-installed contracts for all Kujira dApps and a sample wallet connection for SONAR too.

Developer Docs

Alongside our fantastic existing developers, we are producing a developer curriculum/docs that will assist in onboarding new builders to the ecosystem. This is in addition to a complete overhaul of the existing Kujira docs coming this week.

All of this is in an effort to make Kujira the best place to build on top of.

Conclusion

This wraps up our update into what Kujira is currently building, and what the future roadmap looks like. We may even have missed things off given the sheer quantity of building going on – it can be hard to track!

But we also believe it is important to answer the question of “Why Kujira has been quiet”. To make Kujira what it is today, our team and all the individuals in this ecosystem have worked flat out for 2.5 years. We have shipped immensely during this time, and it is due to our work ethic and resilience that we have achieved so much in such a short period.

Naturally, we needed a short break to recoup and regather ourselves after an action-packed 2023. This coincided with the December holidays and the New Year, so we used this time to get our energy back and focus on what we wanted to ship next. Most of us are back now and ready to hit 2024 hard, but we would like you to appreciate the human nature behind this machine.

We have always been honest and transparent with our work, and we hope that this mega-thread gives you all the answers to your recent questions. We suppose the last question to answer is simple… “Wen?”. Soon.

2024 will be Kujira’s biggest year yet.