Kujira is a decentralized ecosystem offering a range of innovative and sustainable FinTech solutions for protocols, builders, and Web3 users. One of the main features of Kujira is the ability to earn stablecoin yield in various ways, such as lending on GHOST, providing liquidity on stableswap LPs on BOW, and bidding on ORCA liquidations.

In this article, we will explore how these methods work and how you can benefit from them.

Contents

- Lending on GHOST

- Providing Liquidity on Stableswap LPs in BOW

- How to LP Stablecoins on BOW

- Bidding on ORCA liquidations

- Conclusion

- Useful Links

Lending on GHOST

GHOST is a money market protocol on Kujira that allows users to lend and borrow various assets, such as USK, axlUSDC, KUJI, ATOM, and more. Users who lend their assets on GHOST receive xAssets in return, which are yield-bearing tokens that represent their share of the pool and accrue interest over time.

For example, if you lend USK on GHOST, you will receive xUSK, which will increase in value as the borrowed interest accumulates. You can redeem your xAssets at any time for the underlying asset plus the accrued interest, with no lockup period. The best part? All of the yield is sustainable and not formed from inflationary incentives.

Lending on GHOST is a simple and passive way to earn stablecoin yield, as you can choose from a variety of stablecoin pools, such as USK, axlUSDC, USDC, and more. The interest rate you earn depends on the utilization ratio, which is the percentage of the total pool that is borrowed. You can check the current interest rates and pool statistics on the GHOST dashboard.

Providing Liquidity on Stableswap LPs in BOW

A stableswap pool is a type of decentralized exchange (DEX) liquidity pool (LP) designed specifically for trading stablecoins. Stablecoins are cryptocurrencies pegged to the value of a fiat currency, such as the US dollar, with Kujira’s decentralized stablecoin (USK) attempting to maintain a peg of $1. This relatively stable price makes them ideal for trading on a stableswap pool.

Providing a stableswap pool is another way to earn stablecoin yield, as you can earn a portion of the trading fees generated by the swaps. Unlike traditional LPs, which require a 50/50 split between assets, deposits for stableswaps work differently. Simply add USK and observe the amount of USDC you are required to deposit.

You can create stableswap LPs between different USD stablecoins, such as USK, axlUSDC, USDC, and axlUSDT. Stableswap LPs use a special algorithm that keeps the prices of the coins more equal and stable, reducing the risk of impermanent loss and maximizing the efficiency of swaps. In return, you will receive LP tokens representing your share of the pool, entitling you to the fees.

You can also stake your LP tokens on the farms page to earn additional rewards in stablecoins or other tokens with no lockup period. All these features of providing stableswap LP and farming stableswap LP can be done using BOW on Kujira.

Strategy Explained: How to LP Stablecoins on BOW

To start LP’ing stablecoins on BOW, you must first navigate to the stableswap LP on BOW and click ‘Provide’. Unlike traditional LPs, which require a 50/50 split between assets, deposits for stableswaps work differently. Simply add USK and see the amount of USDC you must deposit.

If you notice you need more of one side of the LP, simply click on Swap and purchase it.

Bidding on ORCA liquidations

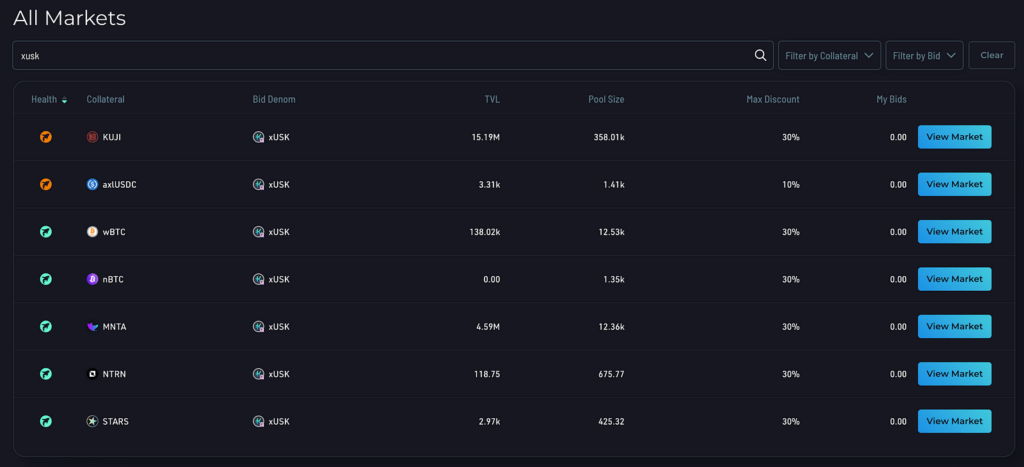

ORCA is a decentralized application on Kujira that enables users to bid on liquidated collateral at a discount. Liquidations occur when borrowers on GHOST fail to maintain the required collateral ratio for their loans, resulting in their collateral being seized and sold to repay the debt.

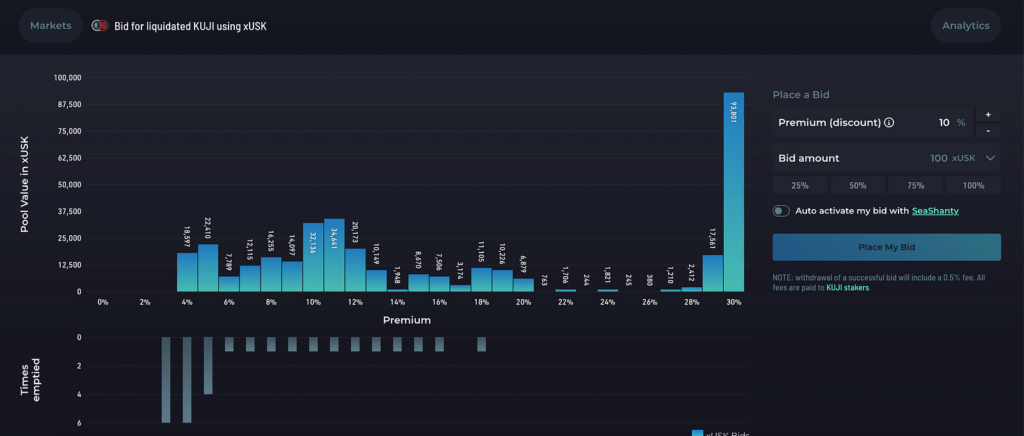

ORCA allows users to participate in a Dutch auction, where the price of the collateral starts high and drops over time until someone buys it. The discount rate ranges from 0% to 30%, depending on the market conditions and the bids placed.

Bidding on ORCA liquidations is a more active and opportunistic way to earn stablecoin yield, as you can obtain collateral at a lower price than the market value and sell it for a profit. To bid on ORCA liquidations, you need to have the bid denom asset for the pool you want to bid on.

For example, if you want to bid on axlUSDC liquidations, you need to have xUSK as a bid denom asset, which you can obtain by lending USK on GHOST, or you can use other assets that are qualified by check in the ORCA market tab. You can then select the desired discount rate and the amount of xUSK or other bid denom asset you want to bid with and wait for the liquidation to happen.

If your bid is successful, you will receive the liquidated axlUSDC in your wallet, which you can then swap or sell as you wish.

A comprehensive guide that explains how ORCA works and how to bid on liquidations can be found in this video.

Conclusion

Kujira is a versatile and innovative ecosystem that offers multiple ways to earn stablecoin yield, depending on your preference and risk appetite. Whether you prefer lending on GHOST, providing liquidity on stableswap LPs, or bidding on orca liquidations, you can find a suitable option for you on Kujira.

To get started, you need to connect your wallet to the Kujira app and choose the product you want to use. You can also join the Kujira community on Telegram or Discord to learn more and get support. Happy hunting!

Useful Links

Written by Zuhair

Kujira Academy is a platform that aims to bridge the gap between young entrepreneurs and Web3, providing them with tangible education and career acceleration opportunities. Built by students, for students. Learn more about the academy and our vision here.

To register your interest and become a student of Kujira Academy, click here.