Table of Contents

Introduction

A brief explanation and overview of our new product

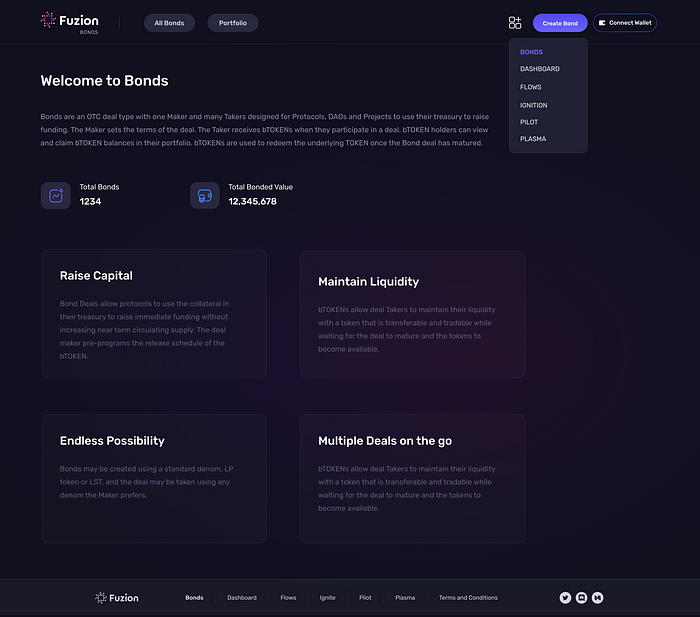

Bonds is a new product developed by the Fuzion team. Like OTC deals on Plasma, it allows Deal Makers to create deals and Takers to find and participate in deals.

While Plasma is intended mainly for retail users, Bonds is built for organisations aiming to accomplish a range of strategic objectives. This may be a Protocol raising capital to fund a project, a DAO diversifying its treasury or a Blockchain incentivising liquidity in a trading pair. These are just a few examples of how they can be used.

Bonds provide the bond Maker with several mechanisms to structure the deal to suit their strategy and needs. In addition, they provide Takers with liquidity in the form of a receipt token (called a bTOKEN) while they wait for the bond to mature.

How Bonds Work

Bonds use a similar format to Plasma’s OTC deal: the Maker creates a deal, offering one kind of token in exchange for another, at a pre-set rate of exchange. The Maker sets the parameters of the deal. This is all facilitated on chain by Fuzion and allows for a trustless transaction.

When a Taker participates in the deal, they receive bTOKENs. These represent guaranteed future access to the tokens in the Bond deal when it reaches Maturity. bTOKENs are redeemed 1:1 for the tokens in the Bond deal, and are tradable and transferable, just like any other token.

Benefits Of Bonds

There are several benefits to using Bonds:

Any denom is usable. A Maker can offer any denom on the Kujira chain in exchange for any other. These include LP tokens. They are not limited to trading pairs on a DEX or stablecoins as payment.

Circulation is controlled. The Maker stipulates the distribution schedules of the offered bTOKENs, but they receive deposits from Takers immediately.

Price impact is negligible. Token distribution schedules mitigate the impact of the tokens in a bond on the circulating supply, negating the shock a sudden influx of tokens into the market may have.

No up-front costs. Bonds carry a commission on completion of a transaction, meaning participants only pay when Bonds are bought. There’s no up front cost and no flat fee. You pay for what is used, when it’s used, at a set commission. Makers pay 2.5%* on their side. Takers pay 0.5% of theirs.

No slippage. The deal Maker sets the price when they create the bond. There’s no risk of slippage and no price fluctuation.

No predetermined size. Bonds of any value and duration can be created. Makers can create several small Bonds as needs be for short term needs, or larger long term deals to fund significant capex-heavy projects.

Community involvement. Bond deals allow projects to directly involve their public. The Maker can incorporate feedback from their community into the variables, using demand as a real time feedback-loop.

Creating a Bond

Bonds are created by connecting a wallet with a Kujira address holding the token offered and walking through a step-by-step guided process.

Bond Creation Variables

- Bond Start Date and Time

- Bond End Date and Time

- Bonded Token Denom

- Quantity of Tokens offered in Bond

- Price of Tokens in Bond

- Purchasing Token Denom

When a Taker participates in the bond, bTOKENs are minted and distributed to them. These are redeemed for the token in the bond when it matures at the Bond End.

bTOKENs are distributed to Takers immediately by default. However, the Maker has the option to create a distribution schedule using Flows, another Fuzion product (more on this in another post).

Schedule Creation Variables

Schedules are instructions created by the Maker defining the distribution of bTOKENs to Takers.

- Percentage of bTOKENs. Makers may add multiple schedules to a Bond, allocating a % of the bTTOKENs to each schedule.

- First Claim Delay. The number of days after the start of the schedule until the Taker may make their First Claim.

- Schedule Start Date.

- Schedule Length.

Bond Maturity and Redemption

When a bond matures, the tokens placed in the deal by the Maker are available to be claimed. Holders of bTOKENs can redeem them for the asset at a 1:1 rate. Every bTOKEN represents a 1:1 access to a token in the bond. The tokens will remain safely in the deal until bTOKENs are redeemed and they are released. There’s no time limit on redemption.

*Preferred Partner Program

We’ll be launching a Preferred Partner Program for anyone looking to build a long term relationship with Fuzion. One of the perks of joining will be Maker fees reduced to 0.75%, amongst other privileges.

Protocols, Chains, DAOs and other organisations interested in becoming a PP, please fill out this form.

Launching Soon

We’re excited about the opportunities this will create and the innovative ways it will be used!

If you would like your deal to be online when Bonds launch, please get in touch as soon as possible.