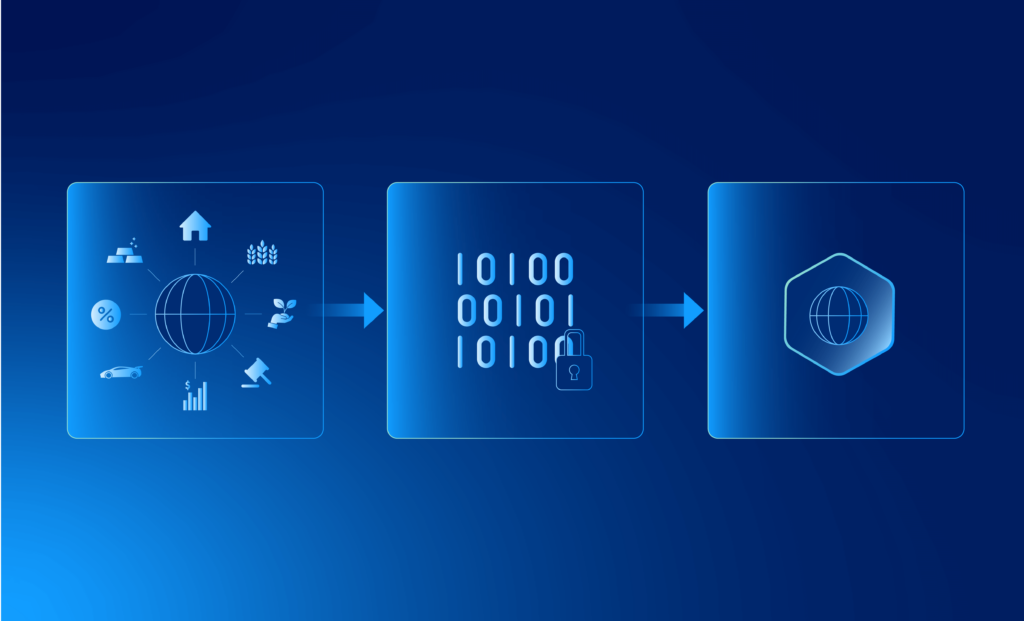

Imagine owning a piece of the Mona Lisa, a fraction of a skyscraper, or a share of a rare vintage car. Sounds impossible, right? Not with digital assets. Cryptocurrencies can turn real-world assets (RWAs) into digital tokens that can be stored, verified, and exchanged on a blockchain.

RWAs can be anything that has intrinsic value and can be owned, such as real estate, art, commodities, intellectual property, etc. By tokenizing RWAs, cryptocurrencies can unlock new possibilities for investors and businesses, creating more liquidity, efficiency, transparency, and accessibility in the global market.

Benefits Of Tokenizing RWAs

Tokenizing RWAs can bring several advantages to both investors and real-world businesses, such as:

- More liquidity: Imagine you have a painting or a property that you want to sell, but you can’t find a buyer who can afford it. What if you could split it into smaller pieces and sell them to different people? This is the power of RWAs. It can make your assets more liquid and tradable, as you can create tokens that represent a fraction of your asset, and sell them to anyone who wants a piece of the pie. This way, you can increase the market liquidity and reduce the cost of selling illiquid assets, which are usually hard or expensive to sell.

- More efficiency: How would you like to buy or sell an asset without dealing with the hassle of paperwork, fees, and delays? RWAs can make your transactions more efficient and cost-effective, as you eliminate the need for middlemen such as brokers, banks, lawyers, and regulators. By using smart contracts, you can automate the transaction process without the need for human intervention or verification. This way, you can save time, money, and resources for both parties.

- More transparency: What if you could verify the ownership and history of an asset with just a click of a button? RWAs can make your transactions more transparent and secure, as you can provide a clear and immutable record of the asset on the blockchain. This way, you can prevent fraud, manipulation, and disputes and facilitate compliance and auditing. Moreover, tokenizing RWAs can enable real-time price discovery and market information, as you can see the supply and demand of the asset in a decentralized and open network.

- More accessibility: RWAs can make the asset market more accessible and inclusive as you can lower the barriers to entry and exit for investors and businesses. By tokenizing RWAs, you can reduce the minimum investment amount, allowing more people to invest in previously inaccessible or unaffordable assets. Furthermore, tokenizing RWAs can enable cross-border and cross-platform transactions, as you can easily transfer and exchange tokens across different jurisdictions and platforms without the need for intermediaries or conversions.

Examples Of RWAs Protocols

There are many projects and platforms that are exploring the potential of tokenizing RWAs using different blockchain technologies and standards. Some of the notable examples are:

Realio

Realio is a blockchain-based digital private equity firm providing a platform for creating, managing, and investing in digital assets. Realio’s platform utilizes blockchain technology to offer a range of services including, tokenization, digital asset issuance, and secondary market trading, as well as hosts a variety of applications including, the Realio Network, Districts, and forthcoming Freehold wallet.

Realio has issued three tokens: the native gas and utility token of the Realio Network, the Realio Network Token (RIO), and two security tokens, the Realio Security Token (RST) and Liquid Mining Fund (LMX).=

RST is a hybrid digital security with network utility features that provides token holders with equity ownership of Realio Network LTD (the IP owner of the Realio technology platform and maintainer of the Realio Network codebase). In addition to earning distributions of profits from the technology platform, RST holders can stake their tokens in a validator on the Realio Network to earn block rewards and secure the network. RST can be purchased on the Realio Platform once KYC is completed.

LMX is a fully tokenized special-purpose vehicle that exposes investors to Bitcoin mining, focusing on immersion cooling technology and sustainable power sources such as hydroelectric. Currently, Liquid Mining Fund directly holds private shares of a large, institutional-scale immersion miner, one of the lowest-cost producers of Bitcoin globally.

Going forward, Liquid Mining Fund will actively seek to acquire ASICs directly by raising new capital and deploying capital from the proceeds of liquidating its existing holdings at opportunistic intervals. Bitcoin mined from the operation of these ASICs will be distributed to holders of LMX.

Realio aims to democratize access to alternative investments by providing a platform for asset owners to create and manage digital securities and for investors to trade those securities on a secondary market. They do this by providing liquidity, efficiency, transparency, and accessibility to the asset market by leveraging the advantages of blockchain and empowering investors and issuers.

Centrifuge

Centrifuge is a decentralized protocol that enables the creation of asset-backed tokens from real-world assets, such as invoices, royalties, loans, and more. It connects asset originators, who want to finance their assets, with investors, who want to invest in them, through a peer-to-peer network. Centrifuge uses two types of tokens: Tinlake tokens, which represent the ownership and cash flows of the underlying assets, and Radial tokens, which are stablecoins that are collateralized by the Tinlake tokens.

Conclusion

Tokenizing RWAs is one of the most promising and innovative use cases of cryptocurrencies, as it can create new opportunities and benefits for investors and businesses in the real-world asset market. By using blockchain technology, tokenizing RWAs can increase the liquidity, efficiency, transparency, and accessibility of the assets, as well as enable new forms of value creation and exchange.

There are many projects and platforms that are working on tokenizing RWAs, using different approaches and models, and offering different types of assets and tokens. Tokenizing RWAs is still a nascent and evolving field, with many challenges and risks, such as regulation, compliance, custody, and valuation. However, it also has a huge potential to transform the global economy and society by bridging the gap between the physical and digital worlds.

Useful Links

Kujira Academy is a platform that aims to bridge the gap between young entrepreneurs and Web3, providing them with tangible education and career acceleration opportunities. Built by students, for students. Learn more about the academy and our vision here.

To register your interest and become a student of Kujira Academy, click here.

Written by Zuhair