This is a detailed step by step guide from your fiat deposit to three different ways of investing, depending on risk levels.

There are a lot more opportunities, but this here is to get you on quickly and with ease…

If you are still unsure about Crypto investing in general, please check my old “why crypto” medium article.

https://medium.com/@fabi07ct/why-crypto-intro-1-184fac7dd86c

Table of content:

- Fiat onboarding

- Deposit Usdc into your Hot Wallet

- Safe investment strategies. Staking, Lending

- Medium safe strategies. Buying coins and earn rewards

- Degen strategies. Leverage

- Research

Fiat onboarding

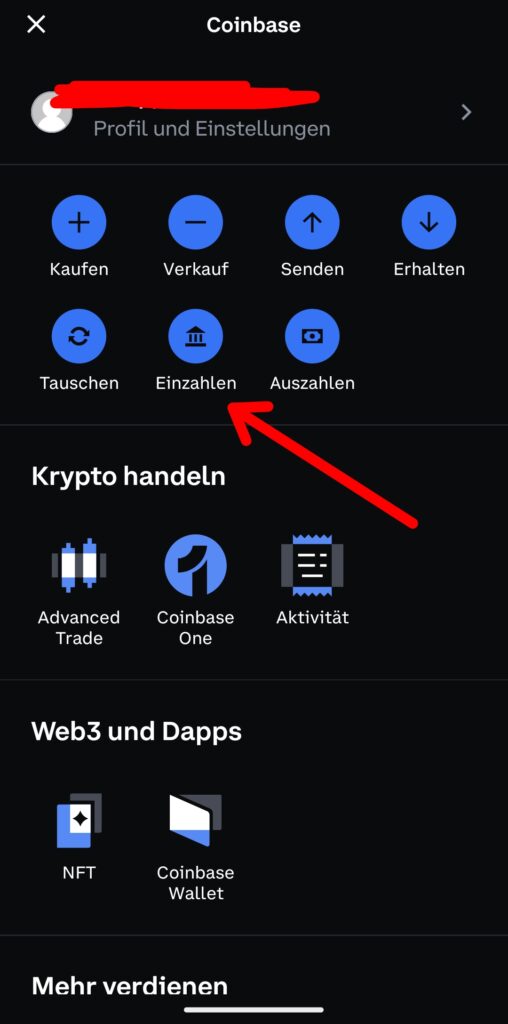

I will show it all on mobile apps my lazy frens. I have installed the sonar wallet from kujira. Please check your app stores. I made a new coinbase account and downloaded their app either. This gives us the easiest fiat on ramp atm. I didn’t like coinbase and had kraken and binance in the past. But ok, at least all worked like a charm until now. Kyc no problem and very fast. First 500€ Sepa bank transfer went through in sensational 5 hours. So let’s do it. I am using the easy mode on coinbase and I am sorry I can’t switch to english. So your 1€ confirmation transfer and kyc went through? Please choose the settings icon at the top left in your coinbase app and choose the bank alike symbol.

Please choose the upper bank transfer option for the fewest fees next.

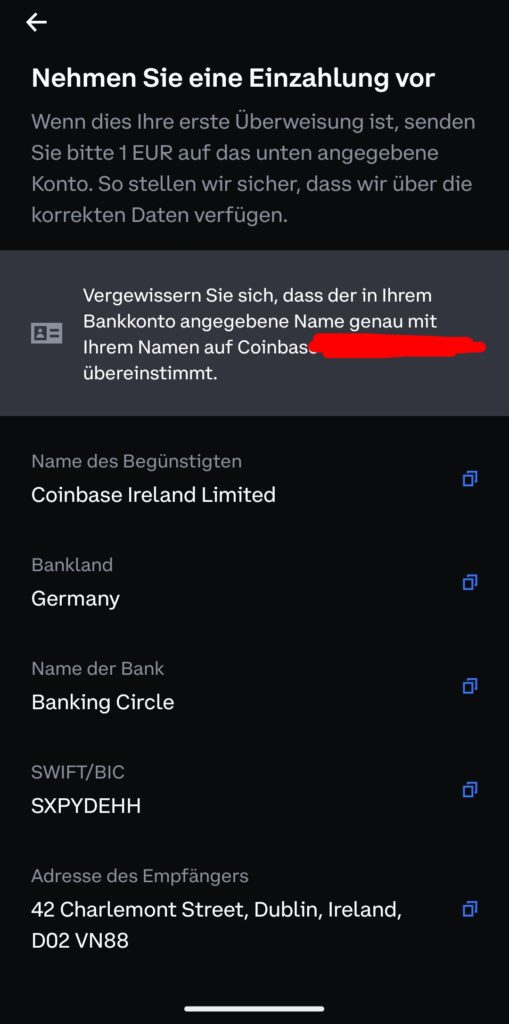

If you scroll down to the iban code on the page all things should be filled automatically if you put it in your personal banking app. It is very rare you not need a memo or anything and only account names have to match. You have to paste the Reference number meanwhile and your account names still have to match.

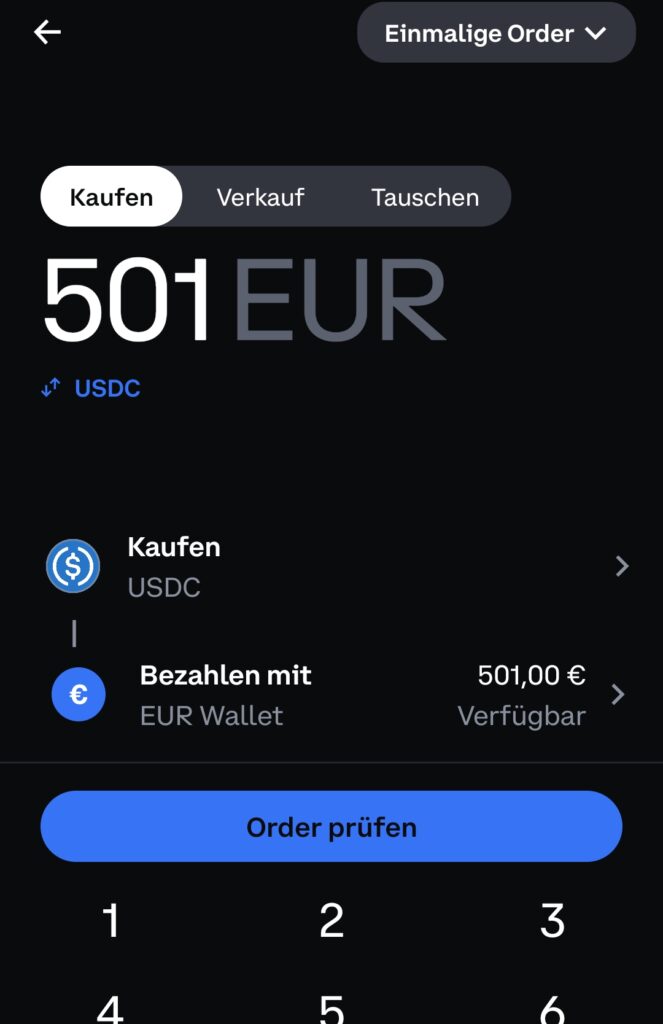

Some time later you have your money deposit on your coinbase account. Again, this takes about 5 hours to one day. Google pay or credit card options are faster but have more fees. Check your portfolio and now we will swap your fiat to usdc. Hit the plus button.

Exchange all to usdc and confirm

Deposit Usdc into your Hot Wallet

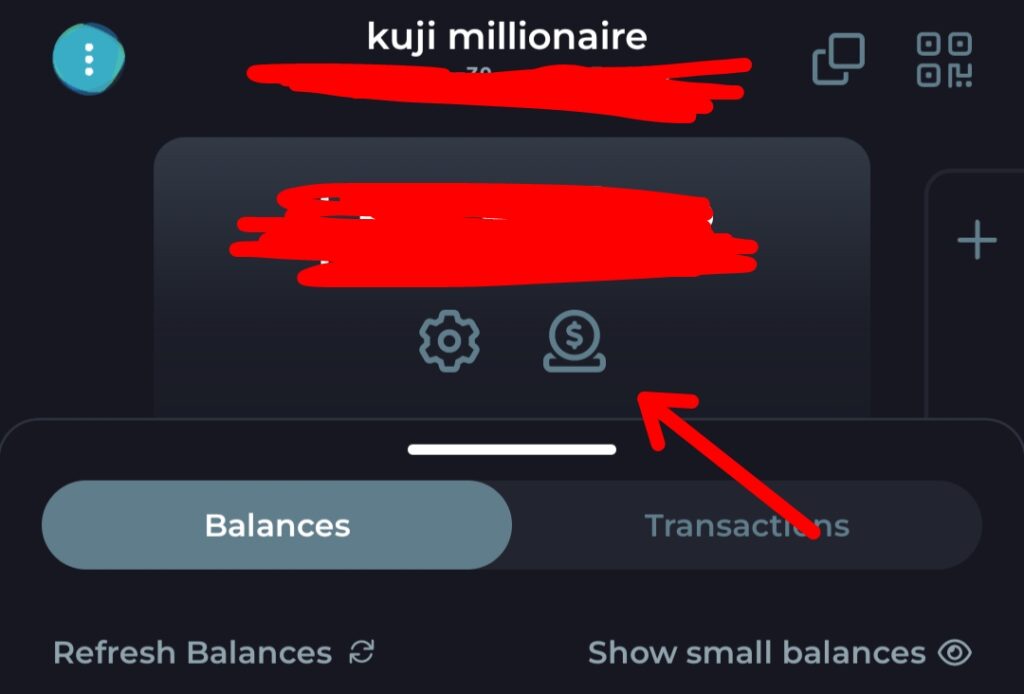

Change to your fresh installed sonar wallet app. Please create a new wallet if you have no old one. Write down your seed phrase. Never show it to anyone. It is your master key and no support team in the world can restore it for you. Hit this symbol.

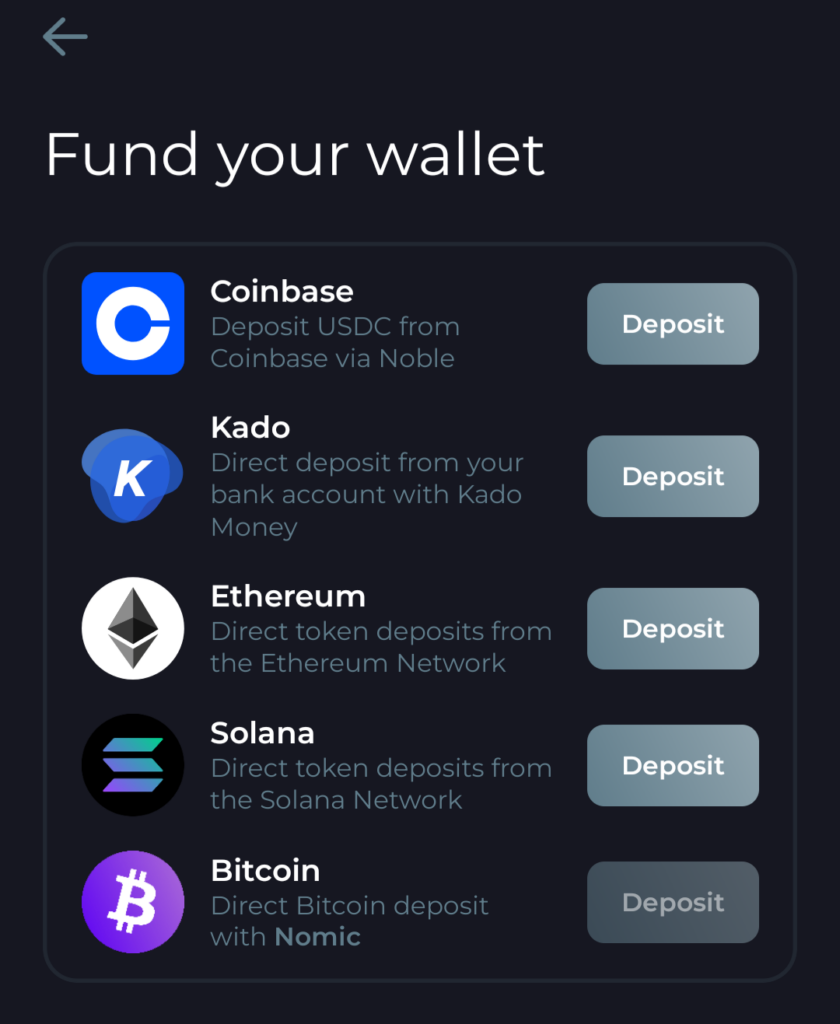

Please choose coinbase deposit and copy the noble address that is shown to you. Back in the coinbase app, go to your portfolio page again and choose send on your new Usdc coins.

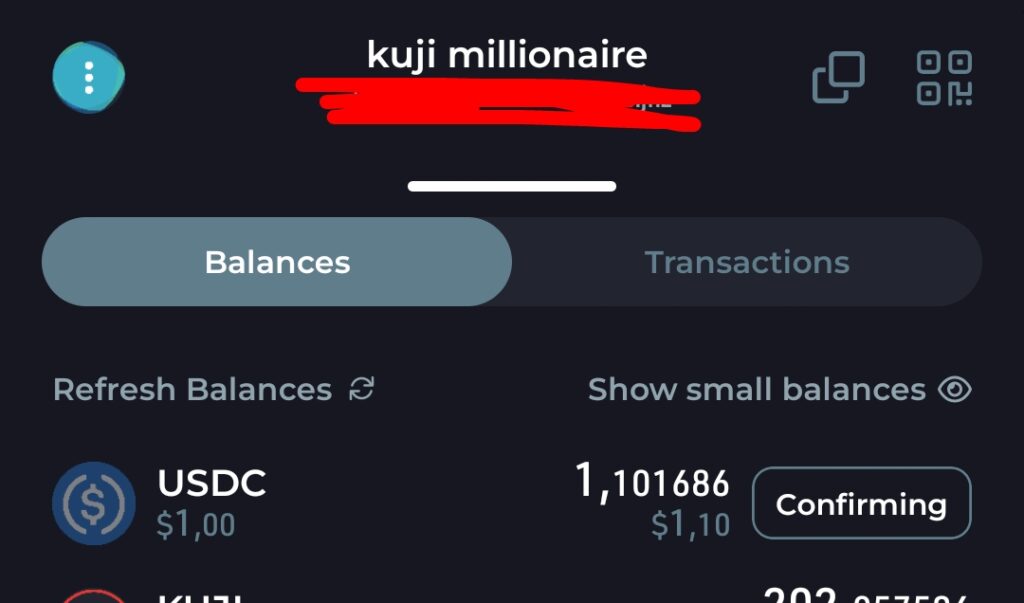

Choose the noble chain and always in crypto send a small 1$ test amount to the adress you copied before. Back on your sonar app you have to refresh the balances and confirm the deposit (with the button). 10 seconds later you have your usdc in your wallet.

Safe investment strategies. Staking, Lending

Ok we are almost ready to do our first investment. For the guys with no trust in crypto or having a lot capital that could get lost. You can leave all the volatility of crypto assets aside, you can also invest with stable coins. Derivates of the us dollar like usdc, usdt, usk. I will only talk about usk from here, because this is the only trustable fiat system in the world to me and the others have huge centralization or transparency flaws. (I will say a lot things like they are facts because this should be a most short manual and no white paper.)

So it can be be good to put the money on ghost, which borrow/lend mechanics are very similar to the well known aave on ethereum.

Please use leap wallet for all actions at the moment, because sonar has own ui’s and is only half finished (but will be the go to wallet then). But please change the gas denom to usdc on sonar here and buy a few kuji with sonar’s swap, to have some kuji for fees. Always let some in wallet for fees.

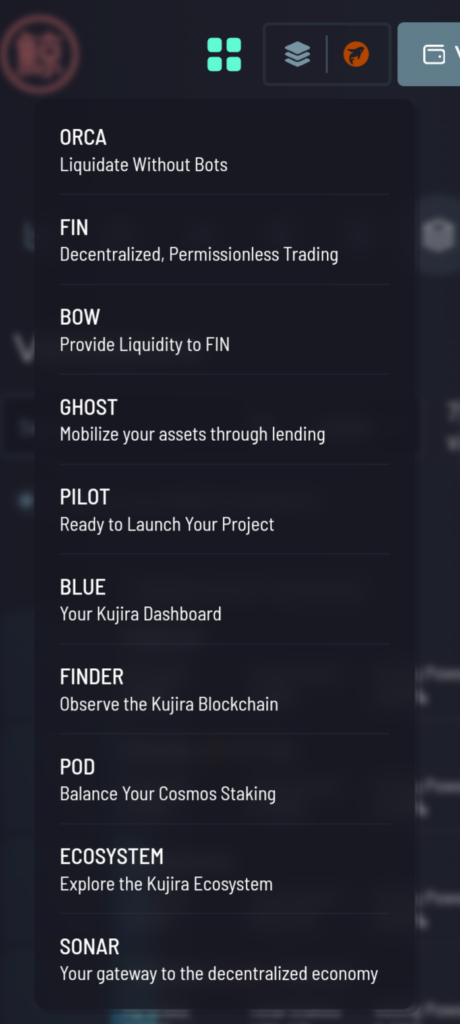

Please select all apps by the above button if you are on any kujira team app. Also all other apps should be rather chosen from the ecosystem button instead of gooogle links.

On the app ghost, hit the “lend” button on your preferred market and deposit your coins. Please know that your shown apr’s are actual, depending on the utilization of the pool. If you deposit usk, you will get the xusk derivate as representative. You can check the apr development on the fin app if you choose the usk-xusk pair. You can use your xusk to place bids for liquidated coins on orca either.

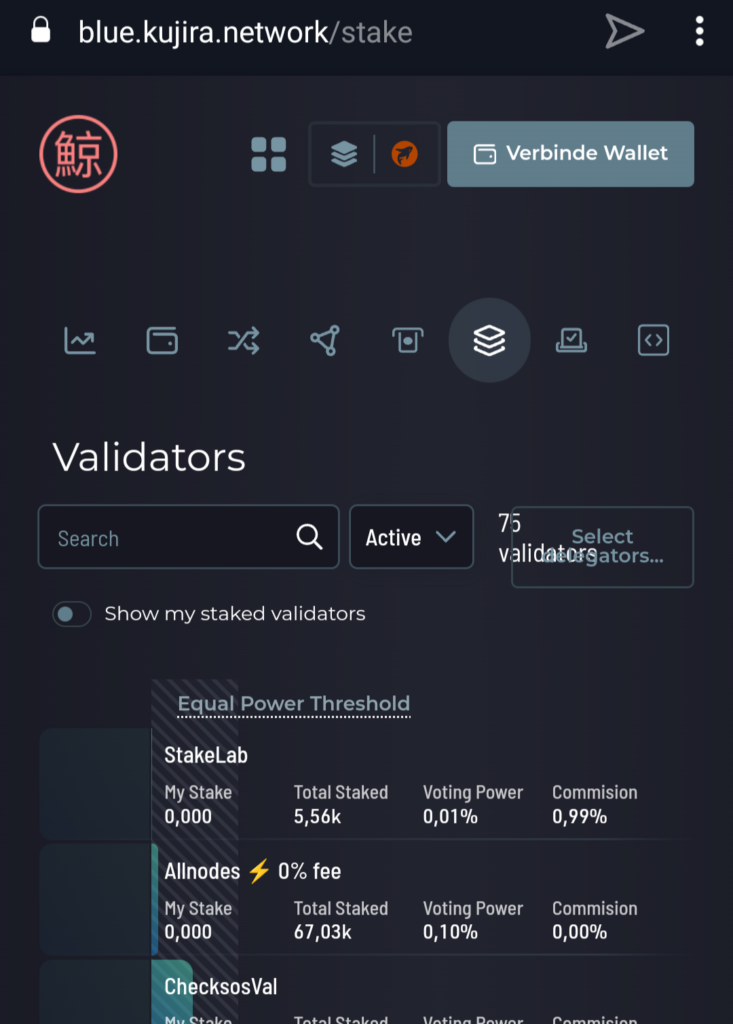

Another risk free attempt is buying the crypto coin you have trust in and earn from this capital by staking. Instead of just laying in your wallet it will help to secure and govern the chain. You can stake your kuji on blue. Staking apr’s are shown on the dashboard there. Please consider to diversify between up to ten validators. Because you could get amounts slashed (1, 2 or 5%) , depending on the faults your validator made (rare event, avoid vals with past slashes). Please try to choose a small validator to diversify voting power. I also check for the self stake of the validator and how their voting participation on governance is. You can do this on the webpage of the smartstake validator. If you want to stake other coins like manta for example, you probably have to do this on their homepage.

Medium safe strategies. Buying coins and earn rewards

Buying coins is a part of medium risk strategies. A lot things can go wrong with their price action. A very nice way to avoid your portfolio worth going down from buying a coin is to dca (dollar cost average). Also if there is a protocol for that I would prefer to take care about this myself, because I consider many things besides the price action, like fundamentals and news about a project or about the whole crypto market. Maybe there are very volatile markets or the coin is too new to fetch useful historical data for an ai to trade it for you.

If I have 2000$ I want to put in a coin, I would start building my position like buying the coin with half of my capital and bound it with a stable on the bow app (liquidity pools, like ethereum uniswap). Because I have a hedge to the downside and not much loss to the upside if you check this graph.

Additionally I get high apr’s if I am lucky and if pa goes down, my pool is changing my provided dollars to the coin I would like to hodl with the help of impermanent loss. I also have stable dollar capital for another dollar cost averaging shot, if another downmove happens and I think it’s over.

If the price of my non stable coin is up only, I could consider stop wasting my up leverage, because I am not invested with all my stable dollars and invest the rest to go all in. Preferably with enough downside hedge because of my earned apr and price action winings.

Hit the pools button on the bow app, choose your pair, hit open, and do provide and stake on the opened pages.

Degen strategies. Leverage

If I have invested all my stable capital into a coin, and price action is still going down. I could also make a last shot with this kuji capital, if I put it on ghost as collateral to borrow usk and buy the coin another time to average my entry. But the downmove of your coin should be really over, or you are at risk to loose all your capital with a liquidation.

To sum it up, we should rate the pa of our coin and if we fear sideways or downways action, we should consider hedging our position with half a stable on bow. Please know that all price actions depend a lot on bitcoin pa for maybe 90 percent of the day. The last part of using your coin capital to borrow dollar or else is high risk! But again we can easily shift our art of investing between very safe and risky.

You can also use the borrow function while prices are going up and you are not happy with your current amount of your investment. Again put in your coins as collateral to buy more of them. Again a lot risk, because downside pa can liquidate your whole capital.

Please check https://app.pulsar.finance to monitor your portfolio in detail! Just copy your kuji address from sonar.

If you don’t really understand any process pls check detailed articles. I will add a detail section in the coming weeks either. And will add/change a lot here until february I guess.

Welcome broji (brother who holds kuji)

Research

I thought I would add a detailed section here, but I think I will do seperate articles for further topics.

The important thing I would like to add for your coin investment is about your research. Normis tend to use google websearch and trust ratings from people they never heard of to rate their crypto project. Every usual page like coin telegraph and such is pure bullshit! It is not like there are no valuable articles. But they are used to repeat some project punchlines and that’s it. While on twitter you find a lot more about what is really going on. Like founders cashing out, or calling out their newest stupid ideas, wallets, apps or bridges hacked, chains halted, kudos here, bashes there…

It is much better to do your own research based on the project whitepaper. Check their intention and usecase for an own coin, check their tokenomics (coin distribution) and vesting times (coin release schedules). Check their bosses, their developing and use their apps. If they don’t even have one it is very bad. BE AN USER.

Secondly it is very important you join twitter and start following people talking about your project. You will need some time to find out if these guys are just moonboys that want to pump and dump their bags and how real they are. But there is no better way to get information about the general mood towards your project!

Must follows for Kujira on twitter:

@TeamKujira (project account)

@deadrightdove (team kujira boss, or at least frontman of the boss group)

@KujiraAcademy (a university class providing educational kujira content)

Telegram channels:

https://t.me/team_kujira (team kujira main chat, good for a quick help)

https://t.me/KujiNews (read only news channel)

Discord:

https://discord.gg/teamkujira (feature requests, bugs)