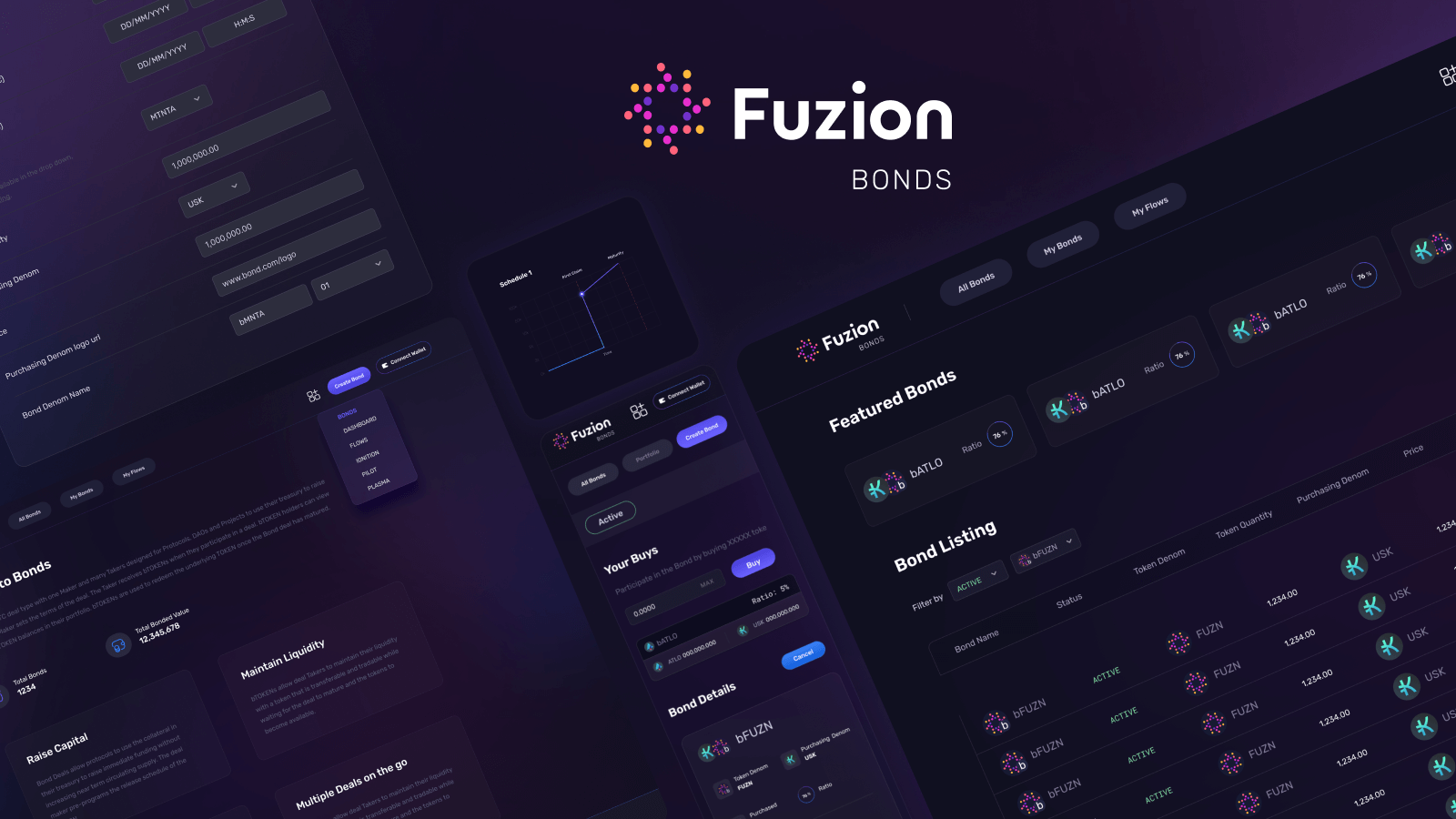

Fuzion, the Kujira project (formerly known as Atlo) responsible for shipping both Pilot, a one-of-a-kind fair gamified launch mechanism leveraging ORCA’s UI, and Plasma, an Over the Counter (OTC) portal enabling users to set up and find deals using a variety of tokens, has done it again by launching Bonds, a new powerful protocol fundraising mechanism.

Fuzion, much like Kujira at its inception, seeks to offer a variety of related products that all tie back to a shared overall vision. It wants to provide a high quality experience that empowers users with new funding opportunities. Fuzion specifically focuses on access, convenience, collaboration, and technology. Their products are aimed at a range of folks including founders, builders, whales, and shrimps.

Pilot makes it easy for serious would-be founders to pursue community raises and fund project development via fair public sales benefitting all participants on both sides of the sale. It is a response to the many existing imbalanced crypto launchpad mechanisms that either heavily favor buyers or sellers and/or require users to hold a large amount of their token in a ponzi-like manner to unlock all related platform functionality. Pilot is different, focusing on its product suite, not catering to whales, and giving every participant the same access. WinkHUB, the platform this article is hosted on, is a perfect example of Pilot’s potential. Maximus and Danny leveraged Pilot to pitch a carefully created idea to the Kujira community and raise the necessary funding to build a powerful Kujira content platform.

Plasma serves an entirely different purpose. Unlike decentralized exchanges like FIN or Manta that face token slippage and price impact, Plasma is to OTC desks what ORCA is to private liquidations: a decentralized platform bringing Over The Counter trading to retail. Plasma aims to facilitate public, transparent exchanges between multiple parties by allowing users to create and/or find deals to swap between tokens. These deals include specific characteristics such as token exchange rates, swap sizes, custom deal durations, and potential participant limits. This has been extremely useful for whales seeking to buy or sell low-liquidity tokens, DAOs wishing to fundraise and/or distribute tokens fairly to the community without creating sell pressure, and shrimps who are now able to track and join in on larger deals and benefit from reduced token sell pressure.

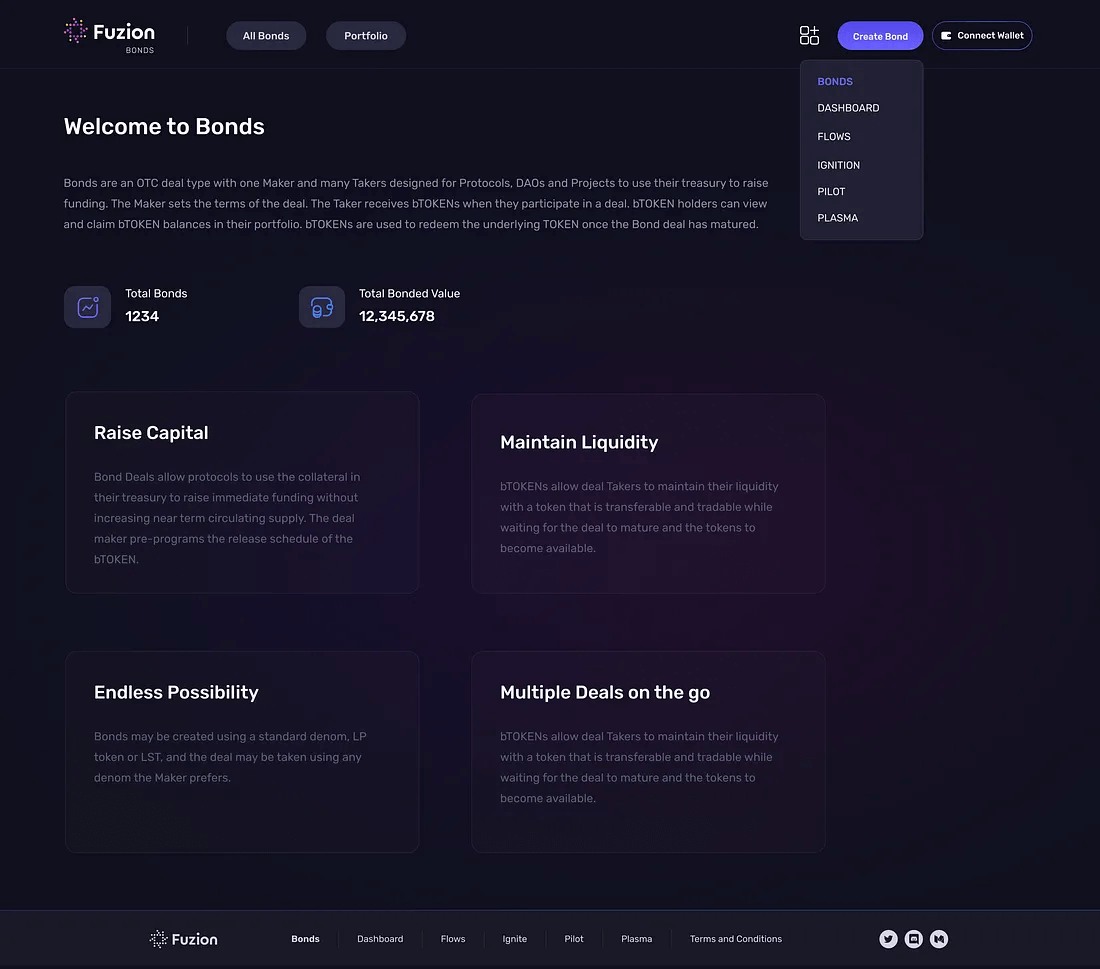

Now Bonds is the latest product in Fuzion’s ever widening DeFi suite. A staple of financial markets due to their unique properties, bonds are a game-changing fundraising mechanism and basic building block that will unlock new mature DeFi functionality and applications on Kujira. Similar to Plasma, Bonds will bring would-be Deal Makers and Takers together to create, locate, and participate in deals. However, unlike Plasma, which is mainly intended for retail, Bonds are specifically built from the ground up for organizations aiming to accomplish a range of strategic objectives. These encapsulate various use cases including protocols raising capital to fund a project, DAOs diversifying their treasury, blockchains incentivizing liquidity in a trading pair, etc. In essence, the platform provides bond Makers with various mechanisms to structure the deal to suit their strategy and needs and bond Takers with liquidity in the form of receipt tokens (bTOKENs) while they wait for the bond to mature.

I recently interviewed Dozzin about Bonds to get a clearer perspective on some of its inner workings and Fuzion’s related bigger picture:

Q. When is the service going to be live?

A. We’re hoping in the next few weeks. Design and development are underway. We’ve got a few protocols who want to have a deal up on launch, and a few more conversations on the go.

Q. How will the platform work in practice for different types of projects trying to sell bonds?

A. The sale mechanism is consistent. There’s something offered by the maker, in exchange for something from the taker. The bond has a maturity date and the bTOKENs the taker receives are distributed on a schedule. The versatility comes in the form of what the deal Maker is offering and asking for.

If they’re raising capital, they might offer their own token from their treasury in exchange for a stable coin. If they’re trying to increase protocol owned liquidity they might offer their token for a Liquidity Pool (LP), or offer the LP they already own for a stablecoin to fund a short term need without risking the reduction in liquidity of a pair.

They may want to build one LP by offering another in exchange. It all depends on the Deal Maker’s objectives and the assets at their disposal.

Q. How would using Bonds differ from raising on PILOT, for example? At least, for the fundraising party?

A. Pilot is amazing for price discovery and public access, while Bonds are an excellent means for established projects financing a specific need.

Pilot is an exciting way to take a token public, especially with its gamified mechanics that can lead to highly effective price discovery. Once the sale is complete, the token price is subject to market forces.

In contrast, a Bond is offered at a price set by the deal maker. This makes it more suited to a token (or LP) that has an established market value which all participants can use as a reference. Of course, protocols can use Bonds to go to market, but that requires consensus on value which is not always available.

Q. What would you say are some of the biggest advantages of Bonds?

A. Bonds give the makers a very high level of control over all the aspects of the deal. If they do their research, understand their audience, and have confidence in their roadmap, makers can fine tune their deal structure to get maximal capital with minimal impact on token circulation.

From the deal taker’s perspective, bTOKENs avoid sacrificing liquidity in exchange for access to great deals on the projects they believe in long-term.

Q. What is Bonds’ biggest game changer?

A. In one example, if we’re strictly speaking about a sale of tokens for stablecoins, there was always a compromise when it came to liquidity and circulation. bTokens greatly reduce that tradeoff.

At the same time, Bonds also offer a lot more granularity. A protocol could issue multiple bonds on differing time frames, at different prices, for different volumes of tokens. It all depends on their roadmap and capital needs.

This allows for a pretty big shift. And that’s without even considering the potential composability unlocked when you consider liquidity pools, Kujira GHOST’s xTOKEN assets, and liquid staking tokens which open up many new possibilities.

Q. What are your favorite features?

A. The self-service aspect. This needs to be as simple as possible for deal Makers to unlock value. It puts the onus on proving worth rather than gaining access.

I think bTOKENs are really exciting. There’s a possibility of them creating all kinds of secondary markets and in turn opening new opportunities. Holding a bTOKEN is a strong indicator of belief in the long-term value of a protocol, but it’s still liquid. This gives protocols new data on who their ardent supporters are as well as new potential ways to engage with them.

Q. What will other protocols be doing differently now? How would it look when they start utilizing Bonds? Can you provide some different types of examples?

A. The big shifts will be in how protocols change the way they launch, because there’s the prospect of raising continually as needs be, rather than an upfront lump sum. They have more options, and more control.

Bonds are one tool they’ll have to raise capital. We’re also building Ignition and… other stuff I can’t mention right now. Observing how MantaDAO and LionDAO are utilizing Plasma OTC deals to build Protocol Owned Liquidity, diversify their treasuries, and establish relationships with other protocols, I am certain once Bonds launches, they will incorporate it into their strategic execution. Our focus is composability; a first class suite of tools to craft the best possible environment in which you can achieve your objectives, whether you’re a builder, user or supporter.

As pointed out in the interview, bTOKENs represent future guaranteed access to tokens in the Bond deal when it reaches maturity. At that time, bTOKENS are redeemed 1:1 for the tokens in the Bond deal. In the meantime, they are transferable and tradeable, just like any other token. There is no time limit on redemption.

In the Bonds dApp, ‘flows’ are custom vesting and cliff schedules that Deal Makers create. These govern how the Deal Taker gets their bTOKENs. When the Maker creates a deal, they have the option to add a flow. A flow consists of multiple schedules. It has a start date, a delay until first claim (a cliff), and a duration (a vesting period). Any flow can be made of as many schedules as the Maker likes.

Aside from the high degree of customizability Deal Makers can employ, Bonds deliver various competitive key benefits:

1. Denom flexibility – DEX trading pairs, stablecoins, LPs, and LSTs

2. Controlled circulation – Makers stipulate bTOKEN distribution schedules but immediately receive Taker deposits

3. Negligible price impact – Distribution schedules mitigate token influxes

4. No up-front costs or flat fees – Bonds carry a commission on transaction completion. Participants only pay when Bonds are bought or used. Makers pay 2.5% and Takers pay 0.5% set commissions on deals.

5. No slippage – Deal Makers set price when creating bonds. There’s no risk of slippage.

6. No predetermined size – Bonds of any value and duration can be created. Multiple bonds with various characteristics can be offered simultaneously by a Maker.

7. Community involvement – Bond deals allow projects to directly involve their public.

Fuzion has a Preferred Partner Program for interested parties looking to build a long-term relationship. One of the perks of joining will be Maker fees reduced to 0.75%, amongst other privileges. Interested parties (protocols, chains, DAOs, and other orgs) can fill out this form.

Excitingly, Fuzion is also developing a fourth product that complements Bonds called Ignition. Ignition emphasizes smaller short-term deals that are more speculative in nature. Importantly, Ignition won’t use bTOKENs, but will allow makers to limit the offer to whitelists and control the maximum participation per address – which makes it a powerful tool in marketing campaigns. I’ll shed more light on Ignition and its role in the Fuzion ecosystem in a future piece.