Mobile technology is unlocking the vast potential of cryptocurrencies and DeFi, ushering in a revolution that looks set to bring financial empowerment to billions worldwide.

Today’s article explores this, introducing DeFi as a solution to the failures of traditional finance, before highlighting its growing role in driving Web3 adoption, and finally presenting improvements to mobile access, using SONAR as an example, as the gateway to financial inclusion for all.

Contents

- The Failures of Traditional Finance

- DeFi: A Solution to the Failures of TradFi

- Unlocking Economic Opportunity: Mobile DeFi

- Mobile DeFi: Overcoming Challenges

- SONAR: Mobile Mastery

- SONAR x Bidali: A Recipe For Success

- DeFi & The Future of Banking

So, where does traditional finance (TradFi) fall short, and what solution does decentralized finance (DeFi) offer?

The Failures of Traditional Finance

Traditional finance (TradFi) is plagued by several issues, with the most notable being its exclusivity and inaccessibility, with this being felt most significantly in developing economies.

In Africa, a substantial amount of the population do not have access to basic banking services, limiting their ability to save, invest and growth their wealth. In fact, over 71% of Moroccans are unbanked, meaning they have no access to financial products like insurance, loans or mortgages.

Banked individuals within this region are not much better off, enduring high transaction fees, lengthy transaction times and stringent requirements for opening accounts. This lack of financial inclusion leaves individuals isolated, with those living in poverty disproportionately affected.

Evidently, this is a pressing issue in need of a solution. This is where DeFi comes in.

DeFi: A Solution to the Failures of TradFi

DeFi harnesses the power of blockchain technology to offer a wide range of financial services without the need for traditional banking infrastructure. By enabling peer-to-peer transactions, DeFi platforms significantly reduce the costs and barriers associated with accessing financial services, making it easier for individuals in developing economies to engage in saving, lending, and borrowing.

For example, small business owners can access microloans as a result of DeFi applications, which they are not able to do through traditional banks due to a lack of collateral or credit history. This not only facilitates economic empowerment at the individual level, but also stimulates local economies by providing the necessary capital for businesses to grow and thrive.

Therefore, in regions where a significant portion of the population lacks access to traditional banking services, crypto and DeFi provide an accessible alternative, allowing individuals to create a digital wallet without needing an identity document or undergoing Know Your Customer (KYC) checks, enabling cross border transactions with instant settlement.

There is no doubt that DeFi offers the potential to transform the economic landscape of individuals in developing economies. However, there is another important factor that will determine whether Web3 proliferates into all areas of the globe.

We explore this now.

Unlocking Economic Opportunity: Mobile DeFi

The role of mobile technology in unlocking economic opportunity through Decentralized Finance (DeFi) in developing economies cannot be overstated, with mobile access surpassing traditional banking infrastructure in these regions, and making financial services accessible and affordable to more people than ever before.

A fitting example of this can be found in Kenya, where the mobile money service M-Pesa has significantly reduced the barriers to financial services, and brought banking to millions of people who previously lacked access, enabling them to deposit, withdraw, and transfer money with a simple mobile device.

However, the journey towards widespread mobile DeFi adoption in developing economies is not without its challenges. Limited internet connectivity, the high cost of smartphones, and a lack of digital literacy represent substantial hurdles that need to be vaulted.

So, how can these challenges be overcome?

Mobile DeFi: Overcoming Challenges

Firstly, DeFi projects must prioritize user-friendly designs that cater to individuals with limited technical expertise and ensure their platforms are accessible on basic smartphones, which are more common in these regions.

Governments must also make a concerted effort to promote financial inclusion. Investing in telecommunications infrastructure, subsidizing smartphone costs, and running educational programs to enhance digital literacy are all ways they can improve mobile access, and ultimately accessibility to financial services.

It should now be clear that improving mobile access is paramount for realizing the transformative potential of DeFi in enhancing financial inclusion and fostering economic opportunity in developing economies.

If the challenges of mobile accessibility and and usability are met, DeFi will achieve mass adoption in Web3, heralding a new era of inclusive, empowered global finance and changing banking infrastructure for the better.

I now provide an example of Mobile DeFi, namely, Kujira’s SONAR wallet, discussing its utility to the Kujira ecosystem and its potential to bring previously unbanked individuals and economies into the fold, once and for all.

We now take a look at SONAR, Kujira’s mobile wallet and a fitting example of Mobile DeFi in action.

SONAR: Mobile Mastery in DeFi

SONAR, Kujira’s mobile wallet, represents a critical advancement towards DeFi’s goal of promoting financial empowerment in developing economies where traditional banking infrastructure falls short.

By transforming smartphones into gateways for financial transactions, SONAR simplifies the use of cryptocurrencies for everyday activities, meaning users can make direct purchases/pay for services with crypto, without the inconvenience, and cost, of currency conversion.

Additionally, the wallet simplifies managing assets across various blockchains. The UI is simple and easy to navigate, with the different financial services laid out in a comprehensible manner that demonstrates a dedication to making users’ experiences as straightforward as possible.

However, SONAR extends this functionality further, facilitating direct payments to merchants, with the integration of Bidali a poignant example.

SONAR x Bidali: A Recipe For Success

Bidali enables users to purchase a wide array of products (shopping, travel, restaurants) using their SONAR mobile wallet without having to cash out, with these gift cards able to be used in-store or online. This means any individual, no matter the country of residence, can use SONAR, Kujira’s mobile wallet, to pay for real-world items, all at the click of a button, and without the hassle of cashing out beforehand.

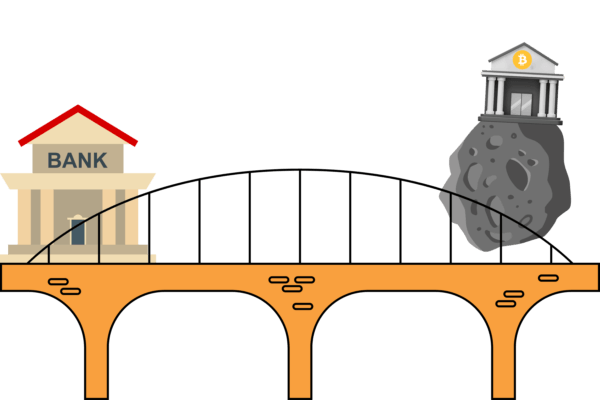

This advancement bridges the gap between conventional shopping and the cutting-edge world of DeFi, and represents a major step toward integrating these two spheres once and for all.

Hence, if successful, SONAR, and other mobile DeFi wallets, will bring millions of previously unbanked individuals into the fold, improving financial inclusion within developing economies and shaping a future where financial inclusivity is the norm.

So, if all goes to plan, what will the future of DeFi, and banking, look like? Let’s take a look at the big picture.

DeFi & The Future of Banking

Decentralized Finance (DeFi) emerges as a revolutionary solution to the limitations and exclusivities of traditional finance (TradFi), particularly in developing economies where a significant portion of the population is unbanked and isolated from financial growth opportunities.

By leveraging blockchain technology, DeFi offers accessible and affordable financial services, enabling individuals to save, invest, and access loans without the need for conventional banking infrastructure or bureaucratic hurdles.

The advent of mobile technology plays a pivotal role in magnifying DeFi’s impact, overcoming geographical and infrastructural barriers by making financial services available through simple mobile devices, and it is this mobile access that is crucial for fostering financial inclusion and economic empowerment in regions previously marginalized by the traditional banking system.

SONAR, a mobile DeFi wallet, exemplifies this transformation, offering an intuitive and accessible platform for managing assets, making direct purchases, and facilitating seamless transactions across borders. By integrating services like Bidali, it bridges the gap between the digital currency ecosystem and everyday commerce, making financial participation more inclusive.

In conclusion, DeFi and mobile access together are paving the way for a new era of financial empowerment in developing economies, promising a future where financial inclusion is not just an aspiration but a reality. Improvements in mobile DeFi, illustrated by innovations like SONAR, are essential for achieving this vision, promising an empowered global finance landscape where everyone has the opportunity to participate and thrive.

So, for all those who saw mobile DeFi as little more than an ambitious dream, I’d urge you to reconsider. The future of banking may be coming sooner than you think.

Kujira Academy is a platform that aims to bridge the gap between young entrepreneurs and Web3, providing them with tangible education and career acceleration opportunities. Built by students, for students. Learn more about the academy and our vision here.

To register your interest and become a student of Kujira Academy, click here.

Written by KujiKaze