The Missing Ingredient

When it comes to DeFi, Kujira is truly a beautiful piece of tech: FIN, the 100% on-chain fair orderbook is a marvel, and its top-notch UI has the potential to offer a CEX-like trading experience to users. With the SONAR mobile app approaching an end to the beta phase, Kujira will soon be able to reach a much wider audience, but the reality is we are not ready for prime time yet. One ingredient is still missing: liquidity.

Liquidity is the backbone of DeFi. On Kujira, more liquidity in the orderbook means more trading volumes on FIN and more bandwidth to facilitate additional economic activity. Liquidity on FIN is also key to scale other products: it enables people to buy the collateral they want to mint USK or deposit on Ghost without costing them high price impact; deep liquidity is also important to facilitate orderly liquidations via ORCA and scale USK supply. More liquidity leads to more economic activity, which leads to more real-yield fees for KUJI stakers.

Having outstanding DeFi tech without enough liquidity is like having a rocket ship with no fuel – it might look amazing, but it’s not going anywhere!

FIN’s UI is great, but until recently, the trading experience was nothing like a CEX due to super thin liquidity in most pairs. Six months ago, before MantaDAO started the liquidity building efforts, BTC liquidity in FIN’s orderbook was so thin that a small 1k USDC market buy order would push the price to infinity. Offering users the ability to trade top crypto assets with a low price impact is a must to compete with CEXs and more established DEXs.

MantaDAO Enters the Picture

One of the core roles of MantaDAO is to build up the necessary liquidity to bootstrap the long-term growth of the Kujira Economy. Coming back to our BTC example, since early August, MantaDAO has spent almost $150k to acquire wBTC which it paired with MNTA, resulting in over $300k worth of liquidity. This enables Kujira users to trade BTC with a much lower price impact via MantaSwap. The same 1k USDC trade is now possible with less than 1.2% price impact – a huge improvement.

The best part is that this liquidity is non-mercenary: because it belongs to the DAO, it’s going to stay on Kujira in perpetuity, and without requiring any incentives. The liquidity will grow organically over time as profits from market making activities are continuously compounded inside the LPs. This model is highly sustainable, just like everything we aspire to do on Kujira.

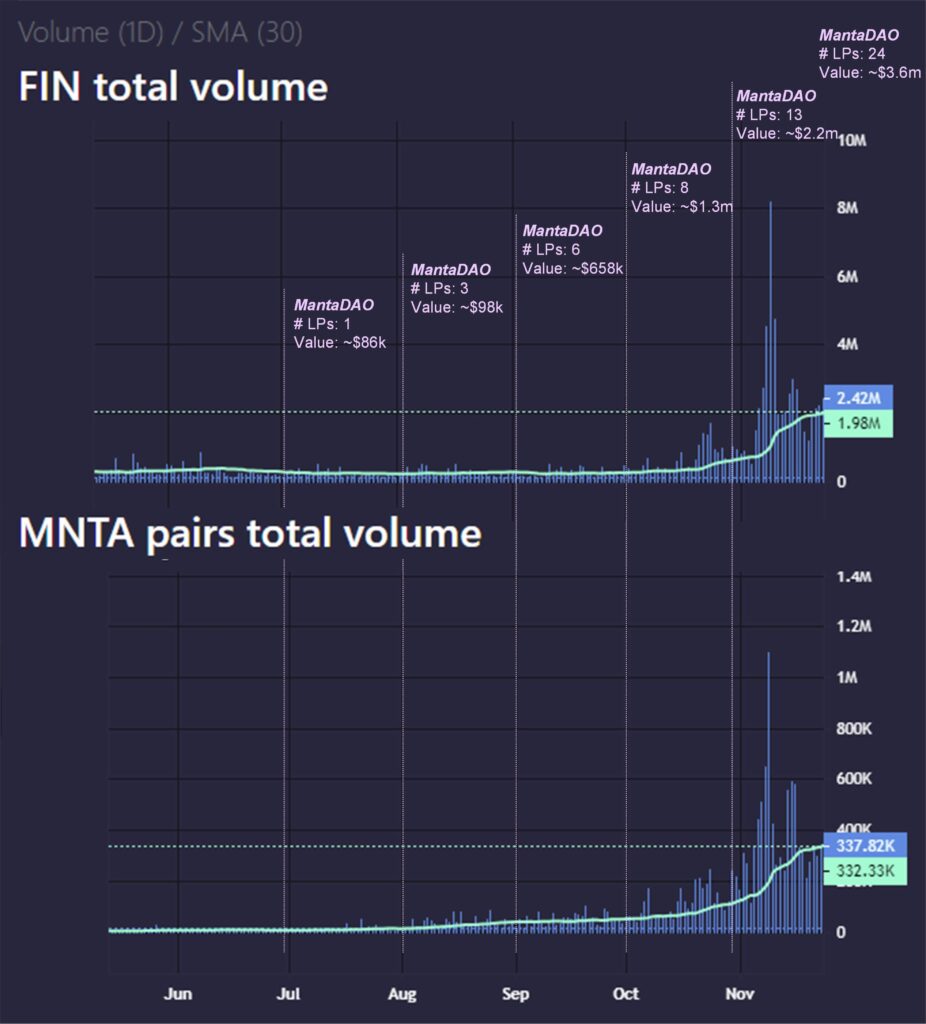

Since MantaDAO became active in July 2023, we managed to accumulate $3.6m worth of protocol owned liquidity (POL) spread across 24 MNTA LPs (KUJI, wBTC, wstETH, wETH, stATOM, STARS, SHD, SOMM and many more, including WINK). The more liquidity we build up for FIN, the more trading volumes can be facilitated and the more fees for KUJI stakers. The impact MantaDAO has had on FIN trading volumes is noticeable.

MantaDAO POL went from nothing at the beginning of June 2023 to 24 LPs with a total value of ~$3.6m as of 24-Nov-2023. Total trading volumes on FIN really picked up steam in mid-September, with average daily volumes going from ~$220k/day to ~$2.0m/day (a 9.0x increase in ~2 months). This acceleration is highly correlated to MNTA pairs volumes that increased from ~$39k/day to ~$332k/day (8.5x) over the same period. MNTA pairs currently represent ~17% of FIN total volumes.

What is MantaDAO anyway?

MantaDAO is a community owned DAO deployed on the Kujira blockchain. The DAO went live in April 2023. It started with an airdrop to KUJI stakers, followed by the launch of MantaSwap by the incredible Mike. There was no team allocation, no inflationary rewards, just a revenue generating product and an airdrop. It was up to the recipients to decide what happened next.

After the airdrop, some members of the Kujira community started to engage, and a subset became increasingly involved. We made plans, quickly moved to actions, and managed to grow POL to over $500k in just 3 months, and then 7x that to ~$3.6m in another 3 months.

MantaDAO’s mission is to support the entire Kujira ecosystem in delivering a best-in-class experience to both traders and protocols looking to list their token on FIN (Kujira’s orderbook DEX), while being profitable for MNTA stakers.

To achieve that, MantaDAO operates two complementary activities: (i) a Development arm building applications, tooling and analytics to improve users’ experiences and opportunities across the Kujira ecosystem, and (ii) a Market Making arm focusing on deepening liquidity on FIN’s orderbook via long-term Protocol-Owned Liquidity (POL) and sustainable market-making programs (i.e. not requiring token incentives).

Both pillars play a critical role in bringing the trading experience on FIN closer to what traders are used to on CEXs (e.g. low slippage on spot trades, fast execution for limit orders around market price, and reliable prices tracking CEXs and larger DEXs).

MantaDAO Development arm

On the Development side, the first product is MantaSwap, a multi-hop router for FIN which enables users to find the optimal route to swap any input token to any output token (as opposed to being limited to trading within the pairs listed on FIN). For example, if you want to buy ETH with USK, instead of directly putting a trade in the ETH/USK pool, you might get a better deal by taking a longer route that capture arbitrages within FIN pairs, something like USK<>ATOM<>alxUSDC<>ETH.

In that scenario, it means executing 3 market orders on FIN instead of one, and it’s a win-win for all parties:

- The trader ends up with more ETH than if they had directly put a market order in the USK/ETH pool (they captured an “internal” arbitrage);

- For FIN, it increases price consistency across pairs for a given token;

- For KUJI stakers, it is three market orders instead of one, which means 3x more fees (3x 0.15% taker fee).

Swaps conducted on MantaSwap charge a 0.1% fee that goes to MantaDAO’s treasury and are currently distributed to MNTA stakers once a week. MantaSwap has been integrated as the default swapping interface on Sonar (Kujira’s mobile app) and will be integrated to Kujira web apps next. Next MantaSwap upgrade will integrate split-route swaps, enabling a better trading UX (especially for larger swaps), and spreading the multiplicative effect on FIN volumes and fees across more pairs.

Several other products are in the making, each aiming at increasing economic activity on Kujira while leveraging other pieces of the Kujira infrastructure. Things in the making include: various custom market-making vaults that will place orders on FIN and complement BOW (Kujira’s first AMM built on top of FIN); a DAO Platform allowing any project to easily launch a DAO on Kujira and manage its treasury (based on MantaDAO’s own governance smart contracts); various vaults leveraging other pieces of the Kujira infrastructure such as the liquidation engine ORCA, and the money market GHOST. Each of these products will generate fees for MantaDAO.

MantaDAO Market Making arm

MantaDAO’s Market Making arm focuses on deepening liquidity on FIN’s orderbook via long-term protocol-owned liquidity and sustainable market making programs (i.e. not requiring token incentives). There is a total supply of 100m MNTA, of which 5% was airdropped to KUJI stakers at inception. The remaining 95m supply is DAO-governed and utilized in a controlled, data-driven manner to build POL (mostly) and, to a lesser extent, fund the development of new revenue generating products.

Methods of funding for POL include:

- Treasury swap deals;

- Public OTC deals;

- Bond sales;

- DCA-out strategies;

- Minting USK;

- Borrowing on GHOST.

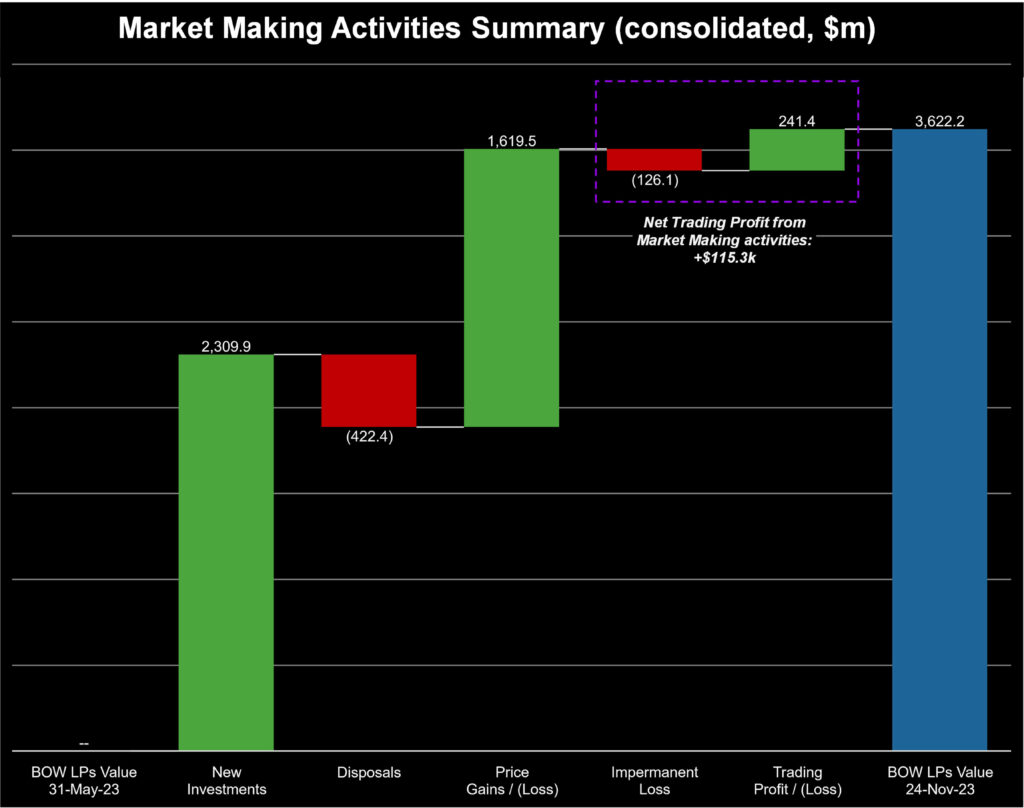

As of 24-Nov-2023, the DAO accumulated ~$3.6m worth of POL spread across 24 MNTA LPs. Revenue from market making activities has been strong so far, with $115.3k of Net Trading Profits since inception (~18% APR), materially outperforming impermanent loss.

More info on the state of MantaDAO’s finances is available in our latest monthly report.

Wrapping up

We hope this article hosted by our friends at WinkHUB (thanks guys <3), helps you better understand what MantaDAO is all about, and how it benefits the entire Kujira ecosystem. We have plenty more in the pipeline, and if you like what you see, please come and join our vibrant community on Telegram (where the real action is) or Discord, and follow us on Twitter.