You may not have heard, but Perpetual swaps are coming to Kujira. With this next building block in place, Kujira further solidifies itself as the go-to ecosystem for all things DeFi-related, with all revenue directed to a singular token — KUJI. In this article, I will go through:

- What are Perpetual Swaps?

- Benefits to KUJI stakers

- Comparisons to existing perps products

- Surprise bonus at the end!

What are Perpetual Swaps?

Perpetual swaps (Perps) are a type of derivative contract that allows traders to bet on the future price of an asset without having to own the underlying asset. Let’s simplify this:

Imagine you and your friend are making a bet. You bet that the price of Bitcoin will go up tomorrow, and your friend bets that it will go down. If the price of Bitcoin goes up, you win the bet and your friend gives you some money. If the price of Bitcoin goes down, you lose the bet and you have to give your friend some money.

Perpetual swaps are like this bet but with a few key differences. First, perpetual swaps are traded on an exchange (FIN), so there are always buyers and sellers available within the orderbook. Second, perpetual swaps use leverage, which means that you can bet more money than you actually have. This can amplify your winnings, but it can also amplify your losses.

Benefits of Perpetual Trading in Crypto

Perpetual trading offers several benefits for crypto traders, including:

- Leverage: Perpetual contracts allow traders to use leverage to multiply their profits (or losses). This can be a great way to boost returns on small investments.

- Liquidity: Perpetual contracts are typically very liquid, meaning that there are always buyers and sellers available. This makes getting in and out of trades easy and efficient.

- 24/7 Trading: Perpetual contracts can be traded 24/7, meaning that traders can take advantage of market movements around the clock.

Benefits for KUJI Stakers

All revenue from perpetual trading on Kujira will be shared with KUJI token stakers, as is the case for all Kujira products. This means that KUJI stakers will directly benefit from the success of the perpetual trading product.

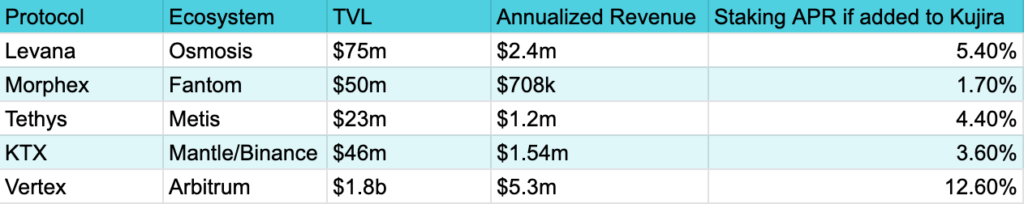

The addition of perps is expected to have a significant impact on the staking APR for KUJI tokens. By comparing the revenue stats of other perps products within Cosmos and in ecosystems with similar Total Value Locked (TVL) as Kujira, I can estimate the potential impact on the staking APR.

For reference, the staking APR for KUJI tokens is 0.5% (as of 10/25/23) and is based on an annualized revenue of $336k.

Here is a comparison of the revenue stats of other perps products within Cosmos and in ecosystems with similar TVL as Kujira:

But wait, it gets better…

In addition to the revenue from trading fees, KUJI stakers will also receive revenue from liquidations on the perps. This means that even for the same amount of volume and trading fees, Kujira and KUJI stakers would achieve even higher returns, making the staking APR increase further. It is hard to estimate the increase in revenue and it would be disingenuous to estimate based on this data, but you can imagine this would be a large increase.

Conclusion

The addition of perpetual trading to Kujira’s product suite is a major milestone for the protocol. KUJI stakers are expected to benefit significantly from the addition of perpetual swaps, with revenue from trading fees and liquidations expected to have a major impact on the staking APR for KUJI tokens.

Kujira is building the DeFi rails to offer all products in one single ecosystem with a single token that benefits from all this liquidity. Come and join us.

This article was written by David from the University of Kent on behalf of Kujira Academy. Kujira Academy is a platform that aims to bridge the gap between young entrepreneurs and web3, providing them with rigorous education and career acceleration opportunities. Built by students, for students. Learn more about the academy and our vision here.

To register your interest and become a student of the Kujira Academy, click here.