Twitter space: https://x.com/TeamKujira/status/1716847290797699316?s=20.

This transcript is nearly identical to the Twitter space, but I’ve removed filler words, paraphrased, and changed some language for brevity.

Timestamps will be included on the left hand side.

Introduction (2:31)

What is Kujira (4:15)

Kujira Futures (Perps) (8:43)

BOW Leveraged LPs (12:14)

Value of Perps (15:21)

Solvency of Perps (16:45)

Expanded Developer Team (18:47)

Unified UX/UI (21:05)

Backwards Evolution of UX Demands (23:59)

SONAR Importance: Please Get Involved (28:04)

SONAR Vision (30:34)

Unified Lending/Borrow (32:48)

Other Options Than Seed Phrases (34:09)

Dove’s Funny Anecdote About Seed Phrases (37:30)

Dove Introduces Joe From Aquelibre (39:24)

What Aquelibre is (Real World Assets) (41:19)

Real World Business/Kujira’s Supportiveness (43:30)

Aquelibre Market opportunity (44:25)

Difference Between Voluntary and Mandatory Markets (46:36)

How Kujira First Discovered Aquelibre (49:17)

Good Market Sentiment and OTC Deal (51:33)

Upcoming AQLA PILOT sale (52:45)

The Power of Community Sales on PILOT (54:12)

Wrap up (56:35)

Kujira Cares About Projects / call to arms for new devs / POND (58:03)

Penguin Noises (1:00:56)

General Kujira community happiness / goodbyes (1:00:58)

Introduction

2:31 Dove: Hey everyone, noot noot, gm gm, all that stuff. Hope everyone’s super well. We’ll wait a couple of minutes for everyone to come in. But thank you very much for everyone that’s taken the time. These are impromptu chats that we have. We call it the Kujira Chinwag, and you know beer and wine sessions, whatever, but we like to have this opportunity to let everyone know what we’re up to and how we’re approaching things. We should probably do this more often, but there’s a lot of building going on, and sometimes we get a bit carried away with that.

3:21 Dove: Super good to have everyone here. This is Dove, by the way, just chatting from the Kujira account because it’s much better; more people can see, there’s many more followers there, and people can remember, “oh shit” there’s a space on and jump in. Today we have Mr. Hans, Mr. Brett, and later we’ll have a special guest pop up and potentially announce or chat through a few things. For those of you who don’t know, who are just spectating, I think we have been lucky to have a bit of hype going on lately. So perhaps you’re wondering what the deal is. I’ll give you a really short preview for those who don’t know.

What is Kujira

4:15 Dove: At Kujira, we are building an inclusive and very complete, decentralized finance (DeFi) ecosystem. I like to call it complete because we’re trying to get every single person involved in almost every sphere of DeFi. And that doesn’t have to be a scary concept or something overly complicated. It started with us being the first to allow anybody with a wallet address and the ability to click on a few buttons to bid on liquidated collateral. This sounds complicated, but it’s not really.

5:00 Dove: If you take out a loan, you put up collateral against that loan—and that collateral can be liquidated in the event of the price moving beyond your liquidation price. Obviously, that might sound strange to some, but this was really a novel concept, is what got us known, which was a good thing. Well, from there on, we thought—well, we don’t just want to do liquidations. We like the concept of putting things into people’s hands that they didn’t have before. This is why we have the terminology ‘Everyone deserves to be a whale’ and ‘Kujira empowers everyone’. To us, these are not just slogans and snappy little titles that we throw around. These are things that we put into every product that we build.

5:49 Dove: So basically, the Kujira ecosystem is a financial system that we want to work for the participants rather than for the usual men in gray suits hiding in the corner that we see in the real world. But unfortunately, we see it in crypto as well, right? This is something that we are really trying to avoid in the Kujira ecosystem. So if ever there’s some kind of commission or fee, we push all of those back to stakers so there aren’t any gray middle men in-between.

6:28 Dove: That’s obviously a very generic explanation, but hopefully over the course of this chat–and as I said, these are really chilled. We don’t plan a single thing for this. I jotted down a few points that I thought you might want to hear. You can always jot some questions into the comments. Because these things tend to go on a bit, it’s a bit hard to do a full-on Q&A. It’s not like we’re avoiding questions, it’s more that on these sessions with the team we like to let you guys know our thoughts and what we’re up to rather than it being a typical AMA which we do a lot of. So we like to keep these just to give you some insight into what we do and how we do it.

7:22 Dove: I think that now I’ve waffled plenty. As I said we have Hans and Brett on the call. And we have a whole bunch of things in the pipeline as always. I think that something a lot of people have been talking about for a long time is perps. And, we know what it can do to volume and that’s something that people have been looking forward to in Kujira. Although, somewhat ironically in the two days leading up to this, that’s really improved. And I thank each and every one of you. As I think this real community push towards doing something right and not having market makers and people who float fake liquidity through our books. It’s pretty impressive what we’ve done as a community. But yeah, let me open the floor to Hans for this one because there’s been a lot spoken about perps, and I think we’ve tried a somewhat different approach. But Hans, do you want to give some color to our approach, and how we’ve been handling this?

Kujira Futures (Perps)

8:43 Hans: Yeah, I mean, perps can mean a lot of different things to different people and protocols implement it in different ways. The way we are currently going about it–and the reason this has taken a while is because we want to be very careful about the way that we design the system. It’s safety guarantees, solvency guarantees, all of these kinds of things. The way that we’re currently designing it, strangely works on the back of everything that we’ve done so far. Perps is, in our mechanism–which may not be the same as what you’ve seen elsewhere–is weirdly like if you take USK and copy it, flip it upside down, and then bolt the two together. That’s what our perps are going to be.

9:34 Hans: When you think about USK, it’s a tokenized debt, and with our margin contracts you can leverage that debt, so you never actually withdraw it. It’s just contained inside that same ecosystem. And so the current model for our perps will basically allow you to trade that debt with somebody else that thinks that debt is actually collateral and put that up against a position. In that model, it’s basically just a CDP (collateral debt position). But it’s just a CDP that’s taken against another player. Nobody’s actually getting any of the spot products here. It is taking a bet. And so we’ve been able to leverage a lot of the stuff we’ve learned, a lot of the code, a lot of the learnings from GHOST, from USK, the way the debt is modeled, the way the interest is modeled, the way that all that stuff works together, and so we’ve been able to focus more on the modeling than the building of it. The building of it just uses the box we already have. But I think we’ve ended up with quite a nice product and system. It’s a lot to go into detail into a spoken thing like this. We’ll put some really in-depth stuff out so that when you start using the system you understand how it works. Broadly speaking, that’s where we are. Our system of perps uses FIN, it uses the same stuff that GHOST uses; it allows you to trade bets with someone on the opposite side of that position.

11:18 Dove: Awesome, yeah. And I think the thing that stands out is the fact that we’ve been using our own ecosystem. It’s quite interesting. To be perfectly honest, between the three of us, I don’t think we really saw exactly how that would work in terms of—I mean we started with ORCA, and then ‘hang on’ we had FIN, and then suddenly we had a need for this market making, but then what ended up happening in terms of what Hans was saying—these rails that we’ve built, we can just keep on adding to this circular ecosystem. And it’s not even talking about just perps. I think that’s been amazing to watch.

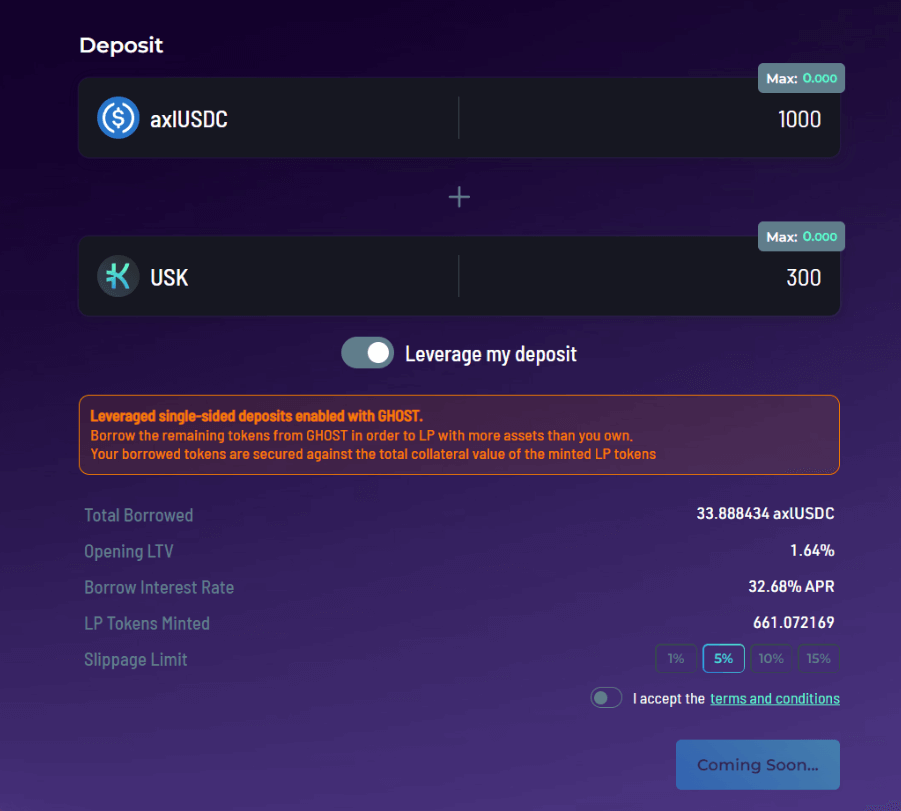

BOW Leveraged LPs

12:14 Hans: Yeah, like BOW leverage. Amit’s been crushing this—it uses BOW, GHOST, FIN; it uses the whole product suite and allows you to tell your strategies and it’s the same with perps. At GMX, you’ve got an XYK (market-making strategy) (liquidity) pool in the middle. It has incredible strengths that we see. But it has a few markets that can’t move fast enough. And we saw some problems with that last year. Whereas with FIN in the middle, you have okay BOW will exist as one market-maker, but in the same way as we’ve got FIN and BOW as these two separate entities, you have the trading venue, the market maker, and the traders as separate participants in our spot markets–and the same is true for perps.

13:06 Hans: So if you have strong market movements whether natural or unnatural, the market and the market makers will and should move with them. Another nice thing is that perps will most likely use single-token margin which will likely be USK–although it’s not 100% committed. We’ve seen some really good improvements in the stability of USK so we feel more comfortable using that margin token across all the perps. This means you’ll be able to provide liquidity across all the perp markets with a single token, which will be USK.

13:49 Dove: Yeah, that’s really sick. Even as one of the cofounders, I’ve found a lot more security in USK being a lot more stable, so that’s pretty handy. But for the people on the chat, how we can sort of simplify the BOW leveraged LPs for everyone here? More to say what it is rather than technical stuff.

14:15 Hans: I feel like the percentage of people here that remember Anchor is reducing although the overall number is probably the same. But we all understand the basic principles of borrowing against collateral. So I think it was made clearer when we shared that screenshot of borrowing assets against your LP tokens, which is kind of the first piece of a leveraged LP. All you’re doing is freeing up some of the capital in that LP, and paying a bit of interest in order to do so. The comments that I saw on that were ‘I’m going to loop this’, ‘I’m going to loop this’, ‘I’m going to loop it’. That’s all that leverage is. It’s like a loop to infinity. So you borrow it, buy it, you redeposit it as collateral, borrow it, buy it, redeposit it as collateral, over and over again. And so yeah when you think about it like that, all the leverage contract does is give you the end result of that loop. It just lets you set your final position balance and opens it up to that position.

Value of Perps

15:21 Dove: Sick yeah, that’s awesome. And this is a personal comment, from my side. I saw one or two comments, like is there some value in these leveraged products and are we trying to create the next big shot or whatever? The way I see it is that people want these products available to them, you know the people who are happy with a bit more risk. But I think we’ve taken a lot of time to ensure solvency within the actual protocols themselves. You’re going to have individuals that are going to go off and do some crazy stuff because it’s probably a form of gambling in some way, but that’s what finance is in many ways. There’s no money that comes down from trees, but the difference here is that we are sharing either wins or losses at any time with KUJI stakers, which is something that hopefully becomes more evident as this evolves. So yeah, Hans, do you want to add anything there?

Solvency of Perps

16:45 Hans: Yeah, as far as solvency. I think it’s an important question. And everything across our entire ecosystem is way too conservative, but rightly so. Most LTV is maximum at 60% and to be solvent you have to sell it at 100%–what it’s worth currently–the most you can sell it for, and the lowest discount, the least you can sell it for on ORCA is 70%. So you’ve got a 10% buffer there, usually at least 20%, because the more high risk stuff is 50% max LTV. So it can drift by 20% before it even starts potentially not having enough bids. And even when it gets into that 30% range, you know the liquidation doesn’t exist so you still have an opportunity to get your 29%, 28%, 20%, 15%, 10%, or 5% discount.

17:44 Dove: Yeah, exactly. That’s it for sure. I think there were people wondering about the liquidations and the solvency of the markets and maybe rightly so, but how long has it been now? Maybe a year or more of Kujira as an L1. Well, certainly more than that, and, even in the depths of the bear market with things going really badly, I don’t think we’ve had any insolvency issues on a particular market.

18:22 Hans: Yeah, and you need to be aware of all the times. I don’t think it’s necessarily wrong that one year isn’t enough data, but we’ve seen a lot worse happen in a lot shorter time. But yeah, it makes me happy when I see the community challenging all these things and questioning them.

Expanded Developer Team

18:47 Dove: Yeah. I think from everyone here we just appreciate everything you’re doing. I know you mentioned Amit, and people may not be aware, but we do have a good squad of devs working alongside us. Some are more full-time compared to others; we’re not like some old school startup where you know we necessarily need to have all the dry stuff involved. There’s people that just come on board and do a bunch of work for us and we compensate for that. But yeah I just wanted to let you know Amit, just incredible work on this BOW stuff. And I think we’ve got another five guys now that are getting stuck into things that you may not see, but they’re there whether they be like oracle work or just all bits happening behind the scenes to make the Kujira ecosystem stronger. Because I realize that, we do the odd tweet here and there, but it’s probably not big enough for people to understand that we’re onboarding good developers as much as we can. It’s not easy, finding people that can work at this level, but we are. And they’re all amazing and we thank them. I think, Brett, this is something that I’ve seen come up and naturally so, because we started with say one, two, maybe three products. And we couldn’t have envisioned what may be coming. I know this concept of a more unified UX & UI has been knocking on your door for a long time. But I know you’ve been doing some epic work, so I don’t know if you wanted to chat with the peeps about what you’ve been up to? I’ll share a couple of sneaky previews in the comments.

Unified UX/UI

21:05 Brett: Yeah, hello everyone. I think that has been one of the most common requests apart from little bits here and there. Somewhere that users can see what’s happening for them across everything that we’ve got. And like you said, we’ve started out and slowly built out more and more. You both talked about it already—all these big cogs that exist to make everything work. And something that has been requested a lot, but it’s also just looking again from an outsider’s point of view in terms of how to get into Kujira. How do you start with zero knowledge? Centralized exchanges are really good at this. Because it’s a centralized platform, they do everything off-chain. They’re more of a traditional website with login and KYC (Know your customer). The advantage with DeFi is you don’t need that stuff. You’re in charge of everything you do. But people still want that experience because it’s familiar. So what I have been working on is trying to make this more familiar and unified in terms of how you get started from a complete noob that doesn’t even know what DeFi is. Just to get in and have a look and go “okay well I don’t want to do all these things—and I want to just buy some KUJI or some USK or I just want to put some money or some tokens to work for me with some interest and then kind of forget about it”. So yeah we’re looking at it from that centralized-exchanges-type of onboarding, but not as intimidating. Just super user friendly, easy to do stuff, maybe changing our language a bit too to be more user friendly. And yeah I think that’s kind of it, I lost my own train of thought there.

23:40 Dove: No, I think that’s really epic. I mean especially from a design and UX perspective. I know that it’s really cool for people to listen and understand why you’re doing the things you do and how you go about it.

Backwards Evolution of UX Demands

23:59 Brett: Yeah, so what I was going to say is that traditionally where we started is helping people liquidate loans. So you didn’t necessarily arrive and go okay cool I want to liquidate a loan that’s at risk without any kind of knowledge about how this works. So we’ve always sort of been on that sort of footing with our UX and UI where we expect a certain level of understanding from people. But now as we’ve grown and created all these things it doesn’t have to be that way. It can be a lot more simple for the average person that wants to get involved and put some money to work. So yeah that’s the focus. Simplifying, but still allowing. We’re not going to change the UI people are familiar with, but just introduce simpler gateways into it–like on a higher-level and unify everywhere you are so get a good overview into where you exist within Kujira basically.

25:13 Dove: Yeah *laughs*, I’ve actually just had to have a good laugh at that because it’s such a good point, and maybe one I didn’t appreciate. We started the UX and journey on people liquidating collateral. It was a big language and design problem to solve because no one had ever liquidated someone else’s collateral unless they were extremely in-tune and had bots and running heavy scripts and machinery i.e. not 99.99% of people. So we almost had a unique problem design or language-wise where we had to go backwards from the most insane thing ever towards something more mainstream and sane.

26:11 Brett: That’s such a foreign concept for anyone. I suppose even for us when we built it you know, it was like “what are we doing here, how do we make this friendly for people”.

26:24 Dove: Yeah, we didn’t have a clue, it was insane. It was a first for all of us which was fun. Yeah, man, so I think that is epic. Hopefully everyone’s stoked to hear about that particular bit. I think that the unification of the UX is something that everyone has been looking forward to. Just to let you all know–we don’t miss these things, we do see them. We appreciate that everyone is keen to see these updates happen really fast, but what we’ve had to focus on all these different components and make sure they all work in this circular ecosystem that we’ve been chatting about. An ecosystem that allows you to go BLUE here, and go there, but for now it needs to exist in that way. And I think it’s good that the core Kujira community understands that. You know they push that along and help people along their way. And that’s been awesome to see. This is just to let people know that we’re on it, that we’re doing these things, unifying stuff, and we’re going to bring everyone into one full house. And this also leads into that other house we have. So now you’ve probably seen those screens I’ve shared–which were for desktop, which we’re never going to ignore–if you’re looking at the comments. But the real baby here is SONAR.

SONAR Importance: Please Get Involved

28:04 Dove: I can speak for all of us when we say SONAR is going to be increasingly important moving forward. To be able to do this stuff completely, it’s going to be a challenge. I know you’re all waiting for it to come out of BETA, but if you’re on this call, I would genuinely encourage you to help us by navigating to sonar.kujira.network. I really encourage you to jump on there. We’ve already got 3000 active users. I know people are waiting for this moment where the stores just open up, but please trust us there’s nothing that’s going to really change and we’ve already had a few good months of updates, but it’s been menial stuff. It’s mainly been updates from the team adding protocols or whatever. And we haven’t had loss of funds or any crazy stuff like that from poor security. Anyway, please do help us get on the SONAR beta. Because I think once you start interacting with that, you literally have this DeFi gateway in the palm of your hands. This is something really special. And, all of these rails that we’re talking about that are built on Kujira, you know the FINS, the ORCAs, the GHOSTs, the lending, and everything else that is going on, is key to making that all happen–and that’s really what we want to be. The gateway to decentralized finance. And you know it’s kind of like, why not? And we’ve seen some really good indications now where things like liquidity and volume were a concern maybe three to six months ago. Maybe there’s room for improvement, but we could really use all of your help in terms of jumping in there, giving us your feedback, and really going for it. So I’ll just share in the comments. So, Brett, I don’t know if you want to chat through what’s going on there with a couple of the updates you’ve made, and you know Hans as well. Obviously, you guys, it’s hand in hand; so yeah just fire away.

SONAR Vision

30:34 Brett: Yeah, I think SONAR has pushed us in the direction of making it an easier app to use for people who may not be as familiar with all these hardcore things but still give them the tools they need to do all this crazy degen stuff if they want. But yeah that screenshot below is… Between Hans and I just using the app–we use it daily as well while developing it–and something we both realized is that we’re constantly tapping on tokens to do something with them. Traditionally this standard sort of UX in a mobile app with banking or crypto is you tap it and where do you want to send this token, and we realized that ‘we were tapping on this’ and that ‘we wanted to do something with this’ and ‘it’s not necessarily sending right’, so we both kind of just had that idea at the same time. The app needs to be token centric because there’s so much that you can do especially now with BOW and GHOST, and everything where you can just lend it, you can stake it, you can LP it, you can trade it, you can use it to bid on liquidations. It’s all token dependent, so you’ll have this little action pad that pops up here. And you know you can do stuff with it and that also just gives you an overview of what you are currently doing with that token too in the ecosystem. Like you may be staking your KUJI, LP’ing that in BOW and have some rewards or something, you might be lending that out… So it’s just another way to get a quick overview into it and then dive deeper into the app and what you can do with it too. And, yeah I don’t know, Hans, you may want to talk about the overall unification of the assets across lent and borrowed because I think you can explain that part better.

Unified Lending/Borrow

32:48 Hans: Yeah, it’s the same thing you were just talking about really. We’ve traditionally relied on third party providers, portfolio apps, etc., to say ‘this is your unified view of your wallet or wallets’, ‘you know you’re lending this much’, ‘you have this much provided as collateral’, ‘you’re paying this much’, etc. Well when you’re thinking about things from a banking point of view, I just want to say look how much of this token have I got? So this where the next main release of SONAR will go as Brett said. And you guys all know what an xTOKEN or LP token is, but when we start talking about the next people that come along that’s another mental overhead they’ve got to learn about. So if you can just say I’ve got 1000 USDC and 500 of it is collateral for a short position I’ve got open, 200 of it is lent out, 300 of it is in my wallet and I can send it, but on my homepage it says I have 1000–that’s what I care about. So that’s where going with this token centric design.

34:02 Dove: Lovely, yeah, I’m loving it already.

34:07 Brett: Can I jump in?

34:08 Dove: Yeah, please.

Other Options Than Seed Phrases

34:09 Brett: What I do want to talk about is account access and seed phrases–and how shit they are. And how–not in the next release but not too long in the future–you’ll be able to create a wallet without the seed phrase using pass keys which is a web 3 standard rolling out across most devices now. You’ll see it appear in one password—you’ll see it appear in your icloud keychain—you’ll see it appear everywhere. And we will be supporting them in SONAR. So a new user will be able to download SONAR, scan a fingerprint or do a face ID, and have a wallet and a private key for that wallet, which is then encrypted again and shared again across iCloud keychain. So it’s a decision that you make as a user, but it makes it semi-non-custodial. You know, Apple would have to brute force your password for your keychain and they don’t have access to it. But that means that it’s synchronized and recoverable. So if you lose your phone, you get a new phone, you restore your same iCloud, it restores your same private key back to your phone—you open Sonar again, you’ve got the same wallet, you’ve never seen a seed phrase, you’ve never seen a private key, it’s just there and you’ve never even set up an account, password, username, or anything; it’s just part of your phone.

35:33 Dove: Hell’s teeth. Well, yeah, *laughs*, I’m pretty sure the last time you told me that this was on the cards, you said ‘I don’t know if it’s going to happen’. I mean dude, that’s fantastic, really, I’m frothing.

35:51 Brett: From an onboarding perspective, for somebody not familiar with crypto and who wants to get into it, it’s insane to know that it’s secured like that and not secured on some database somewhere that’s actually secured on the device. Especially if you are somebody that’s not familiar with crypto, saying ‘here is your private key, don’t lose that, don’t store it on your computer, print it out and stick in a safe but somewhere where no one else knows but you can find it’, like that’s a daunting task, right?

36:29 Dove: *Laughs* I have a funny personal story about that. Let’s just say that someone I know, an older person–

36:38 Brett: Dozzin.

36:39 Dove: *Laughs* it could easily be. But like we all know, people from another generation–I mean, I’m not young by any means, but you think about what Brett was just saying now. This concept of just ‘go off and store these 12 words’ and often you’re talking to people who have passwords like name1234. And that’s not being derogatory. That is an actual fact. So you can’t really deny it. Ah yes, Brett, jump in.

37:15 Brett: So I was just musing. I was just going to say it was like that. It was not Jimmy Carr, it was some other comedian who does that thing on–

37:25 Dove: *Laughs* (Michael) McIntyre yes.

37:26 Brett: He predicts like everyone’s password in the audience.

Dove’s Funny Anecdote About Seed Phrases

37:30 Dove: But that’s exactly it. So this family member of mine just the other day came up to me in the car and said, “Uh, you know, Dove, you wouldn’t really believe this, but like I shit myself this morning, I couldn’t remember how do I get into my wallet? How do I see my Kujira?” And I was like “oh don’t tell me–you know what have you done?” And anyway, it turns out that his son was waiting for this moment, for this whole time, and he made the call to his kid, and he literally said: “I’ve been waiting for this moment, don’t worry, here it is.” But you know, there’s going to be way too many people that are going to put that thing on a piece of toilet paper and that’s just not going to happen. So anyway, I’m pretty sure we can all agree that’s not a good thing.

38:11 Brett: Yeah, totally, and also just to be clear, this is an optional thing. I think by default when you install and download the app, that’s the route, but there will be an option to be like ‘no I don’t want to do that, I want to restore a seed phrase or do it the old-fashioned way and just generate a seed phrase’. So it’s not going to be de facto–you have to do this–to be clear.

39:00 Dove: Yeah, that’s a very good point. Definitely, and I think that’s a way to bridge this gap between people that you know understand these things and are going to go this step further but also try to offer this experience. I think we’re getting closer and closer.

39:15 Brett: Yeah, lowering the barrier of entry basically for the next wave of people that get into crypto.

Dove Introduces Joe From Aquelibra

39:24 Dove: Indeed, indeed, yeah, sounds sick. Okay, so, Joe. Just to give some color here. I wanted to introduce a very special guest from Aquelibra. And Joe, I’m going to put it down to you, but this is a special real world assets project that we’ve been working really closely with, and I just wanted to mention that as a funny aside it is no cousin to Todd, Aqua, or his many tokens. But yeah, Joe, really stoked to have you on board. Please feel free, just sort of casual chat, and we’ll go from there.

40:16 Joe: Yeah, well thanks for bringing me on. Good to learn about the other products you’re doing. Some of what you’ve been talking about there makes perfect sense to me coming from more of a regulated financial background. So, you know wherever there’s someone making a profit, there’s always someone making a loss. So all the products that you’re boating on are absolutely superb. But, obviously, the project that we’re going to be working on very closely with Kujira is the AQLA token which we are in the process of trying to get launched over the coming weeks. It is primarily a carbon credit project. So despite people being spun out over crypto, I’ll try not to spin you out over the carbon credit world because it equally is a very fractionalized market. Lots of different sorts of voluntary carbon credits on the market all with varying different pricing and all doing their own bit in terms of different projects around the world. We’ve been in this space developing our business.

What Aquelibra is (Real World Assets)

41:19 Joe: So first and foremost, our business is a carbon credit trading platform. And from that we’ll derive profits from arbitraging other project developer credits or simply generating our own carbon credits. We’ve got three or four projects that we’ve got working on close(d) at the moment that are in development stages. We’ve got established projects from around the world: Brazil, Columbia; and we’ve got a big direct air capture business, which is actually about to launch in the North East of the UK. We’ve got various fossil fuel projects actually preventing oil with licensed mining from coming out of the ground as well as coal. All are then eligible for millions of potential carbon credits off the back which will obviously go onto our platform to be traded. And the gateway to access carbon credits is gonna be the AQLA token. So anyone coming onto our platform will have to effectively do so with the basis of the AQLA token.

42:20 Joe: They can obviously deposit in fiat. The market is primarily the corporate world to start with as that’s where the pressure is on the big organizations around the world to reduce their emissions and the only real way of doing that is to buy carbon offsets. And we’ve got clients, we’ve got the product, and from a very fruitful meeting with Hans several weeks ago—we’ve obviously been chin wagging about how to really develop, the front end portal which is currently in development and an MVP, which will hopefully be ready to be demoed and tested within the next four to six weeks. And then, integrate that with your backend orderbook and the real sort of bone is working out where we create the value in the token for the speculators as well as our stakeholders. I think we’ve pretty much modeled it exactly where we want it to be now. We’re just revising some of the tokenomics. But I am massively excited to be working with the team and I think it’s going to be a very fruitful relationship for everyone involved.

Real World Business/Kujira’s Supportiveness

43:30 Dove: Yeah. Thanks a lot, Joe. Honestly, we are super excited as you know already, and I think that the trick here is having these real business entities, real clients that are going to be getting involved. This is where there’s often this disconnect between blockchain and real-world business, unfortunately. And this is something we’ve been trying to break down from the beginning. So yeah, we’re going to be working really closely with the Aqua Libre team making sure that isn’t just going to be some idea. They’ve got the business, we’ve got the blockchain experience–and we’re going to make sure we can get these real world assets out there. Joe I don’t know if you want me to add—

Aquelibra Market Opportunity

44:25 Joe: Yeah absolutely because look this is a business that technically could be done in web 2. You could have a front end corporate website, login, KYC, pick your project, pick your carbon credits, and the clients could obviously purchase. But the reality is the problem with the carbon credit world historically has been the ledger. And as it stands now, corporations are buying millions of dollars of carbon credits and they’re serial numbers on bits of paper. So there has been double counting, there’s been fraud, there’ve been problems in the market that need addressing. And other firms have had a look at this problem but never come up with a solution. The real world asset of a carbon credit, you know it should be available to both retail as well as corporates. Because the reality is, demand outweighs supply, and will, leading up to 2030-2040 and beyond. The prices will continue to grow. I think there’s several analysts who predict the market might increase 40x over the next 5 to 10 years. So there has to be a forward thinking process in play now that allows us to grow & be sustainable as a business. Because you know, most tokens don’t live beyond five years. There’s not many you can probably name that have. And that’s where we want to be and just future proof the business from the web 3 perspective and blockchain perspective with Kujira. And allowing retail to come in and invest in our token, our business, carbon credits, or whatever they want to do.

46:03 Dove: *Laughs* Joe, I don’t want to sound like I’m frothing unnecessarily, but I really am. Honestly, as you say, when you say the problem has literally been the ledger and the accountability, I mean there literally couldn’t be a better use of the blockchain. And this is literally where crypto falls flat. People come up with all these weird and wonderful ways of making problems that the blockchain can fix, but this is actually not that at all–which is bloody amazing.

Difference Between Voluntary and Mandatory Markets

46:36 Joe: No, it’s not. And look, a lot of people go into crypto, thinking it will solve problems that also don’t exist. And this is a real problem that can be solved. It’s in a massively expanding marketplace. I mean they’re estimating maybe $250 billion per marketplace over the next 10 years in the voluntary carbon market. And I think it’s an important point that we are in the voluntary carbon market. So all of our projects are generally going into green solutions. The mandatory market effectively allows the big boys to continue polluting and effectively it’s a tax on their businesses until they can transition to greener energy and beyond. Our projects are actually self-developed projects whether they be in wind, solar, or deforestation, or afforestation, or technology like direct air capture. And we’re going to have all of the credits on our platform to be sold to whomever wants to buy.

47:38 Dove: Yeah, I mean it’s insane. Genuinely, I mean. I know I’m hosting this. I’m one of the founders not a twitter space host or whatever, but I’m genuinely interested in what you’re talking about and it really is exciting. I want to say that in terms of everything going on with Kujira–our objective as I said before earlier on in the call is to try and make things accessible to the everyday person. And this is basically what you guys are doing as well—and then by getting involved you’re actually doing good—it really resonates with us.

48:25 Joe: It’s a long road, but we will get there. The line in the sand is obviously 2050 to get the world to net zero. Whether that gets pushed back with everything else going on in the world at the moment who knows for sure. Whether it’s a subscription service or someone buying a carbon credit, which is basically one ton of carbon taken out of the atmosphere a month. So you can have the retail guys who want to do good because they’re driving around in a big 3 liter diesel or the perception with all the corporations who want to advertise to their clients that they’re net-zero. We also offer the consultancy side of the business which is also fee earning where we will go and advise corporates on their carbon footprint, work out what their tonnage is per year, and then offset them through our platform accordingly.

How Kujira Discovered Aquelibra

49:17 Dove: Yeah, that’s fantastic, obviously an actual business that knows exactly what they’re doing. And the cool thing is that you guys have all these clients lined up. You’d be surprised in this game–well, you wouldn’t be surprised I guess. There’s so many jokers, and they come to the table saying there’s going to be all this real world stuff and it never happens. In this instance, I love this story as well. A by chance meeting in the pub with Hans in London, and that’s just fucking epic.

49:47 Joe: That meeting I was supposed to be at originally was booked in for Thursday, and then by chance that got canceled and I think ended up on a Monday. And the pub wasn’t even particularly busy, and I was actually pitching on a zoom call to another client exactly what we’re talking about today and it just so happened at the end of the call. Someone was earwigging and they said can we have a chat and it was one of them fruitful meetings. And then even stranger, we ended up living like 5 miles round the corner from each other. So we’ve had several meetings since to chew the fat and work out exactly how both businesses can benefit from what we’re trying to achieve. And it looks like we’ve got a great potential relationship moving forward.

50:35 Dove: Yeah, exactly, I mean I just love that. I often hear from Hans. I personally lived in London for a long time. Brett did too. And I just love that kind of pub, and we often get these stories like ‘oh there’s this person here where we’ve heard some weird stuff like people talking about Kujira 2 tables back’ and funny stuff like that. But this one was just insane.

50:59 Joe: Also, it was the timing of it as well. Because you know we’re in that process that we’re looking at exchanges and building our community, so it’s come at the right time where we’ve managed to deep-dive into where the business wants to go and what it wants to achieve.

51:16 Dove: Indeed. And barring any crazy stuff happening–you never know with the market–a market upswing is a good time to be launching. It’s just one of those things, you can’t avoid it. So hopefully you guys have got the rub of the green.

Good Market Sentiment & OTC Deal

51:33 Joe: I think we’re turning a corner with everything going on with Bitcoin and everything else which is looking very positive, so we’re looking to be launching with you guys potentially at the end of November. We’ll probably also have some AMA stuff to get to know your community better and get them to know what we’re doing from a project perspective. We’ve got a new project website being built and there’s lots of other stuff that we’ll also put into the public domain with the tokenomics, white papers, business plans, and that sort of stuff. But happy to start speaking to you guys and then work out exactly when we’re going to launch and get your community in–if they want to get in–from a seed perspective. That’s what we’re working to do–to get a raise and to pay for all the things that we want to do. But the business can start to turn profits very quickly because we’ve got a potential OTC deal at the moment which is going the old school way, not web 3, and if we get that over the line, it generates some significant profits which will massively benefit our stakers.

Upcoming AQLA PILOT Sale

52:45 Dove: That’s awesome I mean I know we chatted super briefly before the call. I know that the people on this chat really appreciate when there’s real business happening—there’s such a lack of it in this space. And I know I’ve repeated that a few times, but just to be clear to everyone here. It’s 99% likely that there’s going to be a PILOT sale, so everyone–from whether you’re a big-ass investor or whether you are a shrimp and just want to put in a little bit of your money–as per the Kujira ethos, you are going to be able to invest and then be able to follow this wonderful project as they go along. So we are really in the wings as I’ve said here before for any projects that come on board, and we get really involved. So I just wanted to mention that this is going to be something the community can be involved in and something I personally think is pretty awesome.

53:49 Joe: Well, we don’t want short term massive pumps. We want to build a sustainable token that significantly grows over time as the profits of the platform grow year on year like any proper business should.

The Power of Community Sales on PILOT

54:12 Dove: Yeah, exactly Joe. So that’s one thing that we found, and I’ve been honest about this on multiple calls. When Kujira first launched it wasn’t on our own platform, it was on Terra, which subsequently had a wobble. But yeah, what was interesting was that we launched in the literal height of the mania. And, you know, we managed to raise a decent sum of money–which of course evaporated because of the base token. But one thing that was really interesting to us, and this is something I and Hans and Brett always advise other people, is that it’s all good. You can go in and get like whatever a few good million from these behind closed doors investors or whatever, but they’re literally just going to send the token to hell once it does a 5x. If you get a community, a true community I would say, especially the Kujira community, you’ve got thousands. Instead of having say 10 holders of your pre-seed value you have like 5000–it’s almost invincible. Because sure, maybe 500 might bail, but you know what I mean, just the law of averages is spread out, and you have this passionate community that knows they got in on the ground instead of some fancy pants guy that usually gets in there, which is awesome.

55:42 Joe: And the good thing is that it doesn’t matter what level of the ladder you get in. If you’ve got a proper business that’s driving profits, distributing to stakeholders, it doesn’t matter because you’re never going to miss the boat. And I think people just panic when they see a 3 to 4x, and it goes. Well, we’re looking to build a 30, 40, 50, 60x whatever, over years so whether you’re in, out, staking, speculating, it doesn’t really matter. Because the business is making money, everyone’s going to benefit.

56:13 Dove: Yeah, dead right. Alright, epic man, thank you very much Joe, I really appreciate that yeah and wish you guys well.

56:20 Joe: It’s been good to have a chat and learn about what you’re doing equally as much as I hope it’s been informative for our little project.

56:27 Dove: Absolutely, mate. Absolutely. Thank you very much. Obviously looking forward to just working together and cracking on.

56:33 Joe: Absolutely, speak soon everyone, cheers.

Wrap Up

56:35 Dove: Ciao mate, ciao ciao. Alright boys and girls, Hans, Brett if you want to close with something. I think it’s been an hour. I don’t want to drag this into something where we just start talking shit. Hopefully we’ve given some good insights. That’s the idea. I know there’s like one or two requests, guys, I hope you don’t mind. Sort of one question about the next 6 months. We get this one a lot. I think it’s really—I’m hoping that people can see what we’ve done over the last year or two for example. Okay Plucky Penguins requested to speak, holy hell. Let me finish my little outro there. But anyway, hopefully people can see what we build and like in a few months. 6 months is almost too long a timeframe for team Kujira—not that we don’t have goals and plans. But what we’ve been furiously trying to do is build these rails up to the point where companies like you’ve just heard from can just click on or even us as a team can clip on to various bits and pieces, and build on what we’ve already done.

Kujira Cares About Projects / Dev Call to Arms/ Pond

58:03 Dove: I’ll be honest, the focus has been about mobile adoption and at the same time everything about the desktop experience. But genuinely making sure that systems are in place that people can build on top of. A notable example is the MantaDAO which has been doing fantastically well. And I think you can now see the potential when you look at some of the APRs that are moving through GHOST or through BOW. These are real. And now there’s Nami. There’s protocols coming on top and simply making it easier for people to just go “Ok, I’ll put a token in here, I’ll get X out the back”. As a team, it’s hard for us to build those kinds of protocols because we can’t really spend our time building, say, an Anchor or a savings account. Those kinds of things are really well suited for people to come along. And then you get to participate in their sub economies, and now we’re seeing the Kujira native tokens doing really well, which I love. And some people ask the question, is it a problem if MNTA does well and KUJI is stagnant? No, I think for anyone that has been involved in a truly inclusive financial ecosystem… Any single project that comes onto the Kujira network, whether or not they have their own token or not… If they do well, that is massively important for Kujira itself. So yeah, I just wanted to say that we are always happy with people coming on and building. Please just get in touch whenever you can. We’d love to have new builders. We’ve got a framework called POND, which I will share. We do have a Tweet about it, but I will share it again here.

1:00:16 Dove: We are really keen for people to come along, build on the network, and just keep up this good momentum. We literally can do this. We can do this without a big fund from XYZ. We can make this the actual community blockchain that people are hoping for… Let’s head over to the Plucky Penguins. Which penguin is that? PP you’re on mute.

Penguin Noises

1:00:56 Peruggi: NOOOOOOOOOOOT NOOOOOOOOOOOOOT (Noot Noot)!!!!!!!!!!!!!!!!!!!!!!!!!!!!

General Kujira Community Happiness / Goodbyes

1:00:58 Dove: *Laughs*, right, yeah. I should have expected that. But anyway, check out the Plucky Penguins. You know this is another cool thing with the Kujira blockchain. *Laughs more* I do think we’re probably one of the happier places in Crypto and on Crypto Twitter in general. Our Telegram has been lit up the whole last two years. There’s never been any sort of stagnation or people overly panicking. Anyway, check out the Plucky Penguins mint coming up–that’s a good one. Anyway, peace, we love you very much. Hope you don’t mind if we don’t sit around with questions. We all just wanted to get you all in the loop. We do, as I say, love you loads. And, yeah, until the next one. We’ll make sure it’s not too far away. Big love everyone.

1:01:58 Hans: Thank you everybody.

1:02:00 Brett: That was awesome.

1:02:04 Dove: Ciao guys, see you later.